The New Hampshire Eligible Director Nonqualified Stock Option Agreement is a legal document specifically designed by Kyle Electronics to provide eligible directors with an opportunity to acquire shares of stock from the company. This agreement is specifically tailored for directors who are not considered employees of Kyle Electronics. Under this agreement, eligible directors are granted the right to purchase a specific number of shares of Kyle Electronics' stock at a predetermined price, known as the exercise price. The exercise price is typically set at a discounted rate to incentivize the directors to participate in the stock option program. This option grant is nonqualified, meaning it does not qualify for special tax treatment under the U.S. Internal Revenue Code. The New Hampshire Eligible Director Nonqualified Stock Option Agreement of Kyle Electronics offers certain advantages and benefits to eligible directors. Firstly, it provides an opportunity for directors to align their interests with those of the company and its shareholders by allowing them to become shareholders themselves. This can enhance their commitment and dedication to the long-term success of the organization. Additionally, the option agreement allows directors to participate in any increase in the stock price, enabling them to benefit from the company's growth and financial performance. By granting stock options, Kyle Electronics aims to motivate and retain talented directors, as these options can be exercised over a specific period of time, encouraging long-term loyalty and dedication. It's worth noting that there may be variations or different types of New Hampshire Eligible Director Nonqualified Stock Option Agreements offered by Kyle Electronics. These variations could be dependent on factors such as the specific terms and conditions, the vesting schedule for the options, and any additional provisions that may be included to cater to the particular needs of the company and its eligible directors. In conclusion, the New Hampshire Eligible Director Nonqualified Stock Option Agreement of Kyle Electronics empowers eligible directors to purchase company stock at a predetermined price, promoting alignment of interests and providing them with the opportunity to benefit from the company's growth and performance. Different variations of this agreement may exist, accommodating specific requirements and circumstances of the company and its directors.

New Hampshire Eligible Director Nonqualified Stock Option Agreement of Wyle Electronics

Description

How to fill out New Hampshire Eligible Director Nonqualified Stock Option Agreement Of Wyle Electronics?

If you need to total, down load, or produce lawful record themes, use US Legal Forms, the largest variety of lawful kinds, that can be found on the web. Take advantage of the site`s simple and easy hassle-free research to find the documents you require. Various themes for enterprise and personal purposes are sorted by types and states, or keywords and phrases. Use US Legal Forms to find the New Hampshire Eligible Director Nonqualified Stock Option Agreement of Wyle Electronics in a few click throughs.

Should you be currently a US Legal Forms customer, log in to your account and click the Acquire option to get the New Hampshire Eligible Director Nonqualified Stock Option Agreement of Wyle Electronics. You can even gain access to kinds you previously delivered electronically from the My Forms tab of the account.

If you work with US Legal Forms for the first time, refer to the instructions below:

- Step 1. Make sure you have chosen the form to the correct metropolis/land.

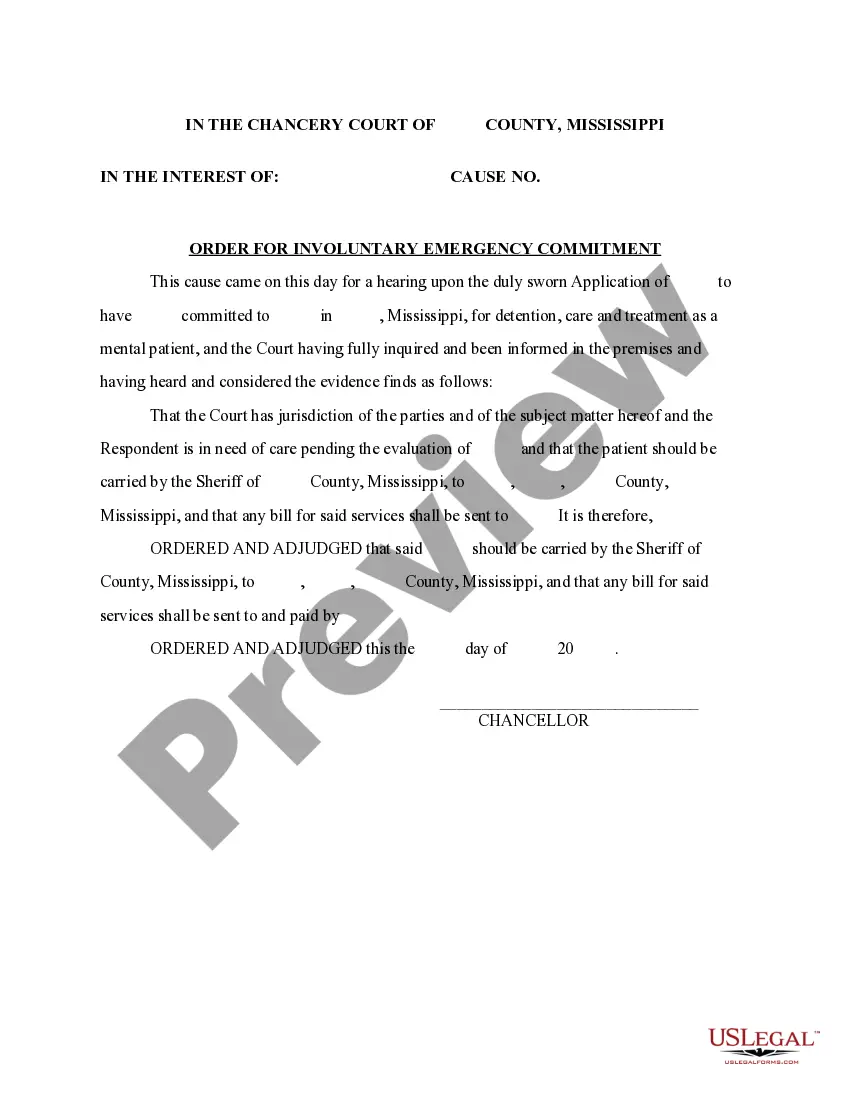

- Step 2. Utilize the Preview choice to look over the form`s articles. Don`t neglect to learn the information.

- Step 3. Should you be not satisfied together with the kind, utilize the Research area on top of the display to get other variations in the lawful kind design.

- Step 4. When you have found the form you require, go through the Buy now option. Choose the prices program you choose and add your qualifications to sign up for an account.

- Step 5. Approach the transaction. You can use your credit card or PayPal account to perform the transaction.

- Step 6. Find the formatting in the lawful kind and down load it in your device.

- Step 7. Full, modify and produce or indication the New Hampshire Eligible Director Nonqualified Stock Option Agreement of Wyle Electronics.

Every single lawful record design you purchase is yours eternally. You might have acces to every single kind you delivered electronically inside your acccount. Go through the My Forms section and choose a kind to produce or down load once again.

Remain competitive and down load, and produce the New Hampshire Eligible Director Nonqualified Stock Option Agreement of Wyle Electronics with US Legal Forms. There are thousands of skilled and condition-certain kinds you may use to your enterprise or personal demands.