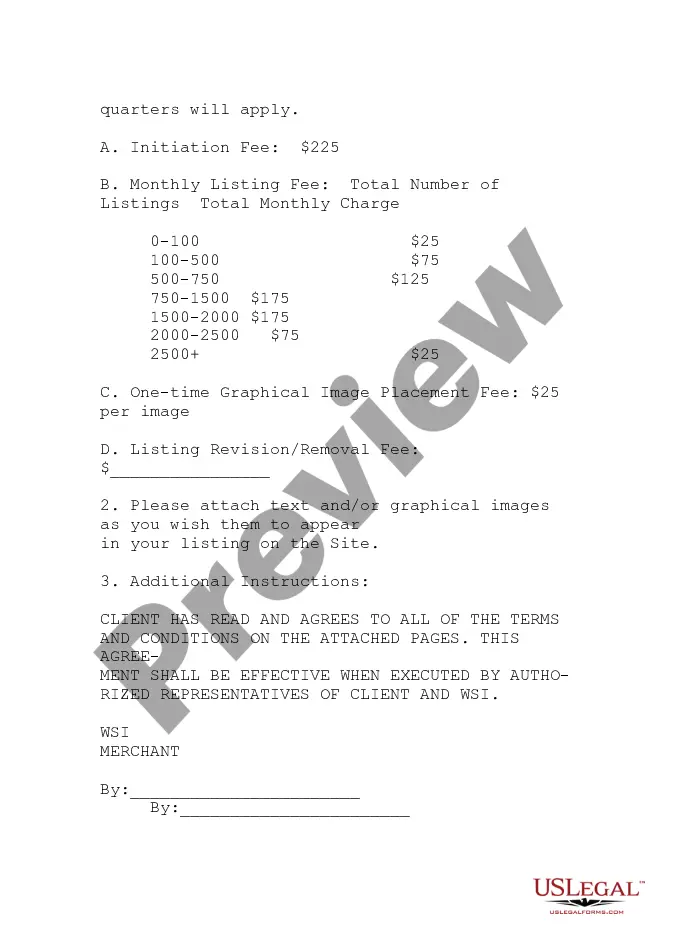

New Hampshire Retail Internet Site Agreement is a legally binding contract specifically designed for retail businesses operating in the state of New Hampshire to establish the terms and conditions for selling products or services through an online platform. This agreement governs the relationship between the retail business and its customers who purchase goods or services through the internet site. The agreement includes various sections that encompass important aspects of online retailing, such as terms of use, payment and billing, shipping and delivery, returns and refunds, customer data privacy, dispute resolution, intellectual property rights, and limitations of liability. Keywords: New Hampshire, Retail, Internet Site Agreement, online platform, retail business, customers, goods, services, terms of use, payment, billing, shipping, delivery, returns, refunds, customer data privacy, dispute resolution, intellectual property rights, limitations of liability. There are no specific types mentioned for the New Hampshire Retail Internet Site Agreement, as it is a comprehensive agreement that can be customized to suit the unique needs and requirements of each retail business. However, based on the nature of the products or services being sold, additional clauses or provisions may be added to the agreement, such as: 1. Subscription-Based Agreement: This agreement type is suitable for businesses that offer subscription services to customers, such as monthly box deliveries or access to exclusive content. 2. E-commerce Agreement: This agreement focuses specifically on businesses engaged in electronic commerce, where products are sold or services are rendered over the internet. 3. Service-Based Agreement: Retail businesses offering services rather than tangible goods can include clauses addressing service delivery, performance, and customer satisfaction. 4. Drop-shipping Agreement: This type of agreement is relevant for businesses that do not stock inventory but have arrangements with suppliers to directly ship products to customers. It includes provisions related to order processing, inventory availability, and the responsibilities of each party involved. Overall, the New Hampshire Retail Internet Site Agreement provides a solid legal framework and protects the rights and interests of both the retail business and its internet customers, ensuring a smooth and secure online shopping experience.

New Hampshire Retail Internet Site Agreement

Description

How to fill out New Hampshire Retail Internet Site Agreement?

You are able to devote hours on the web searching for the legitimate file format that fits the federal and state specifications you want. US Legal Forms gives a huge number of legitimate types that happen to be analyzed by specialists. You can easily obtain or print the New Hampshire Retail Internet Site Agreement from our service.

If you have a US Legal Forms accounts, it is possible to log in and then click the Down load key. After that, it is possible to comprehensive, change, print, or signal the New Hampshire Retail Internet Site Agreement. Each legitimate file format you buy is yours permanently. To acquire an additional backup of any bought form, proceed to the My Forms tab and then click the corresponding key.

If you are using the US Legal Forms internet site for the first time, keep to the easy directions beneath:

- Very first, make certain you have selected the correct file format for the region/area that you pick. See the form outline to make sure you have picked the correct form. If accessible, take advantage of the Review key to look from the file format at the same time.

- In order to get an additional version of your form, take advantage of the Search area to get the format that meets your needs and specifications.

- After you have located the format you would like, simply click Acquire now to continue.

- Find the rates program you would like, type your references, and register for an account on US Legal Forms.

- Comprehensive the transaction. You should use your Visa or Mastercard or PayPal accounts to cover the legitimate form.

- Find the structure of your file and obtain it for your device.

- Make modifications for your file if necessary. You are able to comprehensive, change and signal and print New Hampshire Retail Internet Site Agreement.

Down load and print a huge number of file layouts while using US Legal Forms site, which provides the greatest collection of legitimate types. Use professional and express-specific layouts to take on your business or personal needs.

Form popularity

FAQ

State of New Hampshire New Hampshire Meals and Rooms (Rentals) Tax: 8.5% of the listing price including any cleaning fee and guest fee for reservations 184 nights and shorter. For detailed information, please visit the New Hampshire Department of Revenue website.

Yes. Short-term rental operators registered with the New Hampshire Department of Revenue Administration are required to file returns each assigned filing period, regardless of whether you had any short-term rental income or collected lodging taxes.

New Hampshire does not have a state sales tax and does not levy local sales taxes. New Hampshire's tax system ranks 6th overall on our 2023 State Business Tax Climate Index. Each state's tax code is a multifaceted system with many moving parts, and New Hampshire is no exception.

No New Hampshire residents are obligated to pay sales tax on anything they purchase on the internet. All internet sales tax is imposed on a state-by-state basis and New Hampshire does not require sales tax to be collected on any item that is being delivered to people in the state.

Personal Income Taxes in New Hampshire at a Glance The state of New Hampshire has a flat 5 percent income tax rate on interest and dividends, but not on general income such as wages. As such, there is no state tax withheld from individual workers' W-2 forms.

FUN FACTS. While the state doesn't impose a sales tax, New Hampshire does have a Meals & Rentals Tax, Communication Services Tax, and Alcoholic Beverage Tax.

No New Hampshire residents are obligated to pay sales tax on anything they purchase on the internet. All internet sales tax is imposed on a state-by-state basis and New Hampshire does not require sales tax to be collected on any item that is being delivered to people in the state.

New Hampshire has no income tax on wages and salaries. However, there is a 5% tax on interest and dividends. The state also has no sales tax.