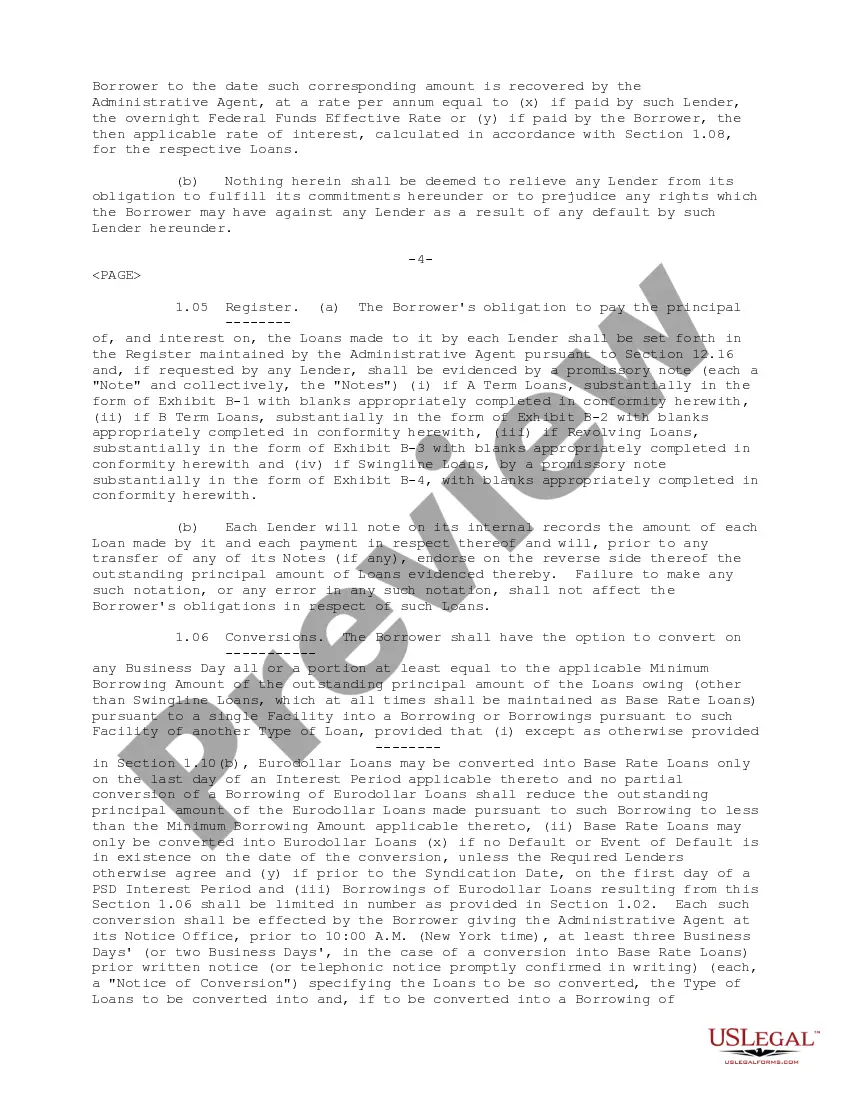

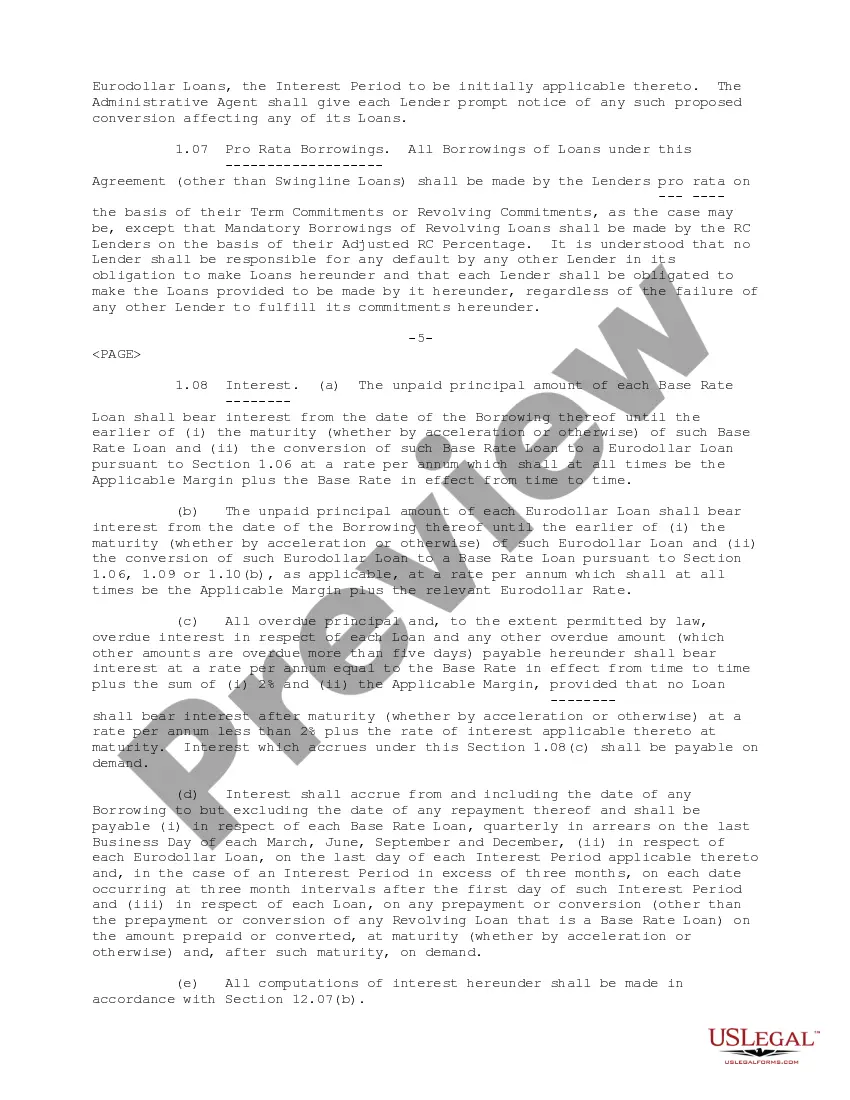

New Hampshire Credit Agreement: Unilab Corp, Various Lending Institutions, Bankers Trust Co, and Merrill Lynch Capital Corp A New Hampshire Credit Agreement between Unilab Corp, Various Lending Institutions, Bankers Trust Co, and Merrill Lynch Capital Corp is a legally binding document that outlines the terms and conditions under which Unilab Corp can access credit facilities provided by the lending institutions. This agreement enables Unilab Corp to obtain funds for various needs, such as working capital, expansion projects, or debt refinancing, while ensuring the lending institutions are adequately protected. Keywords: New Hampshire, credit agreement, Unilab Corp, lending institutions, Bankers Trust Co, Merrill Lynch Capital Corp, terms and conditions, access to credit, facilities, funds, working capital, expansion projects, debt refinancing, protection. Types of New Hampshire Credit Agreement between Unilab Corp, Various Lending Institutions, Bankers Trust Co, and Merrill Lynch Capital Corp: 1. Revolving Credit Agreement: This type of credit agreement offers Unilab Corp a pre-approved line of credit up to a specified limit. Unilab Corp can withdraw and repay funds as needed within that limit, providing them with flexibility to manage their cash flow and working capital requirements. 2. Term Loan Agreement: In a term loan agreement, Unilab Corp receives a lump sum amount from the lending institutions, which is then repaid over a predetermined period through regular installments. This type of credit agreement is often used for financing long-term capital investments or specific projects. 