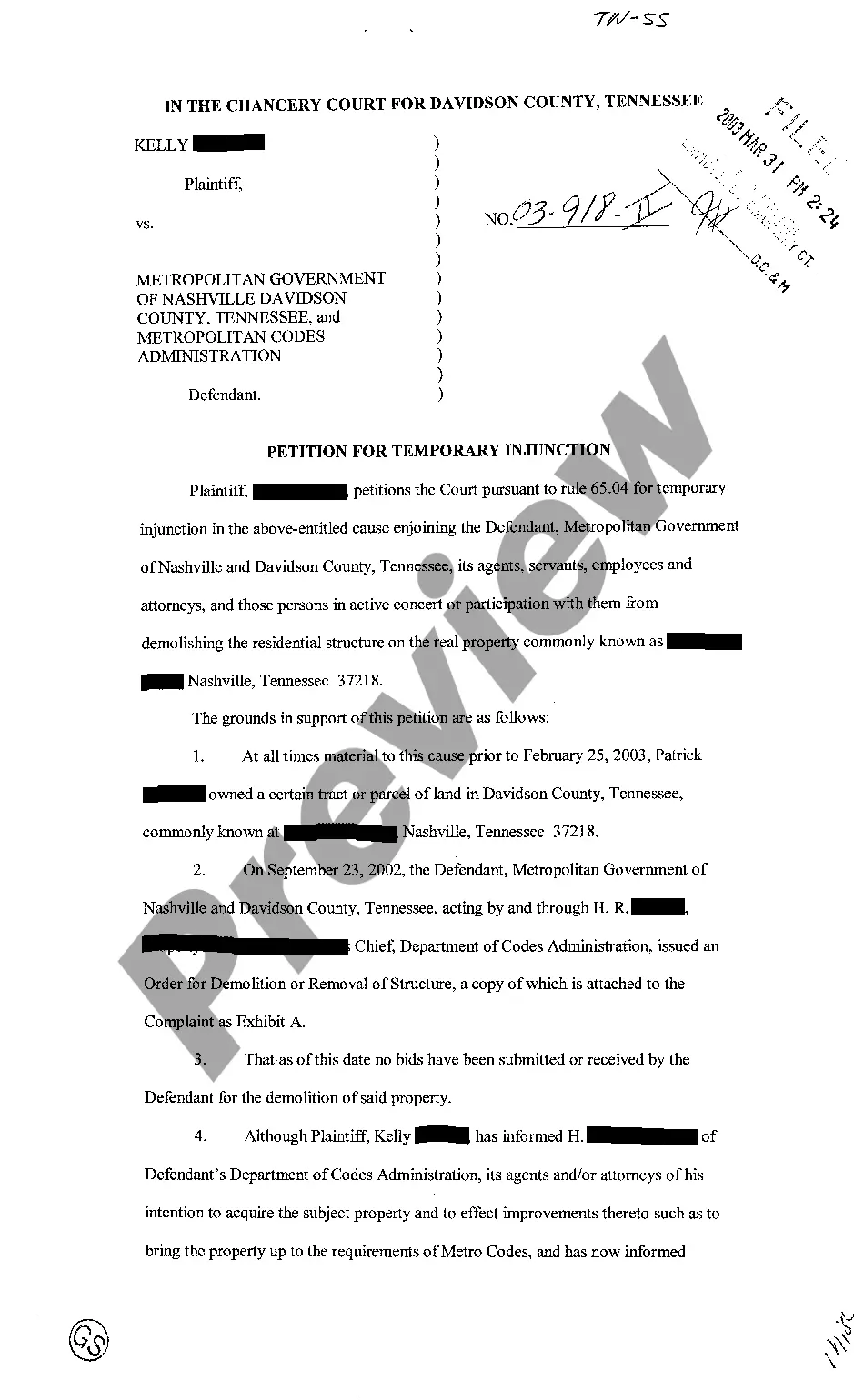

New Hampshire Proposal to amend stock purchase plan

Description

How to fill out Proposal To Amend Stock Purchase Plan?

If you have to total, acquire, or print authorized document web templates, use US Legal Forms, the greatest collection of authorized kinds, that can be found on the web. Make use of the site`s basic and hassle-free search to obtain the papers you want. Various web templates for organization and person functions are categorized by groups and claims, or keywords. Use US Legal Forms to obtain the New Hampshire Proposal to amend stock purchase plan in a couple of click throughs.

When you are currently a US Legal Forms customer, log in to your account and then click the Down load key to get the New Hampshire Proposal to amend stock purchase plan. You can also accessibility kinds you formerly delivered electronically in the My Forms tab of your account.

If you are using US Legal Forms the first time, follow the instructions listed below:

- Step 1. Ensure you have selected the form to the proper area/nation.

- Step 2. Use the Review method to examine the form`s information. Never forget about to read the information.

- Step 3. When you are unhappy together with the kind, make use of the Search industry at the top of the display screen to discover other variations in the authorized kind format.

- Step 4. When you have located the form you want, click on the Buy now key. Pick the rates plan you prefer and add your qualifications to sign up to have an account.

- Step 5. Procedure the purchase. You can utilize your Мisa or Ьastercard or PayPal account to finish the purchase.

- Step 6. Pick the formatting in the authorized kind and acquire it on your own system.

- Step 7. Complete, modify and print or sign the New Hampshire Proposal to amend stock purchase plan.

Each and every authorized document format you buy is the one you have forever. You have acces to each kind you delivered electronically with your acccount. Click on the My Forms area and pick a kind to print or acquire again.

Remain competitive and acquire, and print the New Hampshire Proposal to amend stock purchase plan with US Legal Forms. There are thousands of expert and condition-specific kinds you can utilize for your personal organization or person needs.

Form popularity

FAQ

[Right of Privacy.] An individual's right to live free from governmental intrusion in private or personal information is natural, essential, and inherent. [Art.] 3.

The most obvious protection of privacy in the Bill of Rights is the Fourth Amendment, which protects individuals in their persons, homes, papers, and effects from "unreasonable searches and seizures" by the government.

[Self-defense right explicitly protected.] New Hampshire: All persons have the right to keep and bear arms in defense of themselves, their families, their property and the state.