New Hampshire Carrier Services Contract - Self-Employed Independent Contractor

Description

How to fill out New Hampshire Carrier Services Contract - Self-Employed Independent Contractor?

Choosing the right legal document design can be a have difficulties. Of course, there are a variety of web templates available on the net, but how would you get the legal type you will need? Take advantage of the US Legal Forms web site. The support offers 1000s of web templates, including the New Hampshire Carrier Services Contract - Self-Employed Independent Contractor, which you can use for enterprise and private requires. Every one of the kinds are checked by professionals and meet up with state and federal specifications.

In case you are presently authorized, log in for your profile and click the Down load key to get the New Hampshire Carrier Services Contract - Self-Employed Independent Contractor. Utilize your profile to check through the legal kinds you may have bought previously. Proceed to the My Forms tab of your respective profile and have an additional version of the document you will need.

In case you are a whole new consumer of US Legal Forms, listed below are straightforward guidelines that you can stick to:

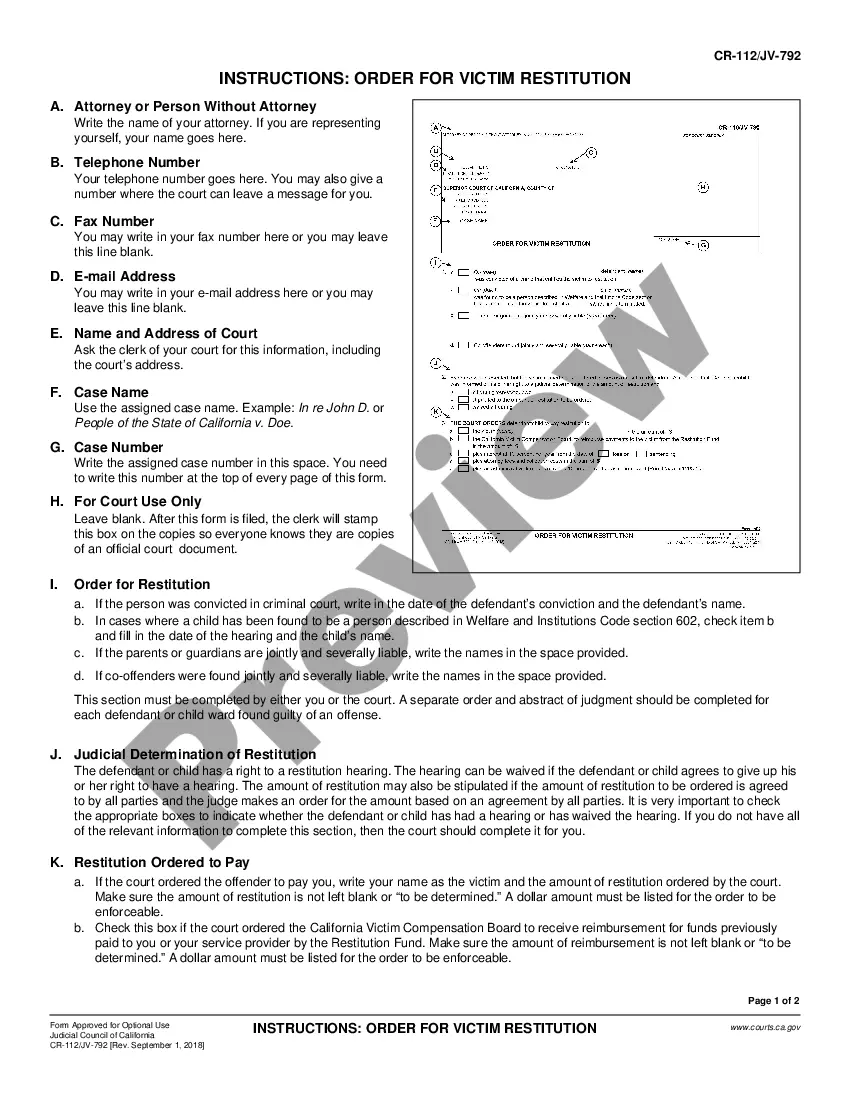

- Very first, make sure you have selected the appropriate type for your personal town/county. You can check out the shape using the Review key and study the shape information to guarantee it is the best for you.

- In case the type fails to meet up with your preferences, take advantage of the Seach industry to get the right type.

- Once you are certain that the shape is proper, click on the Purchase now key to get the type.

- Pick the rates plan you want and type in the needed information. Build your profile and pay for the transaction making use of your PayPal profile or bank card.

- Opt for the file structure and obtain the legal document design for your device.

- Comprehensive, edit and printing and signal the attained New Hampshire Carrier Services Contract - Self-Employed Independent Contractor.

US Legal Forms is definitely the greatest catalogue of legal kinds that you can discover numerous document web templates. Take advantage of the service to obtain professionally-made paperwork that stick to express specifications.

Form popularity

FAQ

The definition of a contractor seems to be broader; it is anyone to whom a business makes available consumers' personal information for a business purpose, as opposed to a service provider who must "process information" for a business.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

1. The individual possesses or has applied for a federal employer identification number or social security number, or in the alternative, has agreed in writing to carry out the responsibilities imposed on employers under NH wage laws.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.14-Feb-2022

A service provider is an individual or entity that provides services to another party. The provision of services between a service provider and a company is typically governed by a service agreement.

There are a few subtle distinctions between the two definitions. The definition of a contractor seems to be broader; it is anyone to whom a business makes available consumers' personal information for a business purpose, as opposed to a service provider who must "process information" for a business.

Contract Service Provider means a third party person or organization with which Licensee enters into a written contract for the provision of specific services (e.g., testing, contract manufacturing, distribution, etc. to Licensee) in support of Licensee's sale or distribution of Licensed Products.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.