New Hampshire Security Agreement regarding borrowing of funds and granting of security interest in assets

Description

How to fill out Security Agreement Regarding Borrowing Of Funds And Granting Of Security Interest In Assets?

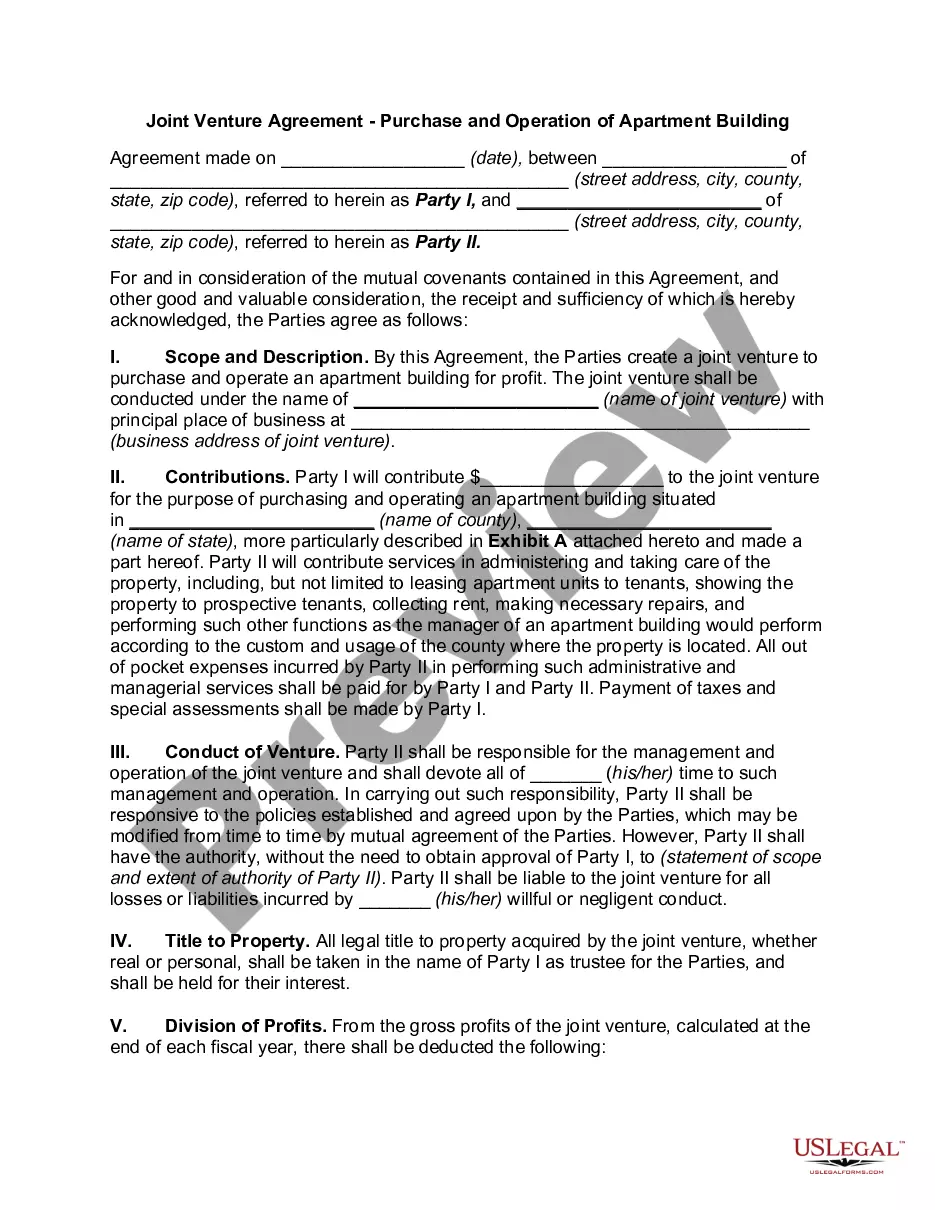

Finding the right legitimate document template could be a have difficulties. Of course, there are a variety of web templates available on the Internet, but how can you find the legitimate kind you need? Make use of the US Legal Forms site. The services gives 1000s of web templates, like the New Hampshire Security Agreement regarding borrowing of funds and granting of security interest in assets, which can be used for enterprise and private needs. All of the varieties are checked out by specialists and satisfy federal and state needs.

