New Hampshire Partnership Agreement

Description

How to fill out Partnership Agreement?

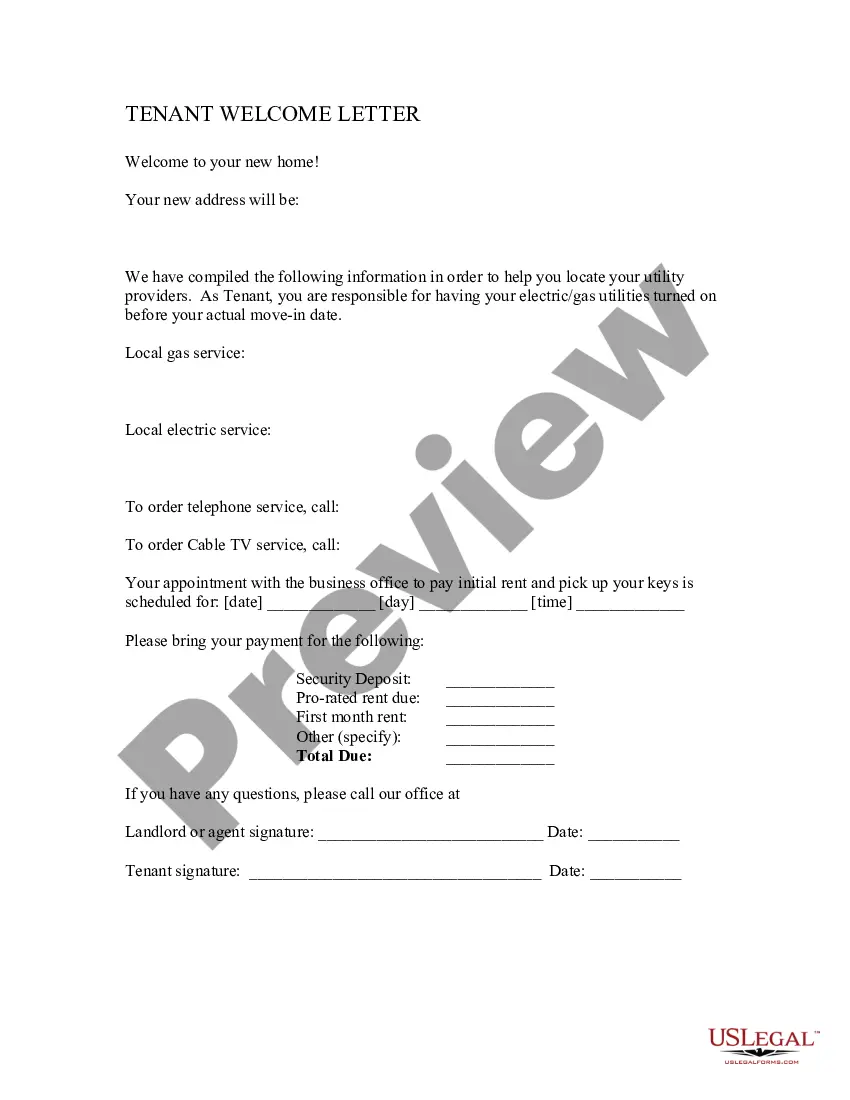

Choosing the best lawful papers design can be quite a have difficulties. Needless to say, there are a variety of layouts available online, but how would you find the lawful form you want? Make use of the US Legal Forms web site. The assistance provides a huge number of layouts, such as the New Hampshire Partnership Agreement, that you can use for enterprise and private requirements. Each of the forms are inspected by experts and fulfill federal and state specifications.

Should you be presently signed up, log in to the accounts and then click the Down load button to obtain the New Hampshire Partnership Agreement. Make use of accounts to search with the lawful forms you might have ordered formerly. Go to the My Forms tab of the accounts and get another copy of the papers you want.

Should you be a fresh end user of US Legal Forms, allow me to share easy recommendations for you to stick to:

- Initial, be sure you have selected the proper form for your area/region. You are able to check out the form using the Preview button and study the form information to guarantee this is the best for you.

- When the form does not fulfill your expectations, make use of the Seach industry to obtain the correct form.

- Once you are certain the form is proper, click on the Get now button to obtain the form.

- Opt for the prices prepare you desire and type in the required details. Design your accounts and purchase an order using your PayPal accounts or bank card.

- Opt for the data file structure and obtain the lawful papers design to the gadget.

- Total, edit and print and indication the obtained New Hampshire Partnership Agreement.

US Legal Forms is definitely the biggest library of lawful forms for which you can see different papers layouts. Make use of the company to obtain expertly-manufactured files that stick to status specifications.

Form popularity

FAQ

How to Start a Partnership in 7 Easy Steps What a Partnership Means. Before You Go Into a Partnership. Make Decisions About Partners. Step 2: Decide on Partnership Type. Step 3: Decide on Partnership Name. Step 4: Register with Your State. Step 5: Get an Employer ID Number. Step 6: Create a Partnership Agreement. How to Start a Partnership in 7 Easy Steps - The Balance thebalancemoney.com ? easy-steps-to-start-a... thebalancemoney.com ? easy-steps-to-start-a...

The business profits tax is imposed on any enterprise, whether corporation, partnership, limited liability company, proprietorship, association, business trust, real estate trust, or other form of organization organized for gain or profit and carrying on any business in New Hampshire.

Your New Hampshire LLC's tax classification depends on its number of members. Single-member LLCs (SMLLCs) are taxed like sole proprietors by default, and multi-member LLCs are taxed as general partnerships.

However, many aspiring business owners don't understand how to write a partnership agreement that will prevent issues down the road. The easiest way to write a valid agreement without mistakes is by creating a template using a contract management platform. How to Write a Partnership Agreement: A Step by Step Guide - Parley Pro parleypro.com ? blog ? how-to-write-a-partnershi... parleypro.com ? blog ? how-to-write-a-partnershi...

A partnership agreement should include details such as the purpose of the partnership, ownership interest, decision-making process, responsibilities and liabilities of each partner, dispute resolution procedures, and continuity and succession planning. How to Write a Partnership Agreement (Step-by-Step Guide) - OnBoard onboardmeetings.com ? blog ? partnership-... onboardmeetings.com ? blog ? partnership-...

New Hampshire has no income tax on wages and salaries. However, there is a 5% tax on interest and dividends. The state also has no sales tax.

It is a tax on interest and dividend income. Please note that the I&D Tax is being phased out. The I&D Tax rate is 5% for taxable periods ending before December 31, 2023. That rate is 4% for taxable periods ending on or after December 31, 2023, and 3% for taxable periods ending on or after December 31, 2024.

The business profits tax is imposed on any enterprise, whether corporation, partnership, limited liability company, proprietorship, association, business trust, real estate trust, or other form of organization organized for gain or profit and carrying on any business in New Hampshire. New Hampshire - Overview - Income Taxes, Corporate - Explanations cch.com ? document ? state ? over... cch.com ? document ? state ? over...