New Hampshire Notice Regarding Introduction of Restricted Share-Based Remuneration Plan

Description

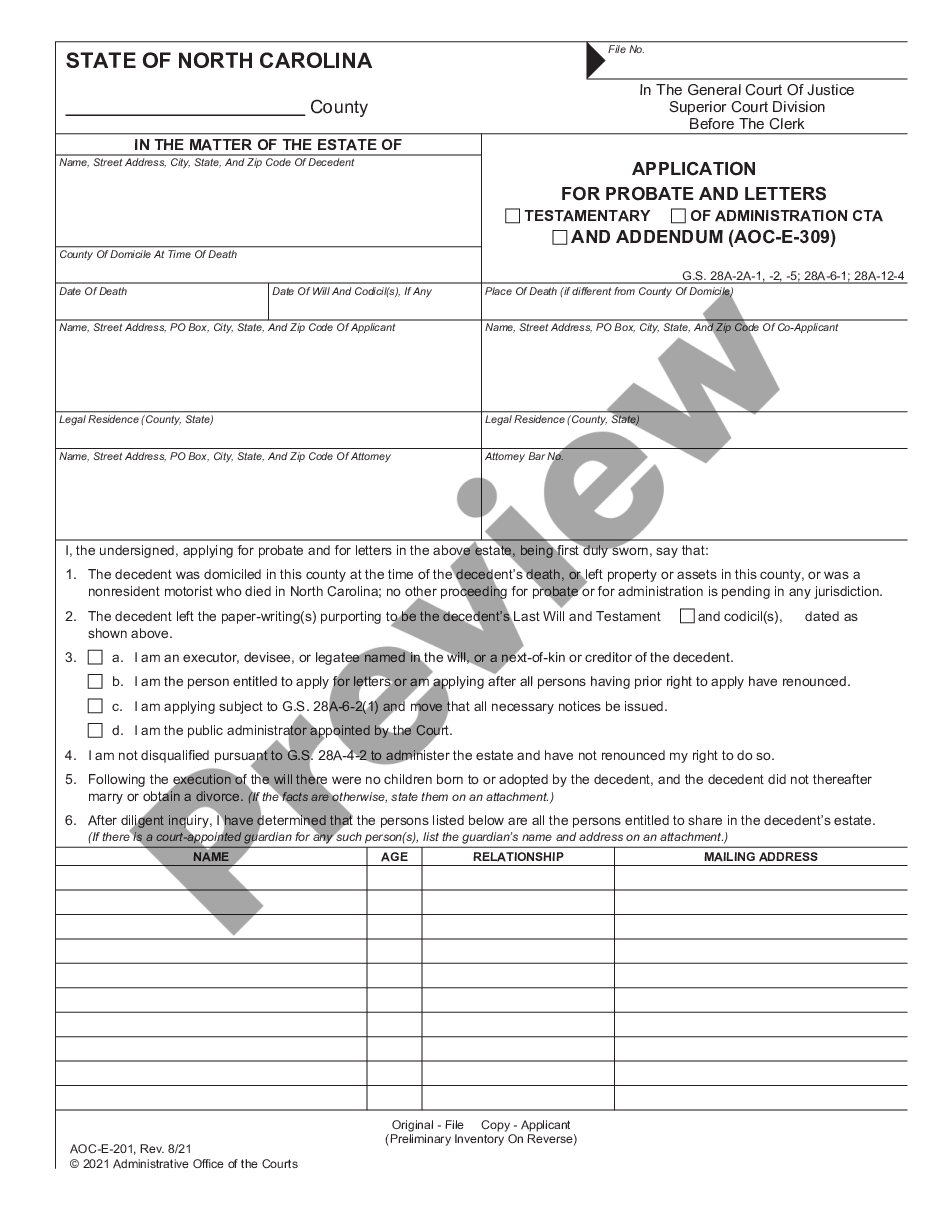

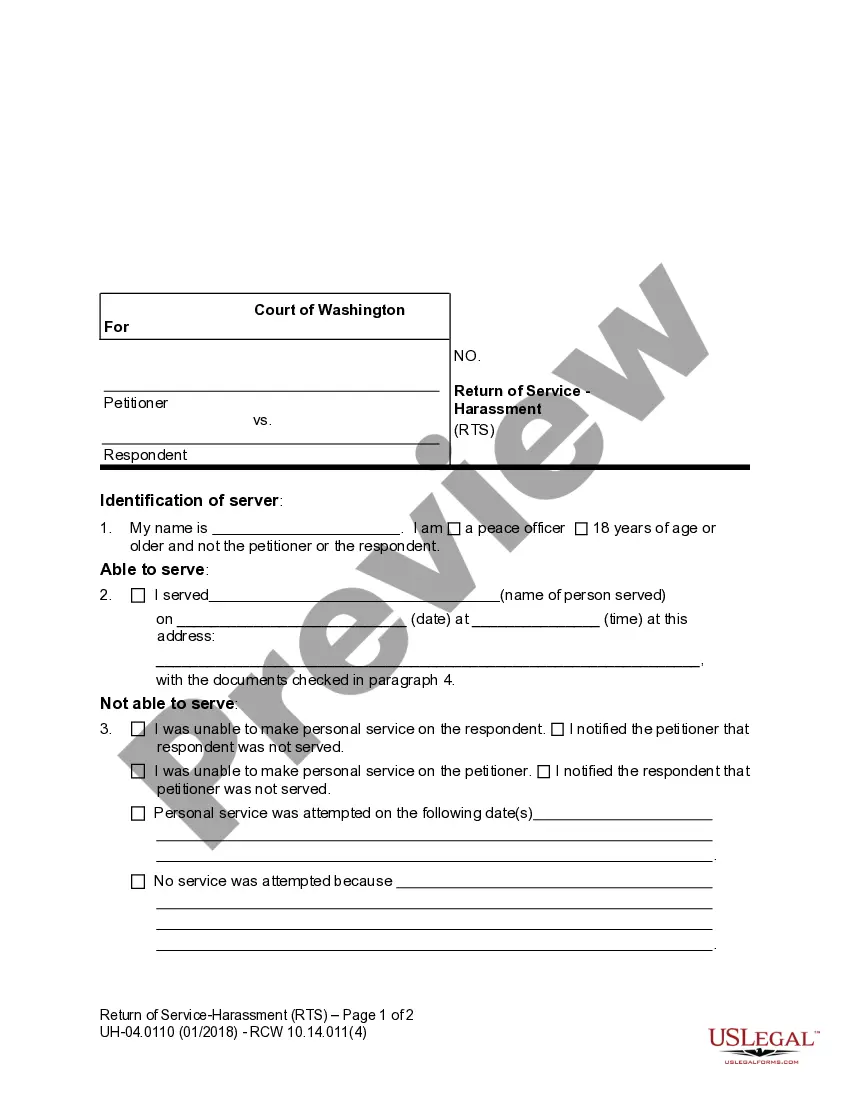

How to fill out Notice Regarding Introduction Of Restricted Share-Based Remuneration Plan?

US Legal Forms - one of many most significant libraries of lawful forms in America - provides an array of lawful document templates you may down load or print. Using the site, you may get thousands of forms for organization and individual uses, categorized by groups, says, or keywords.You can get the newest types of forms like the New Hampshire Notice Regarding Introduction of Restricted Share-Based Remuneration Plan in seconds.

If you already possess a monthly subscription, log in and down load New Hampshire Notice Regarding Introduction of Restricted Share-Based Remuneration Plan from your US Legal Forms local library. The Acquire switch can look on each and every develop you look at. You gain access to all previously saved forms from the My Forms tab of your respective profile.

If you wish to use US Legal Forms initially, allow me to share simple instructions to obtain started:

- Be sure to have picked out the proper develop for the town/area. Select the Review switch to review the form`s content. See the develop information to ensure that you have selected the correct develop.

- In case the develop doesn`t suit your needs, make use of the Search industry on top of the monitor to discover the the one that does.

- If you are content with the form, verify your decision by clicking the Acquire now switch. Then, select the prices strategy you favor and offer your credentials to sign up to have an profile.

- Method the financial transaction. Use your bank card or PayPal profile to finish the financial transaction.

- Choose the structure and down load the form in your gadget.

- Make alterations. Fill up, modify and print and indicator the saved New Hampshire Notice Regarding Introduction of Restricted Share-Based Remuneration Plan.

Each template you included with your account does not have an expiration date which is yours forever. So, if you wish to down load or print yet another backup, just visit the My Forms segment and click around the develop you need.

