The New Hampshire Investor Rights Agreement is a legal document that outlines the terms and conditions for investors who purchase Series C Preferred Stock shares in a company based in New Hampshire. This agreement aims to protect and specify the rights, privileges, and obligations of investors in relation to their investment in the company. Key terms and provisions included in the New Hampshire Investor Rights Agreement are: 1. Series C Preferred Stock: This agreement specifically pertains to investors who have purchased Series C Preferred Stock shares, a specific class of stock with certain rights and preferences. 2. Voting Rights: The agreement outlines the voting rights attached to the Series C Preferred Stock shares, including the number of votes per share and any special voting requirements. 3. Dividend Preferences: It defines the dividend preferences and payment terms for Series C Preferred Stock shareholders, outlining whether they receive a fixed dividend rate, participate in distributions with common stockholders, or have a cumulative dividend feature. 4. Liquidation Preferences: The agreement specifies the liquidation preferences for Series C Preferred Stock shareholders, determining the order in which they will receive their investment back in the event of a liquidation or sale of the company. 5. Conversion Rights: It explains the conversion rights of the Series C Preferred Stock shares, detailing the circumstances and conditions under which investors can convert their preferred shares into common shares. 6. Anti-Dilution Protection: This provision protects investors from dilution by adjusting the conversion price or providing additional shares in case the company issues new equity at a lower price. 7. Information Rights: The agreement stipulates the information rights of the investors, ensuring they receive regular reports and financial statements from the company to keep them informed about the company's financial health. 8. Board of Directors: It may include provisions regarding the representation of Series C Preferred Stock shareholders on the company's board of directors, granting them specific voting rights or observer rights. 9. Transfer Restrictions: The agreement may impose restrictions on the transfer of Series C Preferred Stock shares, such as preemptive rights, right of first refusal, or lock-up periods. 10. Indemnification: It may outline the company's obligation to indemnify and hold harmless the Series C Preferred Stock shareholders against any legal liabilities or claims arising from their investment in the company. While the general New Hampshire Investor Rights Agreement covers most terms and conditions, variations may exist depending on the specific terms negotiated between the company and the investors. Additionally, the agreement may be tailored for different series of preferred stock, such as Series A or Series B Preferred Stock, each with their own distinct provisions.

New Hampshire Investor Rights Agreement regarding the purchase of Series C Preferred Stock shares