In case you are currently signed up, log in to the profile and click on the Download option to get the New Hampshire Security Agreement regarding borrowing of funds and granting of security interest in assets. Make use of profile to search through the legitimate varieties you might have purchased previously. Go to the My Forms tab of the profile and acquire one more copy of the document you need.

In case you are a whole new user of US Legal Forms, allow me to share straightforward instructions so that you can comply with:

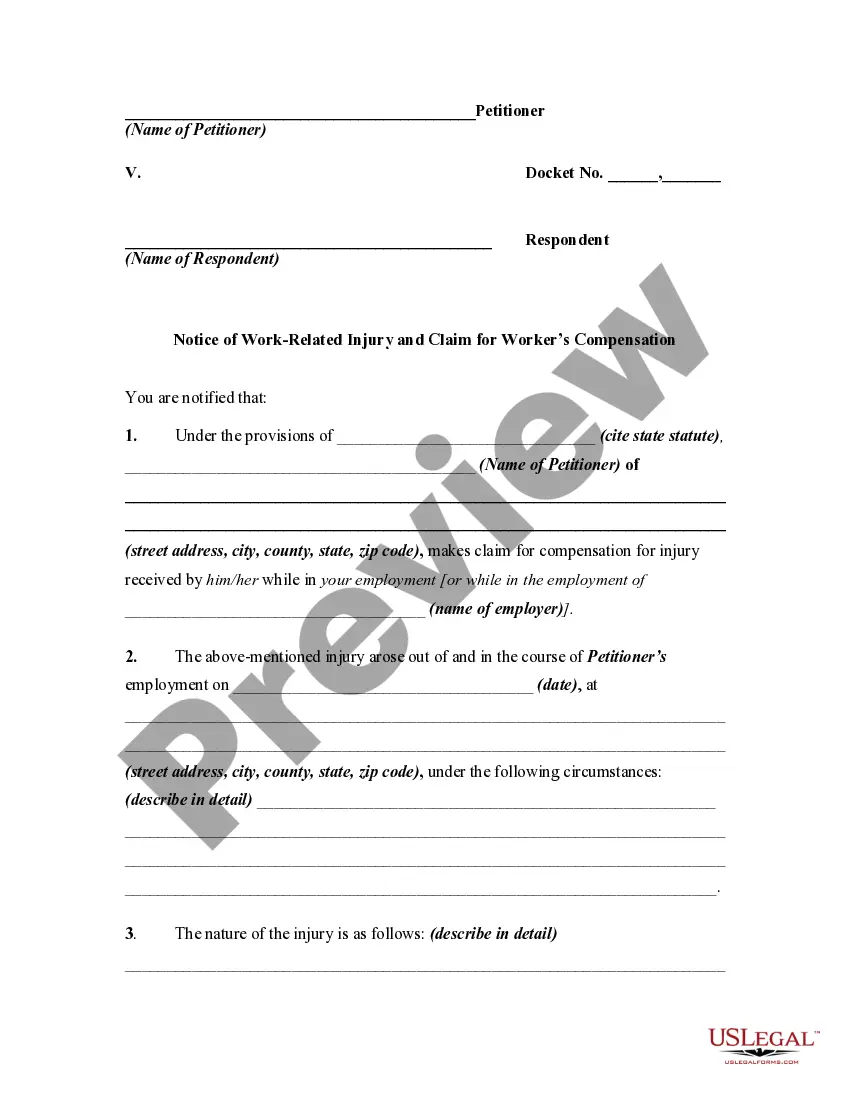

- Initially, make sure you have chosen the appropriate kind for your personal city/county. You may look through the shape making use of the Review option and read the shape explanation to guarantee it will be the best for you.

- In case the kind fails to satisfy your expectations, take advantage of the Seach discipline to find the right kind.

- When you are certain the shape is proper, click the Get now option to get the kind.

- Choose the prices plan you desire and enter in the needed info. Make your profile and buy the transaction with your PayPal profile or credit card.

- Choose the document file format and download the legitimate document template to the device.

- Complete, modify and produce and indicator the received New Hampshire Security Agreement regarding borrowing of funds and granting of security interest in assets.

US Legal Forms will be the greatest collection of legitimate varieties in which you can discover various document web templates. Make use of the service to download professionally-produced files that comply with condition needs.

