New Hampshire Uniform Residential Loan Application

Description

How to fill out Uniform Residential Loan Application?

If you have to total, acquire, or print out authorized record themes, use US Legal Forms, the biggest variety of authorized forms, which can be found on the Internet. Utilize the site`s easy and practical search to obtain the files you require. Various themes for business and individual functions are sorted by types and suggests, or keywords. Use US Legal Forms to obtain the New Hampshire Uniform Residential Loan Application with a handful of clicks.

If you are already a US Legal Forms customer, log in to your accounts and click the Acquire switch to get the New Hampshire Uniform Residential Loan Application. You can even access forms you earlier acquired inside the My Forms tab of your own accounts.

If you use US Legal Forms the very first time, follow the instructions under:

- Step 1. Ensure you have chosen the form to the proper town/country.

- Step 2. Make use of the Review method to look over the form`s content. Don`t forget to read through the outline.

- Step 3. If you are unsatisfied using the develop, utilize the Lookup field on top of the monitor to get other variations of the authorized develop web template.

- Step 4. When you have found the form you require, click on the Purchase now switch. Select the rates program you prefer and put your credentials to register on an accounts.

- Step 5. Method the deal. You should use your credit card or PayPal accounts to perform the deal.

- Step 6. Find the structure of the authorized develop and acquire it on your own product.

- Step 7. Full, modify and print out or indication the New Hampshire Uniform Residential Loan Application.

Each authorized record web template you get is yours permanently. You might have acces to every develop you acquired with your acccount. Go through the My Forms portion and pick a develop to print out or acquire again.

Remain competitive and acquire, and print out the New Hampshire Uniform Residential Loan Application with US Legal Forms. There are millions of skilled and state-specific forms you may use to your business or individual demands.

