The New Hampshire Stock Option Agreement of Interwar, Inc. is a legally binding document that outlines the terms and conditions surrounding the issuance and exercise of stock options to employees or other eligible individuals. This agreement is specific to Interwar, Inc., a company based in New Hampshire that offers stock option plans for their employees. Interwar, Inc. may have different types of stock option agreements based on various factors such as the vesting period, exercise price, and eligibility criteria. Some possible variations of the New Hampshire Stock Option Agreement of Interwar, Inc. include: 1. Employee Stock Option Agreement: This agreement is designed for Interwar, Inc. employees and defines the terms and conditions under which they may acquire and exercise stock options offered by the company. It typically includes details such as the number of options granted, vesting schedule, exercise price, and any restrictions on exercising the options. 2. Non-Employee Stock Option Agreement: Interwar, Inc. may also offer stock options to consultants, advisors, or other non-employees. This type of agreement would outline the terms and conditions applicable to non-employee option holders, including the number of options granted, exercise period, and any specific restrictions or requirements. 3. Incentive Stock Option (ISO) Agreement: An ISO agreement is a type of stock option agreement that provides favorable tax treatment to the option holder. It may be offered to employees of Interwar, Inc. who meet certain eligibility criteria defined by tax laws. The agreement would contain provisions specific to SOS, such as the exercise price, holding periods, and tax implications. 4. Non-Qualified Stock Option (NO) Agreement: NO agreements are another type of stock option agreement that does not qualify for special tax treatment. These options may be offered to employees or non-employees of Interwar, Inc., and the agreement would outline the terms and conditions applicable to Nests, including exercise price, vesting schedule, and any specific restrictions. 5. Restricted Stock Unit (RSU) Agreement: While not strictly a stock option, RSU agreements are often included under the umbrella of stock-based compensation plans. An RSU agreement outlines the terms for granting restricted stock units to employees of Interwar, Inc. RSS represent a promise to deliver shares of stock in the future, subject to certain conditions. The agreement would define the vesting period, settlement criteria, and restrictions on the RSS. It is important to note that the specific content and terms of each type of agreement may vary based on the company's internal policies, legal requirements, and individual circumstances of the option holders.

New Hampshire Stock Option Agreement of Intraware, Inc.

Description

How to fill out New Hampshire Stock Option Agreement Of Intraware, Inc.?

Finding the right legal file design can be quite a have difficulties. Of course, there are a lot of layouts available online, but how will you obtain the legal type you want? Utilize the US Legal Forms website. The support gives a large number of layouts, including the New Hampshire Stock Option Agreement of Intraware, Inc., which can be used for enterprise and personal requirements. All of the varieties are examined by specialists and fulfill state and federal needs.

If you are already signed up, log in to the profile and click the Acquire key to find the New Hampshire Stock Option Agreement of Intraware, Inc.. Make use of profile to appear from the legal varieties you possess acquired previously. Go to the My Forms tab of your profile and obtain yet another duplicate from the file you want.

If you are a fresh user of US Legal Forms, allow me to share straightforward recommendations for you to stick to:

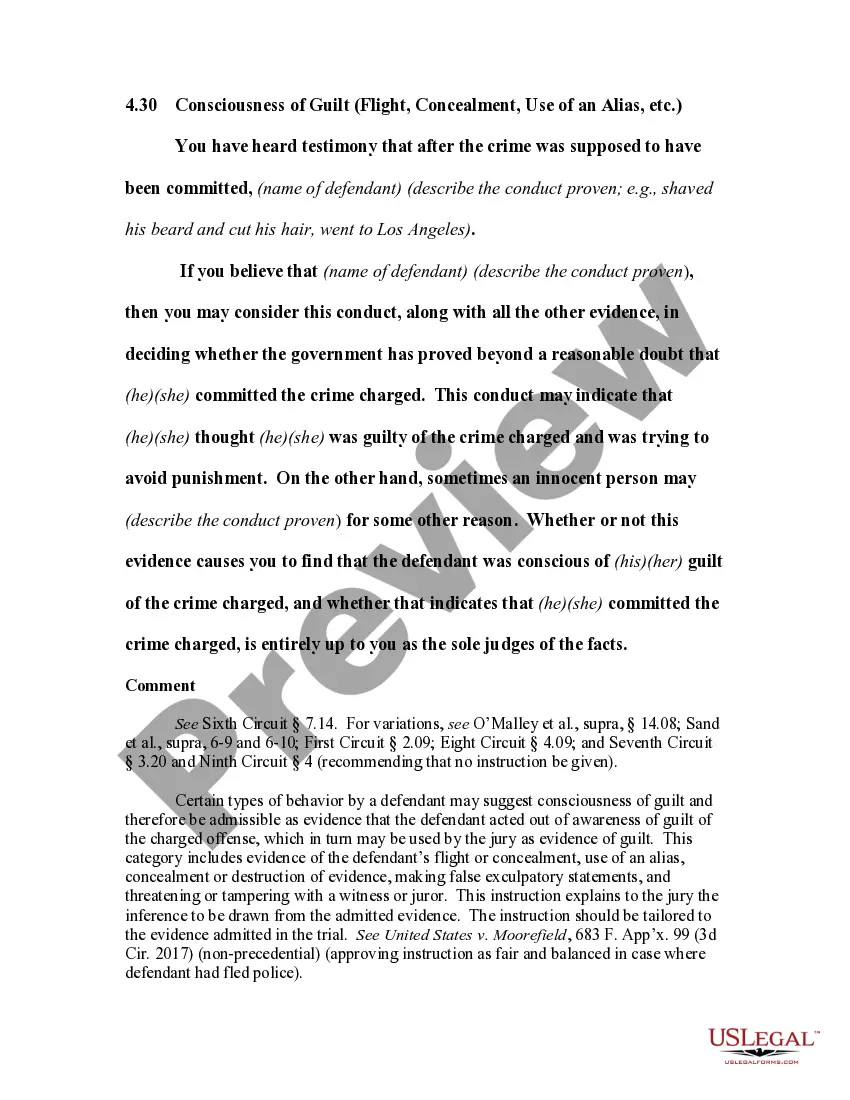

- First, be sure you have selected the correct type to your area/area. You may look through the form using the Review key and study the form explanation to ensure this is the right one for you.

- In the event the type fails to fulfill your expectations, use the Seach discipline to obtain the right type.

- Once you are certain that the form is suitable, click on the Buy now key to find the type.

- Pick the prices strategy you desire and type in the essential information and facts. Design your profile and purchase your order with your PayPal profile or charge card.

- Choose the data file file format and obtain the legal file design to the system.

- Complete, modify and printing and indicator the obtained New Hampshire Stock Option Agreement of Intraware, Inc..

US Legal Forms is the largest collection of legal varieties where you can see numerous file layouts. Utilize the company to obtain appropriately-created paperwork that stick to condition needs.