New Hampshire Stock Option Agreement by Telocity, Inc.

Description

How to fill out Stock Option Agreement By Telocity, Inc.?

Choosing the best legitimate document design might be a struggle. Of course, there are plenty of templates available online, but how will you get the legitimate kind you want? Use the US Legal Forms website. The assistance gives 1000s of templates, for example the New Hampshire Stock Option Agreement by Telocity, Inc., which can be used for enterprise and personal requirements. All of the types are inspected by professionals and fulfill state and federal needs.

When you are currently signed up, log in for your bank account and click the Acquire option to have the New Hampshire Stock Option Agreement by Telocity, Inc.. Make use of bank account to appear throughout the legitimate types you may have purchased in the past. Go to the My Forms tab of your own bank account and obtain an additional copy of your document you want.

When you are a fresh customer of US Legal Forms, listed below are easy recommendations for you to follow:

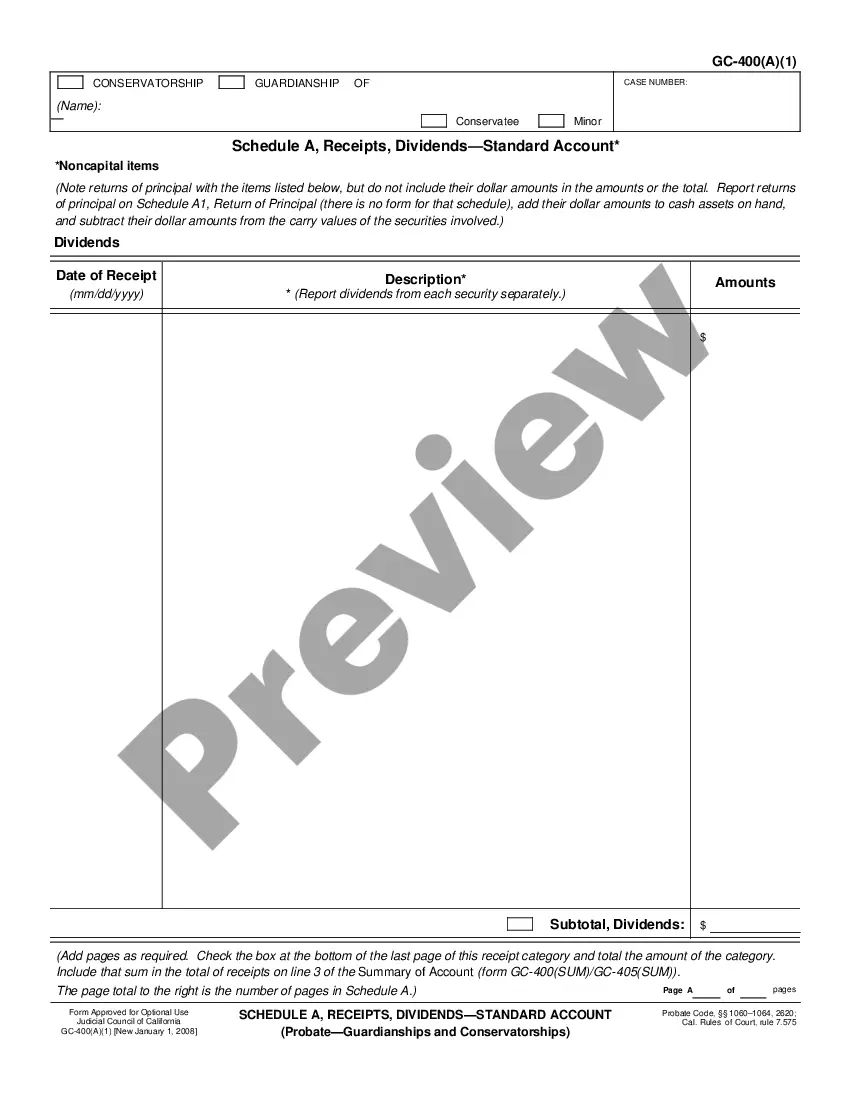

- Initial, make certain you have chosen the proper kind to your metropolis/area. You can examine the form making use of the Preview option and look at the form explanation to ensure this is basically the right one for you.

- When the kind does not fulfill your preferences, make use of the Seach field to find the proper kind.

- When you are certain that the form is acceptable, click on the Buy now option to have the kind.

- Opt for the prices strategy you need and type in the needed details. Design your bank account and pay money for the transaction using your PayPal bank account or Visa or Mastercard.

- Select the file format and acquire the legitimate document design for your product.

- Full, change and produce and indicator the received New Hampshire Stock Option Agreement by Telocity, Inc..

US Legal Forms is definitely the greatest library of legitimate types where you can find numerous document templates. Use the service to acquire expertly-produced papers that follow condition needs.

Form popularity

FAQ

How do I accept a grant? On the Summary page, click Accept Grant next to the grant in the list of Unaccepted Grants. Once you've indicated that you've read the plan document and grant agreement, you can accept the grant by clicking Accept on the Grant Terms and Agreement page.

This Amendment may be executed in counterparts, each of which when signed by the Company or Employee will be deemed an original and all of which together will be deemed the same agreement. Form of Amendment to Stock Option Agreement - SEC.gov sec.gov ? Archives ? edgar ? data ? dex101 sec.gov ? Archives ? edgar ? data ? dex101

For example, you may be granted the right to buy 1,000 shares, with the options vesting 25% per year over four years with a term of 10 years. So 25% of the ESOs, conferring the right to buy 250 shares would vest in one year from the option grant date, another 25% would vest two years from the grant date, and so on. Employee Stock Options (ESOs): A Complete Guide - Investopedia investopedia.com ? terms ? eso investopedia.com ? terms ? eso

A stock option provides an employee with the opportunity to purchase a set number of shares of company stock at a certain price within a certain period of time. The price is called the ?grant price? or ?strike price.? This price is usually based on a discounted price of the stock at the time of hire. 10 Tips About Stock Option Agreements When Evaluating a Job ... melmedlaw.com ? how-to-evaluate-stock-op... melmedlaw.com ? how-to-evaluate-stock-op...

Stock options are a form of compensation. Companies can grant them to employees, contractors, consultants and investors. These options, which are contracts, give an employee the right to buy, or exercise, a set number of shares of the company stock at a preset price, also known as the grant price.

Logging into your Carta account will take you to the Tasks page, where you will accept your option grant. You can click on View Details link to review your option, including the documents. To accept, click on Accept.

Remember: If you hope to purchase and sell your stock someday, accepting your stock option grant is the first step you have to take.It doesn't cost anything to accept the grant, and you're not obligated to actually exercise your options. Stock Options Explained: What You Need to Know - Carta carta.com ? blog ? equity-101-stock-option-basics carta.com ? blog ? equity-101-stock-option-basics

Remember: If you hope to purchase and sell your stock someday, accepting your stock option grant is the first step you have to take.It doesn't cost anything to accept the grant, and you're not obligated to actually exercise your options.