A New Hampshire Complex Will with a Credit Shelter Marital Trust for Spouse is a comprehensive estate planning tool that provides a way to protect and distribute assets for married couples in the state of New Hampshire. This document is created to ensure that both individuals' interests are protected and that the surviving spouse will receive adequate financial support after the first spouse's death. The main purpose of a Credit Shelter Marital Trust is to maximize estate tax savings while guaranteeing financial security for the surviving spouse. This trust is designed to hold a portion of the deceased spouse's assets, typically up to the federal estate tax exemption amount, and distribute income and principal to the surviving spouse as needed. By utilizing this type of trust, married couples can take full advantage of the available estate tax exemptions and potentially reduce or eliminate estate taxes upon the second spouse's passing. There are different variations of New Hampshire Complex Wills with Credit Shelter Marital Trusts, including: 1. The A/B Trust: Also known as a "Bypass Trust," this arrangement divides assets into two parts upon the first spouse's death. The "A" portion, or the Marital Trust, is available for the surviving spouse's benefit and doesn't incur estate taxes. The "B" portion, or the Credit Shelter Trust, preserves assets up to the estate tax exemption limit and can pass to the heirs, including children or other beneficiaries outside the marital relationship. 2. The TIP Trust: The Qualified Terminable Interest Property Trust is another type of marital trust that allows the first spouse to transfer assets to the trust, ensuring they qualify for the marital deduction for estate tax purposes. The surviving spouse receives income generated from the trust during their lifetime, and upon their passing, the remaining assets are distributed to the beneficiaries chosen by the first spouse. 3. The Unified Credit Marital Trust: This option allows the first spouse to transfer assets equal to the federal estate tax exemption to a trust, with the surviving spouse having the ability to use the trust assets during their lifetime. Any remaining assets after the surviving spouse's passing can then be distributed to the beneficiaries, usually children or other relatives. In conclusion, a New Hampshire Complex Will with a Credit Shelter Marital Trust for a spouse is an estate planning tool that serves to protect assets, reduce estate taxes, and ensure financial security for the surviving spouse. There are various types of trusts available to accommodate different goals and circumstances.

