New Hampshire Underwriting Agreement of Ameriquest Mortgage Securities, Inc. An underwriting agreement is a legal contract between Ameriquest Mortgage Securities, Inc. and an underwriter that outlines the terms and conditions of an underwriting transaction in New Hampshire. Underwriting agreements are often used in securities offerings, including mortgage-backed securities (MBS), to establish the relationship between the issuer and the underwriter. In the case of Ameriquest Mortgage Securities, Inc., a prominent financial services company, their New Hampshire Underwriting Agreement serves as a crucial tool in the process of issuing mortgage-backed securities in the state. This agreement sets forth the obligations and responsibilities of both Ameriquest Mortgage Securities, Inc. and the underwriter, ensuring a transparent and orderly transaction. The main objective of the New Hampshire Underwriting Agreement is to allocate the risk between Ameriquest Mortgage Securities, Inc. and the underwriter. It details the terms of the agreement, including the amount of securities to be underwritten, the underwriter's compensation, and the responsibilities of each party. Key elements addressed in a New Hampshire Underwriting Agreement may include: 1. Securities Offering Details: The agreement specifies the type and quantity of mortgage-backed securities that Ameriquest Mortgage Securities, Inc. intends to issue in New Hampshire. This could include residential mortgage-backed securities (RMBS), commercial mortgage-backed securities (CMOS), or other related offerings. 2. Underwriter Responsibilities: The agreement outlines the specific responsibilities of the underwriter. This may include performing due diligence, assessing the creditworthiness of the underlying mortgage loans, marketing the securities to potential investors, managing the subscription process, and supporting regulatory compliance. 3. Pricing and Compensation: The agreement establishes the pricing and compensation structure for the underwriter. It may include an underwriting discount or fee that the underwriter earns as compensation for assuming the risks associated with the securities offering. 4. Conditions and Representations: The agreement includes provisions specifying the conditions that must be met, representations made by both parties, and any regulatory requirements that need to be fulfilled. This ensures that the transaction adheres to applicable laws and regulations in New Hampshire. 5. Dispute Resolution: The agreement may include a mechanism for resolving disputes that may arise during the underwriting process. This could involve arbitration, mediation, or another agreed-upon resolution method. Different types of New Hampshire Underwriting Agreements of Ameriquest Mortgage Securities, Inc. can vary based on the specific securities being underwritten, such as RMBS or CMOS, as well as any unique terms negotiated between Ameriquest Mortgage Securities, Inc. and each underwriter. Each agreement is tailored to the particular needs and requirements of the specific securities offering. In conclusion, the New Hampshire Underwriting Agreement of Ameriquest Mortgage Securities, Inc. is a legally binding contract that establishes the terms and conditions for the underwriting of mortgage-backed securities in New Hampshire. It serves to protect both Ameriquest Mortgage Securities, Inc. and the underwriter by outlining their respective roles, responsibilities, and compensation in the underwriting process.

New Hampshire Underwriting Agreement of Ameriquest Mortgage Securities, Inc.

Description

How to fill out Underwriting Agreement Of Ameriquest Mortgage Securities, Inc.?

Have you been within a place the place you need paperwork for either business or individual functions almost every time? There are tons of legitimate document themes available on the net, but finding versions you can rely isn`t straightforward. US Legal Forms gives a large number of kind themes, such as the New Hampshire Underwriting Agreement of Ameriquest Mortgage Securities, Inc., that are published to meet state and federal needs.

Should you be presently informed about US Legal Forms internet site and have an account, basically log in. Next, you are able to download the New Hampshire Underwriting Agreement of Ameriquest Mortgage Securities, Inc. design.

If you do not have an bank account and wish to start using US Legal Forms, adopt these measures:

- Find the kind you want and make sure it is for the proper area/region.

