The New Hampshire Directors' Stock Deferral Plan for Nor west Corp. is a comprehensive compensation program designed for directors of Nor west Corp. situating in the state of New Hampshire. This plan offers various benefits and options for directors to defer their stock compensation. Under this plan, directors have the opportunity to defer receiving a portion of their stock compensation until a later date, typically after retirement or a specific vesting period. By deferring the receipt of their stock, directors can strategically plan their income and potentially benefit from tax advantages. This structure allows directors to exercise control over their compensation and align it with their financial goals. The New Hampshire Directors' Stock Deferral Plan for Nor west Corp. encompasses multiple sub-plans providing different options to suit the diverse needs of directors. These sub-plans may include: 1. Deferred Compensation Option: Directors can choose to defer a specific percentage or a fixed dollar amount of their stock compensation. By doing so, they can postpone the recognition of income for tax purposes and potentially take advantage of lower tax rates upon receiving the deferred stock. 2. Stock Purchase Option: This sub-plan allows directors to use a portion of their stock compensation to purchase additional shares of Nor west Corp. stock. This approach enables directors to accumulate a larger stake in the company and potentially benefit from future price appreciation. 3. Stock Exchange Option: Directors have the flexibility to exchange their deferred stock compensation for different investment options offered within the plan. These investment options may include mutual funds, bonds, or other securities, providing directors with the opportunity to diversify their investment portfolio. 4. Lump-sum Payment Option: Directors may also choose to receive their deferred stock compensation in a single lump-sum payment upon retirement or a predetermined event. This option offers directors the convenience of a one-time payout, which can be beneficial for various personal financial requirements. It is important for directors participating in the New Hampshire Directors' Stock Deferral Plan for Nor west Corp. to review all the plan's details, including vesting periods, investment options, and tax implications. Additionally, consulting with a financial advisor or tax professional is recommended to ensure that the chosen deferral strategy aligns with their individual circumstances and long-term financial objectives.

New Hampshire Directors' Stock Deferral Plan for Norwest Corp.

Description

How to fill out New Hampshire Directors' Stock Deferral Plan For Norwest Corp.?

If you need to complete, down load, or print legitimate document web templates, use US Legal Forms, the largest collection of legitimate varieties, which can be found online. Make use of the site`s simple and handy search to find the papers you want. Various web templates for organization and person uses are categorized by groups and states, or search phrases. Use US Legal Forms to find the New Hampshire Directors' Stock Deferral Plan for Norwest Corp. with a couple of click throughs.

If you are currently a US Legal Forms consumer, log in in your account and click the Acquire option to obtain the New Hampshire Directors' Stock Deferral Plan for Norwest Corp.. Also you can entry varieties you in the past delivered electronically within the My Forms tab of the account.

Should you use US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Ensure you have selected the shape for your proper metropolis/nation.

