New Hampshire Recovery Services Contract - Self-Employed

Description

How to fill out New Hampshire Recovery Services Contract - Self-Employed?

US Legal Forms - among the biggest libraries of legal forms in the United States - offers a wide array of legal record templates you may down load or print. Making use of the web site, you will get a large number of forms for company and individual purposes, sorted by groups, suggests, or key phrases.You will find the newest models of forms like the New Hampshire Recovery Services Contract - Self-Employed in seconds.

If you have a monthly subscription, log in and down load New Hampshire Recovery Services Contract - Self-Employed from your US Legal Forms collection. The Obtain switch can look on each and every kind you view. You have accessibility to all formerly acquired forms within the My Forms tab of your respective account.

If you would like use US Legal Forms initially, allow me to share simple instructions to help you get started out:

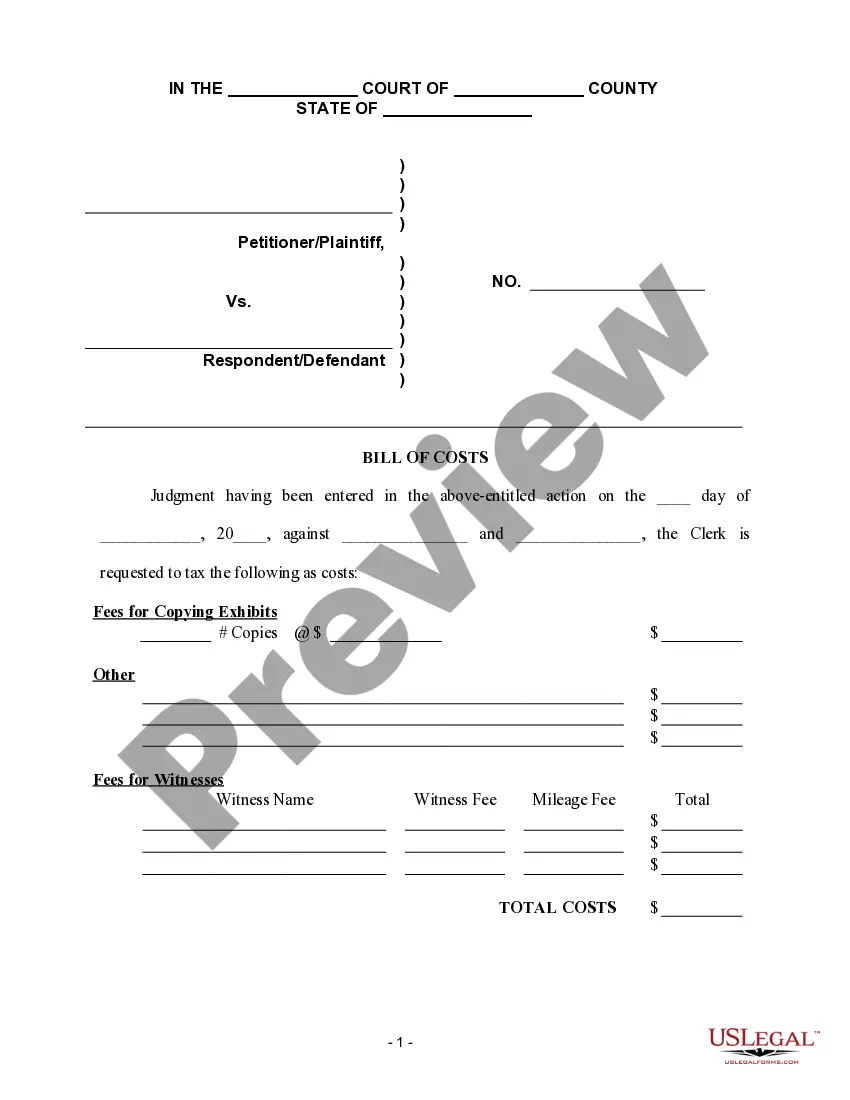

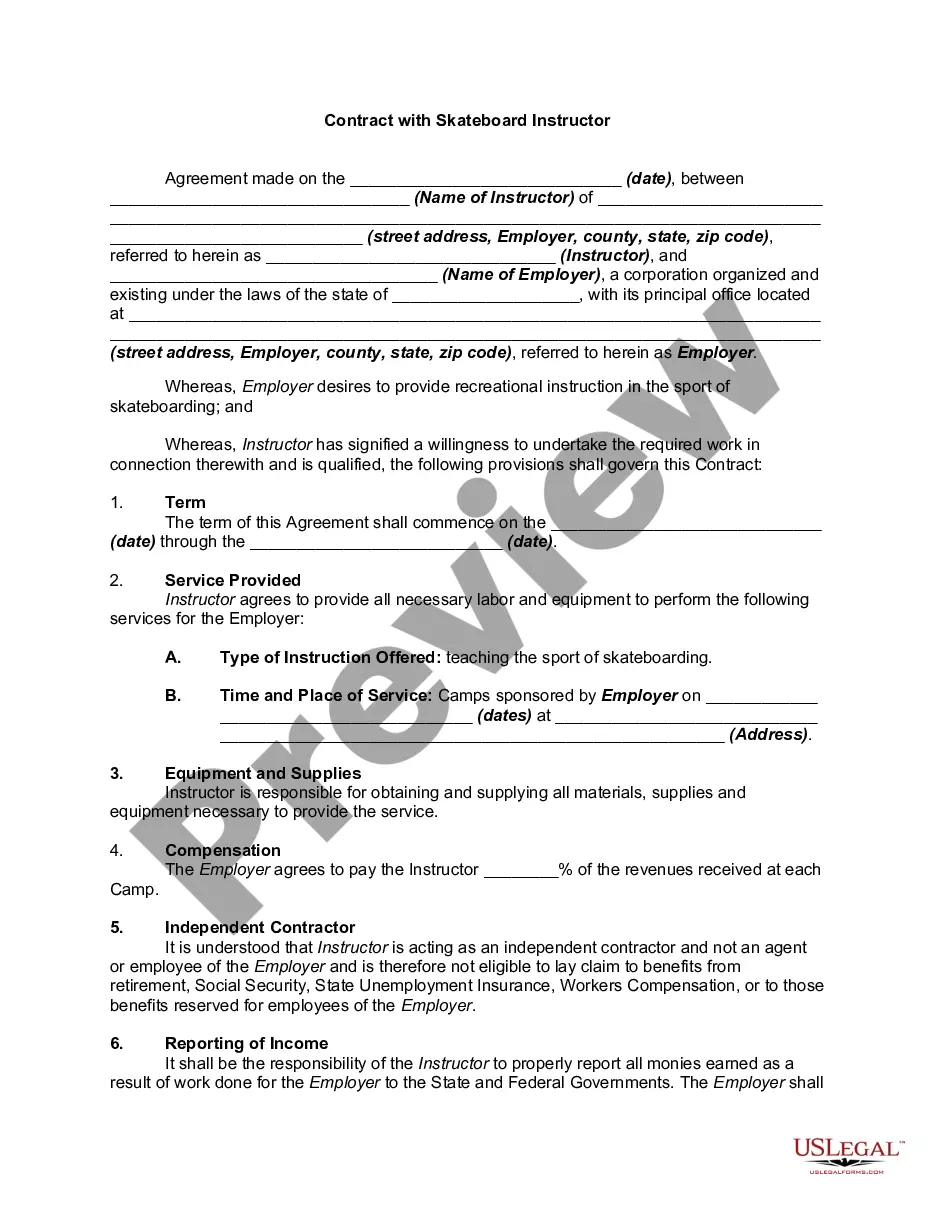

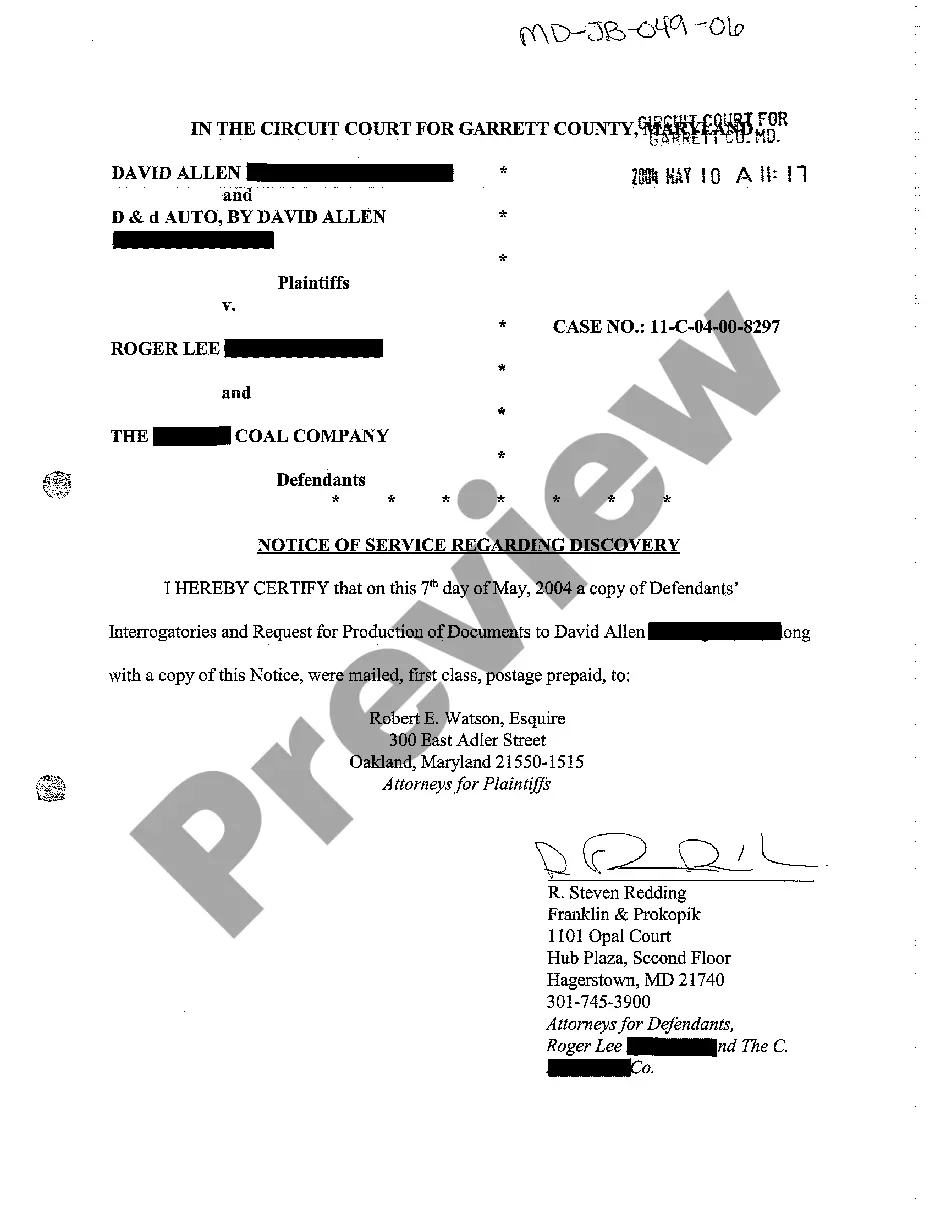

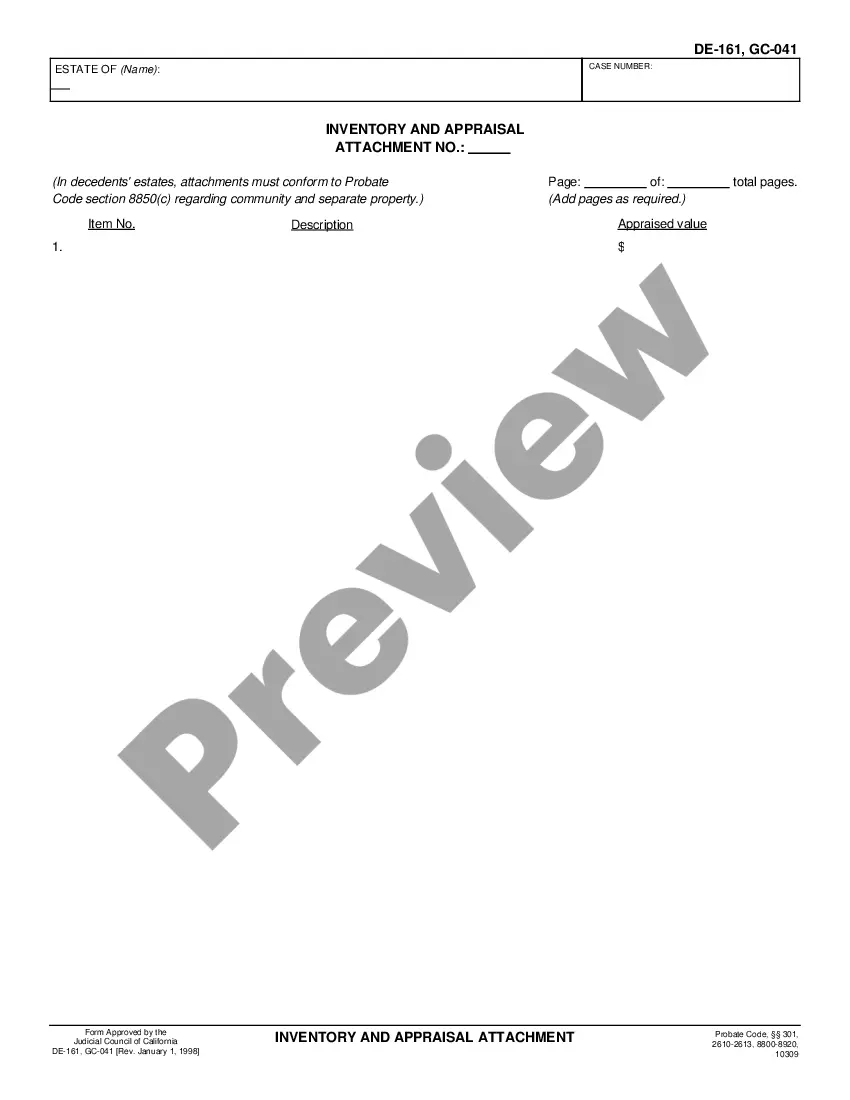