Description

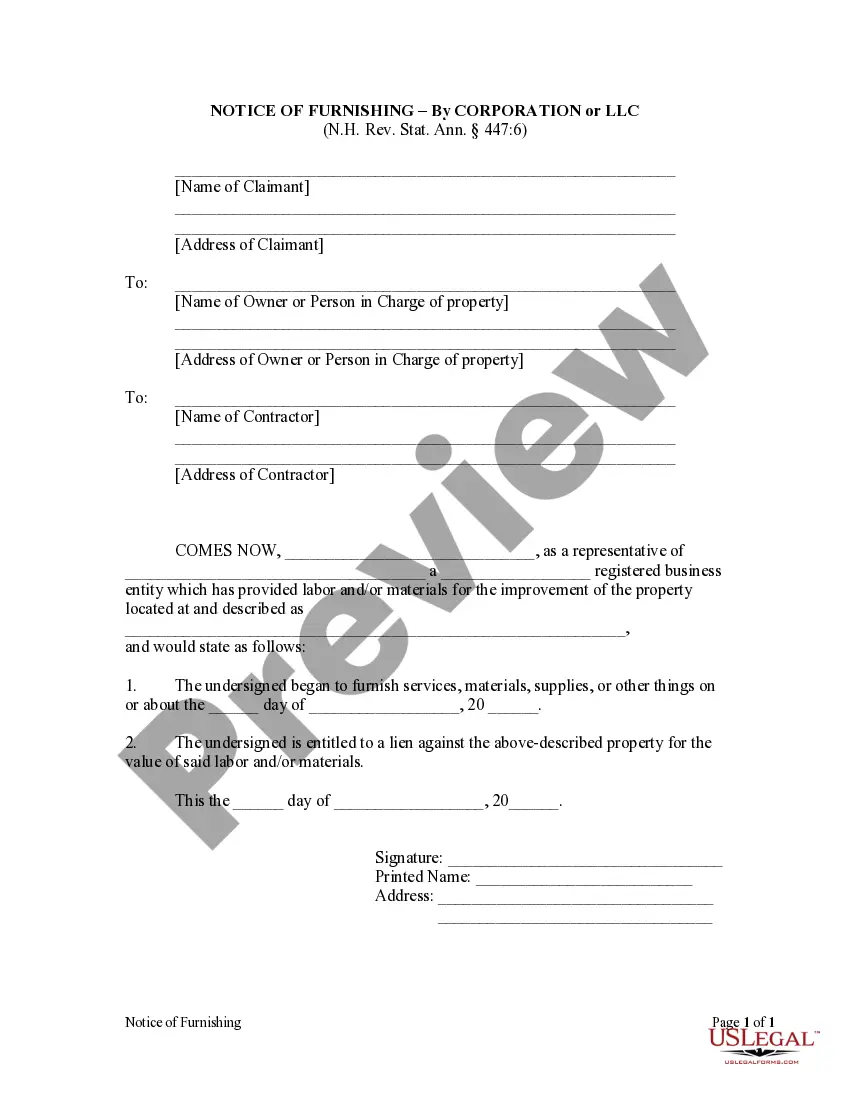

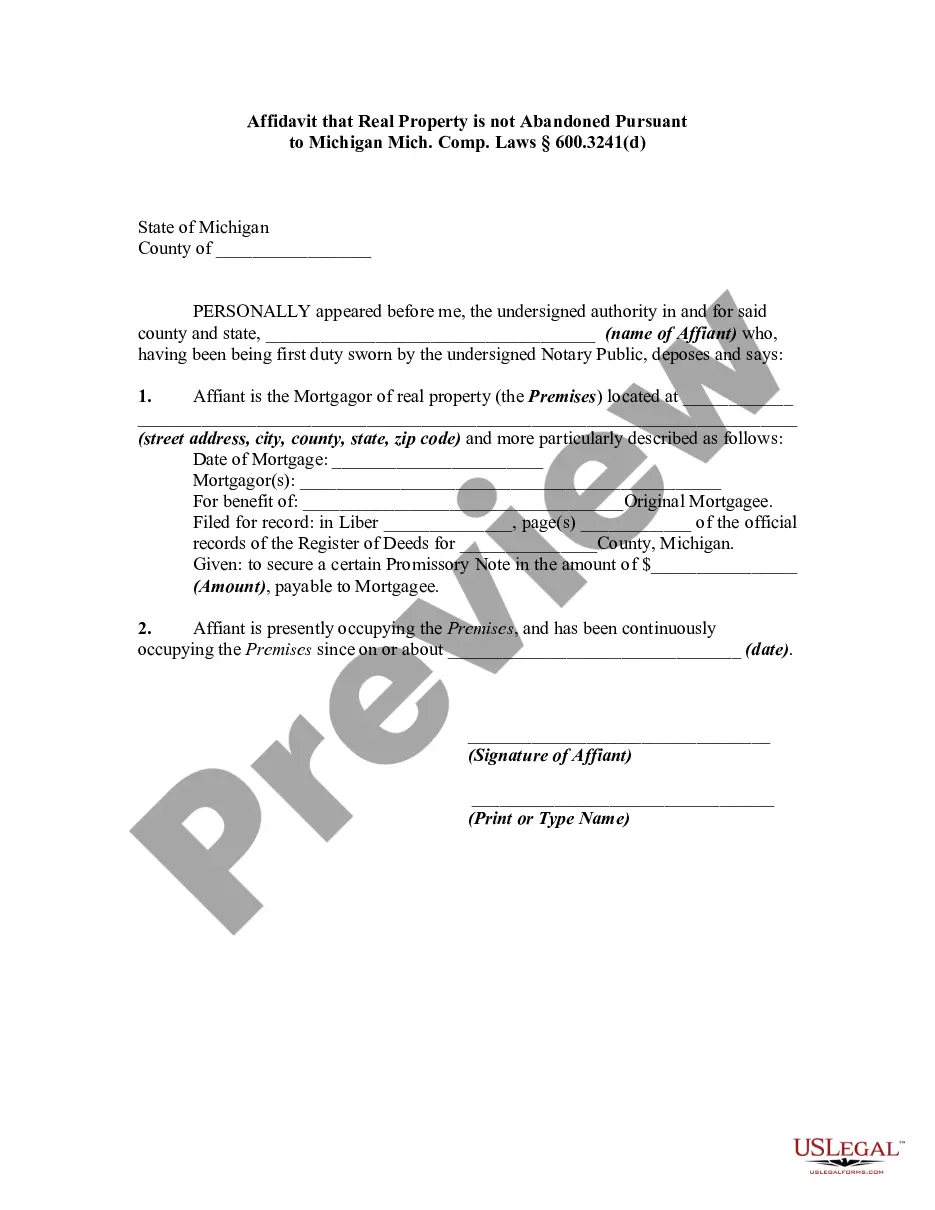

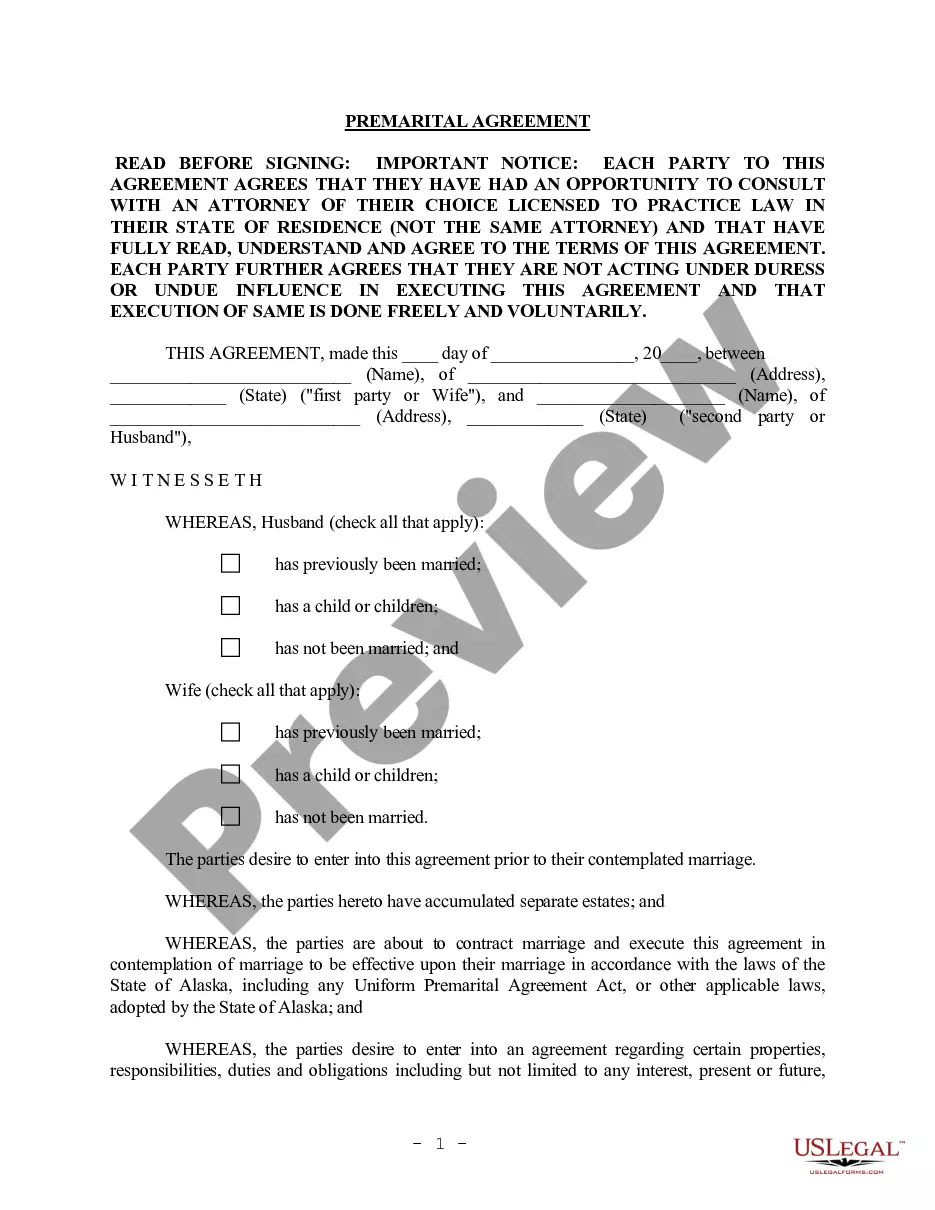

How to fill out New Hampshire Investor Rights Agreement Regarding The Purchase Of Series C Preferred Stock Shares?

Choosing the right lawful record web template might be a struggle. Of course, there are plenty of web templates available online, but how can you get the lawful kind you want? Take advantage of the US Legal Forms internet site. The support gives a huge number of web templates, such as the New Hampshire Investor Rights Agreement regarding the purchase of Series C Preferred Stock shares, which you can use for organization and private needs. Every one of the forms are checked by specialists and satisfy state and federal demands.

In case you are previously listed, log in to the profile and click on the Acquire option to find the New Hampshire Investor Rights Agreement regarding the purchase of Series C Preferred Stock shares. Utilize your profile to look from the lawful forms you might have purchased in the past. Proceed to the My Forms tab of your profile and acquire one more version in the record you want.

In case you are a fresh end user of US Legal Forms, allow me to share straightforward recommendations so that you can comply with:

- Initially, make sure you have chosen the correct kind for your personal city/area. You are able to look over the shape utilizing the Review option and study the shape explanation to guarantee this is basically the right one for you.

