New Hampshire Educator Agreement - Self-Employed Independent Contractor

Description

How to fill out New Hampshire Educator Agreement - Self-Employed Independent Contractor?

You are able to spend several hours online attempting to find the authorized record web template that fits the state and federal demands you require. US Legal Forms provides 1000s of authorized types that happen to be examined by professionals. It is simple to download or print out the New Hampshire Educator Agreement - Self-Employed Independent Contractor from my assistance.

If you have a US Legal Forms profile, it is possible to log in and click on the Acquire option. Following that, it is possible to complete, modify, print out, or indicator the New Hampshire Educator Agreement - Self-Employed Independent Contractor. Each authorized record web template you get is the one you have for a long time. To obtain an additional version of any acquired form, proceed to the My Forms tab and click on the related option.

If you use the US Legal Forms internet site the very first time, follow the easy recommendations below:

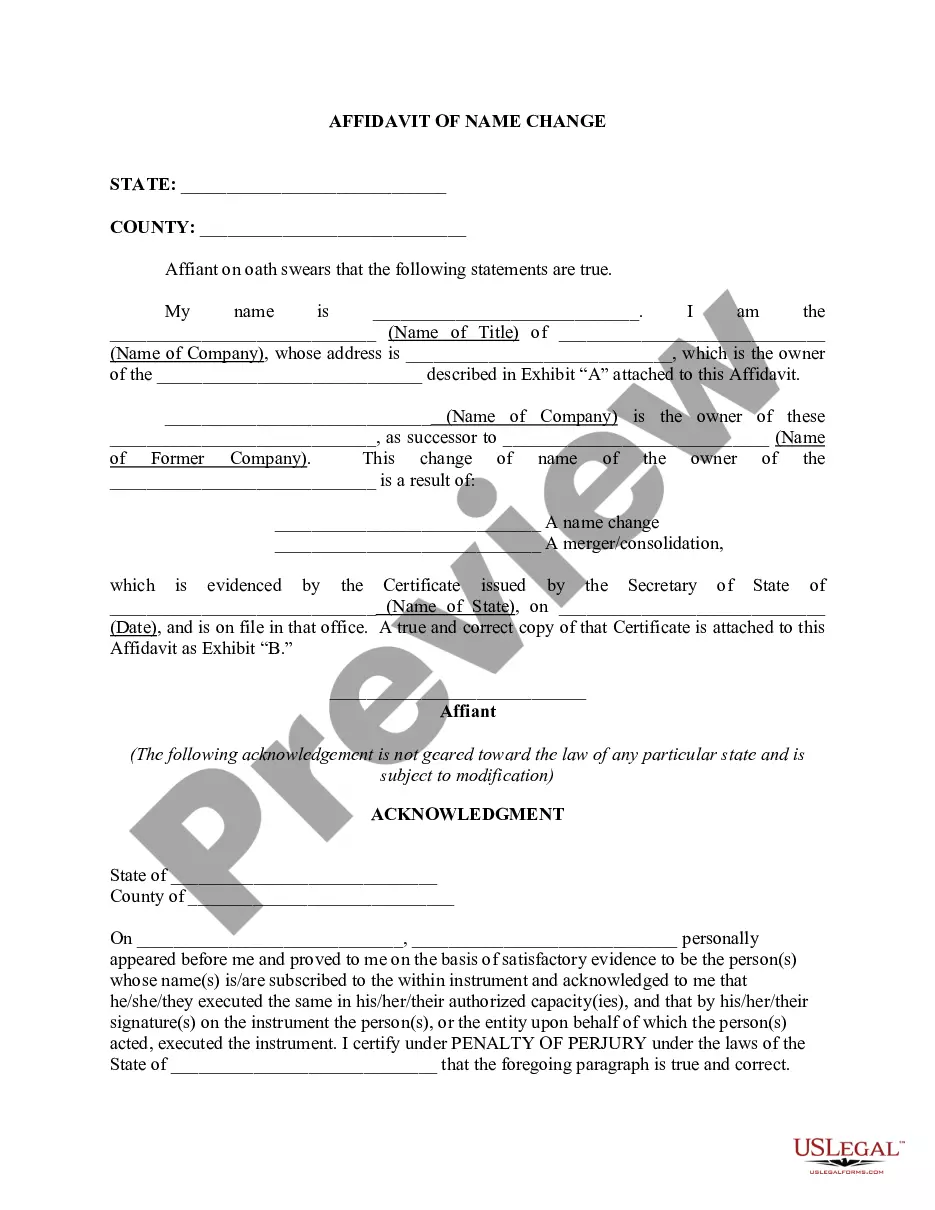

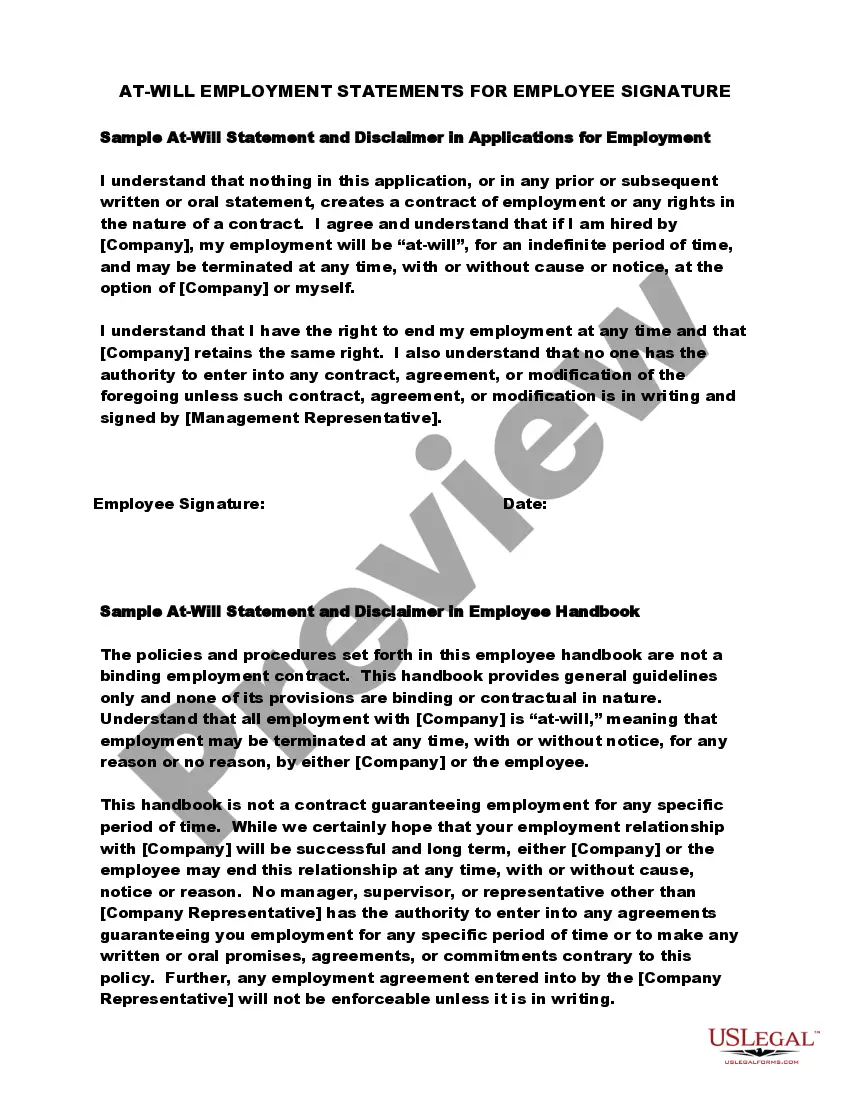

- Initial, make certain you have chosen the correct record web template for the area/town of your choice. Look at the form outline to make sure you have chosen the proper form. If available, use the Review option to look with the record web template as well.

- If you wish to locate an additional version from the form, use the Look for area to obtain the web template that fits your needs and demands.

- Upon having located the web template you would like, click on Purchase now to continue.

- Choose the rates strategy you would like, type in your accreditations, and register for an account on US Legal Forms.

- Complete the financial transaction. You may use your bank card or PayPal profile to cover the authorized form.

- Choose the structure from the record and download it to your product.

- Make adjustments to your record if needed. You are able to complete, modify and indicator and print out New Hampshire Educator Agreement - Self-Employed Independent Contractor.

