New Hampshire Cook Services Contract - Self-Employed

Description

How to fill out New Hampshire Cook Services Contract - Self-Employed?

Are you currently in a place the place you require files for both business or person purposes just about every working day? There are plenty of legitimate document layouts available online, but locating ones you can rely on is not effortless. US Legal Forms gives a huge number of type layouts, such as the New Hampshire Cook Services Contract - Self-Employed, which are created to satisfy state and federal needs.

When you are currently familiar with US Legal Forms website and also have your account, just log in. Next, you are able to acquire the New Hampshire Cook Services Contract - Self-Employed template.

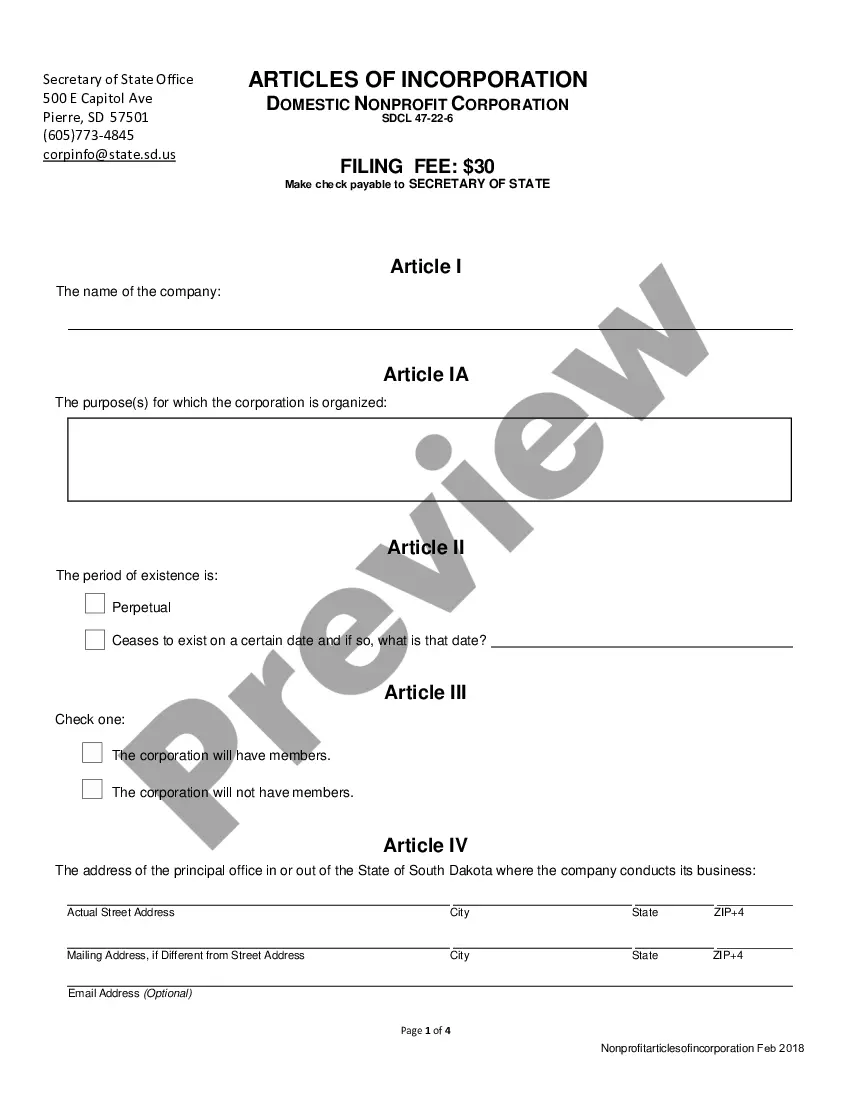

Unless you have an bank account and need to start using US Legal Forms, follow these steps:

- Discover the type you need and ensure it is to the right town/region.

- Utilize the Preview button to analyze the form.

- Browse the explanation to actually have selected the right type.

- In the event the type is not what you`re seeking, take advantage of the Lookup discipline to obtain the type that meets your needs and needs.

- If you obtain the right type, just click Acquire now.

- Choose the pricing strategy you desire, submit the necessary info to create your bank account, and purchase your order utilizing your PayPal or charge card.

