Title: Exploring the New Hampshire Proposed Merger with the Grossman Corporation: A Comprehensive Overview Keywords: New Hampshire, proposed merger, Grossman Corporation, acquisition, benefits, industry experts, potential challenges, regulatory approval, strategy, synergy, market expansion, growth, shareholder value, integration, due diligence, geographical reach, operations, product portfolio, leadership, economic impact Introduction: The New Hampshire proposed merger with the Grossman Corporation has garnered significant attention within the business community. This comprehensive description aims to provide a detailed understanding of the potential merger, its significance, and various aspects associated with it. 1. Overview of the Proposed Merger: The New Hampshire proposed merger entails the integration of the Grossman Corporation, a well-established player in the [relevant industry], with select New Hampshire entities. This strategic move aims to create a more robust business entity capable of capitalizing on shared synergies and reaping potential benefits. 2. Benefits and Potential Advantages: Recognized industry experts project several advantages of the New Hampshire proposed merger with the Grossman Corporation. These benefits include increased market reach, streamlined operations, enhanced product portfolio, strengthened financials, improved competitiveness, and greater shareholder value. 3. Potential Challenges and Mitigation Strategies: While mergers are known to provide numerous growth opportunities, they often pose certain challenges. The New Hampshire proposed merger may have likely considerations such as cultural integration, potential resistance from stakeholders, regulatory compliance, potential brand consolidation, and operational restructuring. However, with meticulous planning, effective communication, and comprehensive due diligence, most of these challenges can be effectively mitigated or overcome. 4. Regulatory Approval and Due Diligence: The New Hampshire proposed merger would require obtaining regulatory approvals from relevant authorities to ensure compliance with antitrust laws and regulations. Thorough due diligence, encompassing legal, financial, and operational aspects, would be vital to assess the compatibility of both entities, identify potential risks, and ensure a smooth integration process. 5. Strategy and Synergy: The merger aims to leverage the core competencies and market strengths of both parties to avail of greater synergy. By combining their expertise, resources, and networks, the New Hampshire proposed merger envisions unlocking new growth opportunities, expanding into untapped markets, and achieving economies of scale. 6. Geographic Reach and Operations: The New Hampshire proposed merger would improve the geographical reach of both entities, enabling them to access previously unexplored consumer bases. Together, they could extend their operational capabilities, strengthen distribution channels, and optimally utilize their manufacturing facilities, resulting in a more efficient and cost-effective structure. 7. Product Portfolio and Innovation: The proposed merger between New Hampshire and the Grossman Corporation would lead to an expanded product portfolio, offering a wider range of options, enhanced technological capabilities, and improved research and development. The pooling of resources and expertise will foster innovation, enabling the merged entity to stay competitive in a rapidly evolving industry. 8. Leadership and Management: The collective leadership and management teams of both entities will play a crucial role in ensuring a successful New Hampshire proposed merger. A clear transition plan and strong integration strategies will be instrumental in harmonizing operations, aligning goals, and fostering a cohesive corporate culture. 9. Economic Impact and Community Involvement: The New Hampshire proposed merger is expected to have a positive economic impact on the local community, generating new employment opportunities, attracting investments, and creating a more stable business environment. Prioritizing community involvement and corporate social responsibility will continue to be crucial pillars of the merged entity's operations. Conclusion: The New Hampshire proposed merger with the Grossman Corporation holds the potential to create a formidable business entity capable of capitalizing on the synergies between both entities. While the merger involves certain challenges, effective planning, regulatory compliance, and diligent integration efforts can ensure a successful transition, resulting in market expansion, growth, and increased shareholder value.

