The New Hampshire Ratification of Stock Bonus Plan of First West Chester Corp is a crucial document that outlines the details and provisions of a stock bonus plan adopted by the corporation. The plan is designed to provide additional compensation and benefits to eligible employees, in addition to their regular salaries and wages. The stock bonus plan is an employer-sponsored benefit that allows employees to receive shares of company stock as a form of incentive or reward. This plan serves as a crucial tool for recruiting and retaining talented employees, as it offers them the opportunity to own a stake in the company's success and potentially benefit from future stock price appreciation. Key provisions of the New Hampshire Ratification of Stock Bonus Plan of First West Chester Corp include: 1. Eligibility: The plan lists the criteria that employees must meet to be eligible for participation in the stock bonus plan. This typically includes factors such as length of service, employment status, and job classification. 2. Allocation of Stock: The document details how stock will be allocated to eligible participants. This can vary based on factors such as employee salary levels, job positions, or a uniform allocation percentage for all participants. 3. Vesting Schedule: The plan establishes a vesting schedule that outlines the timeline for employees to gain ownership rights to their allocated stock. Vesting can be immediate or staggered over a specified period, incentivizing employees to remain with the company. 4. Dividends and Distributions: The document addresses how dividends and other stock-related distributions will be handled. This may include options for participants to receive dividends in cash or reinvest them to acquire additional shares. 5. Stock Valuation: The plan outlines the methods used to determine the value of the company's stock for the purpose of stock allocations and distributions. This may involve using a specific valuation formula or relying on an external appraisal. It's important to note that the New Hampshire Ratification of Stock Bonus Plan of First West Chester Corp is a specific instance of such a plan being adopted by the corporation in New Hampshire. While there may not be different "types" of ratification in this context, other companies or corporations in New Hampshire may have their own unique stock bonus plans with different provisions and terms. Overall, the New Hampshire Ratification of Stock Bonus Plan of First West Chester Corp demonstrates the company's commitment to rewarding and incentivizing its employees by offering them the opportunity to participate in the corporation's success through stock ownership.

New Hampshire Ratification of stock bonus plan of First West Chester Corp.

Description

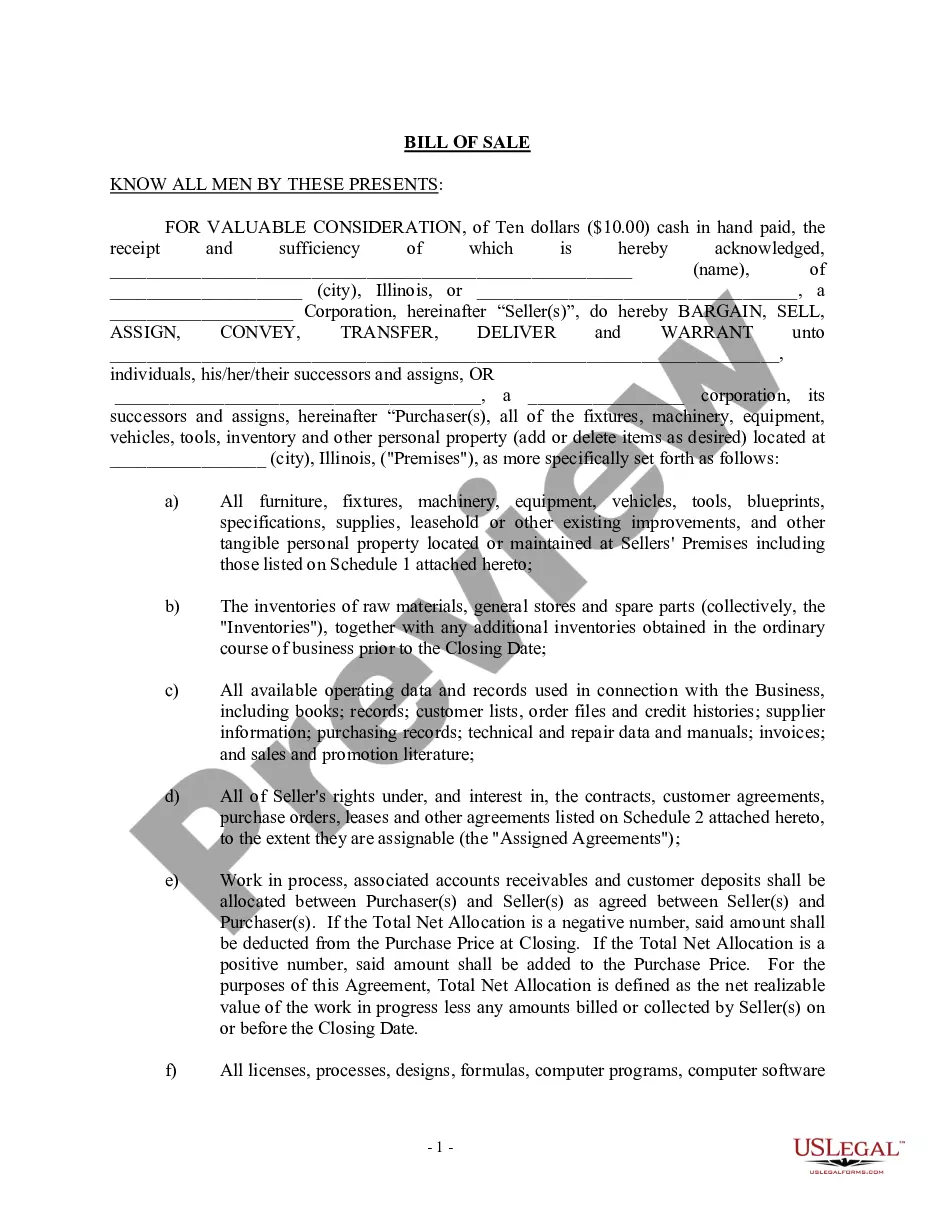

How to fill out New Hampshire Ratification Of Stock Bonus Plan Of First West Chester Corp.?

You may invest hrs on the Internet attempting to find the authorized document template that meets the federal and state needs you will need. US Legal Forms supplies 1000s of authorized kinds which can be examined by professionals. It is possible to download or produce the New Hampshire Ratification of stock bonus plan of First West Chester Corp. from our service.

If you already have a US Legal Forms bank account, you can log in and then click the Download key. Afterward, you can full, revise, produce, or sign the New Hampshire Ratification of stock bonus plan of First West Chester Corp.. Every single authorized document template you buy is your own eternally. To obtain another copy of any acquired kind, go to the My Forms tab and then click the corresponding key.

If you are using the US Legal Forms website the very first time, stick to the basic recommendations below:

- Very first, make sure that you have selected the correct document template for the area/area of your choice. Browse the kind description to ensure you have selected the correct kind. If accessible, utilize the Review key to appear with the document template as well.

- If you want to get another model in the kind, utilize the Look for field to discover the template that fits your needs and needs.

- After you have discovered the template you would like, click Purchase now to carry on.

- Pick the pricing program you would like, enter your accreditations, and sign up for your account on US Legal Forms.

- Full the purchase. You may use your Visa or Mastercard or PayPal bank account to pay for the authorized kind.

- Pick the structure in the document and download it to the system.

- Make alterations to the document if required. You may full, revise and sign and produce New Hampshire Ratification of stock bonus plan of First West Chester Corp..

Download and produce 1000s of document layouts utilizing the US Legal Forms web site, which offers the biggest selection of authorized kinds. Use professional and state-particular layouts to tackle your small business or person demands.