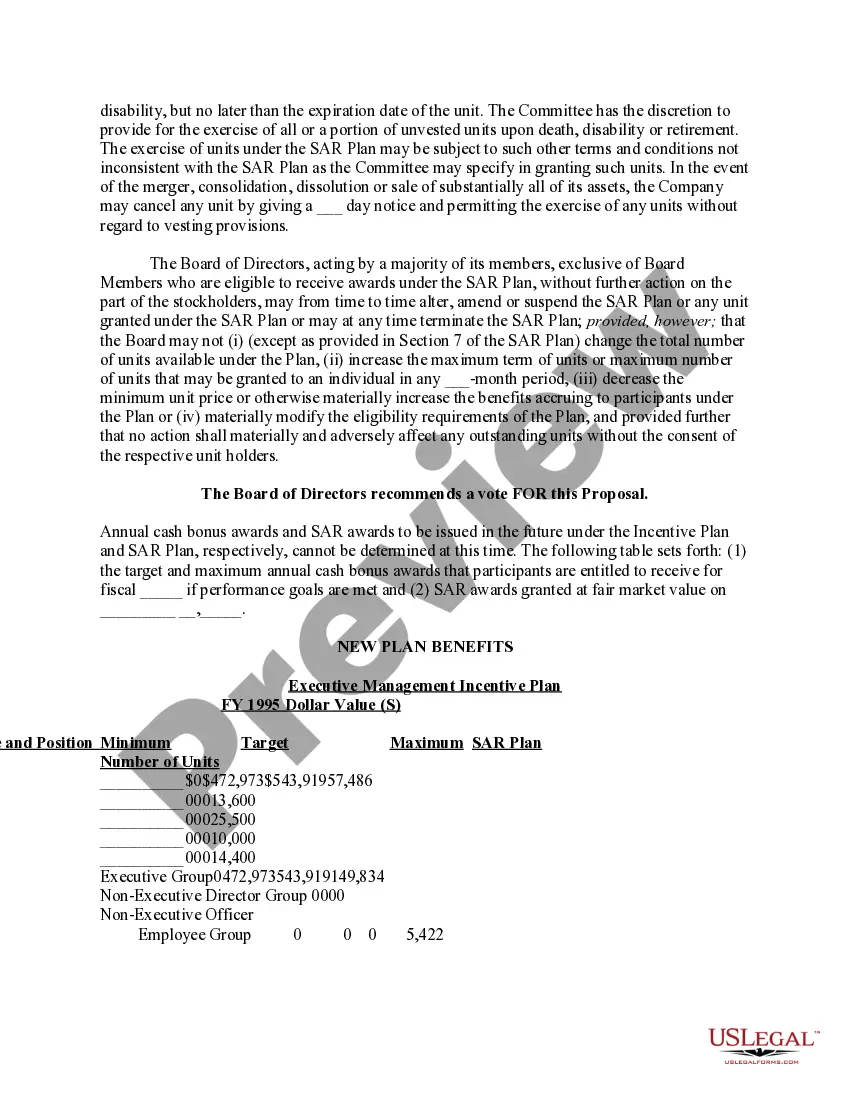

New Hampshire Proposal to approve material terms of stock appreciation right plan

Description

How to fill out Proposal To Approve Material Terms Of Stock Appreciation Right Plan?

If you wish to full, download, or print authorized record web templates, use US Legal Forms, the largest selection of authorized types, which can be found on the Internet. Use the site`s basic and convenient lookup to find the paperwork you need. A variety of web templates for enterprise and specific functions are sorted by categories and claims, or key phrases. Use US Legal Forms to find the New Hampshire Proposal to approve material terms of stock appreciation right plan in just a number of mouse clicks.

Should you be already a US Legal Forms buyer, log in in your accounts and click the Down load key to find the New Hampshire Proposal to approve material terms of stock appreciation right plan. You can also access types you formerly delivered electronically from the My Forms tab of your accounts.

Should you use US Legal Forms the very first time, follow the instructions under:

- Step 1. Be sure you have chosen the form for your correct area/land.

- Step 2. Make use of the Preview option to examine the form`s information. Don`t forget to read the outline.

- Step 3. Should you be not happy with the develop, utilize the Search field on top of the display to discover other models in the authorized develop web template.

- Step 4. When you have identified the form you need, click the Buy now key. Opt for the pricing program you like and add your qualifications to sign up to have an accounts.

- Step 5. Procedure the transaction. You may use your charge card or PayPal accounts to perform the transaction.

- Step 6. Pick the formatting in the authorized develop and download it on your system.

- Step 7. Full, change and print or signal the New Hampshire Proposal to approve material terms of stock appreciation right plan.

Each authorized record web template you get is yours for a long time. You have acces to each and every develop you delivered electronically with your acccount. Go through the My Forms portion and select a develop to print or download once again.

Contend and download, and print the New Hampshire Proposal to approve material terms of stock appreciation right plan with US Legal Forms. There are thousands of skilled and express-particular types you can utilize for your personal enterprise or specific demands.

Form popularity

FAQ

Stock appreciation rights (SARs) are a type of employee compensation linked to the company's stock price during a predetermined period. SARs are profitable for employees when the company's stock price rises, which makes them similar to employee stock options (ESOs).

The primary difference is that an ESO is a compensation plan and employee benefit, whereas an ESOP qualifies as a retirement plan, such as a 401(k). With an ESOP, employees don't purchase shares with their own money, while ESOs allow employees to use their money to buy company shares at a discounted rate.

A Stock Appreciation Right (SAR) refers to the right to be paid compensation equivalent to an increase in the company's common stock price over a base or the value of appreciation of the equity shares currently being traded on the public market.

Stock appreciation rights (SARs) are a type of employee compensation linked to the company's stock price during a predetermined period. An employee stock ownership plan (ESOP) enables employees to gain an ownership interest in their employer in the form of shares of company stock.

SAR plans offer multiple advantages over other forms of stock compensation. One of the benefits is cash benefits without having to pay upfront to exercise options.

The main difference is that under an ESOP (Employee Stock Option Plan), an employee receives real business shares at a certain point in time. In a VSOP (Virtual Stock Option Plan), the employee only receives a contractual right to a payout in the event of certain events (usually the exit).

Employee stock ownership plans (ESOPs), which can be stock bonus plans or stock bonus/money purchase plans, are qualified defined contribution plans under IRC section 401(a). Similar to stock options, stock appreciation rights are given at a predetermined price and often have a vesting period and expiration date.

For purposes of financial disclosure, you may value a stock appreciation right based on the difference between the current market value and the grant price. This formula is: (current market value ? grant price) x number of shares = value.