- Ensure you have picked out the correct kind for the city/region. Click on the Preview switch to check the form`s content. See the kind description to ensure that you have chosen the proper kind.

- If the kind doesn`t satisfy your demands, make use of the Lookup area towards the top of the screen to find the one which does.

- When you are happy with the shape, validate your choice by simply clicking the Acquire now switch. Then, opt for the prices program you favor and supply your qualifications to sign up on an account.

- Procedure the financial transaction. Make use of your Visa or Mastercard or PayPal account to finish the financial transaction.

- Choose the formatting and down load the shape on the device.

- Make alterations. Fill out, revise and print and indication the acquired New Hampshire Recovery Services Contract - Self-Employed.

Every single web template you included in your bank account lacks an expiry time and is yours forever. So, if you would like down load or print yet another copy, just check out the My Forms segment and click on in the kind you want.

Gain access to the New Hampshire Recovery Services Contract - Self-Employed with US Legal Forms, one of the most substantial collection of legal record templates. Use a large number of expert and state-particular templates that fulfill your business or individual requires and demands.

Form popularity

FAQ

Separation pay (including severance, vacation, holiday, sick, bonus, etc.), is disqualifying in New Hampshire. You can not be paid unemployment benefits for a week in which you received or expect to receive a week of separation pay.

If you have forgotten your password, or are locked out, go to your local NHWorks office with identification or call 1-800-266-2252, during normal business hours: 8 a.m. to p.m. Monday-Friday.

An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

You can either go directly to the new jobs portal at or just click the above button for 'Covid-19 Response Recruitment'. Starting May 23rd the department will once again be requiring claim filers to conduct a weekly work search as a condition for being considered eligible for unemployment benefits.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Notices Requesting Documentation for the Pandemic Unemployment Assistance (PUA) Program: If you received notices asking you to provide documents for the PUA program, please go to your dashboard and click the UPLOAD BUTTON and submit the documents as requested.

Self-employed individuals, independent contractors, and other individuals who are unable to work as a direct result of COVID-19 public health emergency and would not qualify for regular unemployment benefits under state law may be eligible to receive Pandemic Unemployment Assistance.

Yes, with the passing of the CARES Act, independent contractors, gig workers, and self-employed individuals are eligible for unemployment insurance if they are unable to work due to COVID-19.

Self-employed individuals, independent contractors, and other individuals who are unable to work as a direct result of COVID-19 public health emergency and would not qualify for regular unemployment benefits under state law may be eligible to receive Pandemic Unemployment Assistance.

Independent contractor, an individual must meet the requirements of all 7 points: 1. The individual possesses or has applied for a federal employer identification number or social security number, or in the alternative, has agreed in writing to carry out the responsibilities imposed on employers under NH wage laws.