- Select a handy paper format and acquire your duplicate.

Discover every one of the document layouts you may have purchased in the My Forms menus. You may get a additional duplicate of New Hampshire Cook Services Contract - Self-Employed at any time, if required. Just select the essential type to acquire or produce the document template.

Use US Legal Forms, probably the most considerable collection of legitimate forms, to save lots of some time and avoid mistakes. The assistance gives appropriately produced legitimate document layouts which can be used for a variety of purposes. Generate your account on US Legal Forms and initiate producing your daily life easier.

Form popularity

FAQ

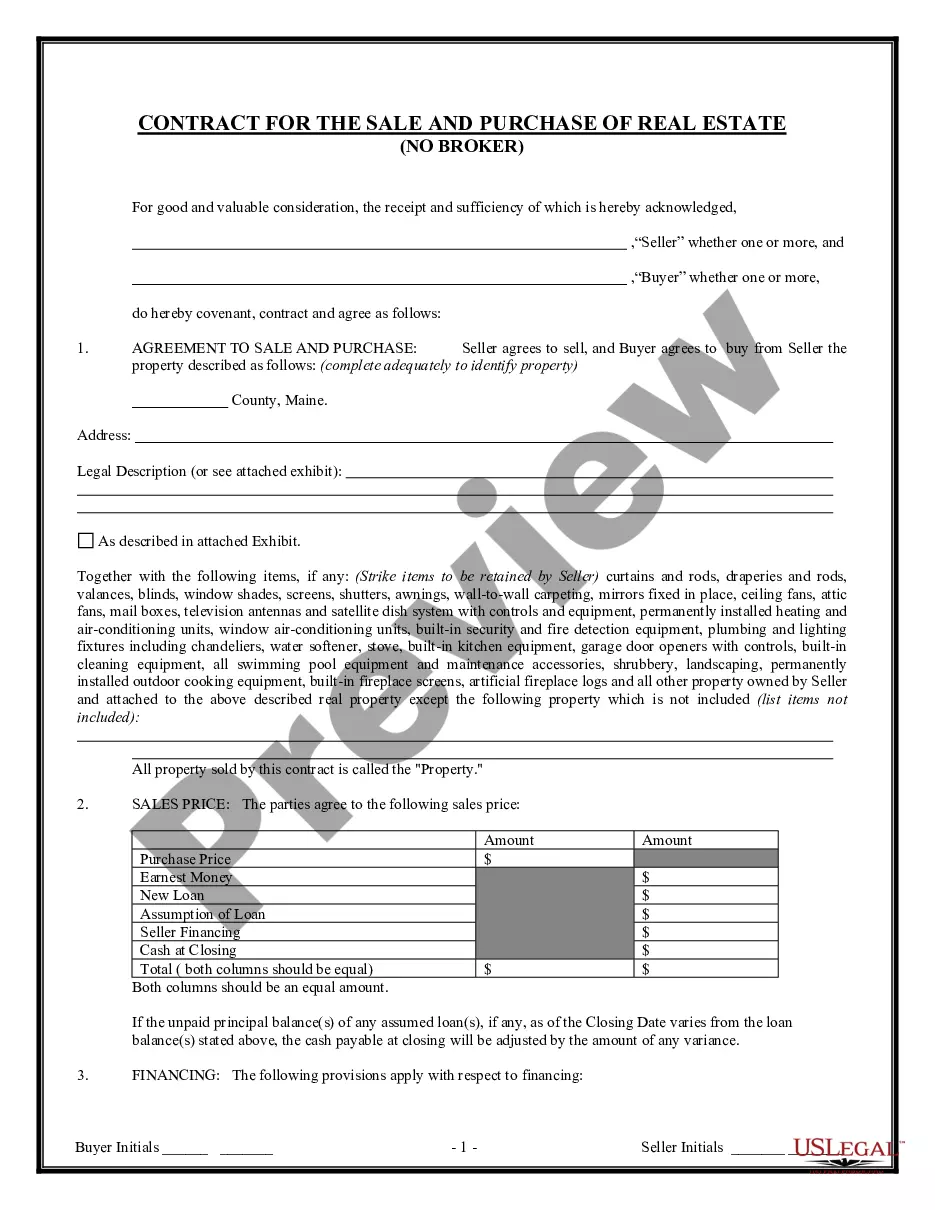

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

A contract that is used for appointing a genuinely self-employed individual such as a consultant (or a profession or business run by that individual) to carry out services for another party where the relationship between the parties is not that of employer and employee or worker.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

