This form is to be used when a collection company is demanding full payment from you and you disagree with the balance. Use this form as your first letter of dispute.

Dispute Move Out Charges Letter Template

Description credit dispute letter template

How to fill out New Hampshire Letter Of Dispute - Complete Balance?

You are able to commit hrs on the Internet searching for the legal record format that fits the state and federal specifications you want. US Legal Forms offers a large number of legal forms that are analyzed by specialists. It is simple to down load or printing the New Hampshire Letter of Dispute - Complete Balance from the support.

If you currently have a US Legal Forms accounts, you can log in and then click the Download option. Following that, you can total, revise, printing, or signal the New Hampshire Letter of Dispute - Complete Balance. Every legal record format you acquire is yours eternally. To have an additional backup associated with a acquired develop, visit the My Forms tab and then click the related option.

If you work with the US Legal Forms internet site the very first time, keep to the easy directions under:

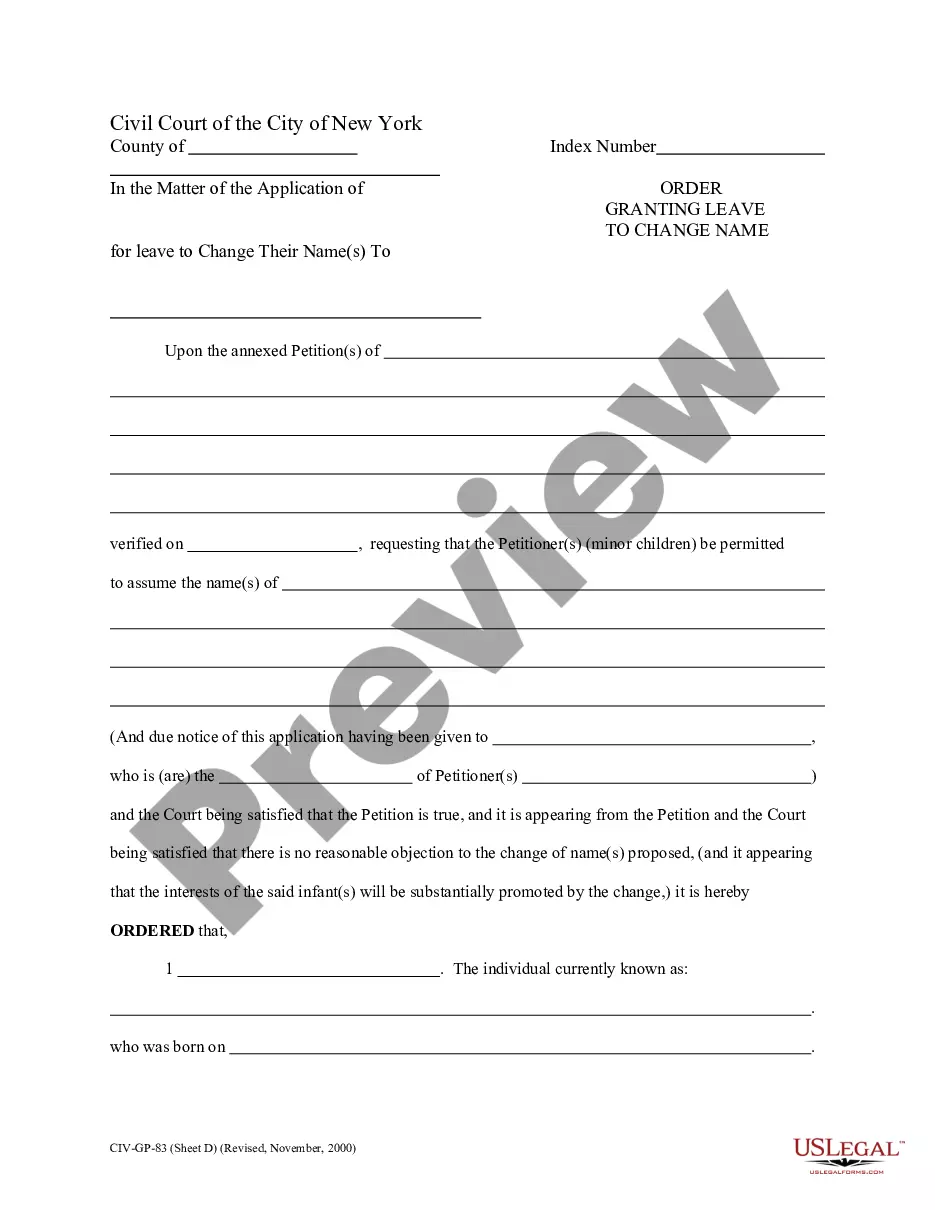

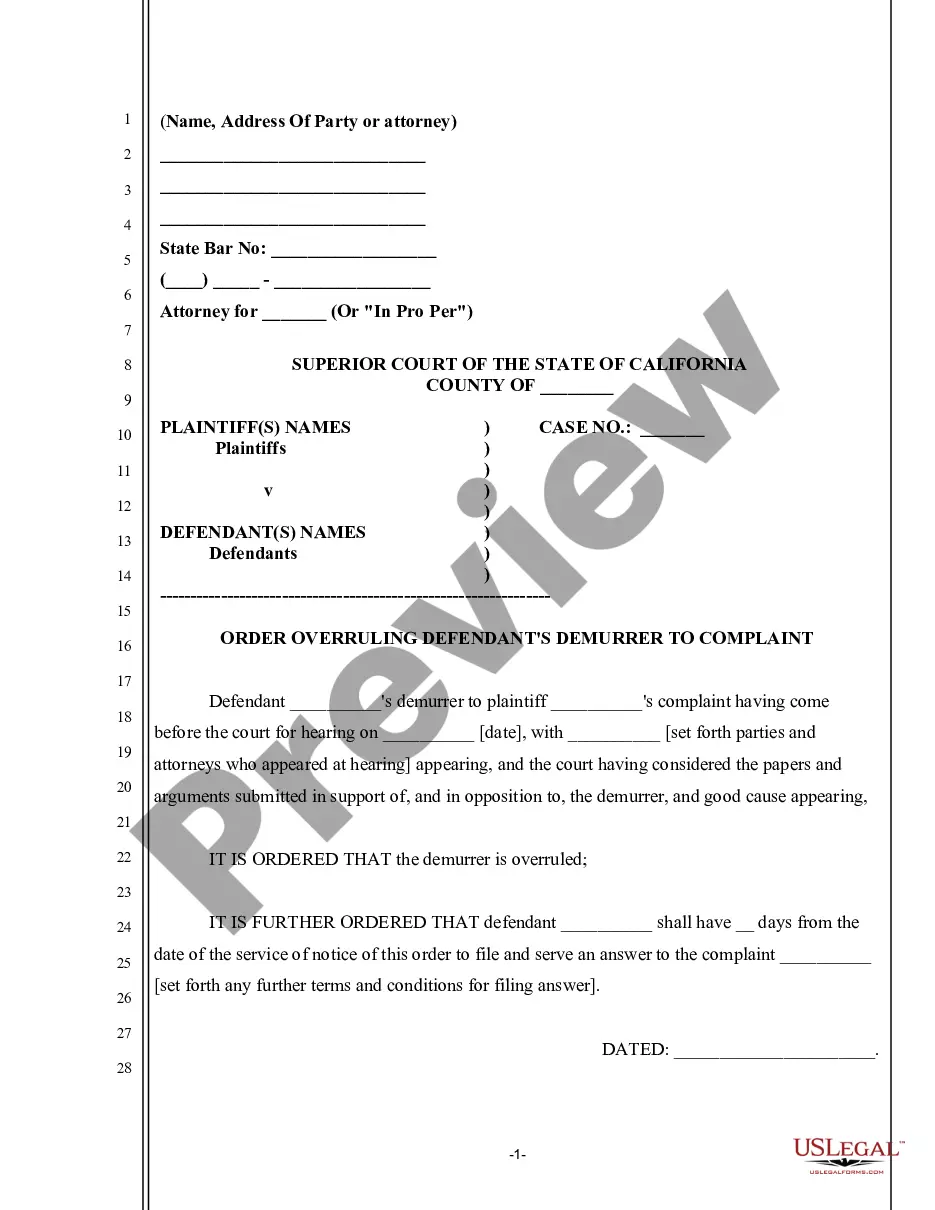

- Initial, make sure that you have chosen the best record format for your county/city of your liking. Browse the develop explanation to make sure you have chosen the proper develop. If available, use the Review option to appear through the record format as well.

- If you want to locate an additional variation of your develop, use the Lookup industry to obtain the format that meets your needs and specifications.

- Once you have discovered the format you desire, click Purchase now to move forward.

- Select the pricing program you desire, enter your qualifications, and register for an account on US Legal Forms.

- Complete the deal. You can utilize your Visa or Mastercard or PayPal accounts to cover the legal develop.

- Select the file format of your record and down load it to your product.

- Make adjustments to your record if possible. You are able to total, revise and signal and printing New Hampshire Letter of Dispute - Complete Balance.

Download and printing a large number of record templates using the US Legal Forms web site, that offers the most important selection of legal forms. Use professional and condition-specific templates to deal with your business or specific requirements.

Form popularity

FAQ

Valid Reasons to Dispute a Credit Card ChargeCharges with wrong date or dollar amount.Math errors (such as an incorrect total after adding a tip)Failure to post payments or credits.Failure to deliver the bill to your current address (assuming you provided it 20 days before the billing cycle closing date)More items...?