Obtain access to the New Hampshire Notice Regarding Introduction of Restricted Share-Based Remuneration Plan with US Legal Forms, probably the most extensive local library of lawful document templates. Use thousands of specialist and condition-distinct templates that fulfill your organization or individual requires and needs.

Form popularity

FAQ

If you quit your job, you will be disqualified from receiving unemployment benefits unless you had good cause. In general, good cause means that your reason for leaving the position was job-related and was so compelling that you had no other choice than to leave.

Now Massachusetts residents can boast that they have a higher income tax, a higher sales tax, and higher property taxes,? noted Paul D. Craney, a spokesman for MassFiscal. Massachusetts ranked #46 in the property tax rankings, while New Hampshire improved their score by four spots to come in at #43.

A ?use-it-or-lose-it? employee vacation policy requires an employee to lose any unused vacation time after a specific date, such as the end of the year. This policy in New Hampshire is permitted by state law, which means that employers may implement it.

The irony in New Hampshire is that it prides itself in having no income or sales tax, yet it ranks high on property taxes. That means New Hampshire relies most heavily on the property tax to fund local services and public education.

Which NH towns have the highest property taxes? Claremont ($41.68) Lisbon ($34.28) Northumberland ($33.06) Charlestown ($32.27) Hopkinton ($32.25)

Failure to pay taxes, penalties or interest when due or assessed, or to comply with the tax laws may result in the following actions: Liens may be placed upon your real estate, personal property, and property interests including bank accounts, accounts receivable, security interests, and similar items.

New Hampshire also has a 7.50 percent corporate income tax rate. New Hampshire does not have a state sales tax and does not levy local sales taxes. New Hampshire's tax system ranks 6th overall on our 2023 State Business Tax Climate Index.

Applicant must be 65 years old before April 1 of the tax year for which the application is being made. You must have resided in New Hampshire for at least three (3) years and owned your home individually or jointly prior to April 1st of the tax year for which you are applying.