New Hampshire Milker Services Contract - Self-Employed

Description

How to fill out New Hampshire Milker Services Contract - Self-Employed?

Are you currently within a place in which you will need paperwork for possibly organization or individual reasons almost every day time? There are tons of legitimate papers web templates available online, but finding kinds you can rely is not effortless. US Legal Forms gives a large number of form web templates, such as the New Hampshire Milker Services Contract - Self-Employed, which can be created in order to meet federal and state requirements.

In case you are presently acquainted with US Legal Forms web site and get a merchant account, basically log in. Next, it is possible to download the New Hampshire Milker Services Contract - Self-Employed template.

If you do not offer an account and want to begin using US Legal Forms, abide by these steps:

- Discover the form you will need and ensure it is for the proper city/county.

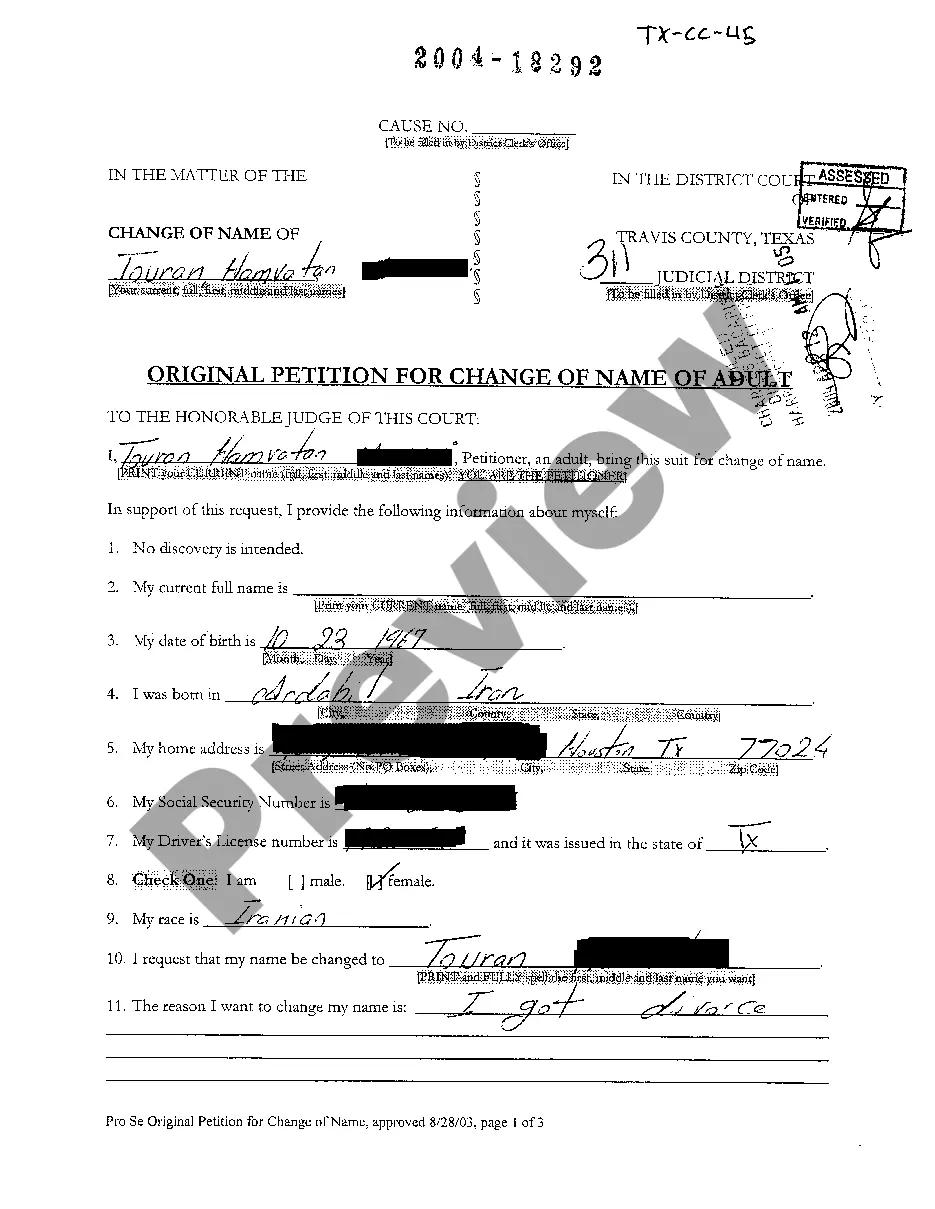

- Use the Review option to analyze the shape.

- Read the information to ensure that you have selected the appropriate form.

- In case the form is not what you`re seeking, take advantage of the Lookup industry to get the form that fits your needs and requirements.

- Whenever you discover the proper form, click Acquire now.

- Pick the prices plan you need, fill out the necessary details to produce your account, and pay for the order with your PayPal or Visa or Mastercard.

- Decide on a hassle-free paper structure and download your copy.

Get every one of the papers web templates you have bought in the My Forms menu. You can obtain a extra copy of New Hampshire Milker Services Contract - Self-Employed any time, if needed. Just click the required form to download or print the papers template.

Use US Legal Forms, by far the most comprehensive variety of legitimate kinds, to save time and stay away from mistakes. The service gives professionally made legitimate papers web templates that you can use for a range of reasons. Generate a merchant account on US Legal Forms and initiate generating your daily life a little easier.

Form popularity

FAQ

An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

New Hampshire is one of four states (New Hampshire, New Jersey, Tennessee and Vermont) that assign SUI tax rates on a fiscal year, rather than a calendar year, basis.

New Hampshire is an at-will state, which means employers can generally fire their employees at any time and for any reasonwith some important exceptions. Note that the state's at-will laws do not apply to union employees or those working on employment contracts.

Most employees in New Hampshire are at-will employees.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Under New Hampshire labor laws, employers cannot require that an employee work more than five (5) consecutive hours without granting a thirty (30) minute lunch or eating period. If the employer cannot allow thirty (30) minutes, the employee must be paid if they are eating and working at the same time.

Self-employed individuals, independent contractors, and other individuals who are unable to work as a direct result of COVID-19 public health emergency and would not qualify for regular unemployment benefits under state law may be eligible to receive Pandemic Unemployment Assistance.

At-Will Employment States:All states in the U.S., excluding Montana, are at-will. Most do have exceptions, but the states of Florida, Alabama, Louisiana, Georgia, Nebraska, Maine, New York, and Rhode Island do not allow any exceptions.

In New Hampshire, an employer can fire without giving a reason or a notice.

Independent contractor, an individual must meet the requirements of all 7 points: 1. The individual possesses or has applied for a federal employer identification number or social security number, or in the alternative, has agreed in writing to carry out the responsibilities imposed on employers under NH wage laws.