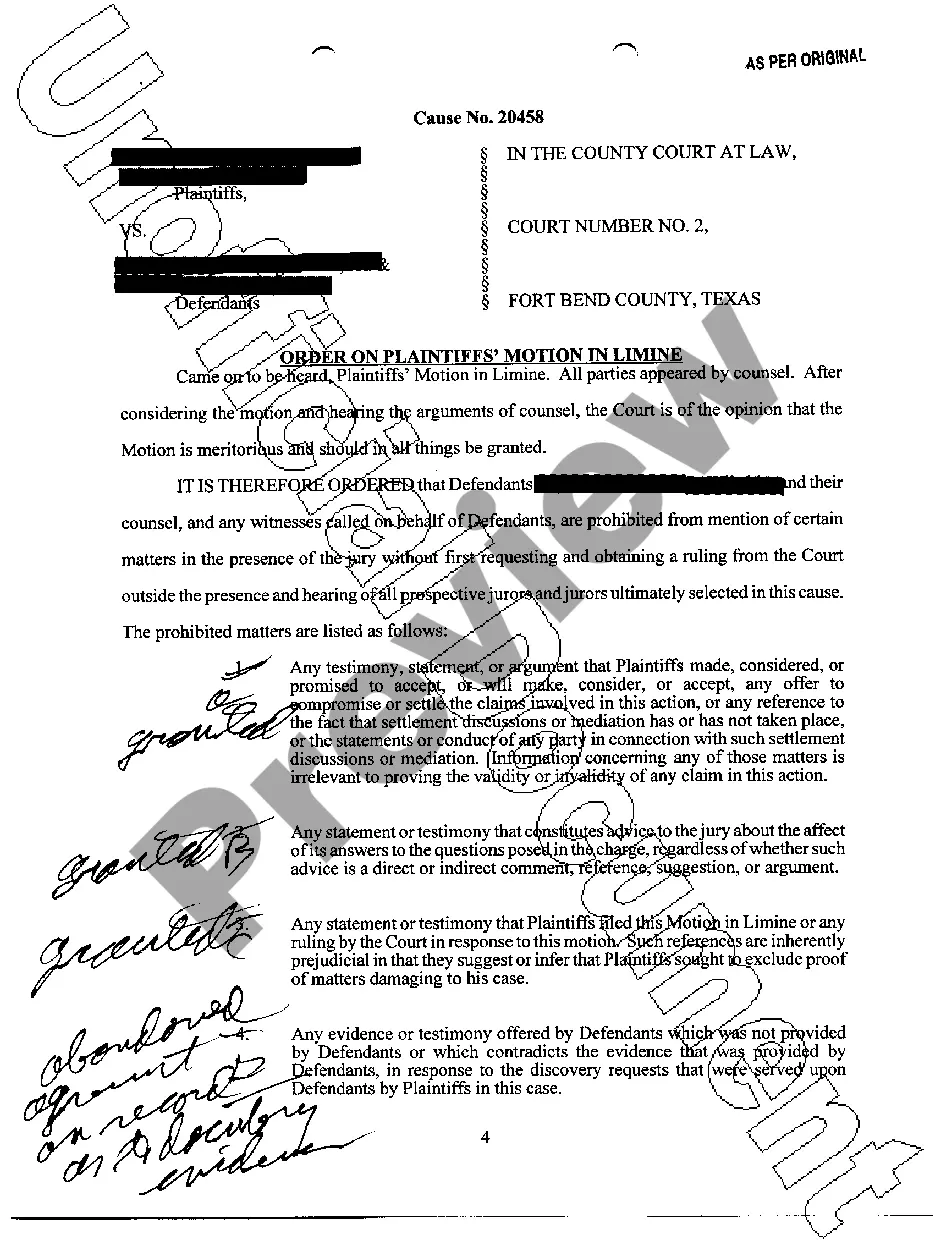

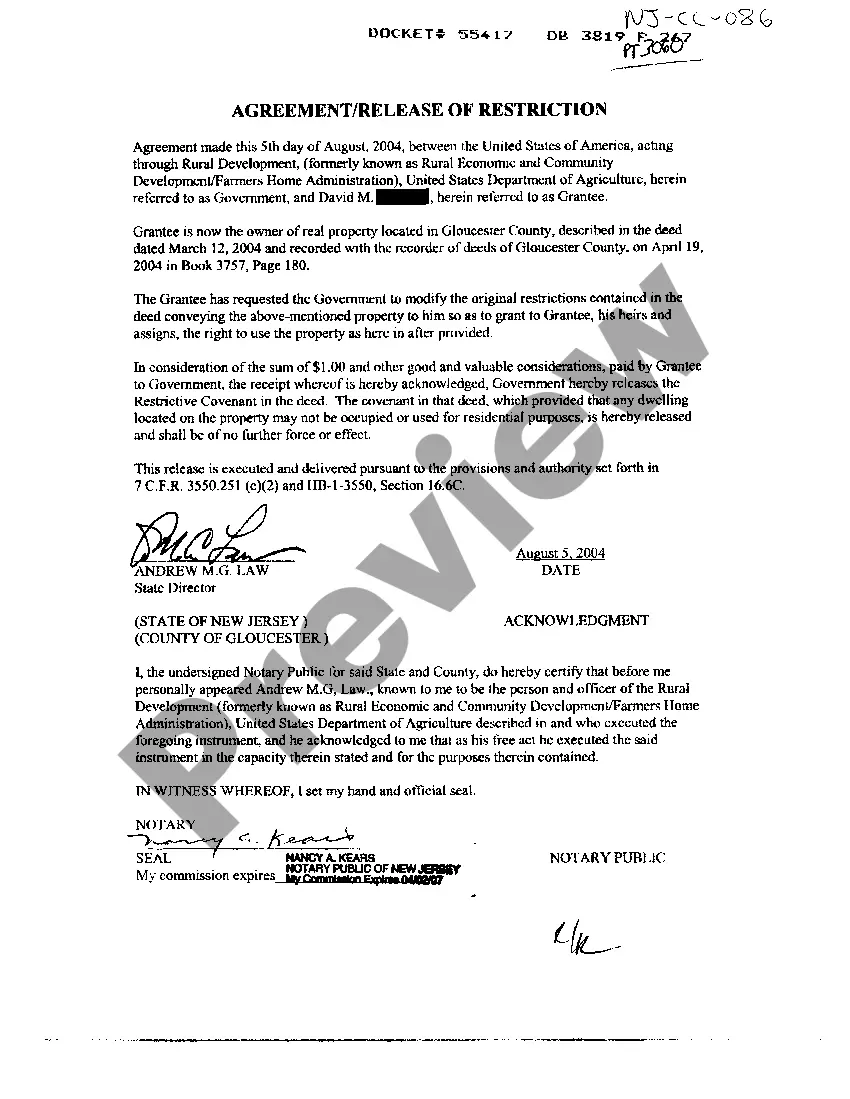

- Step 2. Make use of the Review choice to check out the form`s content. Never neglect to read through the information.

- Step 3. If you are unhappy together with the form, take advantage of the Search industry on top of the screen to find other variations of your legitimate form template.

- Step 4. Once you have identified the shape you want, select the Acquire now option. Pick the pricing program you like and put your qualifications to register to have an account.

- Step 5. Method the deal. You should use your credit card or PayPal account to finish the deal.

- Step 6. Find the formatting of your legitimate form and down load it on the system.

- Step 7. Full, edit and print or indication the New Hampshire Directors' Stock Deferral Plan for Norwest Corp..

Each legitimate document template you acquire is your own property permanently. You possess acces to every form you delivered electronically with your acccount. Click the My Forms area and choose a form to print or down load again.

Contend and down load, and print the New Hampshire Directors' Stock Deferral Plan for Norwest Corp. with US Legal Forms. There are many specialist and status-particular varieties you can utilize for your personal organization or person needs.