New Hampshire Self-Employed Ceiling Installation Contract

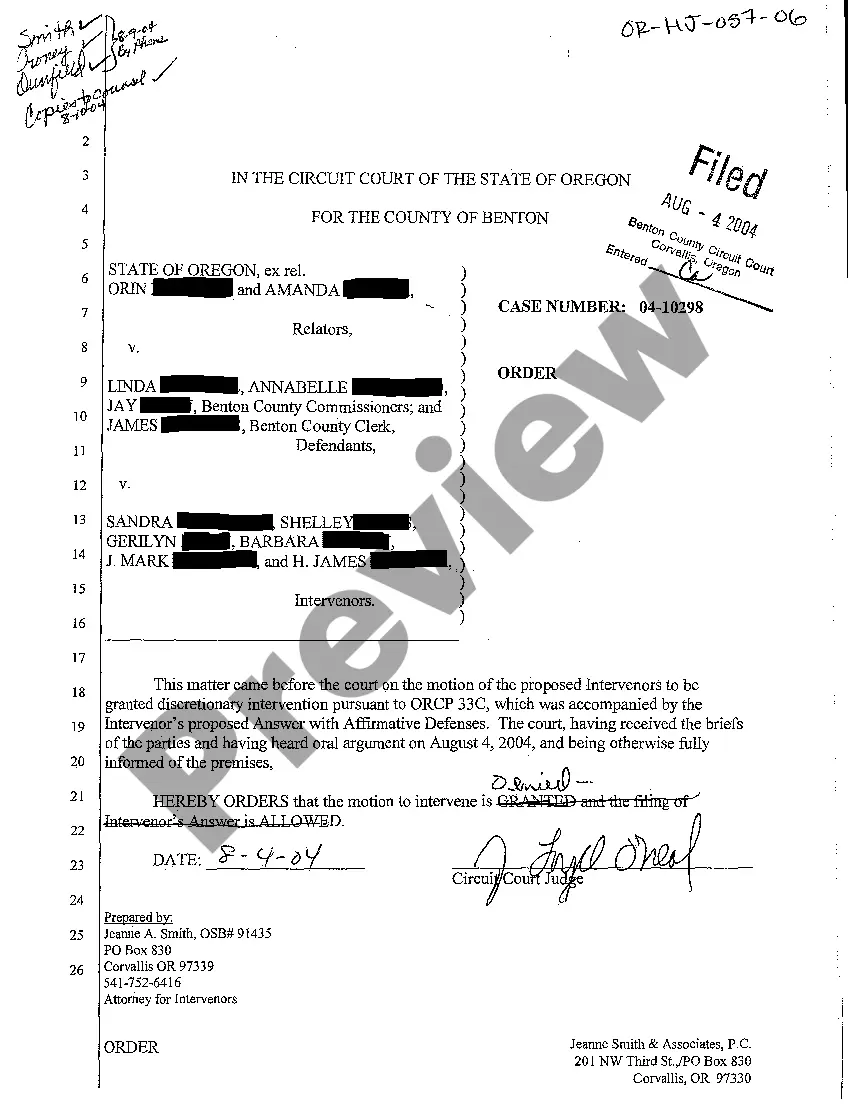

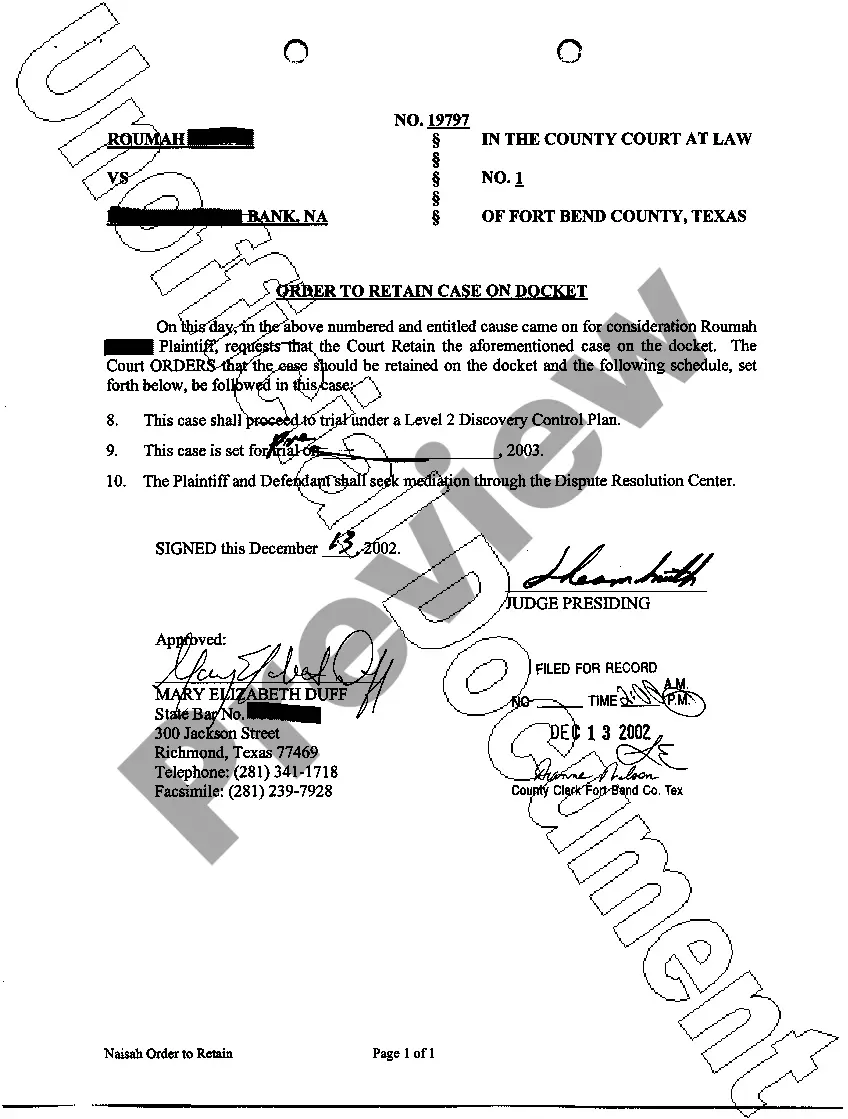

Description

How to fill out New Hampshire Self-Employed Ceiling Installation Contract?

Discovering the right legitimate record format might be a struggle. Obviously, there are plenty of themes available online, but how do you get the legitimate develop you want? Utilize the US Legal Forms internet site. The services delivers thousands of themes, including the New Hampshire Self-Employed Ceiling Installation Contract, which you can use for organization and personal demands. Every one of the kinds are examined by specialists and fulfill state and federal requirements.

Should you be previously authorized, log in to your bank account and then click the Down load button to get the New Hampshire Self-Employed Ceiling Installation Contract. Use your bank account to search through the legitimate kinds you might have purchased in the past. Proceed to the My Forms tab of your respective bank account and have yet another copy of the record you want.

Should you be a fresh consumer of US Legal Forms, listed here are straightforward recommendations that you can stick to:

- Initial, make sure you have chosen the appropriate develop for the city/state. You may look through the shape utilizing the Preview button and browse the shape information to make sure it will be the right one for you.

- In case the develop is not going to fulfill your preferences, use the Seach discipline to find the proper develop.

- Once you are positive that the shape is acceptable, go through the Get now button to get the develop.

- Select the costs prepare you desire and enter in the necessary details. Create your bank account and pay for the order utilizing your PayPal bank account or credit card.

- Opt for the data file format and down load the legitimate record format to your product.

- Full, change and print and sign the acquired New Hampshire Self-Employed Ceiling Installation Contract.

US Legal Forms will be the most significant collection of legitimate kinds for which you will find numerous record themes. Utilize the company to down load skillfully-manufactured papers that stick to status requirements.

Form popularity

FAQ

There are two main accounting methods that independent contractors can choose from when filing their first tax returns as a business.Cash basis is the most simple form of tax returns.Accrual basis will count your expenses and cash when it is earned, not when the money is received.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

A business may pay an independent contractor and an employee for the same or similar work, but there are important legal differences between the two. For the employee, the company withholds income tax, Social Security, and Medicare from wages paid. For the independent contractor, the company does not withhold taxes.

This agreement should clearly state what tasks the contractor is to perform. The agreement will also include what tasks will be performed and how much the contractor will be paid for his or her work. A contractor agreement can also help demonstrate that the person is truly an independent contractor and not an employee.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.