New Hampshire Form of Convertible Promissory Note In New Hampshire, a Convertible Promissory Note is a legally binding document that outlines the terms and conditions of a loan that can be converted into preferred stock at a later date. This type of note provides flexibility to both the lender and borrower, allowing for potential equity ownership in the company rather than just repayment of the loan. The New Hampshire Form of Convertible Promissory Note includes essential details such as the principal amount of the loan, the interest rate, the maturity date, and the conversion terms. The conversion terms specify the conditions under which the loan can be converted into preferred stock, such as a certain timeframe or trigger event. This form of note is typically used in startup or early-stage ventures where traditional financing options may be limited. It provides an opportunity for lenders to participate in the growth and success of the company by converting their loan into ownership shares. Some key provisions that may be included in the New Hampshire Form of Convertible Promissory Note are: 1. Principal Amount: The initial loan amount disbursed to the borrower. 2. Interest Rate: The rate at which interest accrues on the loan, usually expressed as an annual percentage. 3. Maturity Date: The specific date by which the loan must be repaid, either through conversion or full repayment. 4. Conversion Price: The price at which the loan converts into preferred stock. This may be a fixed price or determined based on a predetermined formula. 5. Conversion Ratio: The ratio at which the loan converts into preferred stock, typically based on the agreed-upon conversion price. 6. Conversion Events: Specific events or milestones that trigger the conversion of the loan into preferred stock. These events can include a subsequent equity financing round or a change in control of the company. 7. Voting Rights: The rights of the lender as a preferred stockholder, such as the ability to vote on certain matters that affect the company. 8. Liquidation Preference: The preference given to the lender in case of the company's liquidation or sale. This determines the order in which the lender receives their investment back. Different types of New Hampshire Form of Convertible Promissory Notes may exist based on specific variations and customization required by the parties involved. These variations could include different interest rates, conversion terms, or additional provisions based on the unique circumstances of the loan agreement. It is essential to consult legal professionals experienced in New Hampshire corporate and securities law or seek expert advice when using or drafting a New Hampshire Form of Convertible Promissory Note to ensure compliance with state regulations and to protect the interests of all parties involved.

New Hampshire Form of Convertible Promissory Note, Preferred Stock

Description

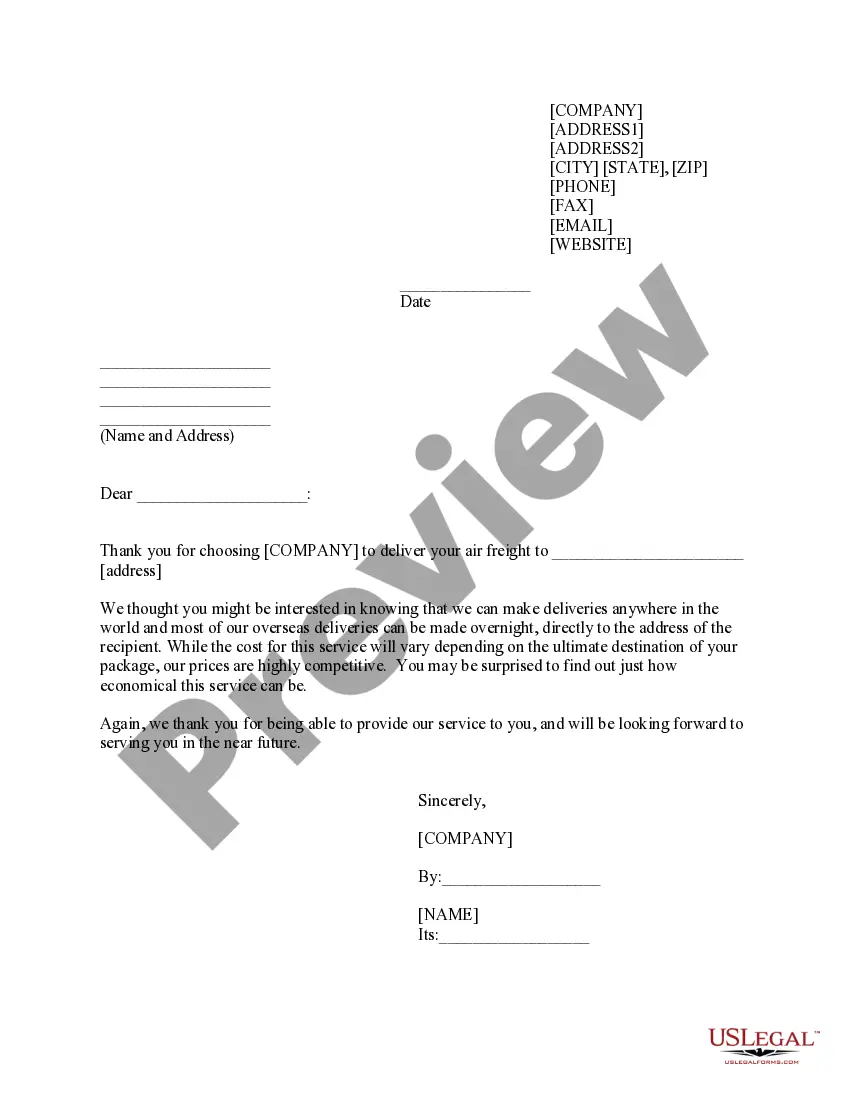

How to fill out New Hampshire Form Of Convertible Promissory Note, Preferred Stock?

Are you currently in the situation in which you need files for sometimes company or individual functions virtually every time? There are a variety of legal document layouts accessible on the Internet, but locating versions you can trust is not simple. US Legal Forms provides thousands of type layouts, like the New Hampshire Form of Convertible Promissory Note, Preferred Stock, which are written to satisfy state and federal requirements.

When you are currently informed about US Legal Forms site and have a free account, basically log in. After that, you can down load the New Hampshire Form of Convertible Promissory Note, Preferred Stock web template.

Should you not come with an accounts and would like to begin using US Legal Forms, abide by these steps:

- Find the type you require and ensure it is for that appropriate town/county.

- Use the Preview option to analyze the form.

- Read the outline to ensure that you have chosen the proper type.

- In case the type is not what you`re trying to find, make use of the Search industry to discover the type that suits you and requirements.

- If you find the appropriate type, just click Acquire now.

- Select the costs plan you need, submit the required information and facts to create your account, and pay money for an order making use of your PayPal or bank card.

- Pick a handy file structure and down load your backup.

Discover all of the document layouts you may have bought in the My Forms food selection. You can get a extra backup of New Hampshire Form of Convertible Promissory Note, Preferred Stock whenever, if necessary. Just click on the necessary type to down load or print the document web template.

Use US Legal Forms, one of the most substantial collection of legal kinds, in order to save efforts and prevent blunders. The assistance provides professionally manufactured legal document layouts that you can use for a variety of functions. Create a free account on US Legal Forms and start producing your lifestyle easier.