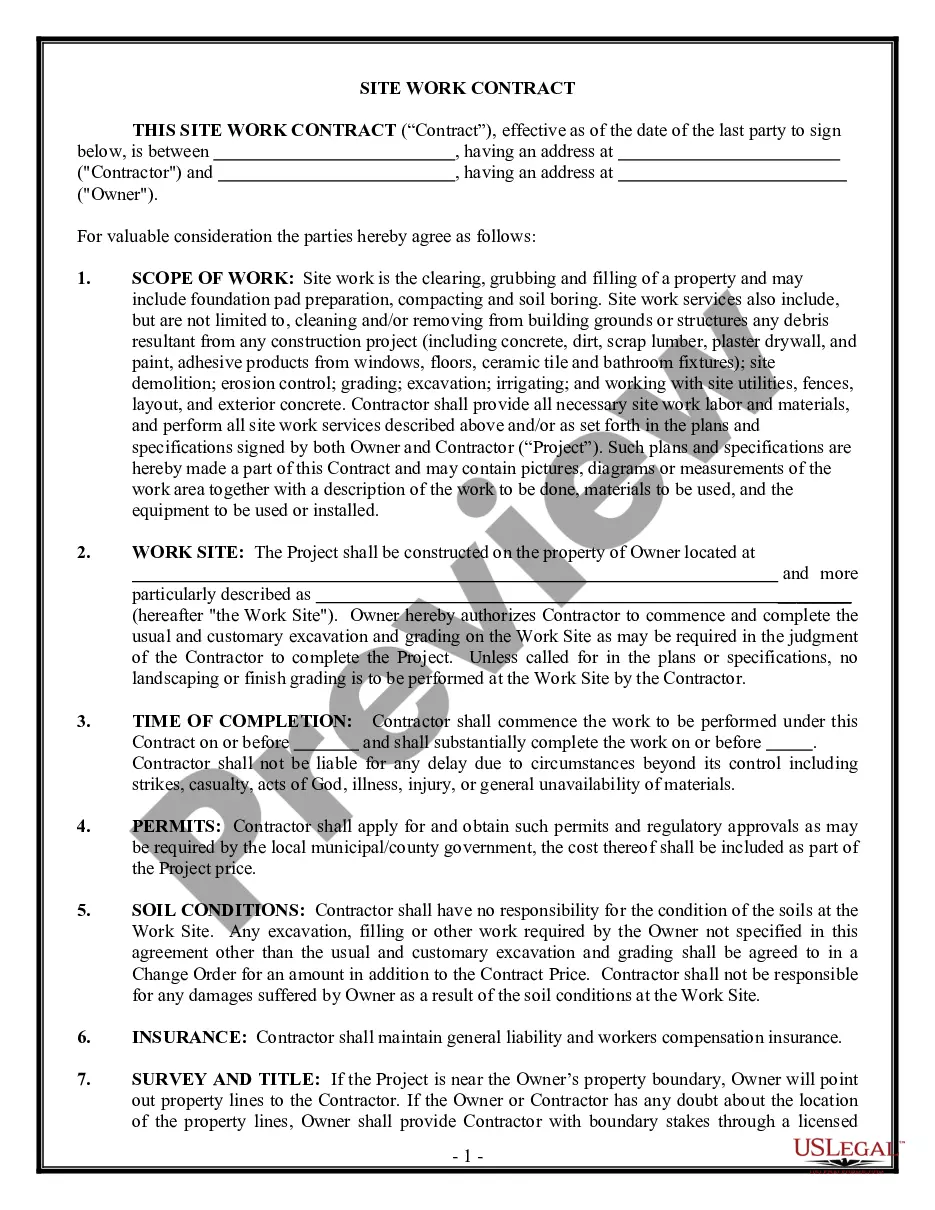

The New Hampshire Self-Employed Independent Sales Contractor Agreement is a legally binding document that outlines the terms and conditions under which a self-employed independent sales contractor operates within the state of New Hampshire. This agreement serves as a written contract between the contractor and the hiring party, establishing a clear understanding of their professional arrangement. The agreement covers various essential aspects relevant to the working relationship between the independent sales contractor and the hiring party. It typically includes sections on the scope of work, compensation and payment terms, intellectual property rights, non-disclosure and confidentiality, termination clauses, and dispute resolution mechanisms. Within New Hampshire, there may be different types or variations of self-employed independent sales contractor agreements depending on the industry, nature of work, or specific requirements involved. Some common names for these agreements may include "Independent Sales Representative Agreement," "Independent Contractor Sales Agreement," or "Sales Consultant Contract." These various names highlight the flexibility of the agreement template to address specific needs within different business sectors. The New Hampshire Self-Employed Independent Sales Contractor Agreement ensures that both parties are protected and have a mutual understanding of their rights and obligations. It establishes clear guidelines for the contractor's role, responsibilities, and the expectations set forth by the hiring party. It also serves as a safeguard to prevent any misunderstandings or potential disputes that may arise during the course of the business relationship. By documenting the terms of engagement and responsibilities of each party, this agreement provides a solid foundation for a successful working relationship. It allows the self-employed independent sales contractor to operate with confidence, knowing they are working within a framework that protects their interests. Similarly, the hiring party benefits from the clarity and legal obligations outlined in the agreement. In summary, the New Hampshire Self-Employed Independent Sales Contractor Agreement is a crucial document that helps establish a transparent and legally binding relationship between self-employed independent sales contractors and the parties engaging their services. This agreement ensures that both parties operate in accordance with the law, promoting fair and ethical business practices within the state of New Hampshire.