3. Asset-Based Loan Agreement: Under an asset-based loan agreement, Unilab Corp can borrow funds against its assets, such as accounts receivable, inventory, equipment, or real estate. The lending institutions assess the value of the company's assets and provide a credit facility based on the determined collateral value. 4. Syndicated Credit Agreement: A syndicated credit agreement involves multiple lending institutions, such as Bankers Trust Co and Merrill Lynch Capital Corp, collaborating to provide a larger credit facility to Unilab Corp. Each institution contributes a portion of the total loan amount, spreading the risk and allowing for higher borrowing limits. 5. Secured Credit Agreement: A secured credit agreement requires Unilab Corp to pledge collateral, such as assets or property, to secure the credit facility. In the event of default, the lending institutions have the right to claim the pledged assets to recover their outstanding loans, providing them with added security. 6. Unsecured Credit Agreement: Unlike a secured credit agreement, an unsecured credit agreement does not require Unilab Corp to provide collateral. Instead, it relies solely on the borrower's creditworthiness and financial strength. However, this type of credit agreement may have higher interest rates or stricter terms to compensate for the increased risk taken by the lending institutions. In summary, the New Hampshire Credit Agreement between Unilab Corp, Various Lending Institutions, Bankers Trust Co, and Merrill Lynch Capital Corp establishes the terms and conditions for providing credit facilities to Unilab Corp. These credit agreements may include revolving credit, term loans, asset-based loans, syndicated credit, secured credit, or unsecured credit, depending on the specific financing needs and risk appetite of all parties involved.

