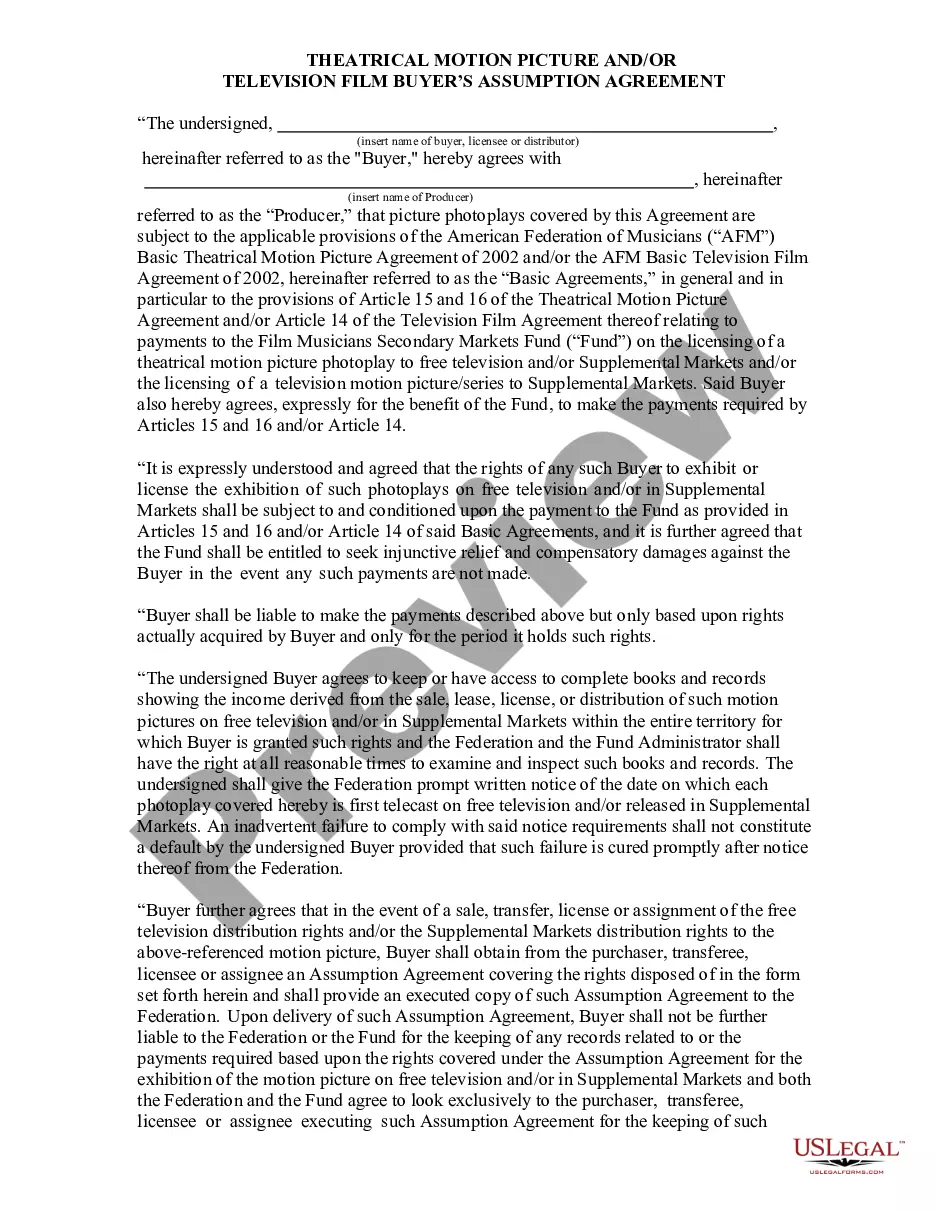

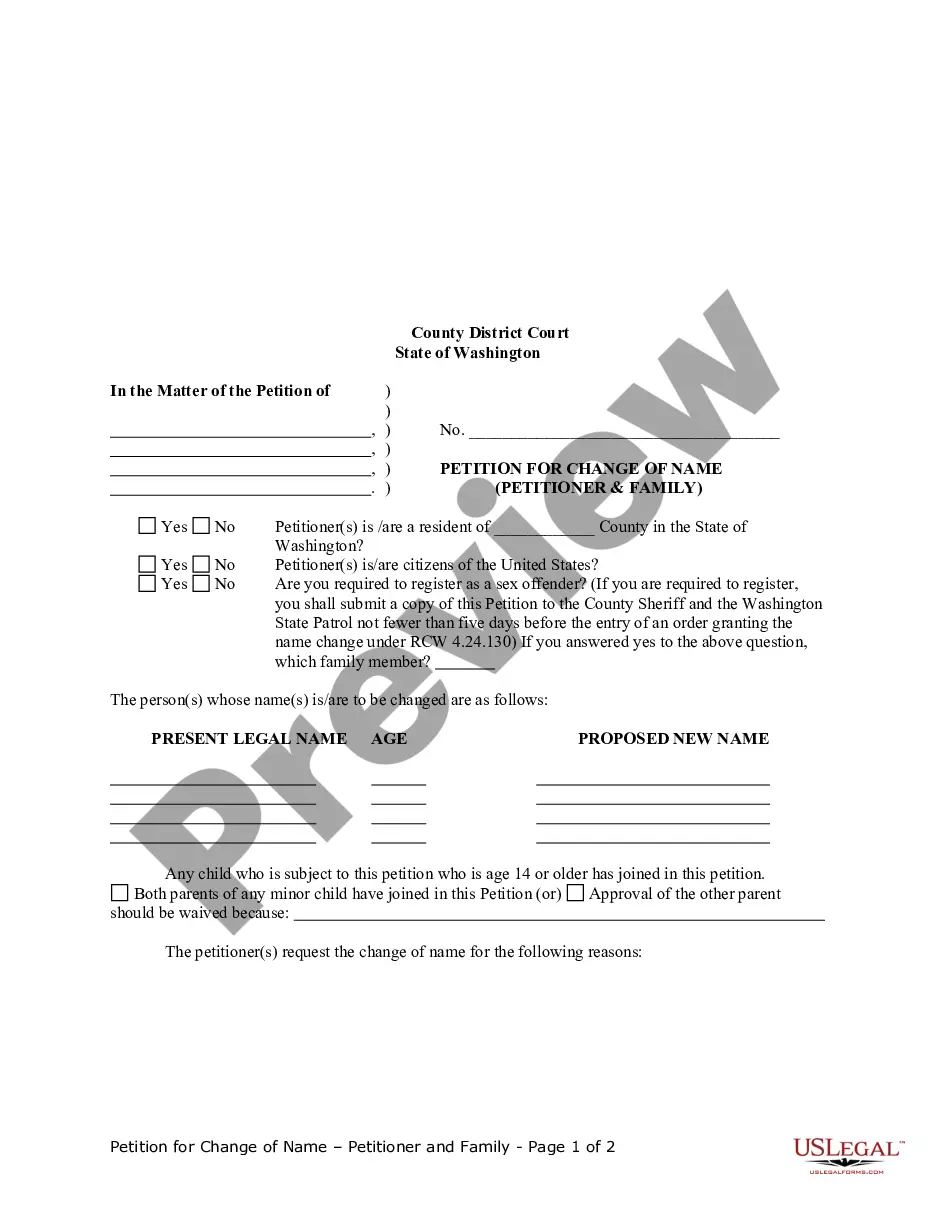

New Hampshire Investment Agreement: A Comprehensive Guide Introduction: The New Hampshire Investment Agreement refers to a legally binding contract entered into by two or more parties, wherein they agree to collaborate and invest in various financial ventures within the state of New Hampshire. These agreements are designed to ensure the proper governance, rights, responsibilities, and obligations of all parties involved, while providing a secure framework for conducting investment activities. New Hampshire offers a favorable environment for investments, attracting businesses, investors, and entrepreneurs from around the world. Key Elements of a New Hampshire Investment Agreement: 1. Parties: The agreement clearly identifies and establishes the parties involved in the investment venture, including investors, sponsors, fund managers, partners, and any other relevant stakeholders. 2. Purpose: The agreement outlines the primary objectives and scope of the investment, including the industries or sectors targeted for investment, such as real estate, technology, manufacturing, renewable energy, healthcare, or any other specific sector. 3. Investment Amount: The agreement specifies the total investment amount committed by each party, as well as any subsequent contributions. It may also outline the mode of payment and the timing of the investment. 4. Profit and Loss Distribution: The agreement defines how profits, losses, and expenses will be allocated among the parties involved. It may establish a predetermined ratio or formula, considering factors such as initial contributions, ongoing investments, and individual roles. 5. Management and Decision-Making: The agreement addresses the management structure, decision-making process, and the roles and responsibilities of each party in the investment venture. It may also designate a lead investor or manager, their authorities, and the process for resolving disputes. 