New Hampshire Self-Employed Independent Sales Contractor Agreement

Description

How to fill out New Hampshire Self-Employed Independent Sales Contractor Agreement?

You are able to invest hours online looking for the lawful document web template which fits the federal and state demands you want. US Legal Forms gives thousands of lawful types which are analyzed by experts. It is simple to download or print the New Hampshire Self-Employed Independent Sales Contractor Agreement from my assistance.

If you have a US Legal Forms bank account, it is possible to log in and click on the Acquire key. Afterward, it is possible to total, revise, print, or indicator the New Hampshire Self-Employed Independent Sales Contractor Agreement. Every single lawful document web template you acquire is yours permanently. To have yet another duplicate of any obtained form, visit the My Forms tab and click on the related key.

If you are using the US Legal Forms site the first time, follow the straightforward recommendations under:

- First, ensure that you have chosen the right document web template to the area/city of your liking. Read the form outline to ensure you have picked out the proper form. If readily available, take advantage of the Review key to search throughout the document web template at the same time.

- If you would like get yet another model of your form, take advantage of the Lookup discipline to find the web template that meets your needs and demands.

- After you have located the web template you want, click Purchase now to carry on.

- Choose the pricing plan you want, key in your references, and register for a merchant account on US Legal Forms.

- Total the transaction. You may use your Visa or Mastercard or PayPal bank account to pay for the lawful form.

- Choose the structure of your document and download it to your device.

- Make modifications to your document if needed. You are able to total, revise and indicator and print New Hampshire Self-Employed Independent Sales Contractor Agreement.

Acquire and print thousands of document web templates while using US Legal Forms Internet site, which offers the most important assortment of lawful types. Use professional and express-particular web templates to tackle your organization or person requires.