Form popularity

FAQ

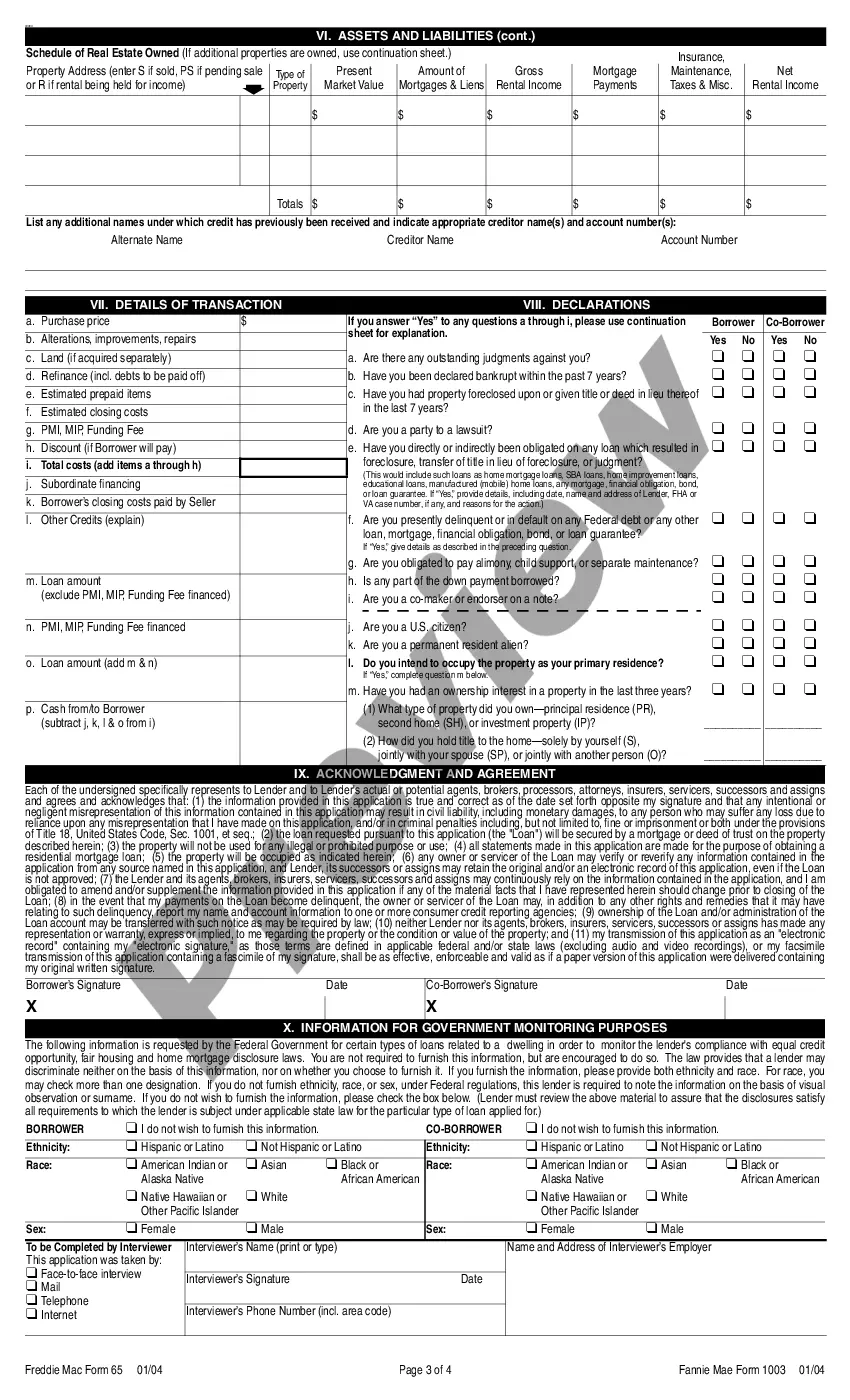

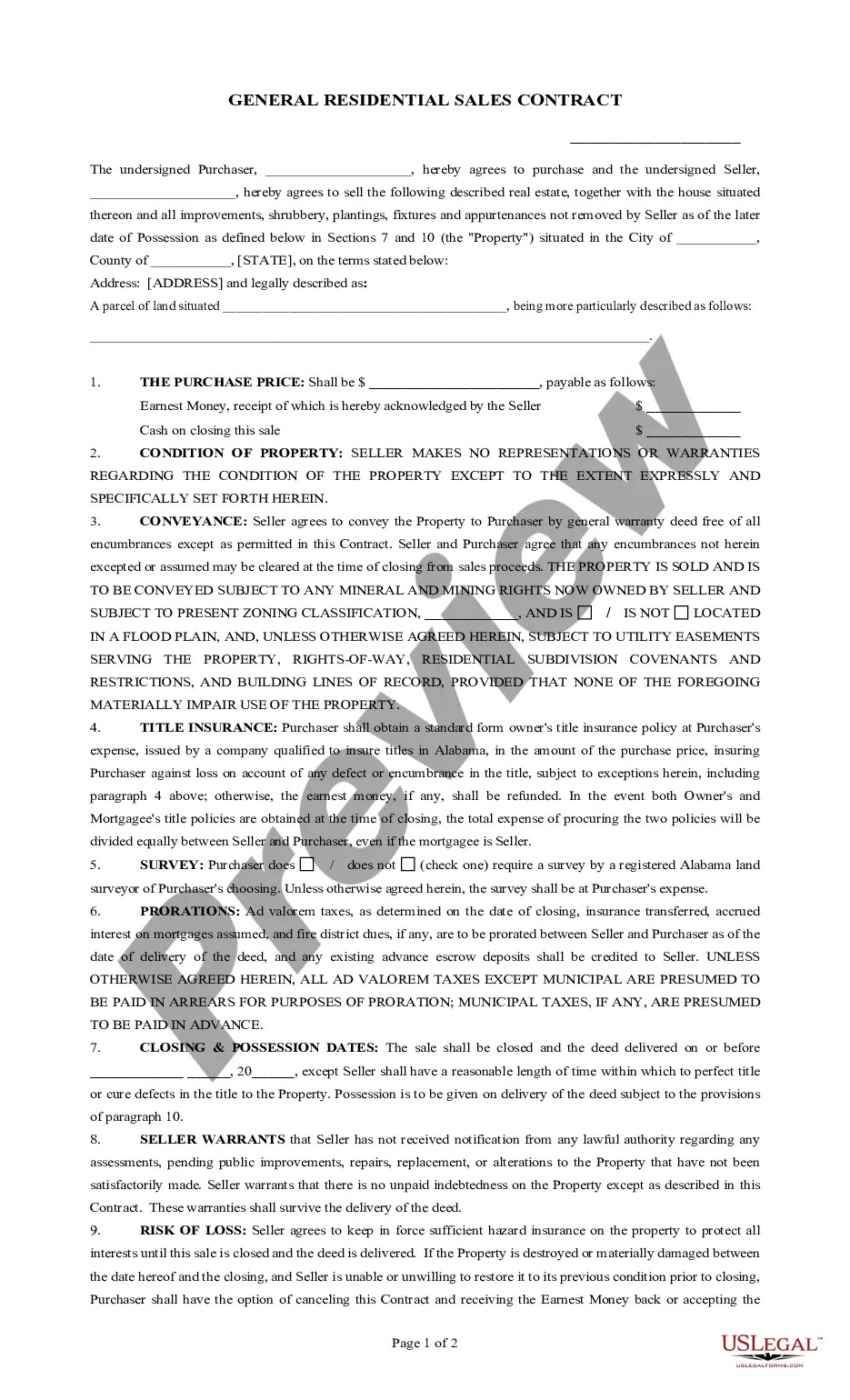

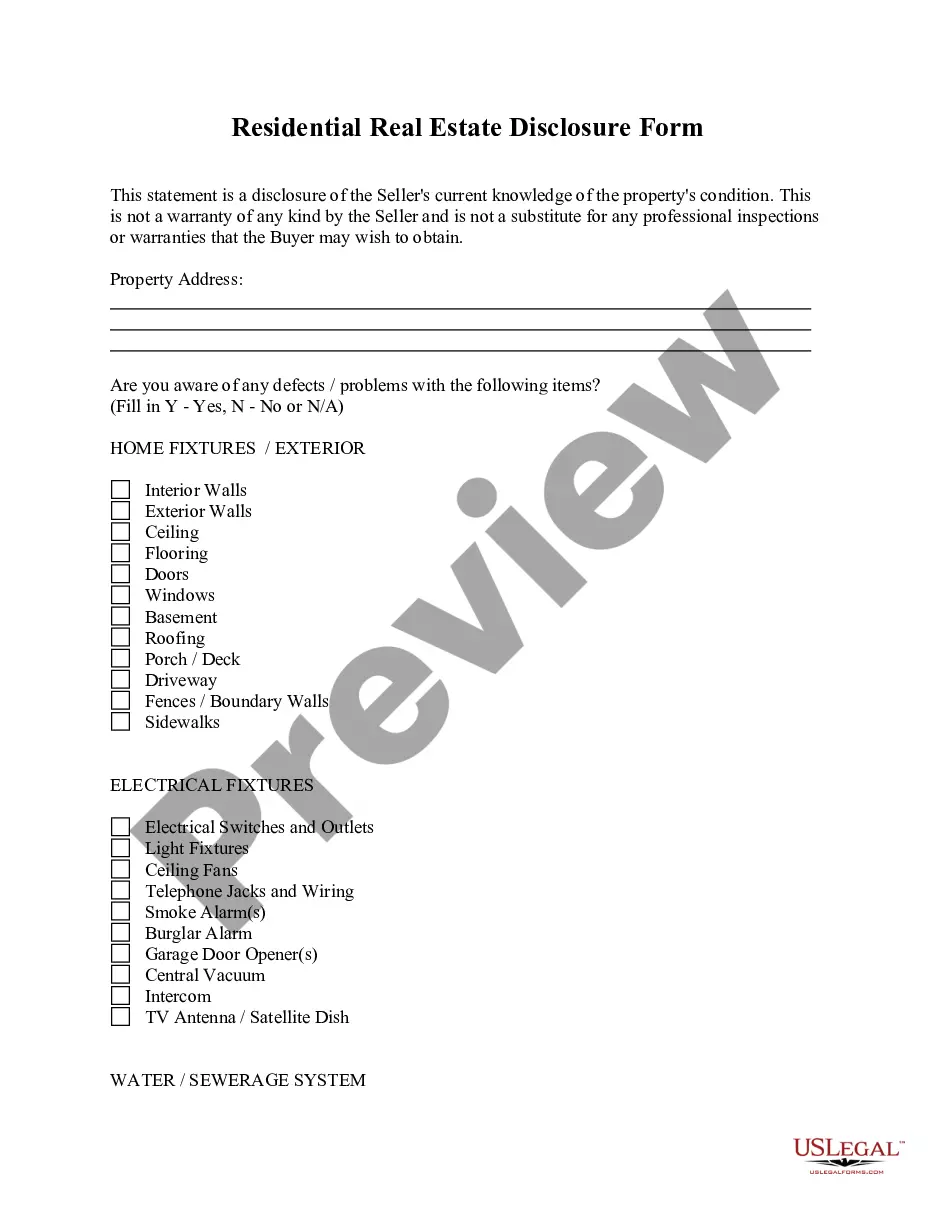

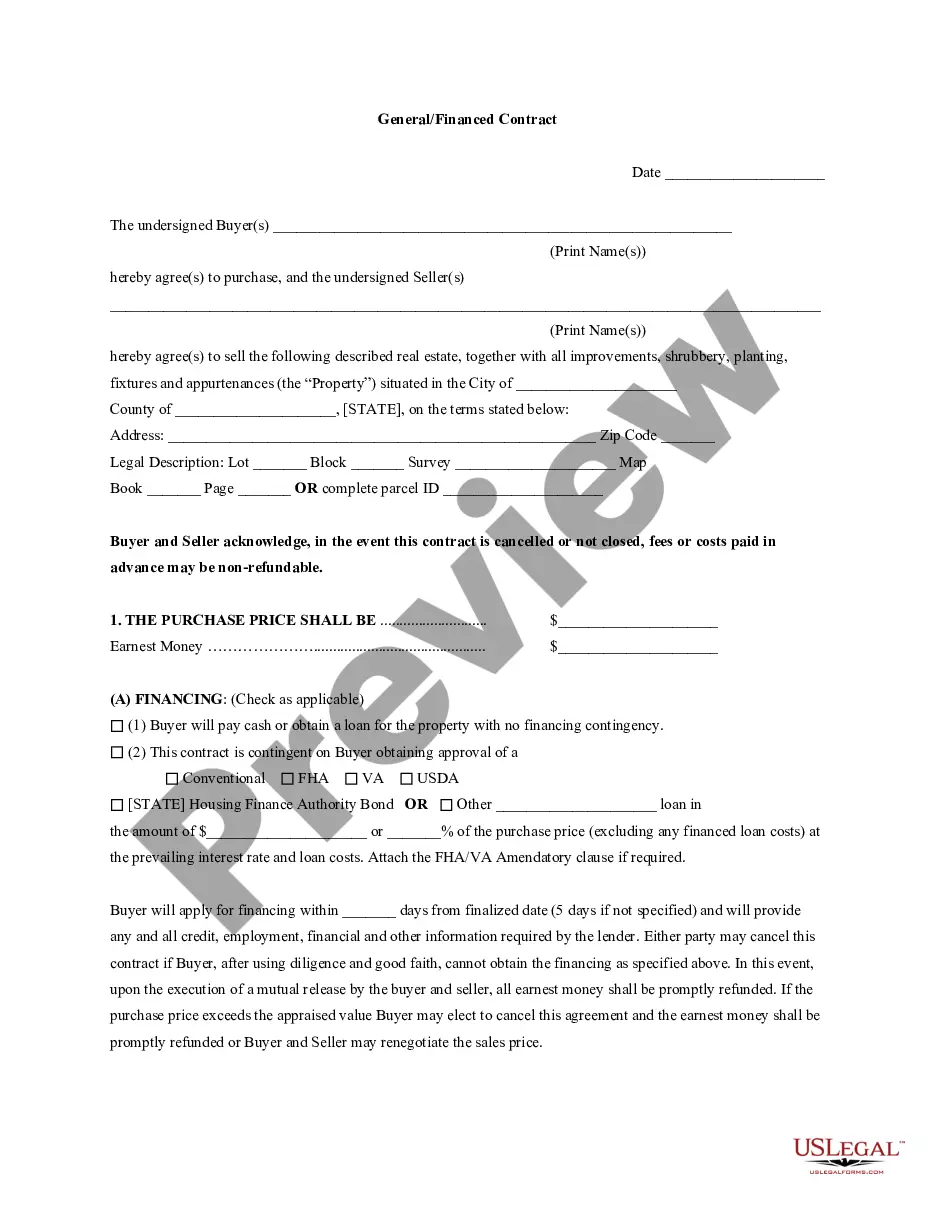

What Is a Mortgage Application? A mortgage application is a document submitted to a lender when you apply for a mortgage to purchase real estate. The application is extensive and contains information about the property being considered for purchase, the borrower's financial situation and employment history, and more.

Why doesn't Alex's lender send a pre-approval? Most often, information is missing or not completed. A pre-approval letter can only be issued once the borrower's financials have been reviewed. If there is missing information, the lender cannot complete their pre-approval process.

