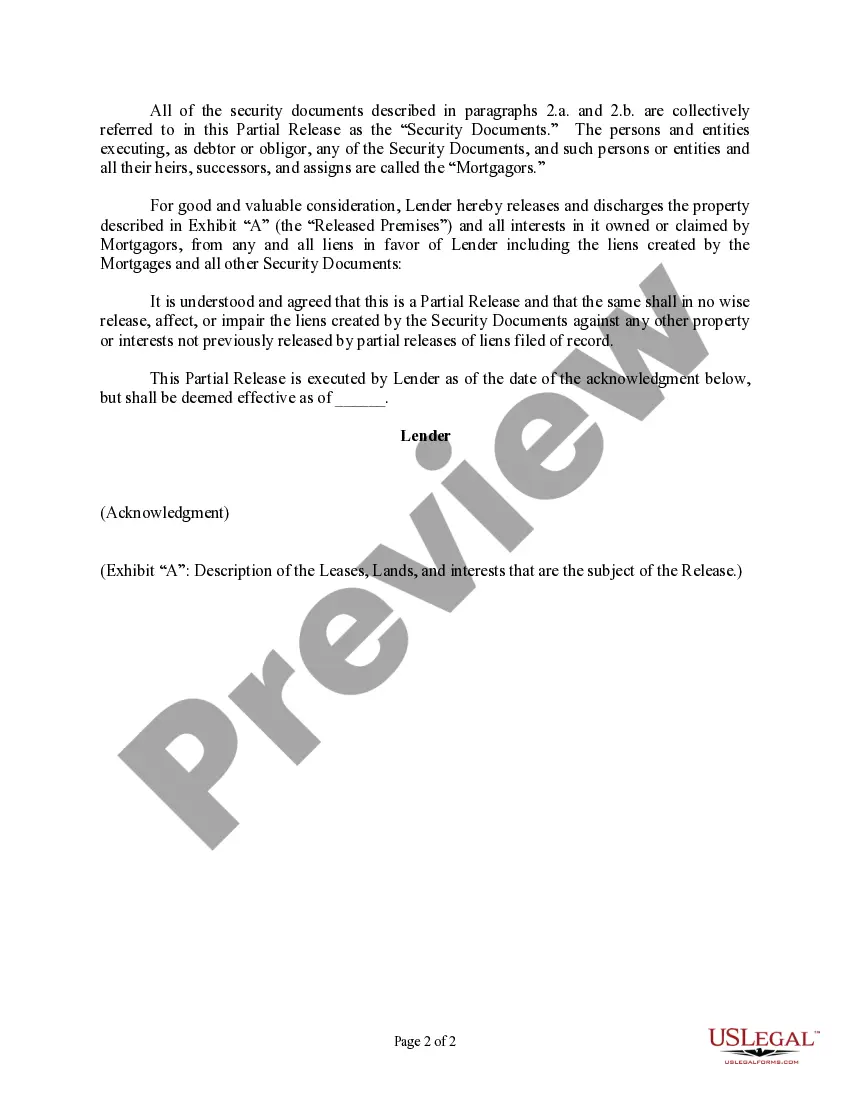

A New Hampshire Partial Release of Liens for Notes and Security Agreements refers to a legal document that grants a partial release of liens on specific assets or properties listed in a note or security agreement. This release allows the debtor to partially clear their collateral from the existing liens, enabling them to use, sell, or transfer the released assets without any encumbrances. In New Hampshire, there may be various types of Partial Release of Liens for Notes and Security Agreements, including: 1. Real Estate Partial Release: This type of release pertains to liens on specific properties or real estate assets. It allows the debtor to release a portion of the property from the lien while keeping the remaining property still encumbered. 2. Equipment Partial Release: This release type focuses on liens related to equipment or machinery. It permits the debtor to release specific equipment from the lien, while the remaining equipment remains secured. 3. Vehicle Partial Release: This release applies specifically to liens on vehicles such as cars, trucks, motorcycles, or boats. It enables the debtor to clear the lien on one or more vehicles, providing the freedom to sell or transfer them without any encumbrances. A New Hampshire Partial Release of Liens for Notes and Security Agreements typically includes the following information: 1. Names and contact details of the creditor (secured party) and the debtor (borrower) involved in the original note or security agreement. 2. Description of the assets or properties to be released from the existing liens, including details such as addresses, identification numbers, or specific equipment names. 3. The percentage or dollar amount of the lien to be released. This indicates the partial value or portion of the collateral that the debtor will regain control over. 4. The date of the original note or security agreement, along with any amendments or extensions made to it. 5. Statements affirming that the debtor has complied with all the terms and conditions outlined in the original agreement, except for the properties or assets being released. 6. Signatures of both the creditor and the debtor, along with the notarization of the document. New Hampshire Partial Release of Liens for Notes and Security Agreements is crucial for borrowers seeking to free up specific assets from liens while still securing other properties or equipment. It offers both parties legal protection and clarity regarding the released collateral, facilitating smooth transactions and asset management.

