New Hampshire Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association

Description

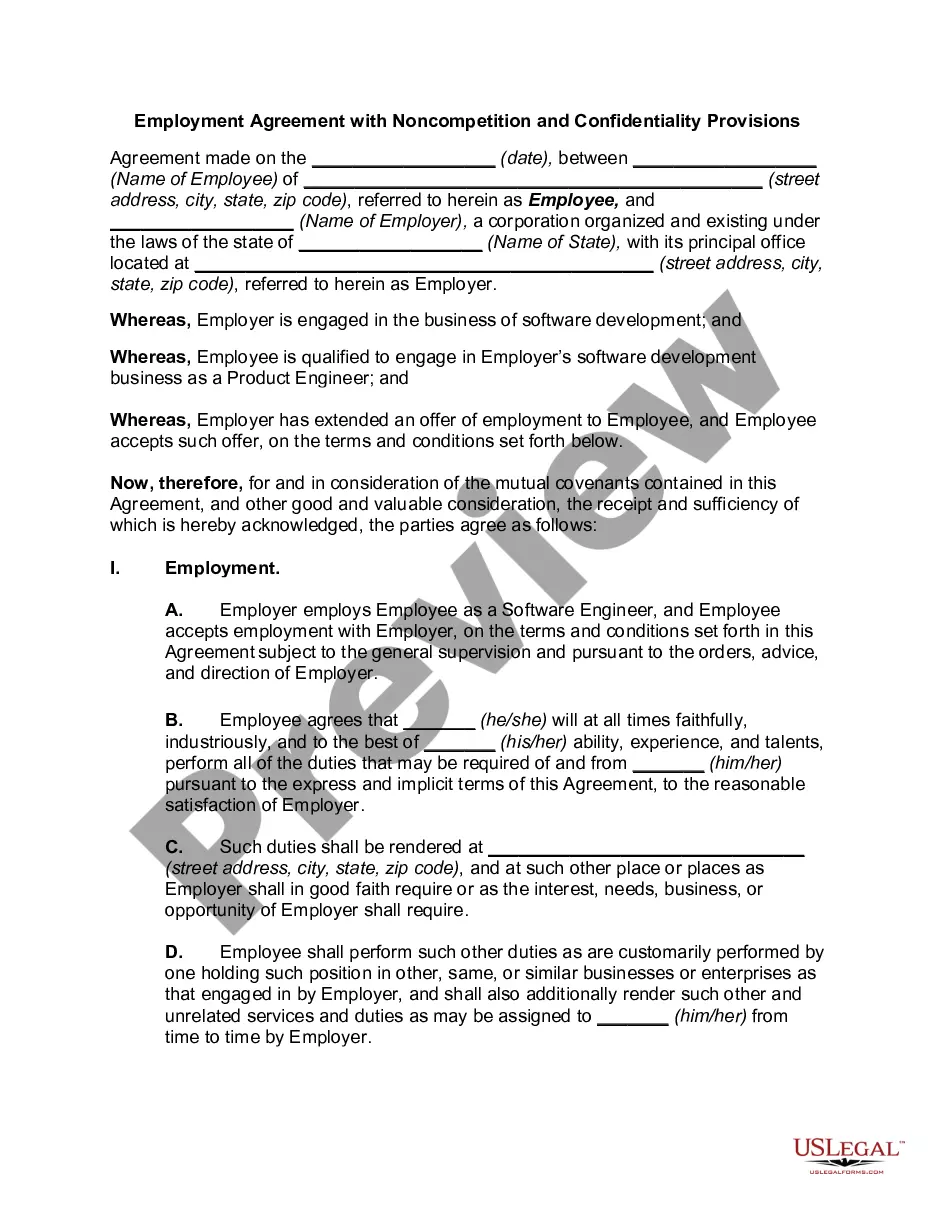

How to fill out Pooling And Servicing Agreement Between Greenpoint Credit, LLC And Bank One, National Association?

US Legal Forms - one of many greatest libraries of lawful types in America - gives an array of lawful papers templates you may acquire or print. While using site, you can find 1000s of types for organization and personal reasons, categorized by groups, states, or keywords and phrases.You can find the newest models of types much like the New Hampshire Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association in seconds.

If you currently have a monthly subscription, log in and acquire New Hampshire Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association from your US Legal Forms collection. The Download switch will appear on every type you perspective. You have access to all earlier delivered electronically types in the My Forms tab of your bank account.

In order to use US Legal Forms the first time, listed here are straightforward recommendations to get you began:

- Ensure you have picked the proper type for the town/region. Click the Review switch to review the form`s articles. Look at the type information to ensure that you have chosen the correct type.

- In the event the type does not satisfy your demands, take advantage of the Research area towards the top of the monitor to find the one that does.

- In case you are pleased with the form, verify your decision by clicking on the Get now switch. Then, opt for the prices strategy you favor and offer your credentials to sign up for an bank account.

- Process the deal. Utilize your credit card or PayPal bank account to finish the deal.

- Find the file format and acquire the form in your gadget.

- Make alterations. Fill out, modify and print and indicator the delivered electronically New Hampshire Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association.

Every format you included with your money does not have an expiry time which is your own forever. So, if you would like acquire or print yet another duplicate, just go to the My Forms portion and click about the type you require.

Obtain access to the New Hampshire Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association with US Legal Forms, one of the most extensive collection of lawful papers templates. Use 1000s of professional and condition-distinct templates that fulfill your company or personal requirements and demands.

Form popularity

FAQ

Company overview shut down GreenPoint in the third quarter of 2007. History: Originally a community bank in Brooklyn, New York, GreenPoint Savings Bank was first chartered in 1868.

The ?Pooling and Servicing Agreement? is the legal document that contains the responsibilities and rights of the servicer, the trustee, and others over a pool of mortgage loans.

An MBS is made up of a pool of mortgages purchased from issuing banks and then sold to investors. An MBS allows investors to benefit from the mortgage business without needing to buy or sell home loans themselves. What Are Mortgage-Backed Securities? rocketmortgage.com ? learn ? mortgage-bac... rocketmortgage.com ? learn ? mortgage-bac...

What is a Pooling Agreement? A pooling agreement is a type of contract where corporate shareholders create a voting trust by pooling their voting rights and transferring them to a trustee. This is also called a voting agreement or shareholder-control agreement since it is used to control the affairs of the corporation. Pooling Agreement: Definition & Sample - Contracts Counsel contractscounsel.com ? pooling-agreement contractscounsel.com ? pooling-agreement

PSA is used primarily to derive an implied prepayment speed of new production loans. 00% PSA assumes a prepayment rate of 2% per month in the first month following the date of issue, increasing at 2% percentage points per month thereafter until the 30th month. PSA Prepayment Rate Definition - Nasdaq nasdaq.com ? glossary ? psa-prepayment-rate nasdaq.com ? glossary ? psa-prepayment-rate

A mortgage pool is a group of home and other real estate loans that have been bundled so they can be sold. A mortgage pool is a group of home and other real estate loans that have been bundled so they can be sold. What Is a Mortgage Pool? - The Balance thebalancemoney.com ? what-is-a-mortgage... thebalancemoney.com ? what-is-a-mortgage...