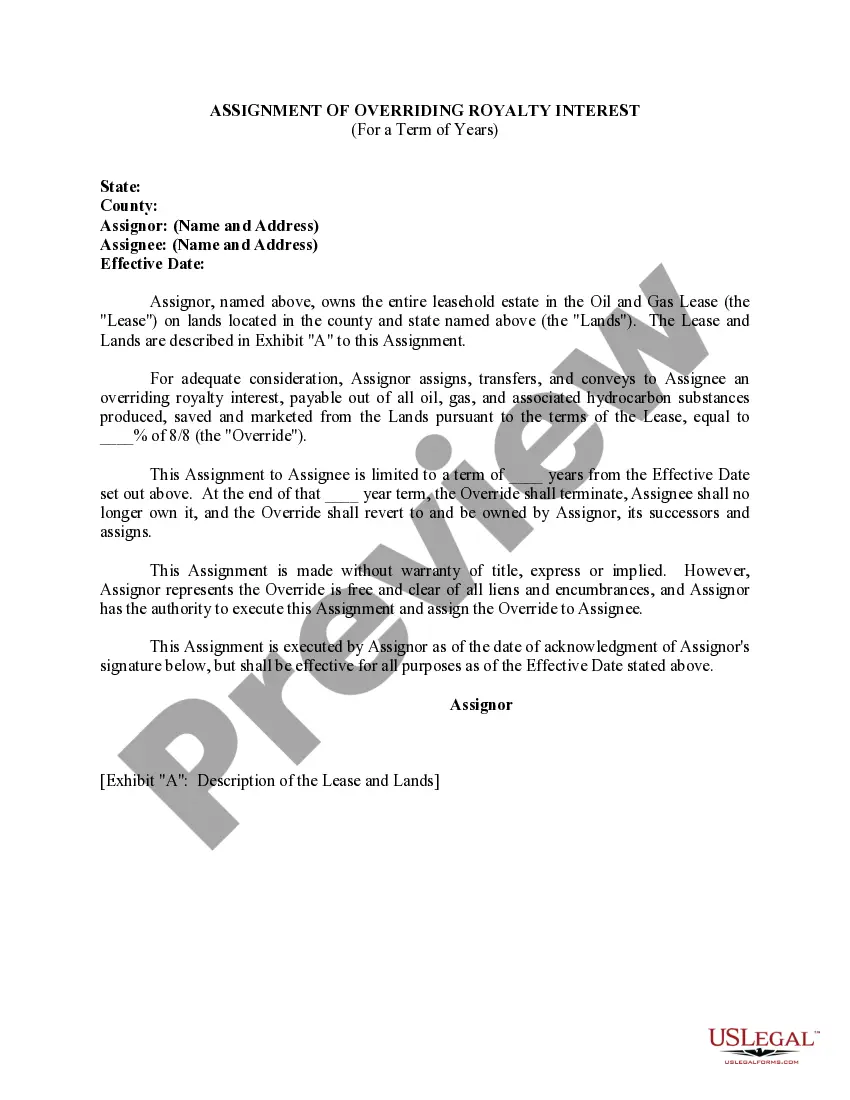

New Hampshire Assignment of Overriding Royalty Interest For A Term of Years: A Comprehensive Overview Keywords: New Hampshire, assignment, overriding royalty interest, term of years, oil and gas lease, mineral rights, landowner Introduction: A New Hampshire Assignment of Overriding Royalty Interest for a term of years is a legal agreement that allows an individual or entity to transfer their ownership rights to an overriding royalty interest in an oil and gas lease for a specified period. This assignment is significant for landowners who wish to monetize their mineral rights without relinquishing complete ownership or control. Understanding Overriding Royalty Interest (ORRIS): An overriding royalty interest is a percentage share of the revenue generated from the production of oil and gas obtained from a specific lease. Unlike a regular royalty interest, an overriding royalty interest is not linked to the land itself but is created through a separate agreement between the mineral rights' owner (assignor) and the assignee (the individual or entity receiving the interest). The assignment is typically limited to a specific period, known as the "term of years." Types of New Hampshire Assignment of Overriding Royalty Interest For A Term of Years: 1. Limited-term Assignment: This type of assignment establishes a specific start and end date for the overriding royalty interest. The assignee gains the right to receive a percentage share of the revenue generated from the oil and gas production on the leased property for the agreed-upon term. Once the term expires, the overriding royalty interest reverts to the assignor. 2. Renewable-term Assignment: In a renewable-term assignment, the overriding royalty interest is assigned for a fixed initial term, but the agreement includes the option for the assignee to extend the term for subsequent periods. The assignor retains the right to review and negotiate the terms of the extension before granting approval. 3. Fixed Rate Assignment: A fixed rate assignment involves a predetermined percentage of the revenue generated from the oil and gas production on the leased property. The assignee receives a fixed percentage of the gross revenue throughout the term of the assignment. 4. Ascending Rate Assignment: Under an ascending rate assignment, the assignee receives an increasing percentage of the revenue generated from the oil and gas production over time. This type of assignment is often used when the initial output from the leased property is expected to be lower, but future production is anticipated to increase. Conclusion: The New Hampshire Assignment of Overriding Royalty Interest for a Term of Years provides landowners with a flexible tool to capitalize on their mineral rights. Assignors can choose from various types of assignments based on their objectives and the specific characteristics of the leased property. It is advisable for both assignors and assignees to seek legal counsel when drafting or entering into these agreements to ensure all parties' interests are protected and the terms accurately reflect the intentions of the parties involved.

New Hampshire Assignment of Overriding Royalty Interest For A Term of Years

Description

How to fill out New Hampshire Assignment Of Overriding Royalty Interest For A Term Of Years?

Are you presently in a position the place you need papers for sometimes enterprise or personal uses almost every time? There are a lot of authorized document themes available on the net, but finding versions you can rely on isn`t effortless. US Legal Forms gives a huge number of form themes, much like the New Hampshire Assignment of Overriding Royalty Interest For A Term of Years, that happen to be published to satisfy state and federal requirements.

Should you be already familiar with US Legal Forms site and possess an account, simply log in. After that, you may down load the New Hampshire Assignment of Overriding Royalty Interest For A Term of Years template.

Should you not offer an account and want to start using US Legal Forms, abide by these steps:

- Get the form you want and ensure it is for your correct metropolis/state.

- Take advantage of the Preview switch to examine the form.

- Read the description to actually have chosen the appropriate form.

- When the form isn`t what you are looking for, use the Search area to obtain the form that suits you and requirements.

- Once you get the correct form, just click Purchase now.

- Opt for the rates strategy you desire, fill in the necessary details to create your account, and purchase the order using your PayPal or charge card.

- Pick a hassle-free paper file format and down load your duplicate.

Get each of the document themes you might have purchased in the My Forms menus. You can obtain a extra duplicate of New Hampshire Assignment of Overriding Royalty Interest For A Term of Years whenever, if needed. Just click on the necessary form to down load or produce the document template.

Use US Legal Forms, the most substantial assortment of authorized kinds, in order to save time and prevent faults. The services gives expertly created authorized document themes which can be used for a variety of uses. Produce an account on US Legal Forms and begin producing your lifestyle a little easier.

Form popularity

FAQ

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production.

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

Overriding Royalty Interest Conveyance means an assignment, in form and substance acceptable to Lender, pursuant to which Borrower grants in favor of Lender an overriding royalty interest equal to six and one-fourth percent (6.25%) of Hydrocarbons produced, saved and sold or used off the premises of the relevant Lease, ...

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.