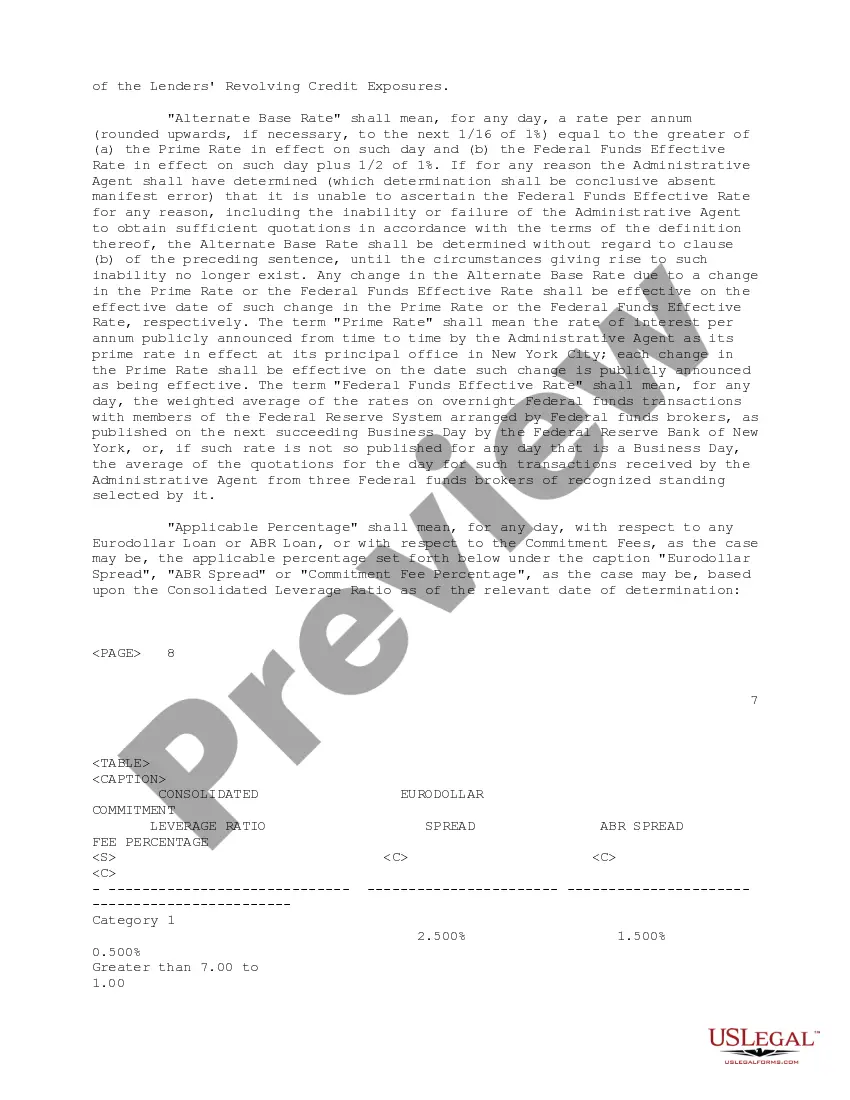

New Hampshire Credit Agreement: A New Hampshire Credit Agreement regarding the extension of credit is a legally binding contract entered into between a lender and a borrower in the state of New Hampshire. It outlines the terms and conditions under which the lender agrees to provide credit or a loan to the borrower. This agreement is designed to protect both parties' interests and ensure that all aspects of the credit extension are clear and transparent. Some key elements covered in a New Hampshire Credit Agreement may include: 1. Parties involved: The agreement will identify the lender and borrower, including their legal names and addresses. 2. Credit Amount: The agreement will specify the maximum credit amount that the lender is willing to extend to the borrower. 3. Interest Rate: The interest rate at which the borrowed amount will accrue interest will be clearly stated. It may be a fixed rate or variable rate, depending on the terms agreed upon. 4. Repayment Terms: The agreement will outline the repayment schedule, including the frequency of payments (monthly, quarterly, etc.) and the duration of the credit facility. 5. Late Payment Penalties: The consequences of late or missed payments will be detailed, including any fees or interest rate increase that may be applicable. 6. Security/Collateral: If applicable, the agreement may include provisions regarding any assets or collateral that the borrower will provide as security for the credit. 7. Default and Remedies: The agreement will specify the conditions under which default can occur, and the available remedies for both parties in case of default. Different types of New Hampshire Credit Agreements regarding the extension of credit can include: 1. Personal Loan Agreement: A credit agreement provided to individuals for personal use, such as financing education, medical expenses, or home improvements. 2. Business Loan Agreement: A credit agreement extended to businesses, which may include different terms and conditions based on the borrower's industry and creditworthiness. 3. Mortgage Loan Agreement: A credit agreement specifically related to financing the purchase or refinancing of real estate property. 4. Line of Credit Agreement: A credit agreement that establishes a revolving credit facility for the borrower, allowing them to access funds as needed up to a predetermined credit limit. It is important for both lenders and borrowers to carefully review and understand the terms and conditions of a New Hampshire Credit Agreement before signing it. Seeking legal advice is recommended to ensure compliance with state laws and regulations, protecting the interests of all parties involved.

