New Hampshire Directors and officers liability insurance

Description

How to fill out Directors And Officers Liability Insurance?

Have you been inside a place in which you need papers for either company or specific uses nearly every working day? There are tons of legal file layouts available online, but discovering types you can depend on is not straightforward. US Legal Forms delivers thousands of form layouts, like the New Hampshire Directors and officers liability insurance, which are composed to fulfill federal and state demands.

If you are previously knowledgeable about US Legal Forms site and have an account, merely log in. Afterward, you can acquire the New Hampshire Directors and officers liability insurance web template.

If you do not provide an profile and would like to start using US Legal Forms, abide by these steps:

- Obtain the form you will need and make sure it is for the right town/region.

- Use the Review button to review the form.

- Browse the description to actually have selected the proper form.

- In the event the form is not what you are trying to find, utilize the Search discipline to get the form that fits your needs and demands.

- When you obtain the right form, click on Acquire now.

- Choose the rates program you want, complete the desired details to produce your account, and purchase an order using your PayPal or credit card.

- Select a practical file file format and acquire your backup.

Discover all of the file layouts you possess purchased in the My Forms menus. You can get a extra backup of New Hampshire Directors and officers liability insurance whenever, if required. Just click on the essential form to acquire or print the file web template.

Use US Legal Forms, probably the most comprehensive selection of legal varieties, to conserve time and stay away from errors. The services delivers appropriately made legal file layouts which can be used for a selection of uses. Make an account on US Legal Forms and initiate creating your way of life a little easier.

Form popularity

FAQ

Public Liability insurance policies, on the other hand, specifically exclude claims for professional advice or duty. Management Liability insurance protects businesses for breaches at management level or mismanagement but will often include additional cover such as for financial crimes committed against the business.