Form popularity

FAQ

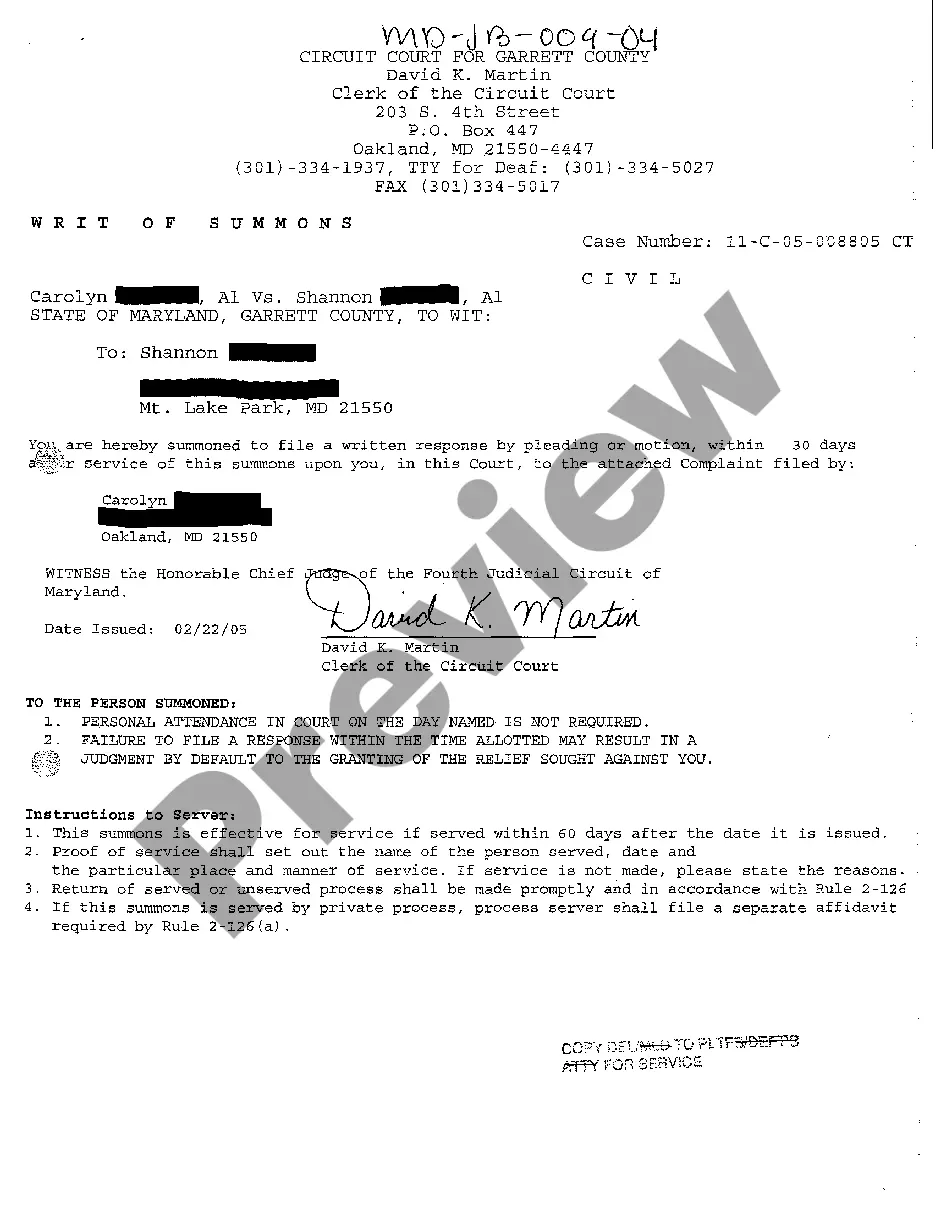

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

An Independent Contractor Agreement is a written contract that outlines the terms and conditions of the working arrangement between an independent contractor and client, including: A description of the services provided. Terms and length of the project or service.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

Five Ways to Market Your Brand as an Independent ContractorKnow Your Online Audience. In order to market yourself effectively as an independent contractor, you have to know who you're marketing to!Build a Brand for Yourself.Know Your Professional Goals.Get Clients More Involved.Take Advantage of Booksy Marketing Tools.03-Sept-2021

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

What Should an Independent Contractor Agreement Contain?Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved.Responsibilities & Deliverables.Payment-Related Details.Confidentiality Clause.Contract Termination.Choice of Law.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.14-Feb-2022

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Independent contractors use 1099 forms. In California, workers who report their income on a Form 1099 are independent contractors, while those who report it on a W-2 form are employees. Payroll taxes from W-2 employees are automatically withheld, while independent contracts are responsible for paying them.