New Hampshire Credit Agreement between Unilab Corp, Various Lending Institutions, Bankers Trust Co and Merrill Lynch Capital Corp

Description

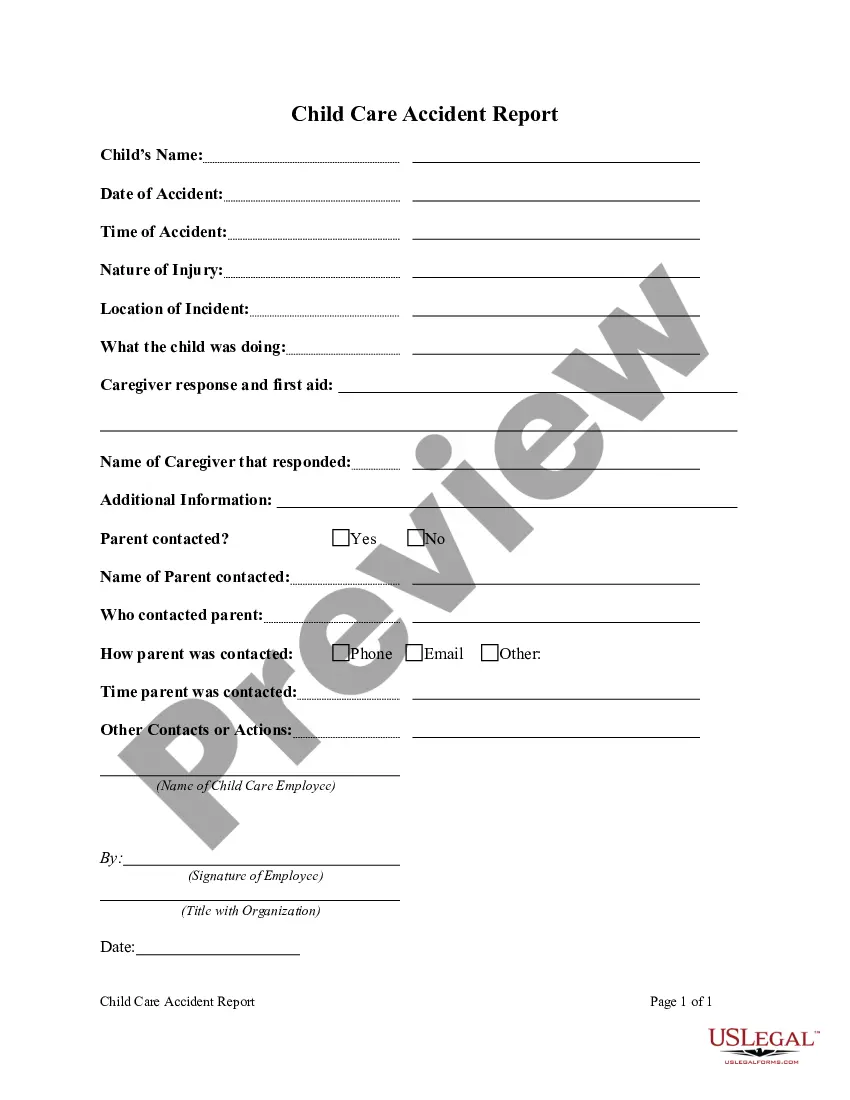

How to fill out New Hampshire Credit Agreement Between Unilab Corp, Various Lending Institutions, Bankers Trust Co And Merrill Lynch Capital Corp?

If you have to total, obtain, or produce lawful document templates, use US Legal Forms, the greatest variety of lawful types, that can be found on the web. Utilize the site`s basic and practical lookup to find the papers you will need. Various templates for enterprise and individual functions are categorized by types and suggests, or keywords and phrases. Use US Legal Forms to find the New Hampshire Credit Agreement between Unilab Corp, Various Lending Institutions, Bankers Trust Co and Merrill Lynch Capital Corp with a few click throughs.

If you are previously a US Legal Forms buyer, log in in your account and click on the Down load switch to have the New Hampshire Credit Agreement between Unilab Corp, Various Lending Institutions, Bankers Trust Co and Merrill Lynch Capital Corp. You may also gain access to types you formerly saved in the My Forms tab of your own account.

Should you use US Legal Forms the very first time, follow the instructions below:

- Step 1. Ensure you have selected the shape for your correct city/nation.

- Step 2. Take advantage of the Preview option to look over the form`s articles. Do not overlook to read through the description.

- Step 3. If you are unhappy together with the develop, make use of the Look for discipline at the top of the display screen to get other models of the lawful develop design.

- Step 4. Once you have located the shape you will need, click the Buy now switch. Opt for the pricing plan you choose and put your accreditations to register for an account.

- Step 5. Method the purchase. You should use your charge card or PayPal account to complete the purchase.

- Step 6. Select the file format of the lawful develop and obtain it on the device.

- Step 7. Comprehensive, change and produce or indicator the New Hampshire Credit Agreement between Unilab Corp, Various Lending Institutions, Bankers Trust Co and Merrill Lynch Capital Corp.

Every lawful document design you get is your own property eternally. You possess acces to every develop you saved inside your acccount. Select the My Forms segment and choose a develop to produce or obtain once again.

Compete and obtain, and produce the New Hampshire Credit Agreement between Unilab Corp, Various Lending Institutions, Bankers Trust Co and Merrill Lynch Capital Corp with US Legal Forms. There are many expert and express-particular types you can use to your enterprise or individual demands.