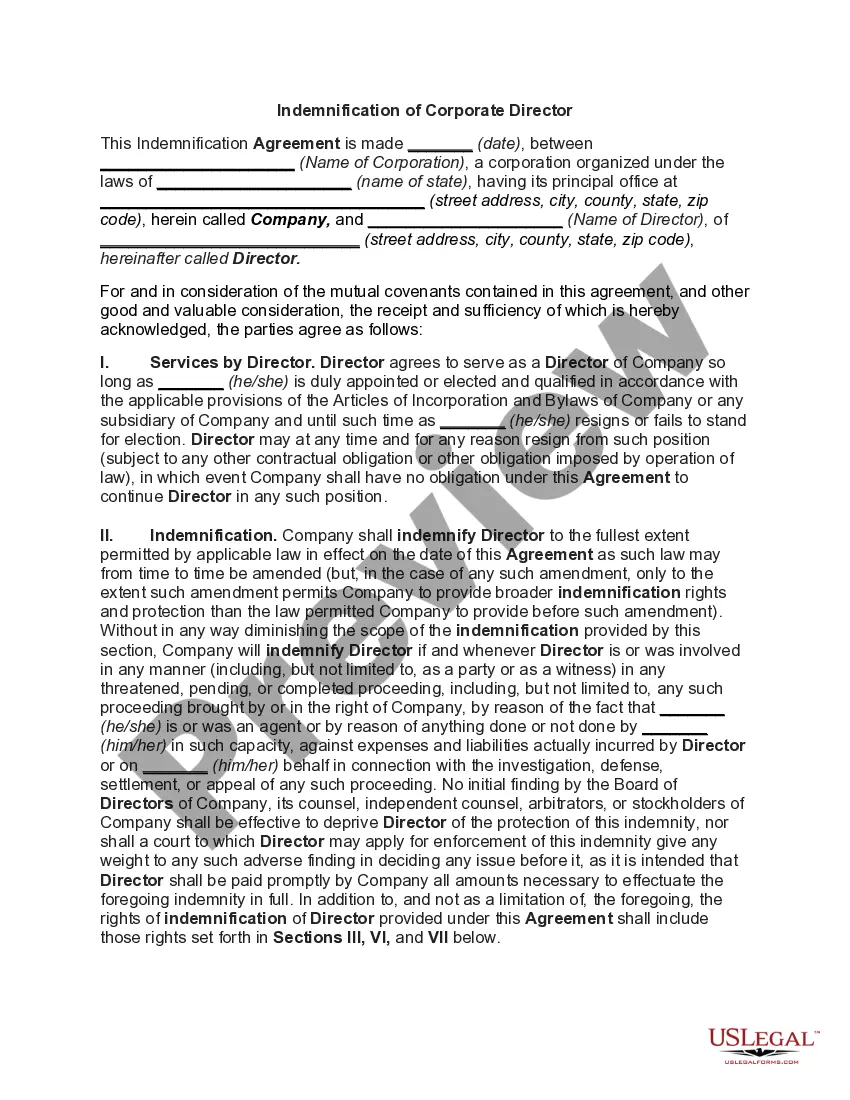

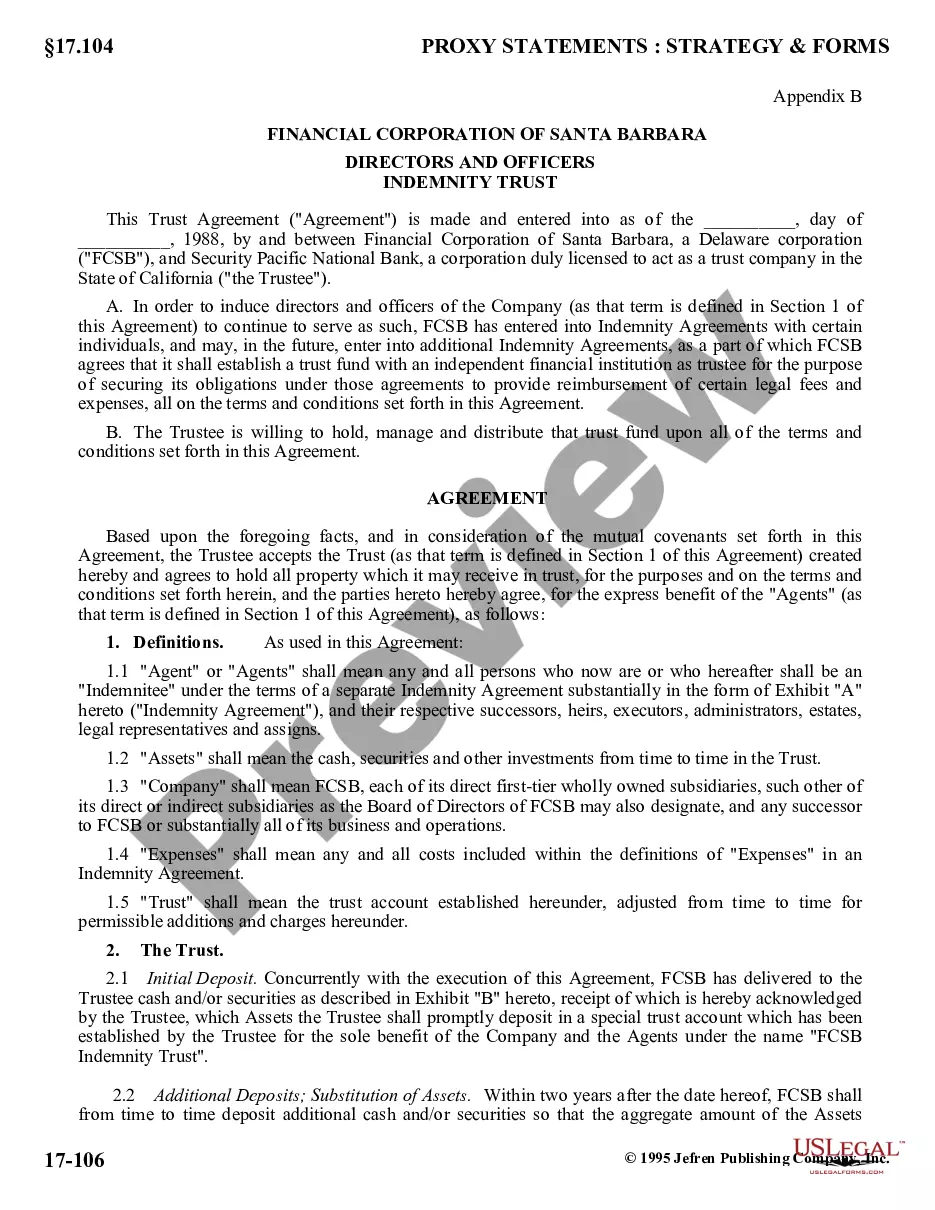

Directors and officers (D&O) liability insurance protects the personal assets of corporate directors and officers, and their spouses, in the event they are personally sued by employees, vendors, competitors, investors, customers, or other parties, for actual or alleged wrongful acts in managing a company.

Directors' and officers' liability insurance ? also known as D&O insurance ? covers the cost of compensation claims made against your business's directors and key managers (officers) for alleged wrongful acts.

Some states require a business owners to have E&O insurance in order to conduct business, such as in the case of physicians. Management liability, as its name says, covers the business's management, not all of its employees.

Directors & officers insurance (D&O) is liability insurance that covers the directors and officers of the company against lawsuits alleging a breach of fiduciary duty. A company pays for this coverage so executives can serve confidently as leaders of their organization without fear of personal financial loss.

However, D&O is a product designed to protect the personal assets of company directors and officers in the event they were sued while acting in their capacity as a director or officer. Management liability protects the company as well as its directors and officers against legal liabilities and statutory obligations.

Further, officers and directors who participate in or authorize the commission of wrongful acts that are prohibited by statute, even if the acts are done on behalf of the corporation, may be held personally liable. Officers and directors may also be liable to the corporation or its shareholders.