Acquire and print out 1000s of record themes using the US Legal Forms website, which provides the biggest selection of authorized types. Use expert and status-certain themes to tackle your organization or individual demands.

Form popularity

FAQ

1. The individual possesses or has applied for a federal employer identification number or social security number, or in the alternative, has agreed in writing to carry out the responsibilities imposed on employers under NH wage laws.

In order to be legally classified as an independent contractor, a yoga instructor must: Be free from control and direction of the fitness studio as to how they perform their services. Perform their work outside of the fitness studio's usual business.

Cons of Independent ContractingContractors must withhold their own federal, state, and local taxes. They may also have to submit quarterly estimated taxes to the IRS. In most cases, contractors aren't eligible for state unemployment benefits, because they're self-employed, and they must fund their retirement accounts.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Most clubs currently classify their coaches as independent contractors and do not pay employment taxes on payments to coaches.

Professional AthleteAn athlete is an employee or an independent contractor depending upon the sport involved and the terms of the contract under which he/she performs. In team sports, such as football and baseball, where the player competes under the direction and control of a coach or manager, he/she is an employee.

Key takeaway: Independent contractors are not employed by the company they contract with; they are independent as long as they provide the service or product agreed to. Employees are longer-term, on the company's payroll, and generally not hired for one specific project.

A worker, personal trainer, or fitness instructor can be classified as an independent contractor if: (a) the worker is free from control and direction in the performance of services; and. (b) the worker is performing work outside the usual course of the business of the hiring company; and.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.