New Hampshire Attorney Agreement — Self-Employed Independent Contractor: Explained In the state of New Hampshire, an Attorney Agreement for self-employed independent contractors outlines the legal relationship between a lawyer and their client when they are working on a contract basis. This agreement ensures that both parties understand their rights, obligations, and responsibilities throughout their engagement. The New Hampshire Attorney Agreement for self-employed independent contractors typically includes the following key components: 1. Introduction: This section identifies the parties involved in the agreement, specifically the attorney (contractor) and the client. It also defines the purpose and scope of the agreement, including the legal services to be provided by the attorney. 2. Status of the Attorney: This section establishes the attorney's status as a self-employed independent contractor, emphasizing that they are not an employee of the client and are solely responsible for their own taxes, insurance, and expenses. 3. Services to be Rendered: Here, the agreement specifies the legal services to be provided by the attorney, including the tasks, deadlines, and any specific requirements outlined by the client. It also highlights confidentiality obligations and attorney-client privilege. 4. Compensation and Payment Terms: This section outlines how the attorney will be compensated for their services. It includes details about billing rates, payment frequency, accepted payment methods, and any additional costs such as travel expenses or filing fees. Alternative fee arrangements, such as flat fees or contingency fees, can also be specified if applicable. 5. Term and Termination: The agreement defines the duration of the engagement, whether it is for a specific project or an ongoing basis. It also includes provisions for termination by either party, outlining the notice period required and any applicable penalties or provisions for dispute resolution. 6. Intellectual Property Rights: If the attorney will be producing any intellectual property during the engagement, such as legal opinions, research, or documents, this section will establish who owns those rights. It may specify whether the client or the attorney retains ownership or if they will be jointly owned. 7. Indemnification and Liability: This component limits the attorney's liability for any losses, damages, or claims arising from their services, as long as the attorney has acted within the bounds of the agreement and applicable laws. It may also include indemnification clauses that protect both parties from third-party claims. Different types of New Hampshire Attorney Agreement — Self-Employed Independent Contractor may cater to specific legal fields or areas of practice, such as: 1. Intellectual Property Attorney Agreement — Self-Employed Independent Contractor 2. Real Estate Attorney Agreement — Self-Employed Independent Contractor 3. Criminal Defense Attorney Agreement — Self-Employed Independent Contractor 4. Corporate Law Attorney Agreement — Self-Employed Independent Contractor 5. Family Law Attorney Agreement — Self-Employed Independent Contractor These are just a few examples, as the type of agreement required depends on the legal expertise and services offered by the attorney. In conclusion, a New Hampshire Attorney Agreement for self-employed independent contractors establishes a clear understanding between the attorney and the client regarding their relationship, services to be provided, compensation terms, and other essential details. It aims to protect the rights and interests of both parties while ensuring legal compliance and professionalism throughout their engagement.

New Hampshire Attorney Agreement - Self-Employed Independent Contractor

Description

How to fill out New Hampshire Attorney Agreement - Self-Employed Independent Contractor?

Are you in the situation that you need documents for either organization or personal uses just about every time? There are a variety of lawful file themes available on the net, but locating ones you can trust is not effortless. US Legal Forms gives a large number of type themes, much like the New Hampshire Attorney Agreement - Self-Employed Independent Contractor, which are composed to fulfill federal and state demands.

If you are presently acquainted with US Legal Forms web site and have a merchant account, just log in. Afterward, you can download the New Hampshire Attorney Agreement - Self-Employed Independent Contractor web template.

If you do not come with an accounts and wish to begin to use US Legal Forms, follow these steps:

- Discover the type you want and ensure it is for that appropriate area/county.

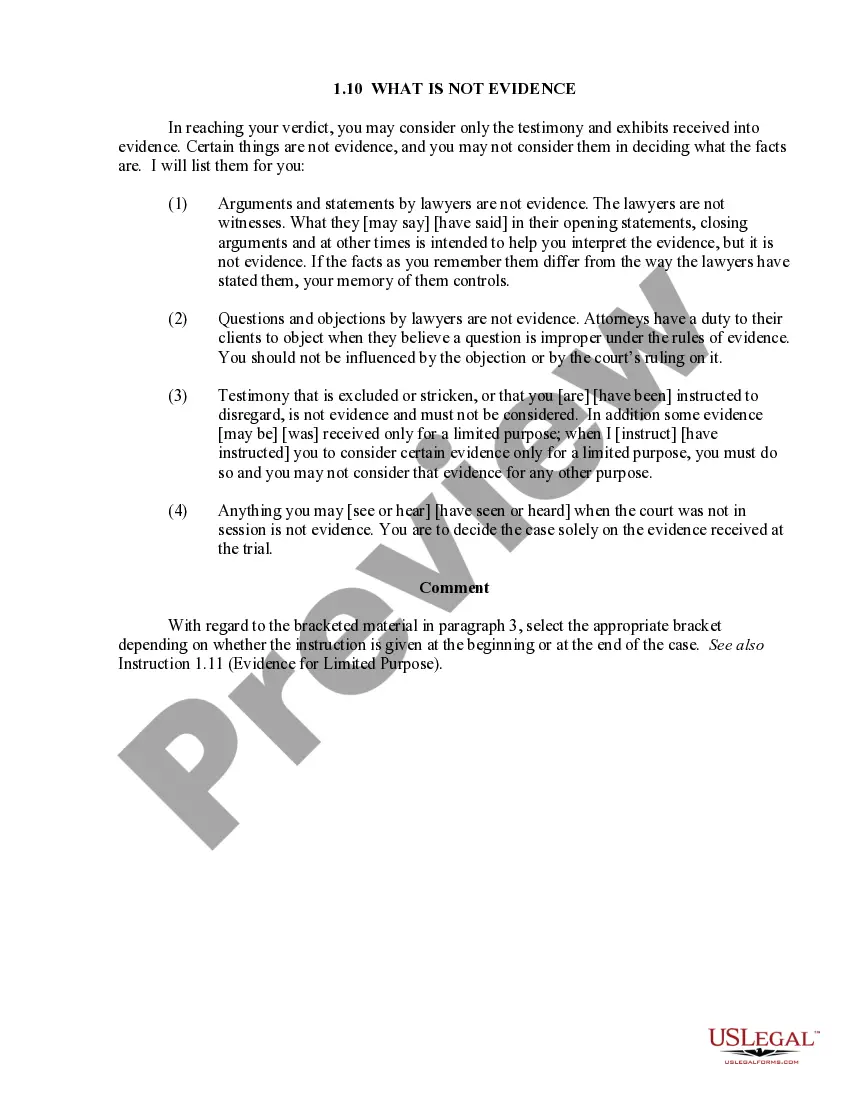

- Utilize the Preview button to analyze the form.

- See the information to ensure that you have chosen the appropriate type.

- When the type is not what you are seeking, use the Look for area to obtain the type that meets your requirements and demands.

- If you get the appropriate type, click Purchase now.

- Select the prices prepare you would like, fill in the necessary information to produce your money, and pay for an order with your PayPal or Visa or Mastercard.

- Choose a convenient data file file format and download your duplicate.

Discover each of the file themes you have purchased in the My Forms menu. You can obtain a additional duplicate of New Hampshire Attorney Agreement - Self-Employed Independent Contractor whenever, if required. Just click on the necessary type to download or produce the file web template.

Use US Legal Forms, the most considerable variety of lawful types, to conserve efforts and steer clear of blunders. The services gives appropriately manufactured lawful file themes which can be used for a selection of uses. Generate a merchant account on US Legal Forms and initiate making your daily life easier.