New Hampshire Lab Worker Employment Contract - Self-Employed

Description

How to fill out New Hampshire Lab Worker Employment Contract - Self-Employed?

US Legal Forms - one of several most significant libraries of legitimate varieties in the United States - delivers an array of legitimate file web templates you are able to down load or produce. Utilizing the website, you can get a huge number of varieties for enterprise and specific reasons, sorted by groups, says, or key phrases.You will discover the newest models of varieties just like the New Hampshire Lab Worker Employment Contract - Self-Employed within minutes.

If you already possess a subscription, log in and down load New Hampshire Lab Worker Employment Contract - Self-Employed through the US Legal Forms catalogue. The Obtain option can look on every form you view. You get access to all in the past downloaded varieties inside the My Forms tab of your respective profile.

If you want to use US Legal Forms initially, listed here are easy directions to obtain began:

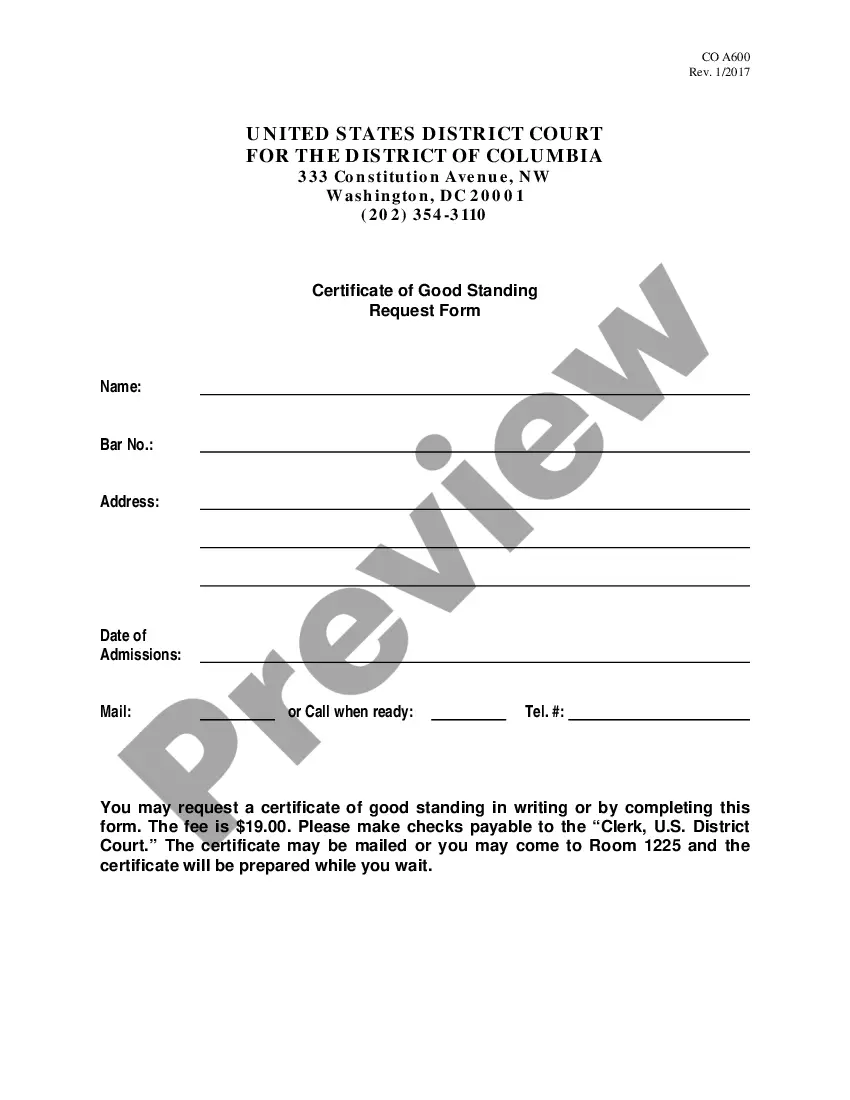

- Be sure you have picked the correct form for the area/region. Click on the Review option to examine the form`s content. Read the form description to actually have selected the right form.

- When the form doesn`t suit your requirements, make use of the Lookup field at the top of the screen to find the one which does.

- Should you be happy with the shape, verify your choice by visiting the Acquire now option. Then, choose the costs program you prefer and give your credentials to register to have an profile.

- Process the purchase. Utilize your bank card or PayPal profile to accomplish the purchase.

- Find the structure and down load the shape on your product.

- Make alterations. Fill up, change and produce and sign the downloaded New Hampshire Lab Worker Employment Contract - Self-Employed.

Every web template you included in your account does not have an expiry date and it is yours eternally. So, in order to down load or produce yet another duplicate, just go to the My Forms area and then click about the form you will need.

Get access to the New Hampshire Lab Worker Employment Contract - Self-Employed with US Legal Forms, probably the most comprehensive catalogue of legitimate file web templates. Use a huge number of specialist and express-distinct web templates that meet up with your small business or specific demands and requirements.

Form popularity

FAQ

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Self-employed people earn a living by working for themselves, not as employees of someone else or as owners (shareholders) of a corporation.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

If someone is self-employed, they do not have the rights and responsibilities of an employee or the rights and responsibilities of a worker. Someone is probably self-employed if they're self-employed for tax purposes and most of the following are true: they put in bids or give quotes to get work.