6. Transfer of Interests: The agreement outlines the conditions under which parties may transfer their interests, whether partially or in full, to other parties. This may include restrictions, rights of first refusal, or approval requirements to ensure transparency and accountability. 7. Duration: The agreement specifies the duration or term of the investment venture, outlining the expected timeline for achieving the desired goals and milestones. Types of New Hampshire Investment Agreements: 1. Joint Venture Agreement: This agreement is commonly used when two or more parties collaborate to undertake a specific project or investment venture in New Hampshire. It clearly defines the rights, obligations, and profit-sharing arrangements of the joint venture partners. 2. Partnership Agreement: In cases where parties wish to form a partnership for long-term investment activities, a partnership agreement is employed. It defines the roles, responsibilities, and interests of each partner, as well as the terms of engagement, profit distribution, and entry or exit mechanisms. 3. Limited Liability Company (LLC) Operating Agreement: When individuals or entities form an LLC to pool their resources and invest in New Hampshire, an operating agreement is essential. It sets out the rights, powers, and allocation of profits among the members, while providing guidelines for the management and operation of the LLC. 4. Shareholders' Agreement: In cases where the investment involves shares in a corporation or startup, a shareholders' agreement is used. This agreement addresses matters such as voting rights, dividend distribution, board representation, and the transferability of shares. Conclusion: The New Hampshire Investment Agreement serves as a crucial legal instrument that promotes transparency, cooperation, and successful investment ventures within the state. Whether in the form of a joint venture, partnership, LLC, or shareholders' agreement, these agreements provide a stable and regulated framework for investors looking to capitalize on the abundant opportunities in New Hampshire's diverse industries. It is essential for all parties involved to seek legal counsel and ensure thorough understanding of the terms and conditions before entering into any investment agreement.