5 ways to deal with a disputed invoiceAsk questions and investigate. It's tempting to get defensive when a customer disputes an invoice.Help the customer understand they're mistaken. If the customer is in the wrong, don't start accusing.Propose a mutually beneficial resolution.Escalate2026Enforce your legal rights.

Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. You may want to enclose a copy of your credit report with the items in question circled.

I am writing to dispute a charge of $ to my credit or debit card account on date of the charge. The charge is in error because explain the problem briefly. For example, the items weren't delivered, I was overcharged, I returned the items, I did not buy the items, etc..

Your dispute letter should include the following information:Your full name.Your date of birth.Your Social Security number.Your current address and any other addresses at which you have lived during the past two years.A copy of a government-issued identification card such as a driver's license or state ID.More items...?

If you believe any account information is incorrect, you should dispute the information to have it either removed or corrected. If, for example, you have a collection or multiple collections appearing on your credit reports and those debts do not belong to you, you can dispute them and have them removed.

The debt dispute letter should include your personal identifying information; verification of the amount of debt owed; the name of the creditor for the debt; and a request the debt not be reported to credit reporting agencies until the matter is resolved or have it removed from the report, if it already has been

There's no evidence to suggest a 609 letter is more or less effective than the usual process of disputing an error on your credit reportit's just another method of gathering information and seeking verification of the accuracy of the report. If disputes are successful, the credit bureaus may remove the negative item.

I am writing to dispute a billing error in the amount of $ on my account. The amount is inaccurate because describe the problem. I am requesting that the error be corrected, that any finance and other charges related to the disputed amount be credited as well, and that I receive an accurate statement.

If you need help, you may wish to contact any of the following agencies: National: Federal Trade Commission -- Credit card, charge account and other billing problems covered by the Fair Credit Billing Act; credit report and debt collection practices. It's always best to contact a regional office of the FTC.