New Hampshire Complex Will - Credit Shelter Marital Trust for Spouse

Description

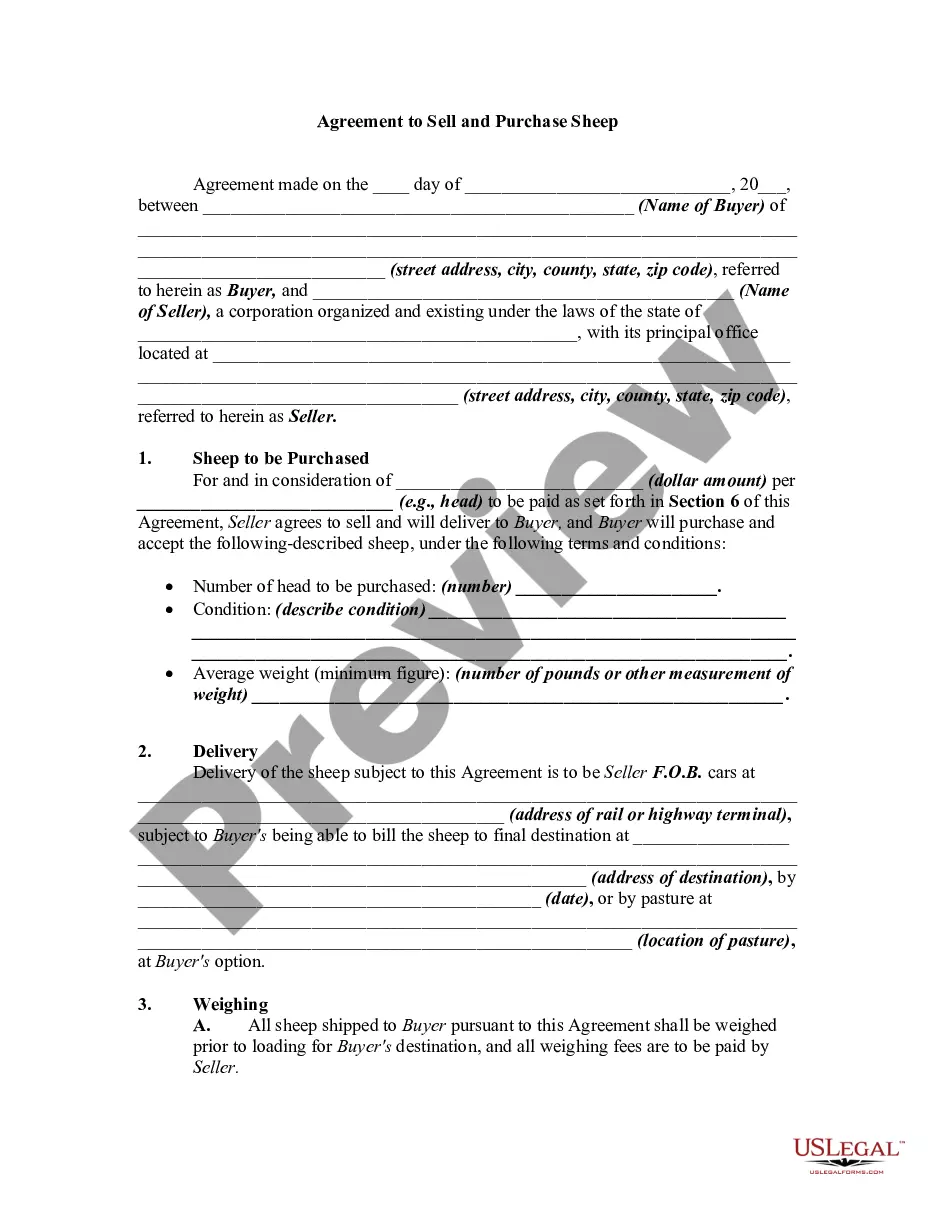

How to fill out New Hampshire Complex Will - Credit Shelter Marital Trust For Spouse?

If you want to comprehensive, acquire, or printing legal papers templates, use US Legal Forms, the biggest variety of legal forms, that can be found on the Internet. Use the site`s simple and handy research to find the files you want. Different templates for organization and person purposes are sorted by groups and says, or search phrases. Use US Legal Forms to find the New Hampshire Complex Will - Credit Shelter Marital Trust for Spouse within a handful of mouse clicks.

In case you are previously a US Legal Forms consumer, log in to the account and click the Download option to obtain the New Hampshire Complex Will - Credit Shelter Marital Trust for Spouse. You can even entry forms you previously downloaded within the My Forms tab of the account.

If you are using US Legal Forms the very first time, follow the instructions under:

- Step 1. Make sure you have selected the shape for the right town/land.

- Step 2. Use the Preview solution to look over the form`s articles. Don`t forget about to read the outline.

- Step 3. In case you are not happy with the develop, make use of the Look for area at the top of the screen to find other models of the legal develop format.

- Step 4. Upon having located the shape you want, go through the Buy now option. Pick the rates strategy you prefer and include your credentials to sign up on an account.

- Step 5. Procedure the deal. You may use your bank card or PayPal account to perform the deal.

- Step 6. Choose the format of the legal develop and acquire it on your own product.

- Step 7. Total, revise and printing or indication the New Hampshire Complex Will - Credit Shelter Marital Trust for Spouse.

Every legal papers format you purchase is your own forever. You have acces to every develop you downloaded inside your acccount. Click on the My Forms portion and choose a develop to printing or acquire once again.

Be competitive and acquire, and printing the New Hampshire Complex Will - Credit Shelter Marital Trust for Spouse with US Legal Forms. There are thousands of expert and state-certain forms you can utilize for your personal organization or person needs.

Form popularity

FAQ

Credit shelter trusts are also commonly known as bypass, family, or exemption trusts.

Upon the death of the surviving spouse, the trust transfers to the heirs, who are exempt from the estate tax that would have resulted from a combined inheritance. Disadvantages of a CST include formation costs and the surviving spouse's lack of control.

This trust is irrevocable and will pass to beneficiaries other than the surviving spouse (usually their children). The surviving spouse must follow the trust's plan without overly benefiting from its operation, but this trust often passes income to the surviving spouse to live on for the rest of their life.

No. Credit Shelter Trusts are a popular tool for estate planning, and there are two main types of CSTs, the Marital Gift Trust and the Qualified Terminable Interest Property Trust (QTIP). Both of these Trusts preserve wealth via estate tax exemptions.

There are three types of marital trusts: a general power of appointment, a qualified terminable interest property (QTIP) trust, and an estate trust.

Unlike a QTIP trust, the assets of the credit shelter trust are not included in the beneficiary's gross estate and, as a result, are not subject to estate tax at the beneficiary's death (in other words, the assets bypass the beneficiary's estate).

Unlike a QTIP trust, the assets of the credit shelter trust are not included in the beneficiary's gross estate and, as a result, are not subject to estate tax at the beneficiary's death (in other words, the assets bypass the beneficiary's estate).