Form popularity

FAQ

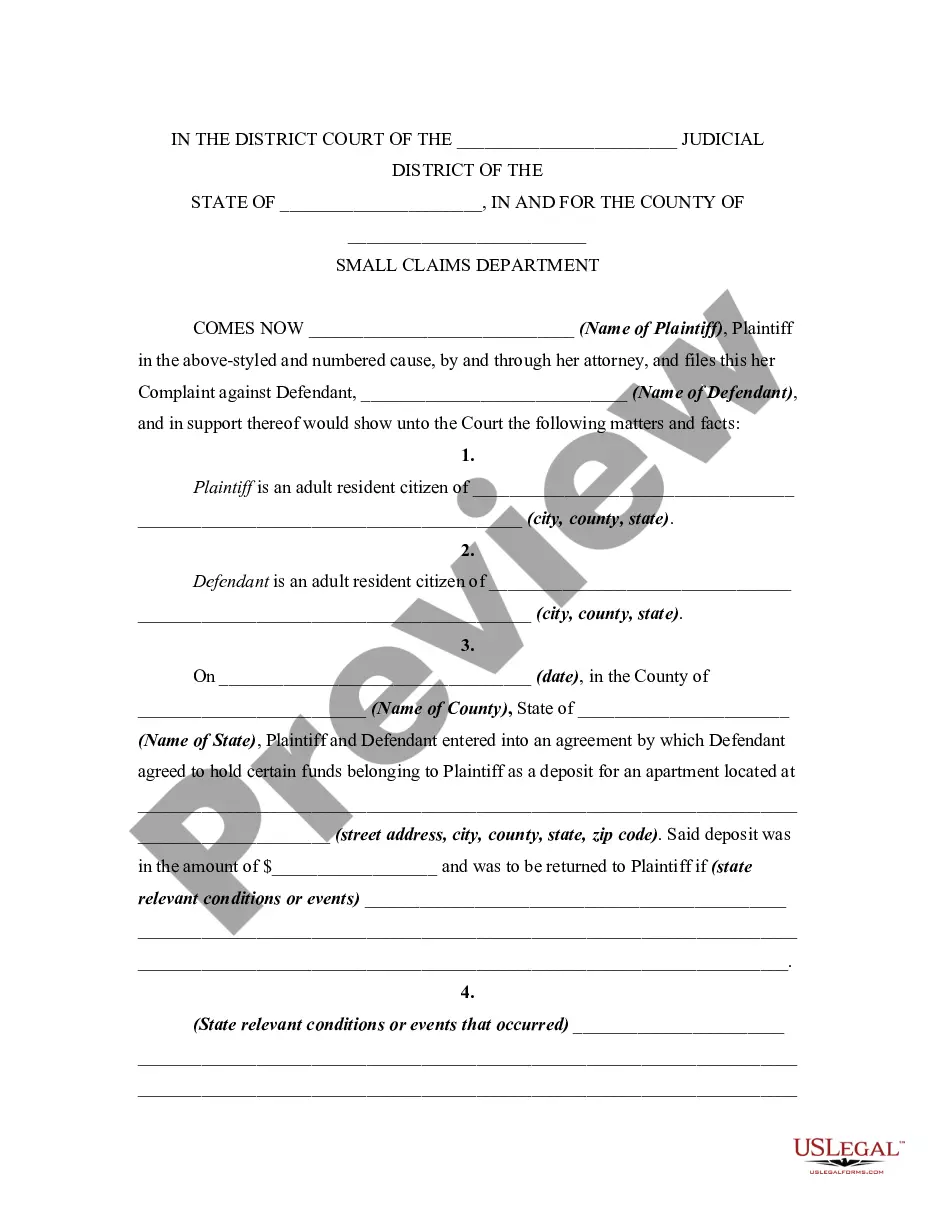

Loans from banks or other institutional lenders are always made using a number of documents, two of which are a promissory and security agreement. In general, the promissory note is your written promise to repay the loan and a security agreement is used when collateral is given for the loan.

If at any time any Grantor shall take a security interest in any property of an Account Debtor or any other Person to secure payment and performance of an Account in an amount in excess of $250,000, such Grantor shall promptly assign such security interest to the Collateral Agent for the benefit of the Secured Parties.