New Hampshire Partial Release of Liens for Notes and Security Agreements

Description

How to fill out New Hampshire Partial Release Of Liens For Notes And Security Agreements?

US Legal Forms - one of several biggest libraries of lawful kinds in the United States - offers a variety of lawful papers layouts you may acquire or produce. Making use of the website, you can get thousands of kinds for business and specific functions, categorized by classes, claims, or keywords.You can find the most recent versions of kinds just like the New Hampshire Partial Release of Liens for Notes and Security Agreements in seconds.

If you currently have a membership, log in and acquire New Hampshire Partial Release of Liens for Notes and Security Agreements through the US Legal Forms catalogue. The Obtain option will appear on every form you view. You get access to all formerly delivered electronically kinds within the My Forms tab of the profile.

In order to use US Legal Forms the first time, listed here are simple recommendations to obtain started:

- Be sure to have selected the correct form for the town/county. Click the Review option to check the form`s information. See the form outline to ensure that you have chosen the right form.

- In case the form does not satisfy your specifications, take advantage of the Search industry on top of the display to obtain the one which does.

- If you are pleased with the form, verify your decision by simply clicking the Buy now option. Then, pick the prices plan you want and offer your references to sign up for an profile.

- Method the transaction. Use your charge card or PayPal profile to perform the transaction.

- Find the file format and acquire the form in your device.

- Make changes. Fill out, modify and produce and indicator the delivered electronically New Hampshire Partial Release of Liens for Notes and Security Agreements.

Every single format you put into your account lacks an expiration time and is also your own property forever. So, if you would like acquire or produce another version, just visit the My Forms segment and click on about the form you require.

Gain access to the New Hampshire Partial Release of Liens for Notes and Security Agreements with US Legal Forms, one of the most comprehensive catalogue of lawful papers layouts. Use thousands of expert and status-certain layouts that fulfill your business or specific requirements and specifications.

Form popularity

FAQ

(1) By entering satisfaction of the lien upon the margin of the record thereof in the clerk's office when not otherwise prohibited by law. This satisfaction must be signed by the lienor or the lienor's agent or attorney and attested by said clerk.

Lien Releases Obtain a Release of Lien, which is a written statement that removes your property from the threat of lien. Before you make any payments, make sure you receive this waiver from all suppliers and subcontractors, and that it covers the materials used and the work performed.

Construction lien waivers are legal documents that are typically used in construction projects to release the right to file a construction lien against a property in exchange for payment or other considerations. In Florida, any party to a construction contract can waive lien rights for services, materials, and labor.

Florida Waivers Don't Have to Be Notarized The Florida statutes related to lien waivers do not require waivers to be notarized in order to be effective or enforceable. In fact, only 3 states ? Mississippi, Texas, and Wyoming ? enforce such a requirement.

A "Conditional Waiver and Release Upon Progress Payment" discharges all claimant rights through a specific date, provided the payments have actually been received and processed. An "Unconditional Waiver and Release Upon Final Payment" extinguishes all claimant rights upon receipt of the payment.

The execution of an Unconditional Waiver upon Final Payment in Florida means that the signor has waived their right to file a mechanics lien for payment in any amount and extinguishes all preexisting claimant rights.