New Hampshire Credit Agreement regarding extension of credit

Description

How to fill out New Hampshire Credit Agreement Regarding Extension Of Credit?

If you have to total, acquire, or printing legal record themes, use US Legal Forms, the most important variety of legal varieties, that can be found on the Internet. Use the site`s basic and convenient search to obtain the papers you require. A variety of themes for company and individual functions are categorized by categories and states, or keywords and phrases. Use US Legal Forms to obtain the New Hampshire Credit Agreement regarding extension of credit in a couple of click throughs.

Should you be currently a US Legal Forms customer, log in to your accounts and click on the Download key to find the New Hampshire Credit Agreement regarding extension of credit. You can also accessibility varieties you formerly downloaded from the My Forms tab of the accounts.

Should you use US Legal Forms initially, refer to the instructions under:

- Step 1. Make sure you have chosen the shape for your right town/region.

- Step 2. Make use of the Review choice to check out the form`s information. Do not forget to read the description.

- Step 3. Should you be unhappy together with the kind, utilize the Lookup area on top of the display screen to locate other versions in the legal kind design.

- Step 4. Once you have discovered the shape you require, click on the Buy now key. Select the pricing strategy you choose and add your accreditations to sign up for an accounts.

- Step 5. Procedure the transaction. You can utilize your credit card or PayPal accounts to perform the transaction.

- Step 6. Find the structure in the legal kind and acquire it on the system.

- Step 7. Complete, edit and printing or indicator the New Hampshire Credit Agreement regarding extension of credit.

Every single legal record design you get is your own for a long time. You possess acces to each and every kind you downloaded within your acccount. Go through the My Forms section and pick a kind to printing or acquire once again.

Be competitive and acquire, and printing the New Hampshire Credit Agreement regarding extension of credit with US Legal Forms. There are millions of expert and condition-specific varieties you may use to your company or individual requirements.

Form popularity

FAQ

Extension of consumer credit means the right to defer payment of debt offered or granted primarily for personal, family, or household purposes or to incur the debt and defer its payment.

Some common types of consumer credit are installment credit, non-installment credit, revolving credit, and open credit. Similarities of these types of credit are that they all have some form of a repayment period, interest rates, the possibility of interest charges, and monthly or lump sum payments.

Credit allows companies access to tools they need to produce the items we buy. A business that couldn't borrow might be unable to buy the machines and raw goods or pay the employees it needs to make products and profit. Credit also makes it possible for consumers to purchase things they need.

FindLaw Newsletters Stay up-to-date with how the law affects your life Legal Maximum Rate of Interest10% unless differently stipulated in writing (§3)Penalty for Usury (Unlawful Interest Rate)-2 more rows

New Hampshire Statute The annual rate of interest in all business transactions in which interest is paid or secured, unless otherwise agreed upon in writing, shall equal 10 percent. No consumer credit transaction, as defined in RSA 358-K:1, V, shall be subject to this paragraph.

Usury is the act of lending money at an interest rate that is considered unreasonably high or that is higher than the rate permitted by law.

CALIFORNIA: The legal rate of interest is 10% for consumers; the general usury limit for non-consumers is more than 5% greater than the Federal Reserve Bank of San Francisco's rate.

There is no federal regulation on the maximum interest rate that your issuer can charge you, though each state has its own approach to limiting interest rates. State usury laws often dictate the highest interest rate that can be charged on loans, but these often don't apply to credit card loans.