A security interest generally is created with a security agreement, which is a contract governed by Uniform Commercial Code (UCC) Article 9, as well as other state laws governing contracts.

A lender can perfect a lien on a borrower's deposit account only by obtaining "control" over the account, which requires one of the following arrangements: (1) the borrower maintains its deposit account directly with the lender; (2) the lender becomes the actual owner of the borrower's deposit accounts with the ...

Filing a Financing Statement to Perfect the Security Interest. Security interests for most types of collateral are usually perfected by filing a document simply called a "financing statement." You'll usually file this form with the secretary of state or other public office.

There are three requirements for attachment: (1) the secured party gives value; (2) the debtor has rights in the collateral or the power to transfer rights in it to the secured party; (3) the parties have a security agreement ?authenticated? (signed) by the debtor, or the creditor has possession of the collateral.

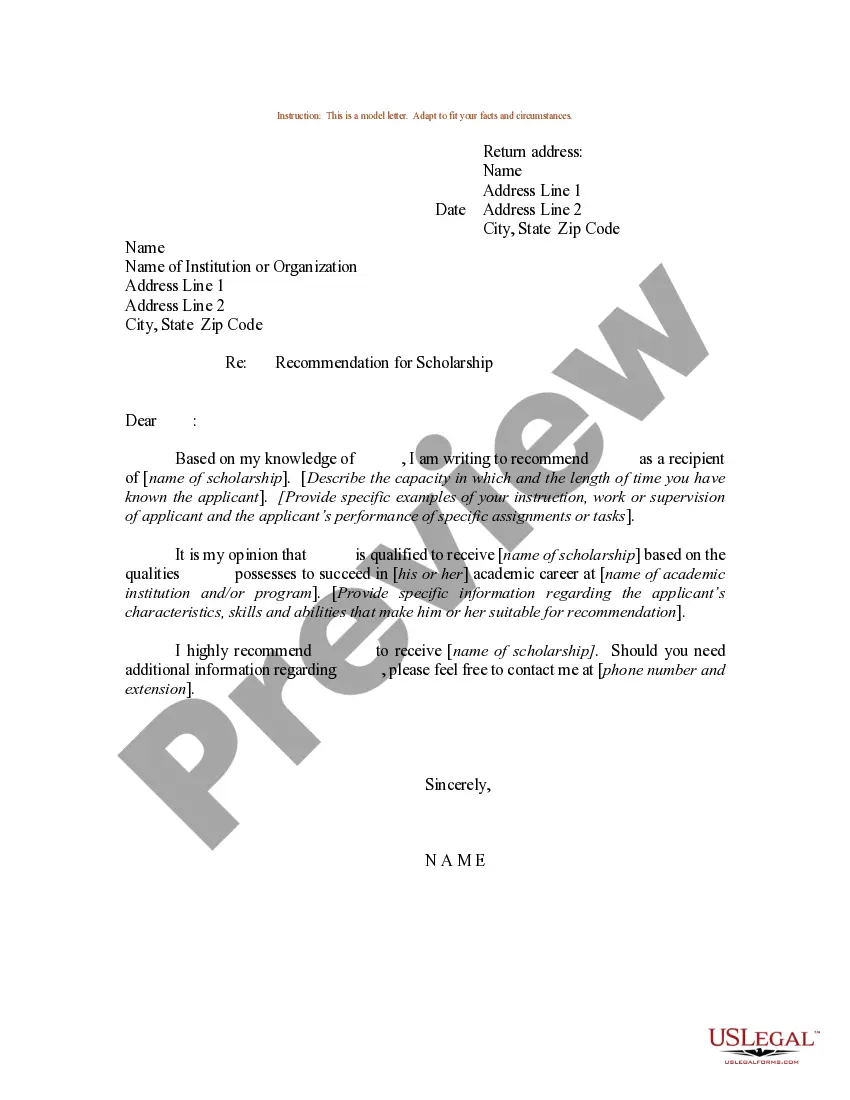

You give the lender this right when you sign your closing forms. The document granting the security interest can be called by different names, but the most common names are "Mortgage" or "Deed of Trust."

Creating a security agreement Some key provisions in a security agreement include: Describing the collateral as accurately and as detailed as possible, so both the borrower and the lender agree upon the secured property. How to determine whether and when the borrower is in default under the loan.