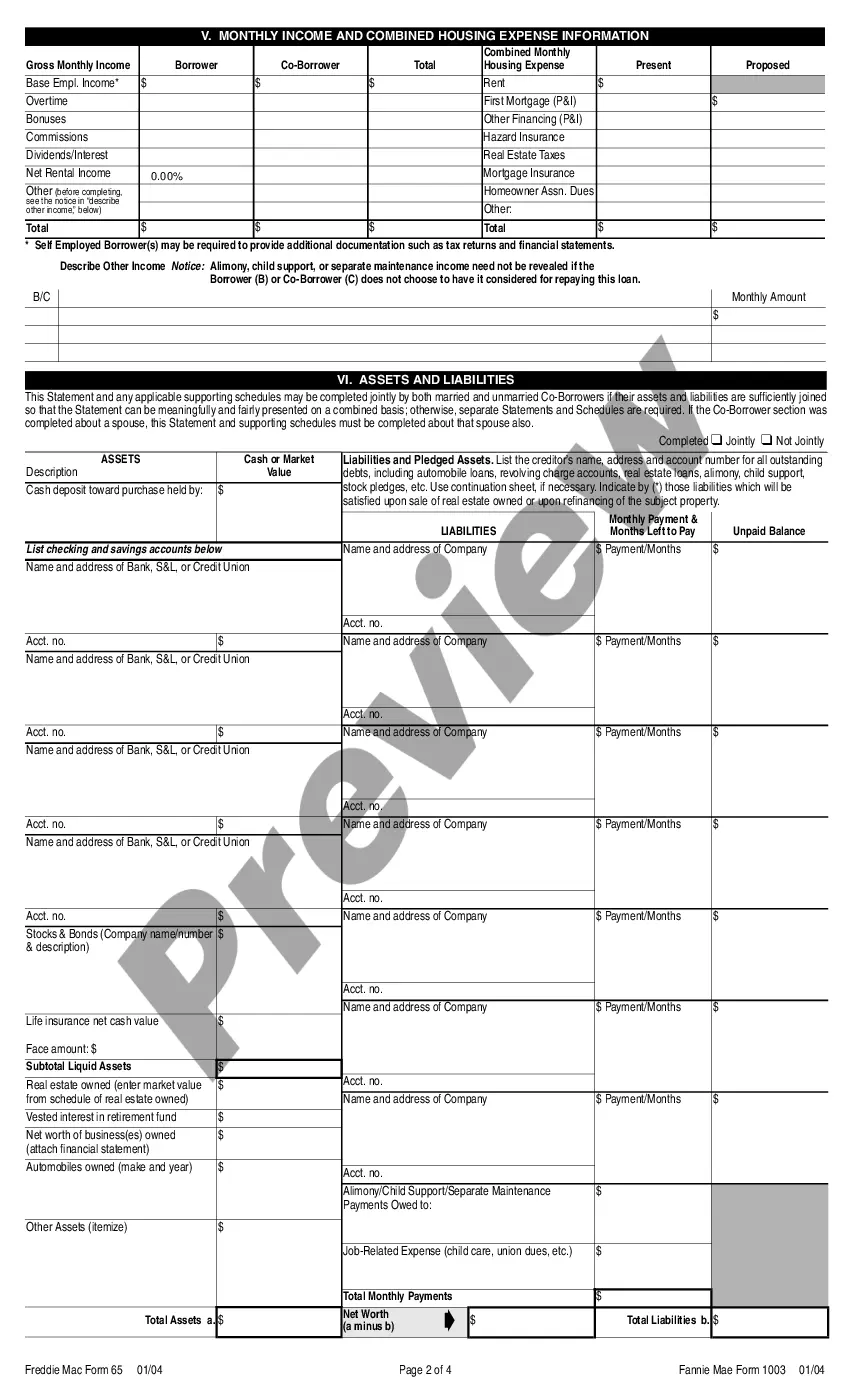

The uniform residential loan application is a form designed by Fannie Mae and Freddie Mac, government-sponsored enterprises (GSE) that support the mortgage market. The form was created to collect the information lenders need to assess your creditworthiness for a mortgage loan.

After years of delays, including a year-long delay due to COVID-19, the release of the new Uniform Residential Loan Application (URLA) is about to happen. Starting March 1, 2021, all lenders who intend to sell closed residential mortgage loans to Fannie Mae or Freddie Mac will be required to use the new URLA.

The URLA consists of two main forms, the Borrower Information Form and the Lender Information Form, which together make up the complete loan application. However, depending on certain situations, additional forms may be required. These are the Additional Borrower form, Unmarried Addendum, and Continuation Sheet.

The home loan application will ask borrowers for information regarding their financial situation, including income and assets, as well as personal information like their Social Security number. You will also be required to provide documentation corroborating the information you provide.