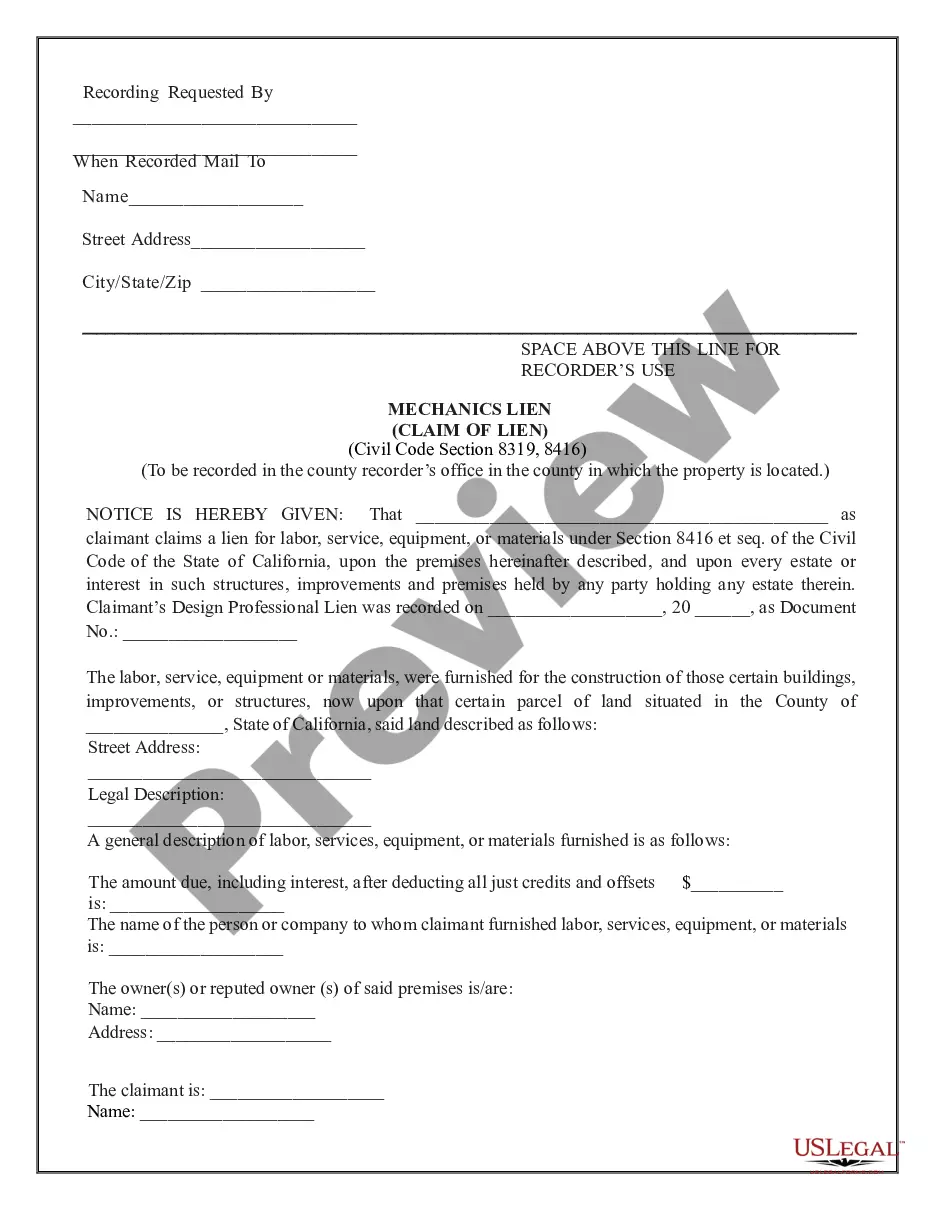

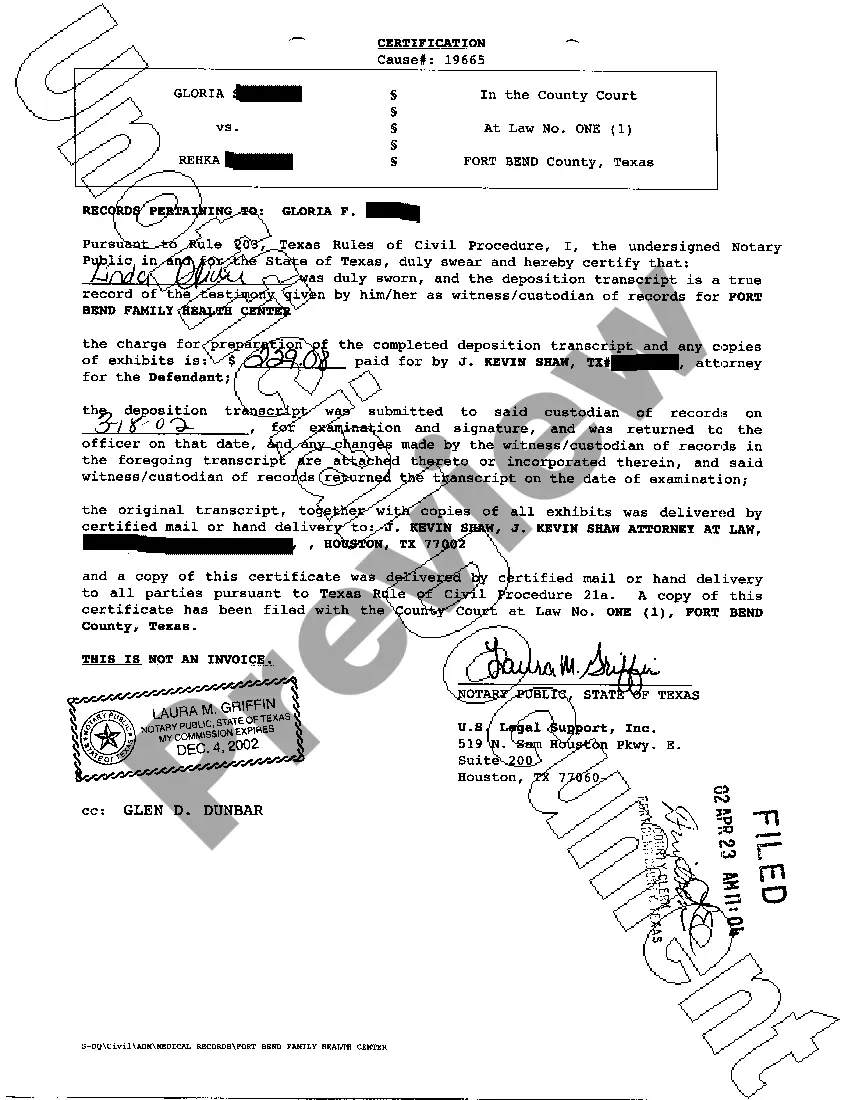

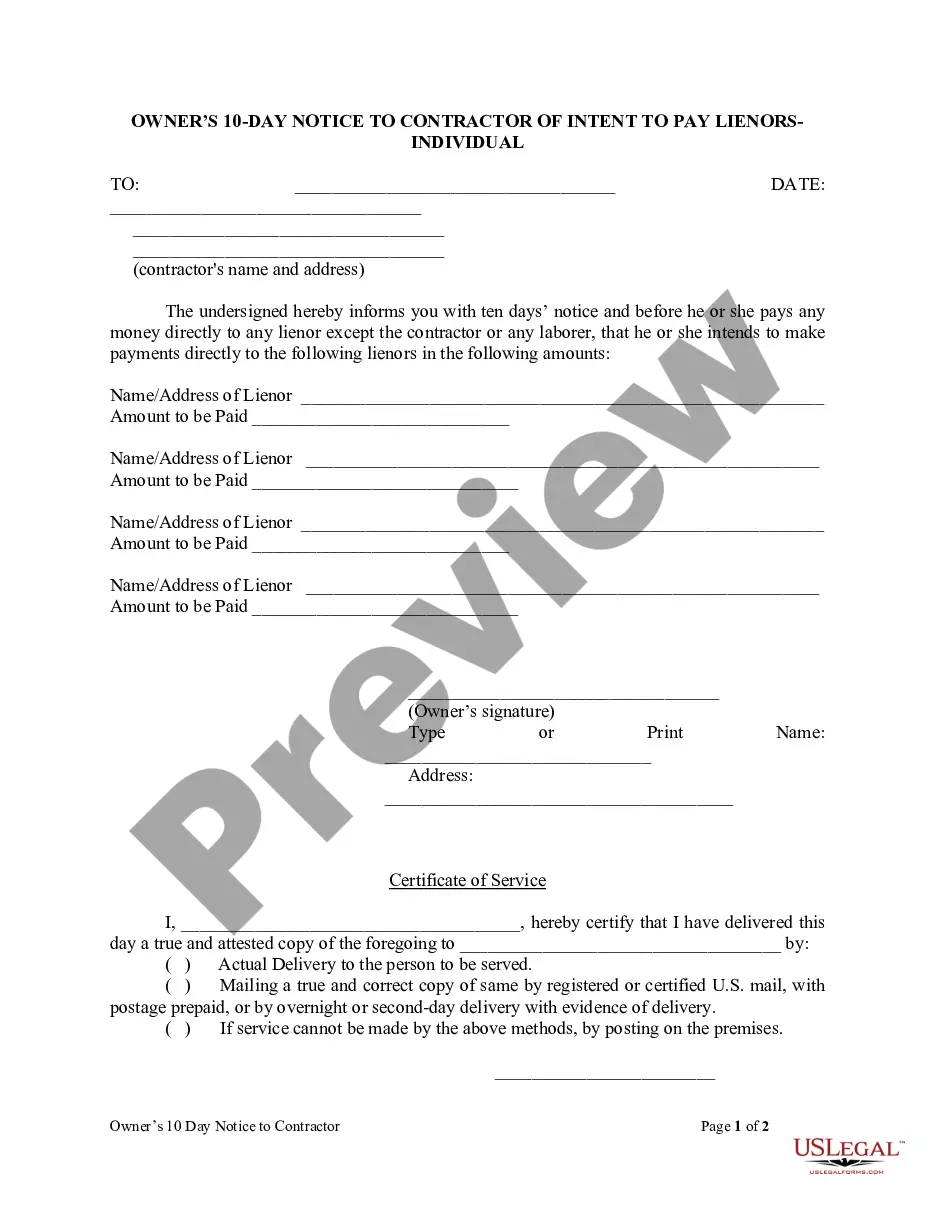

- Take advantage of the Review option to review the form.

- Look at the information to ensure that you have chosen the proper kind.

- If the kind isn`t what you`re trying to find, utilize the Research field to find the kind that suits you and needs.

- If you discover the proper kind, just click Buy now.

- Choose the prices strategy you want, submit the specified information and facts to create your account, and pay for the order utilizing your PayPal or bank card.

- Decide on a convenient file formatting and download your backup.

Find all the document themes you may have purchased in the My Forms menus. You can aquire a more backup of New Hampshire Underwriting Agreement of