New Hampshire Deed and Assignment from individual to A Trust

Description

How to fill out Deed And Assignment From Individual To A Trust?

US Legal Forms - one of several greatest libraries of lawful types in the States - provides an array of lawful record templates it is possible to acquire or print out. Making use of the website, you can find thousands of types for company and person uses, sorted by types, states, or keywords.You can find the latest versions of types just like the New Hampshire Deed and Assignment from individual to A Trust within minutes.

If you already possess a membership, log in and acquire New Hampshire Deed and Assignment from individual to A Trust in the US Legal Forms local library. The Obtain key will show up on every single develop you see. You get access to all in the past delivered electronically types from the My Forms tab of the bank account.

If you wish to use US Legal Forms for the first time, listed here are straightforward guidelines to help you get started off:

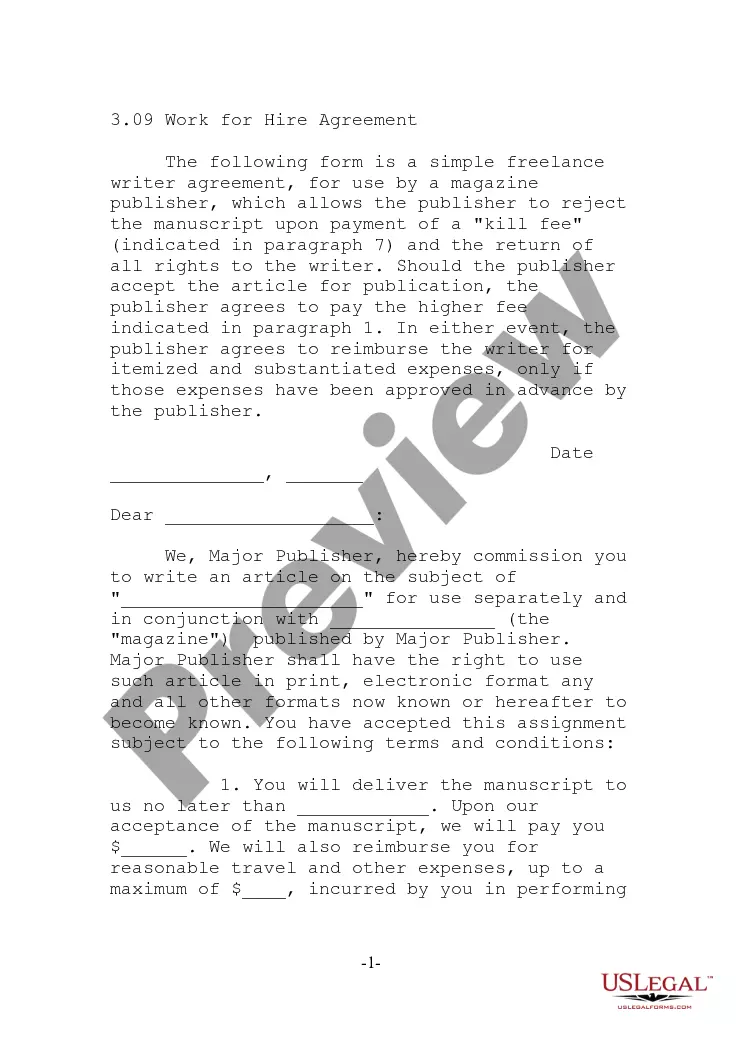

- Make sure you have selected the correct develop for the town/state. Click on the Review key to examine the form`s information. Look at the develop outline to ensure that you have chosen the correct develop.

- When the develop does not fit your demands, make use of the Lookup discipline on top of the display to find the one which does.

- If you are satisfied with the form, validate your option by visiting the Buy now key. Then, select the pricing strategy you prefer and give your accreditations to sign up to have an bank account.

- Process the purchase. Make use of your Visa or Mastercard or PayPal bank account to accomplish the purchase.

- Pick the format and acquire the form in your gadget.

- Make modifications. Fill out, modify and print out and sign the delivered electronically New Hampshire Deed and Assignment from individual to A Trust.

Every single web template you included with your account does not have an expiration time and is your own eternally. So, if you wish to acquire or print out one more version, just go to the My Forms portion and then click around the develop you want.

Gain access to the New Hampshire Deed and Assignment from individual to A Trust with US Legal Forms, by far the most comprehensive local library of lawful record templates. Use thousands of expert and state-specific templates that satisfy your business or person needs and demands.

Form popularity

FAQ

In New Hampshire, the cost of setting up a basic Revocable Living Trust generally ranges from $1,000 to $3,000. More complex trusts may cost even more.