New Hampshire Investment Agreement

Description

How to fill out New Hampshire Investment Agreement?

US Legal Forms - one of several biggest libraries of authorized kinds in the United States - delivers an array of authorized papers templates you can download or printing. Making use of the internet site, you will get a large number of kinds for enterprise and specific uses, categorized by types, claims, or search phrases.You will discover the most up-to-date variations of kinds just like the New Hampshire Investment Agreement in seconds.

If you have a membership, log in and download New Hampshire Investment Agreement from your US Legal Forms catalogue. The Down load button will show up on every kind you see. You gain access to all earlier downloaded kinds in the My Forms tab of your respective accounts.

If you wish to use US Legal Forms for the first time, allow me to share simple instructions to help you get started out:

- Be sure to have picked out the proper kind for your personal area/area. Go through the Preview button to examine the form`s content material. Look at the kind outline to ensure that you have chosen the proper kind.

- In case the kind does not suit your needs, use the Look for discipline at the top of the screen to discover the one who does.

- If you are pleased with the form, affirm your option by simply clicking the Get now button. Then, choose the rates plan you prefer and offer your accreditations to register to have an accounts.

- Procedure the transaction. Make use of your credit card or PayPal accounts to accomplish the transaction.

- Find the file format and download the form in your gadget.

- Make adjustments. Complete, change and printing and indication the downloaded New Hampshire Investment Agreement.

Each and every web template you included in your bank account lacks an expiry particular date and is also your own property for a long time. So, in order to download or printing yet another version, just check out the My Forms portion and click on about the kind you need.

Gain access to the New Hampshire Investment Agreement with US Legal Forms, probably the most substantial catalogue of authorized papers templates. Use a large number of specialist and status-certain templates that fulfill your company or specific demands and needs.

Form popularity

FAQ

The DP-10 only has to be filed if the taxpayer received more than $2400 (single) or $4800 (joint) of interest and/or dividends. TaxAct® supports this form in the New Hampshire program. The taxpayer can enter the date of residency during the New Hampshire Q&A.

Unlike federal capital gains taxes, there is no capital gains tax in New Hampshire. In other words, there is not a state-level tax imposed on capital gains earned by individuals, businesses, or other legal entities.

New Hampshire has historically been rated as one of the most tax-friendly states to live in, especially as a retiree. Some of the financial advantages include: No state income tax. No sales tax.

New Hampshire has no income tax on wages and salaries. However, there is a 5% tax on interest and dividends. The state also has no sales tax. Homeowners in New Hampshire pay some of the highest average effective property tax rates in the country.

New Hampshire uses Form DP-10 for full or part-year residents. The DP-10 only has to be filed if the taxpayer received more than $2400 (single) or $4800 (joint) of interest and/or dividends. TaxAct® supports this form in the New Hampshire program.

New Hampshire does not tax individuals' earned income, so you are not required to file an individual New Hampshire tax return. The state only taxes interest and dividends at 5% on residents and fiduciaries whose gross interest and dividends income, from all sources, exceeds $2,400 annually ($4,800 for joint filers).

All business organizations, including corporations, fiduciaries, partnerships, proprietorships, single member limited liability companies (SMLLC), and homeowners' associations which are part of a group of related business organizations operating a unitary business as defined in RSA 77-A:1, XIV engaged in business ...

It is a tax on interest and dividend income. Please note that the I&D Tax is being phased out. The I&D Tax rate is 5% for taxable periods ending before December 31, 2023. That rate is 4% for taxable periods ending on or after December 31, 2023, and 3% for taxable periods ending on or after December 31, 2024.