Ameriquest Mortgage Securities, Inc. any time, if needed. Just select the necessary kind to download or printing the document design.

Use US Legal Forms, one of the most comprehensive assortment of legitimate forms, to save time and prevent errors. The support gives professionally made legitimate document themes which you can use for an array of functions. Create an account on US Legal Forms and initiate making your way of life a little easier.

Form popularity

FAQ

?The mortgage will be transferred to another bank if the first bank experiences problems and fails, and you will need to start making payments to the new lender. You might need to refinance your mortgage with the new bank, depending on the details of the transfer.?

On September 1, 2007, Citigroup completed its acquisition of Argent Mortgage and AMC Mortgage Services, shutting down Ameriquest Mortgage.

Status: CLOSED. Long Beach was closed by Washington Mutual in 2007. History: Originally a California-based savings and loan, founded in 1979, Long Beach Bank became a federally chartered thrift institution in 1990. In October 1994, it became Long Beach Mortgage Co.

Employer Identification No.) 1100 TOWN & COUNTRY ROAD, SUITE 1100 ORANGE, CALIFORNIA 92868 (Address of principal executive offices) (Zip Code) Registrant's Telephone Number, Including Area Code: (714) 541-9960 Item 5.

The "lender" is the financial institution that loaned you the money. The lender owns the loan and is also called the "note holder" or "holder." Sometime later, the lender might sell the mortgage debt to another entity, which then becomes the new loan owner (holder).