The assets you cannot put into a trust include the following: Medical savings accounts (MSAs) Health savings accounts (HSAs) Retirement assets: 403(b)s, 401(k)s, IRAs. Any assets that are held outside of the United States. Cash. Vehicles.

Transferring personal property to a trust To place them in your living trust fund, you can name them in your trust document on a property schedule (basically a list you attach to the trust document that is referred to in the document) and indicate that their ownership is being transferred to the trust.

For instance, personal property is relatively simple to transfer into a trust. It merely requires a signed statement that lists the assets being transferred. If the personal property is titled in the grantor's name, such as a boat or a motor vehicle, it must be transferred with the correct type of deed.

New Hampshire trust law allows for decanting, a process by which a trustee creates a new trust and transfers assets from an old trust to the new trust, enabling some level of trust modification (and modernization) of the old trust.

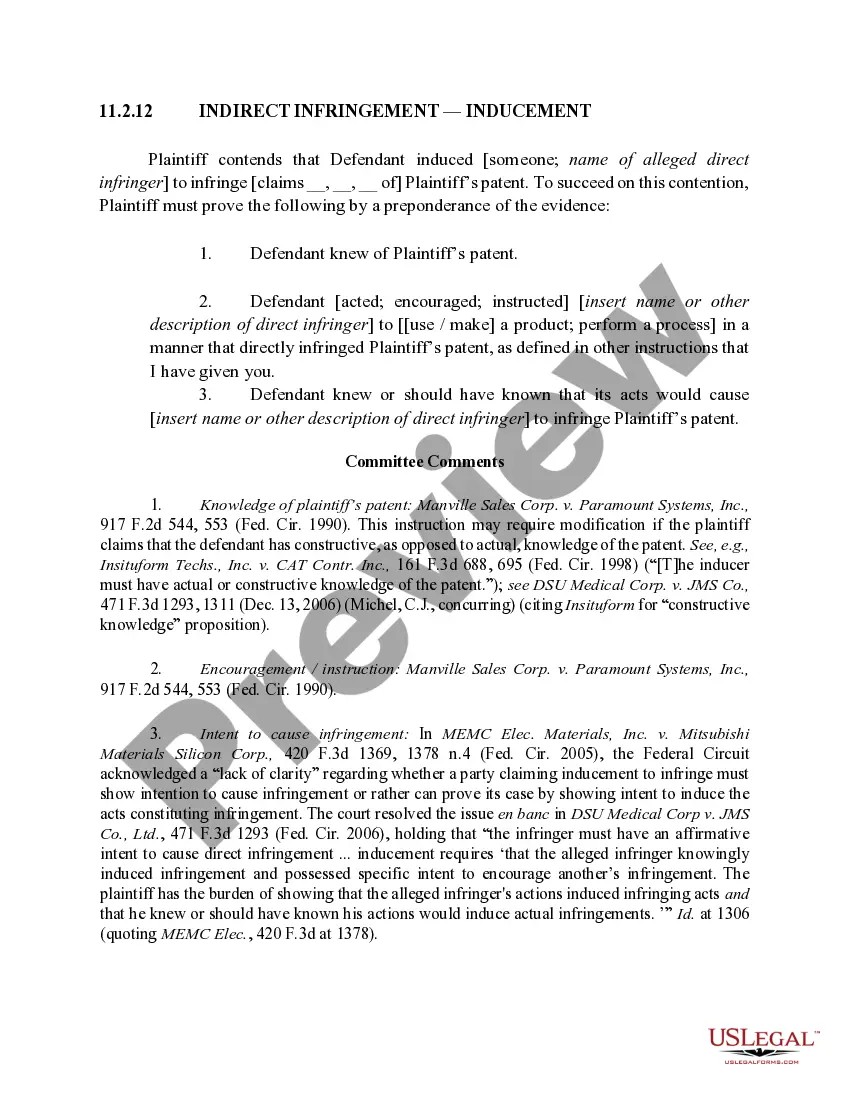

In real estate law, "assignment" is simply the transfer of a deed of trust from one party to another. This usually happens when the beneficiary of a trust deed sells their loan to another lender.

The key disadvantages of placing a house in a trust include the following: Extra paperwork: Moving property in a trust requires the house owner to transfer the asset's legal title. This involves preparing and signing an additional deed, and some people may consider this cumbersome.

How to Create a Living Trust in New Hampshire Take stock of your property. It's important to know exactly what you own and what you want to place into your trust. ... Pick a trustee. ... Create a trust document. ... Sign the trust document in the presence of a notary public. Fund your trust by moving your property into it.