- If the kind is not going to satisfy your preferences, utilize the Seach industry to get the correct kind.

- When you are positive that the shape is suitable, go through the Purchase now option to find the kind.

- Choose the costs plan you want and enter the needed information. Build your profile and pay money for the order using your PayPal profile or Visa or Mastercard.

- Pick the file file format and obtain the lawful record web template to the product.

- Comprehensive, revise and print and sign the attained New Hampshire Investor Rights Agreement regarding the purchase of Series C Preferred Stock shares.

US Legal Forms will be the largest local library of lawful forms for which you can find a variety of record web templates. Take advantage of the company to obtain appropriately-manufactured documents that comply with express demands.

Form popularity

FAQ

Preferred stock can include rights such as preemption, convertibility, callability, and dividend and liquidation preference.

While a buy-sell agreement typically addresses the sale of shares among co-owners of a business, a shareholder agreement may address a wider range of issues, including the management and control of the business, the distribution of profits, and the appointment of directors and officers.

A share purchase agreement is a formal contract or an agreement that sets out the terms and conditions relating to the sale and purchase of shares in a company. The share purchase agreement should very clearly set out what is being sold, to whom and for how much, as well as any other obligations and liabilities.

The Shareholder's Agreement is generally used to resolve disputes between the corporation and the Shareholder. The Share Purchase Agreement, on the other hand, is a document that justifies the exchange of shares held by the Buyer and Seller.

Like buying common stock, purchasing preferred stock requires you to deal through a broker or brokerage firm. Many brokerage firms operate online, allowing you to open an account with a low minimum balance and trade. Brokers have unique advantages and disadvantages.

How to Buy Preference Shares? Choose a brokerage firm: Research and choose a reputable brokerage firm that offers preference shares trading. Open an account: Open a demat account with the desired brokerage firm, providing the necessary personal information and funding the account with the desired amount.

Subscription agreement vs shareholders agreement? A share subscription agreement is essentially an agreement for the purchase of shares from a company. In contrast, a shareholders agreement contains terms that govern the ongoing relationship between shareholders.

A company executes a Share subscription agreement (SSA) in case of a fresh issue of shares. A shareholders' agreement (SHA) is a contract that contains the rights and obligations of the shareholders in a company.