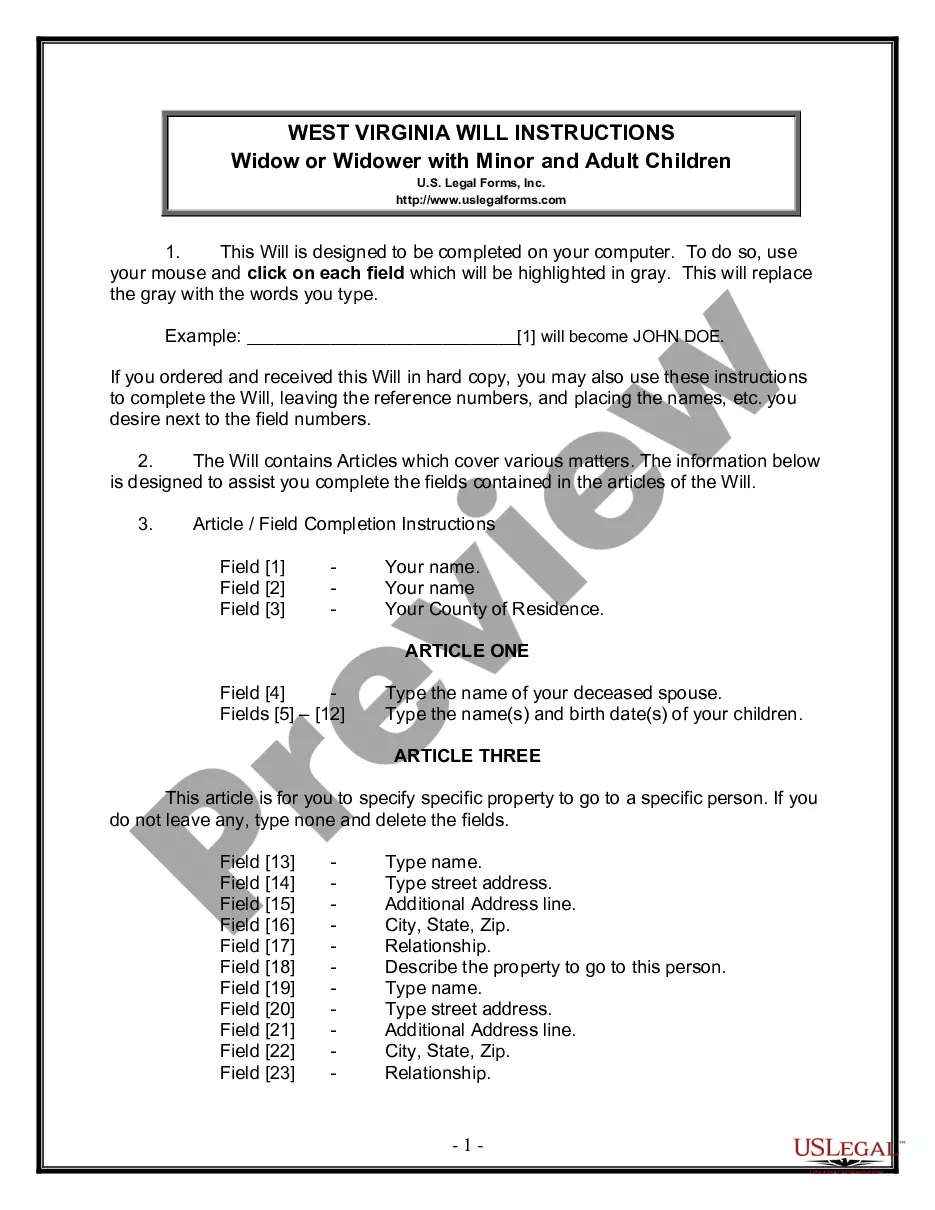

Self-employed people are those who own their own businesses and work for themselves. According to the IRS, you are self-employed if you act as a sole proprietor or independent contractor, or if you own an unincorporated business.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

More info

This is the best job for this type.