New Hampshire Proposed merger with the Grossman Corporation

Description

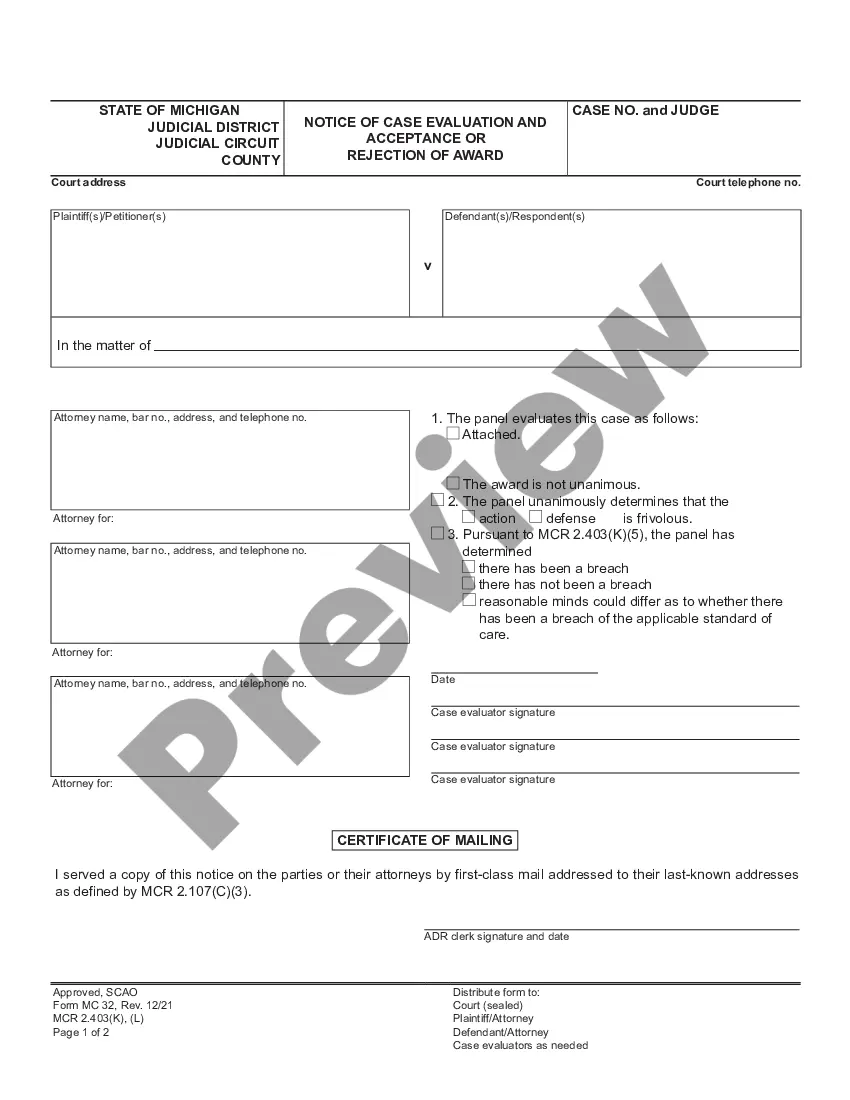

How to fill out New Hampshire Proposed Merger With The Grossman Corporation?

Finding the right legitimate file design can be a have a problem. Needless to say, there are plenty of web templates accessible on the Internet, but how will you discover the legitimate develop you want? Use the US Legal Forms website. The service offers a huge number of web templates, including the New Hampshire Proposed merger with the Grossman Corporation, that can be used for enterprise and private requirements. Each of the kinds are inspected by professionals and meet up with federal and state requirements.

When you are presently signed up, log in to your bank account and then click the Obtain button to obtain the New Hampshire Proposed merger with the Grossman Corporation. Utilize your bank account to check through the legitimate kinds you have bought earlier. Go to the My Forms tab of your bank account and get an additional duplicate of the file you want.

When you are a fresh consumer of US Legal Forms, listed below are straightforward instructions that you should follow:

- Very first, ensure you have selected the right develop for the town/state. You may examine the form utilizing the Review button and look at the form explanation to make certain it is the best for you.

- When the develop will not meet up with your expectations, utilize the Seach industry to find the right develop.

- When you are certain that the form is proper, go through the Get now button to obtain the develop.

- Choose the rates program you desire and type in the necessary information. Create your bank account and pay for the order utilizing your PayPal bank account or credit card.

- Opt for the data file formatting and down load the legitimate file design to your gadget.

- Total, change and printing and sign the acquired New Hampshire Proposed merger with the Grossman Corporation.

US Legal Forms may be the greatest collection of legitimate kinds where you can discover various file web templates. Use the company to down load professionally-made papers that follow condition requirements.