Title: Understanding the New Hampshire Registration Rights Agreement between Trident Group, Inc. and Trident Stockholders Introduction: A New Hampshire Registration Rights Agreement plays a crucial role in ensuring transparency, compliance, and investor protection within Trident Group, Inc., a prominent corporation. This detailed description will shed light on the significance, purpose, and various types of New Hampshire Registration Rights Agreements between Trident Group, Inc. and Trident Stockholders. Definition: A New Hampshire Registration Rights Agreement is a legally binding contract between Trident Group, Inc. and its stockholders, outlining the rights and obligations related to the registration of Trident stock under federal securities laws. It provides shareholders with the ability to request and participate in the registration of their shares, allowing them to sell or transfer their securities in compliance with applicable regulations. Purpose: The main purpose of the New Hampshire Registration Rights Agreement is to protect the interests of Trident stockholders by ensuring fair and orderly trading of their shares in the public market. It facilitates the registration of securities, which grants stockholders the opportunity to sell their shares freely, enhance market liquidity, and potentially realize a return on their investment. Key Provisions: 1. Demand Registration Rights: This provision allows Trident stockholders holding a specified number of shares to request the company to initiate the registration of those shares. The agreement sets forth detailed procedures and timelines for such demands. 2. Piggyback Registration Rights: Under this provision, Trident stockholders holding shares that are not yet registered may "piggyback" on any future registration initiated by the company or other stockholders. This ensures that stockholders are not left behind when registration opportunities arise. 3. Registration Expenses: The agreement typically outlines the allocation of expenses associated with the registration process between Trident Group, Inc. and the participating stockholders. These expenses may include legal fees, filing fees, printing costs, and other related expenditures. 4. Lock-Up Agreements: In certain instances, the agreement may include lock-up provisions, restricting the sale or transfer of securities for a specified timeframe after an initial public offering (IPO) or other significant events. Lock-up periods aim to stabilize the market and prevent excessive volatility. Types of New Hampshire Registration Rights Agreements: 1. Form S-1 Registration Rights Agreement: This type of agreement governs the registration of shares to be sold during an IPO or by a company intending to go public. It outlines the rights of stockholders to participate in the initial registration statement filing and subsequent offerings. 2. Form S-3 Registration Rights Agreement: This agreement allows eligible stockholders to participate in the registration of additional securities on Form S-3, which is a simplified registration form for companies that meet specific SEC requirements. It streamlines the registration process, making it more efficient. Conclusion: The New Hampshire Registration Rights Agreement between Trident Group, Inc. and Trident Stockholders is a crucial legal document that ensures fair trading, liquidity, and investor protection. By comprehensively outlining the rights and obligations of both parties, the agreement promotes transparency and compliance with federal securities laws. Understanding the different types of registration rights agreements enables shareholders to exercise their rights effectively and participate in the registration process in line with their investment goals.

New Hampshire Registration Rights Agreement between TriZetto Group, Inc. and TriZetto Stockholders

