New Hampshire Stock Transfer Agreement between EMC Corp., Eagle Merger Corp., and Shareholders

Description

How to fill out Stock Transfer Agreement Between EMC Corp., Eagle Merger Corp., And Shareholders?

You are able to invest several hours on-line trying to find the lawful file web template that fits the state and federal demands you want. US Legal Forms provides a large number of lawful types that are evaluated by professionals. You can actually obtain or print out the New Hampshire Stock Transfer Agreement between EMC Corp., Eagle Merger Corp., and Shareholders from my service.

If you currently have a US Legal Forms account, it is possible to log in and click on the Obtain key. Following that, it is possible to complete, modify, print out, or sign the New Hampshire Stock Transfer Agreement between EMC Corp., Eagle Merger Corp., and Shareholders. Every single lawful file web template you purchase is your own property permanently. To get another duplicate of the bought form, go to the My Forms tab and click on the related key.

Should you use the US Legal Forms website for the first time, follow the straightforward instructions below:

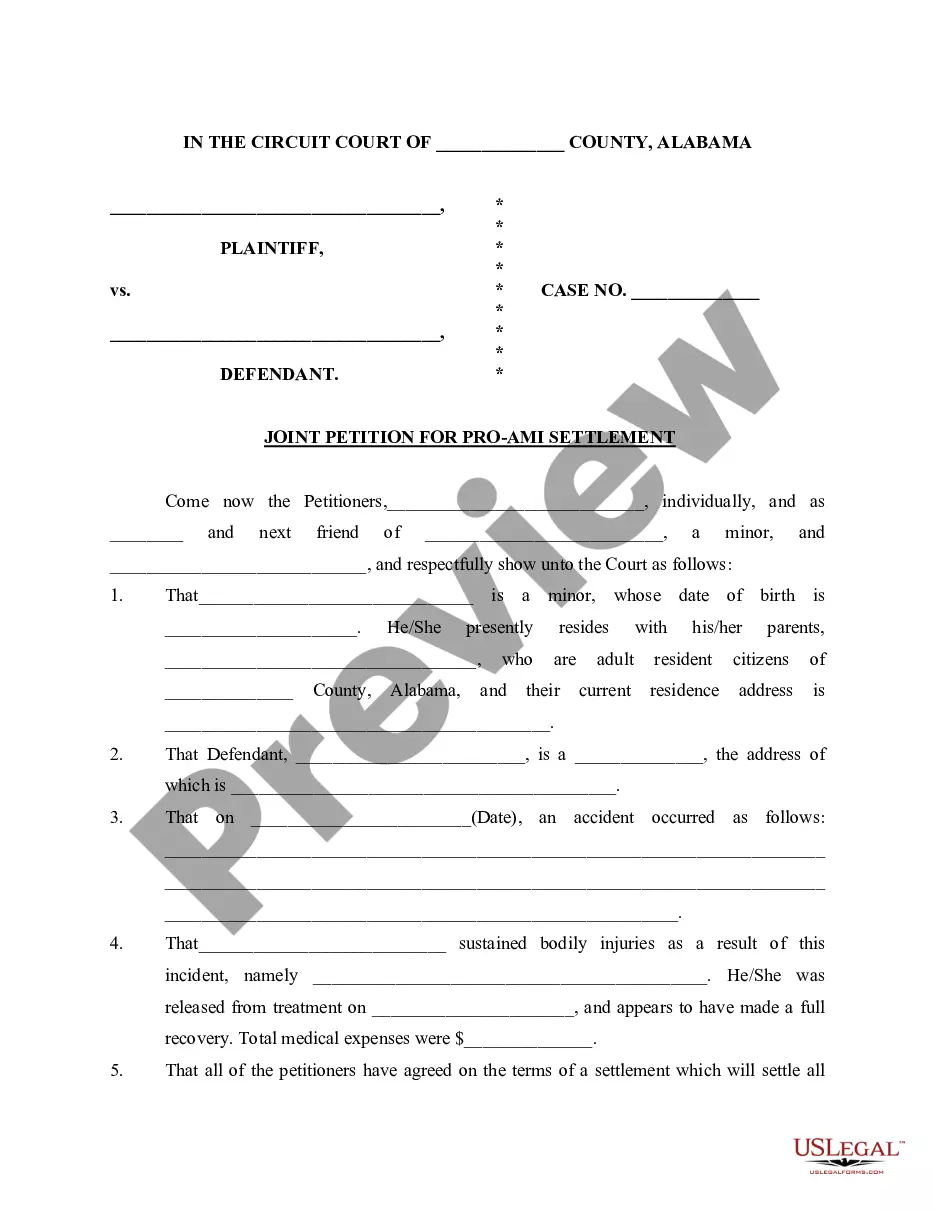

- First, make sure that you have selected the right file web template to the county/area of your liking. See the form explanation to make sure you have picked the proper form. If readily available, utilize the Review key to look through the file web template too.

- If you want to get another variation of the form, utilize the Search area to discover the web template that fits your needs and demands.

- Once you have identified the web template you would like, click Get now to carry on.

- Select the pricing plan you would like, type in your qualifications, and sign up for an account on US Legal Forms.

- Total the deal. You should use your credit card or PayPal account to fund the lawful form.

- Select the format of the file and obtain it to your system.

- Make modifications to your file if needed. You are able to complete, modify and sign and print out New Hampshire Stock Transfer Agreement between EMC Corp., Eagle Merger Corp., and Shareholders.

Obtain and print out a large number of file web templates utilizing the US Legal Forms site, that offers the most important selection of lawful types. Use specialist and condition-particular web templates to take on your organization or individual requirements.

Form popularity

FAQ

Dell Dell took on $48.6B in debt to acquire the storage giant Dell's 2015 decision to buy EMC for $67 billion remains the largest pure tech deal in history, but a transaction of such magnitude created a mountain of debt for the Texas-based company and its primary backer, Silver Lake. Dell spent $67B buying EMC ? more than 3 years later, was it ... TechCrunch ? 2020/03/10 ? dell-spent-67b-bu... TechCrunch ? 2020/03/10 ? dell-spent-67b-bu...

What is a Shares Transfer Agreement? A shares transfer agreement, also known as a stock purchase agreement, is an legal document used to transfer the ownership of shares of stock. The party transferring shares could be a person or a company.

EMC was acquired by Dell in 2016; at that time, Forbes noted EMC's "focus on developing and selling data storage and data management hardware and software and convincing its customers to buy its products independent of their other IT buying decisions" based on "best-of-breed." It was later renamed to Dell EMC.

Dell EMC is an American multinational technology company that offers products and services across all areas of computing, networking and storage. The company was formed when Dell Inc. acquired EMC Corporation in September 2016, along with EMC subsidiaries including VMware, RSA security and Pivotal. What is Dell EMC? | Definition from TechTarget techtarget.com ? whatis ? Dell-EMC techtarget.com ? whatis ? Dell-EMC

On July 19, 2016, EMC stockholders approved the proposal of the merger agreement between Dell, Inc. and EMC Corp. The merger transaction closed on August 2, 2016, and the company's common shares were delisted from the New York Stock Exchange. Who is Dell Technologies' transfer agent and how do I contact them? Investor FAQs | Dell Technologies delltechnologies.com ? investor-faqs delltechnologies.com ? investor-faqs

The deal brought together the leading provider of key computer storage products and top makers of servers and personal computers. The acquisition was to facilitate Dell to become one stop shop for business customers. The combined Dell EMC was named Dell Technologies. Dell's Acquisition of EMC - SpringerLink springer.com ? chapter springer.com ? chapter