New Hampshire Self-Employed Steel Services Contract

Description

How to fill out New Hampshire Self-Employed Steel Services Contract?

Have you been within a position the place you will need papers for both business or person functions nearly every working day? There are a variety of legitimate file templates accessible on the Internet, but discovering types you can trust isn`t simple. US Legal Forms gives 1000s of kind templates, just like the New Hampshire Self-Employed Steel Services Contract, which are written to fulfill federal and state specifications.

When you are currently familiar with US Legal Forms site and get a free account, merely log in. Next, it is possible to obtain the New Hampshire Self-Employed Steel Services Contract web template.

If you do not provide an account and would like to start using US Legal Forms, follow these steps:

- Find the kind you require and ensure it is for your right metropolis/area.

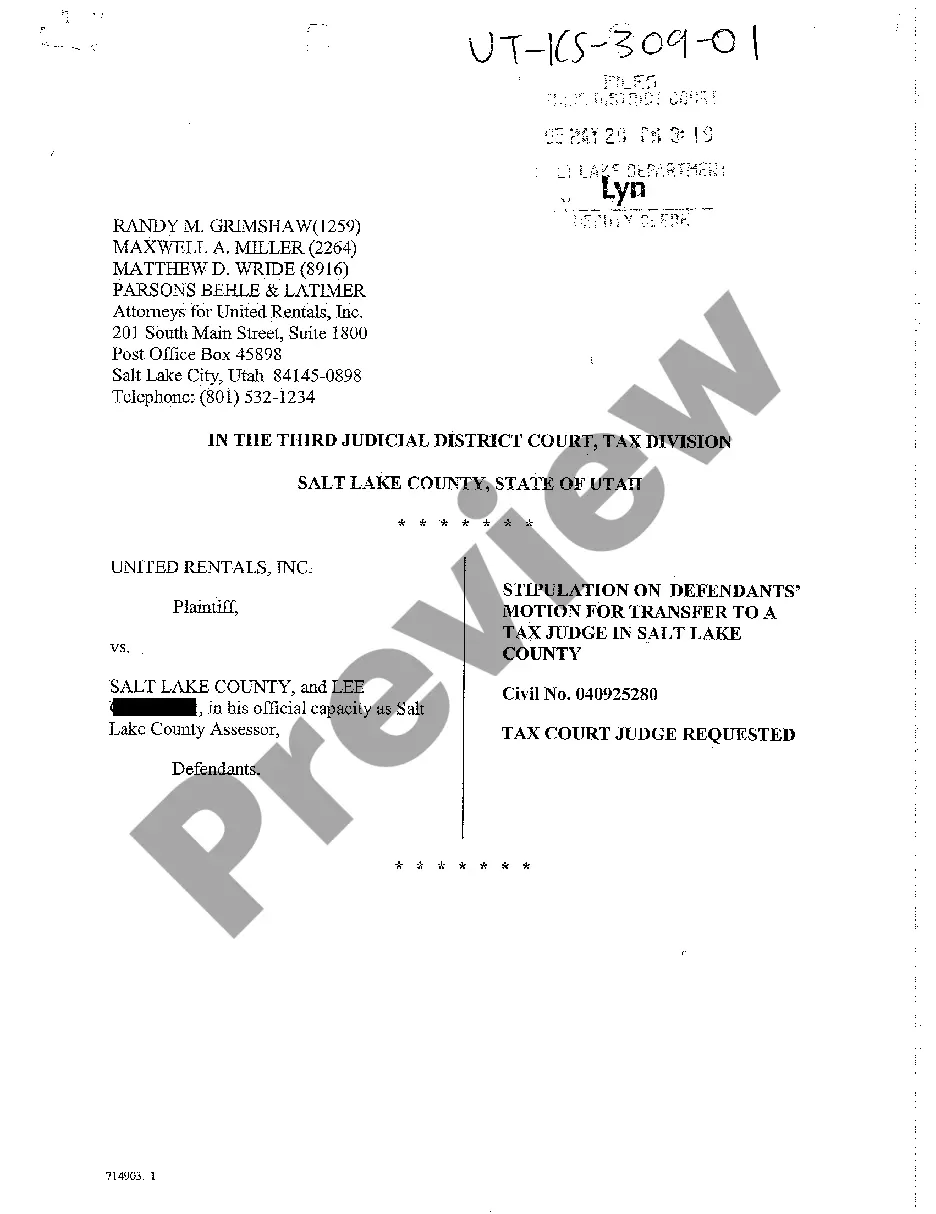

- Use the Preview switch to analyze the form.

- Look at the information to actually have selected the proper kind.

- When the kind isn`t what you are looking for, utilize the Search discipline to discover the kind that suits you and specifications.

- Whenever you obtain the right kind, just click Purchase now.

- Select the prices plan you need, fill in the required details to make your account, and purchase the order utilizing your PayPal or bank card.

- Choose a practical document formatting and obtain your duplicate.

Discover all of the file templates you may have bought in the My Forms food selection. You can obtain a more duplicate of New Hampshire Self-Employed Steel Services Contract any time, if necessary. Just click the essential kind to obtain or produce the file web template.

Use US Legal Forms, one of the most extensive collection of legitimate kinds, in order to save time as well as steer clear of blunders. The assistance gives professionally made legitimate file templates which can be used for a variety of functions. Create a free account on US Legal Forms and begin creating your daily life a little easier.

Form popularity

FAQ

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Write the contract in six stepsStart with a contract template.Open with the basic information.Describe in detail what you have agreed to.Include a description of how the contract will be ended.Write into the contract which laws apply and how disputes will be resolved.Include space for signatures.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

How to write an employment contractTitle the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

How Do You Become Self-Employed?Think of a Name for Your Self-Employed Business. Consider what services you will offer, and then pick a name that describes what you do.Choose a Self-Employed Business Structure and Get a Proper License.Open a Business Bank Account.Advertise Your Independent Contractor Services.7 Sept 2021