New Hampshire Royalty Owner's indemnity Agreement on Interest with Title Dispute

Description

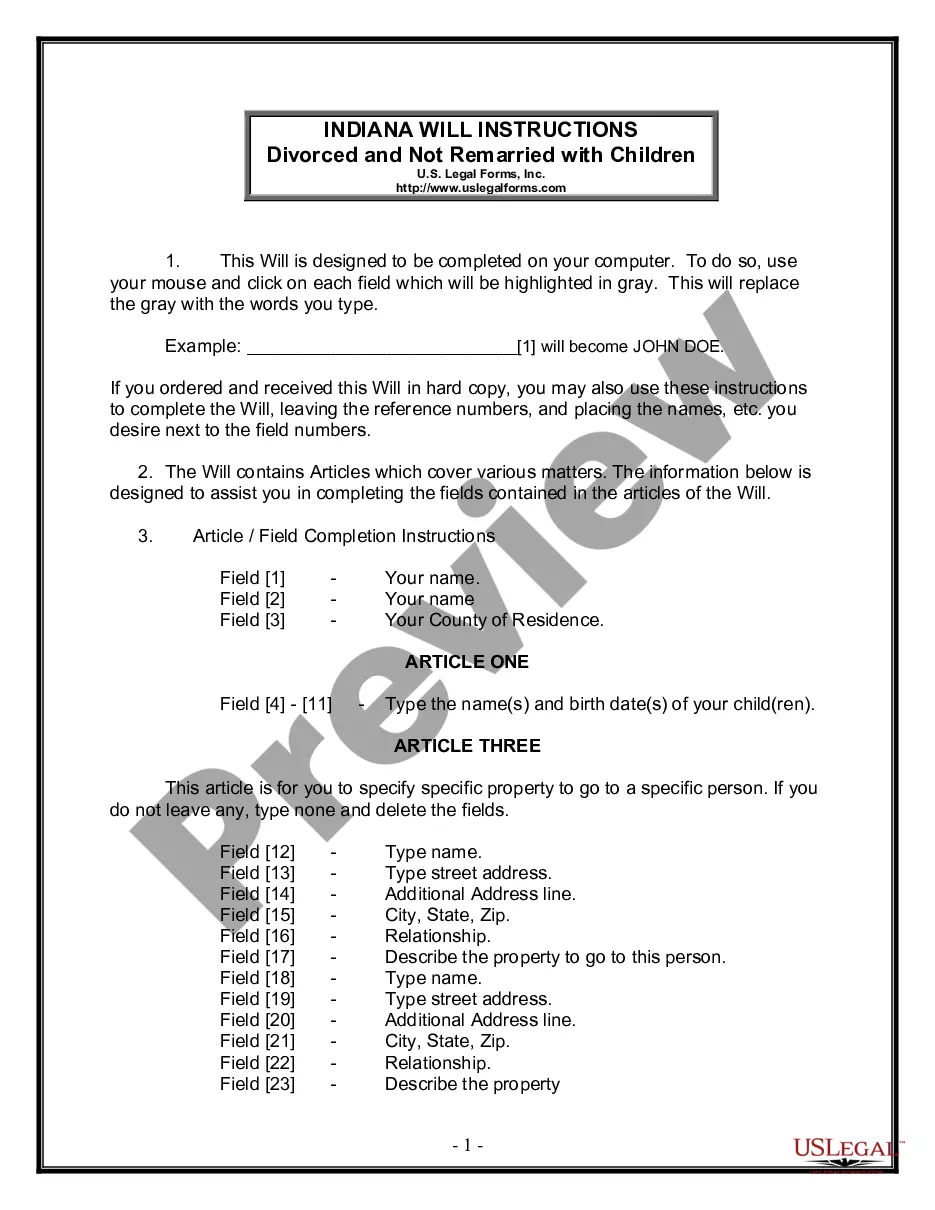

How to fill out Royalty Owner's Indemnity Agreement On Interest With Title Dispute?

US Legal Forms - one of the largest libraries of legitimate forms in the USA - delivers an array of legitimate papers templates you may acquire or print out. Making use of the internet site, you can find thousands of forms for company and individual functions, sorted by classes, suggests, or search phrases.You will discover the most recent types of forms such as the New Hampshire Royalty Owner's indemnity Agreement on Interest with Title Dispute in seconds.

If you have a monthly subscription, log in and acquire New Hampshire Royalty Owner's indemnity Agreement on Interest with Title Dispute in the US Legal Forms library. The Download key will appear on every form you look at. You have accessibility to all previously delivered electronically forms within the My Forms tab of your profile.

In order to use US Legal Forms the very first time, listed here are simple instructions to obtain began:

- Make sure you have picked out the correct form for the area/county. Click the Review key to examine the form`s information. Read the form explanation to ensure that you have chosen the right form.

- If the form does not satisfy your requirements, utilize the Search area near the top of the display to find the one who does.

- In case you are satisfied with the form, verify your choice by clicking the Get now key. Then, pick the pricing program you want and give your accreditations to register for the profile.

- Procedure the deal. Make use of your credit card or PayPal profile to finish the deal.

- Choose the formatting and acquire the form on your system.

- Make modifications. Fill up, revise and print out and indication the delivered electronically New Hampshire Royalty Owner's indemnity Agreement on Interest with Title Dispute.

Each and every format you added to your account does not have an expiration time which is yours permanently. So, if you wish to acquire or print out one more duplicate, just go to the My Forms portion and click on about the form you will need.

Gain access to the New Hampshire Royalty Owner's indemnity Agreement on Interest with Title Dispute with US Legal Forms, the most comprehensive library of legitimate papers templates. Use thousands of skilled and express-specific templates that satisfy your small business or individual requirements and requirements.

Form popularity

FAQ

The indemnitor, also called the indemnifier, or indemnifying party, is the person who is obligated to hold harmless the other party for its conduct, or another person's conduct. The indemnitee, also called the indemnified party, refers to the person who receives indemnification.

How to Write an Indemnity Agreement Consider the Indemnity Laws in Your Area. ... Draft the Indemnification Clause. ... Outline the Indemnification Period and Scope of Coverage. ... State the Indemnification Exceptions. ... Specify How the Indemnitee Notifies the Indemnitor About Claims. ... Write the Settlement and Consent Clause.

An indemnitor is a party who agrees to indemnify certain losses for another party. In doing so, they are legally required to compensate them when these losses are incurred. Insurance companies assume the role of the indemnitor in insurance contracts, agreeing to compensate the insured for specific losses.

An agreement whereby the first party (the indemnitor) agrees to hold a second party (the indemnitee) harmless from tort liability arising out of the indemnitor's negligent act or omission.

The letter of indemnity will indemnify the buyer's title insurer from any losses incurred due to the title defect and will typically also contain an ?undertaking clause? which means that your title insurance company will resolve the title defect after your closing.

A typical example is an insurance company wherein the insurer or indemnitor agrees to compensate the insured or indemnitee for any damages or losses he/she may incur during a period of time.

Indemnification clauses are contractual provisions that require one party (the ?Indemnitor?) to indemnify another party (the ?Indemnitee?) for losses that the Indemnitee may suffer. In prime contracts, the owner usually is the Indemnitee and the contractor is the Indemnitor.

For example, in a surety bond agreement, the indemnitor is typically the party that provides the financial backing and assumes responsibility for any losses that may occur if the bonded party fails to fulfill their contractual obligations.