Description

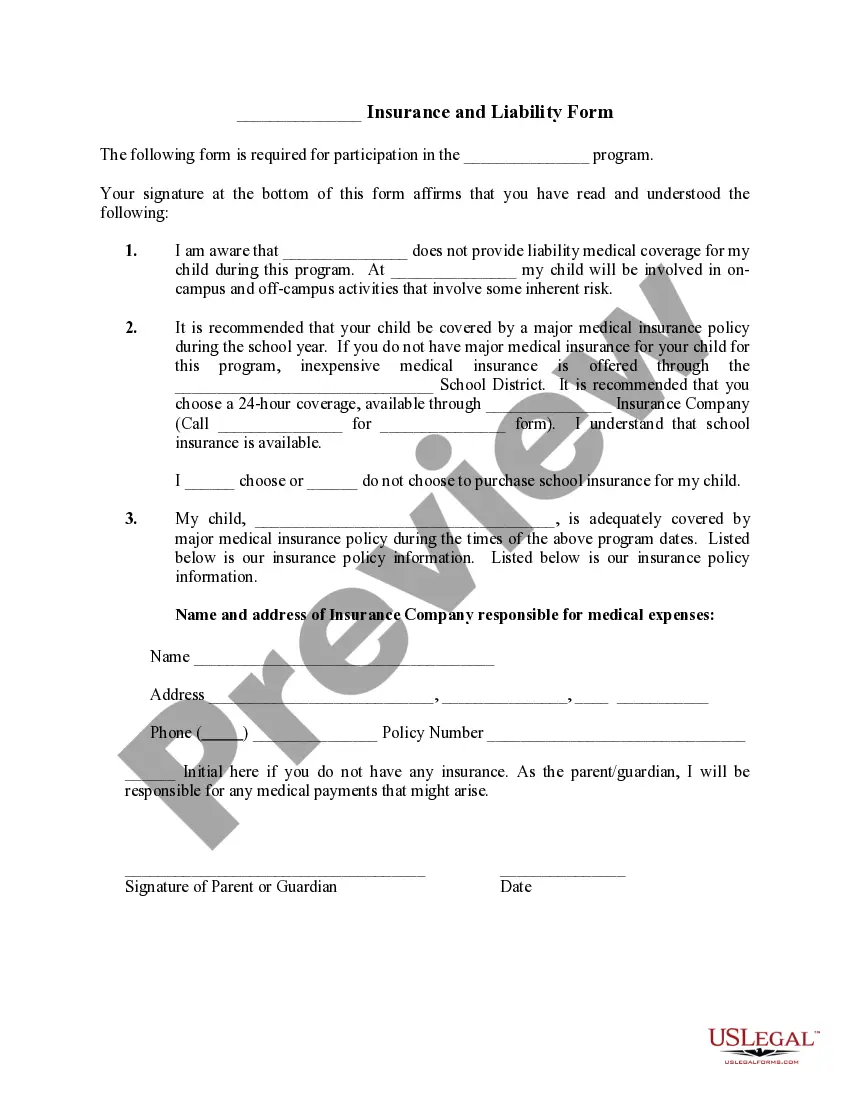

How to fill out New Hampshire Registration Rights Agreement Between TriZetto Group, Inc. And TriZetto Stockholders?

Choosing the best legal file template could be a struggle. Needless to say, there are a lot of templates available on the Internet, but how can you obtain the legal form you require? Utilize the US Legal Forms web site. The assistance provides a huge number of templates, including the New Hampshire Registration Rights Agreement between TriZetto Group, Inc. and TriZetto Stockholders, that can be used for enterprise and personal demands. Every one of the forms are inspected by professionals and meet up with federal and state needs.

If you are presently authorized, log in in your accounts and click on the Down load key to have the New Hampshire Registration Rights Agreement between TriZetto Group, Inc. and TriZetto Stockholders. Use your accounts to check from the legal forms you possess acquired previously. Go to the My Forms tab of your respective accounts and obtain yet another duplicate of the file you require.

If you are a whole new consumer of US Legal Forms, listed here are easy directions that you should stick to:

- First, ensure you have chosen the appropriate form for your metropolis/region. You can look over the form utilizing the Review key and study the form information to make sure this is basically the right one for you.

- In case the form is not going to meet up with your preferences, make use of the Seach discipline to obtain the proper form.

- Once you are positive that the form would work, go through the Acquire now key to have the form.

- Opt for the costs plan you want and enter in the required details. Make your accounts and pay money for the order making use of your PayPal accounts or Visa or Mastercard.

- Pick the submit format and acquire the legal file template in your device.

- Comprehensive, revise and print out and indicator the obtained New Hampshire Registration Rights Agreement between TriZetto Group, Inc. and TriZetto Stockholders.

US Legal Forms may be the most significant library of legal forms where you can see different file templates. Utilize the service to acquire professionally-made files that stick to condition needs.