New Hampshire Memorandum of Operating Agreement and Financing Statement

Description

How to fill out Memorandum Of Operating Agreement And Financing Statement?

Are you within a placement in which you need to have papers for either enterprise or person functions just about every day? There are plenty of legal file layouts accessible on the Internet, but discovering ones you can rely on is not straightforward. US Legal Forms provides thousands of kind layouts, much like the New Hampshire Memorandum of Operating Agreement and Financing Statement, which can be composed in order to meet state and federal requirements.

When you are currently informed about US Legal Forms internet site and also have a free account, merely log in. Afterward, it is possible to download the New Hampshire Memorandum of Operating Agreement and Financing Statement web template.

Unless you have an accounts and need to begin using US Legal Forms, follow these steps:

- Find the kind you will need and ensure it is for that right town/area.

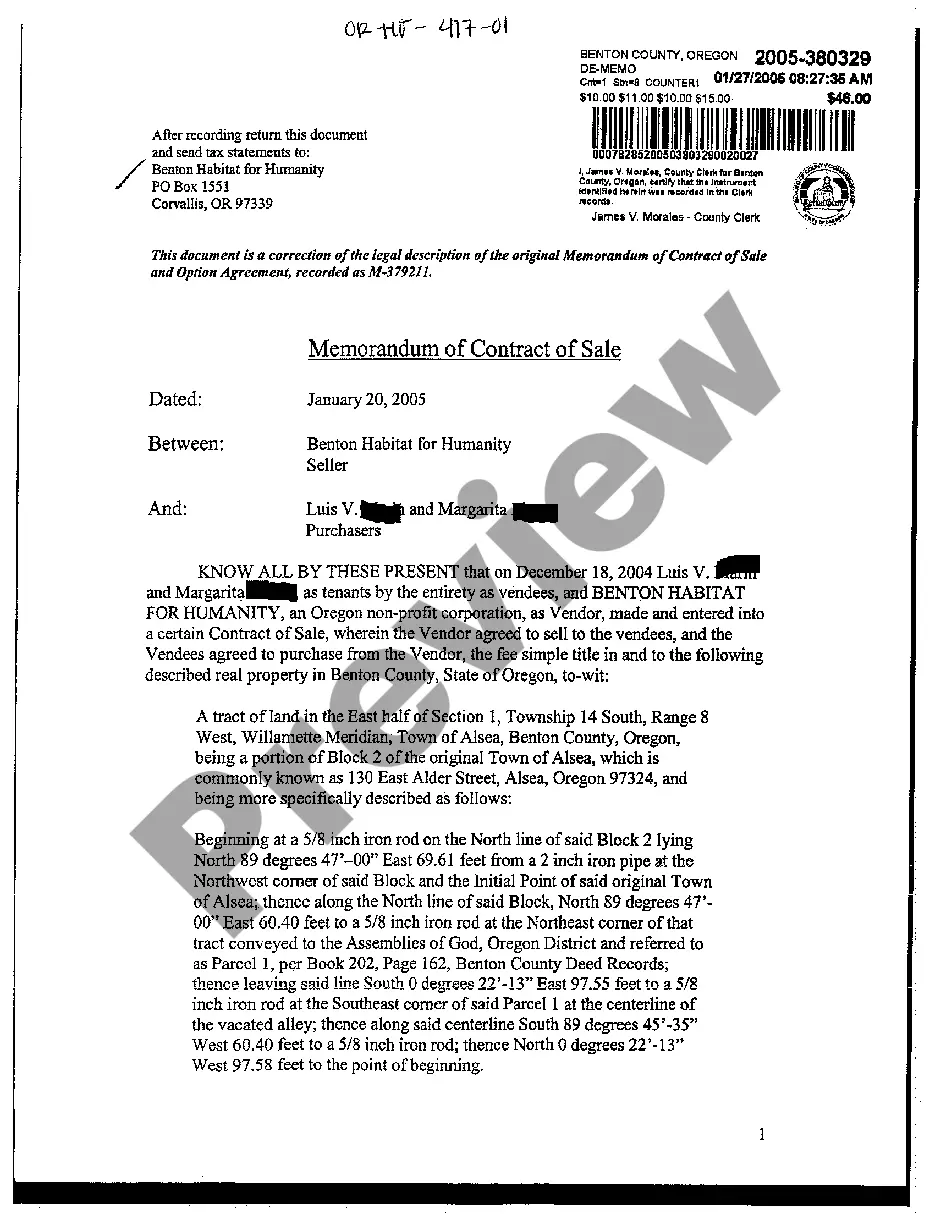

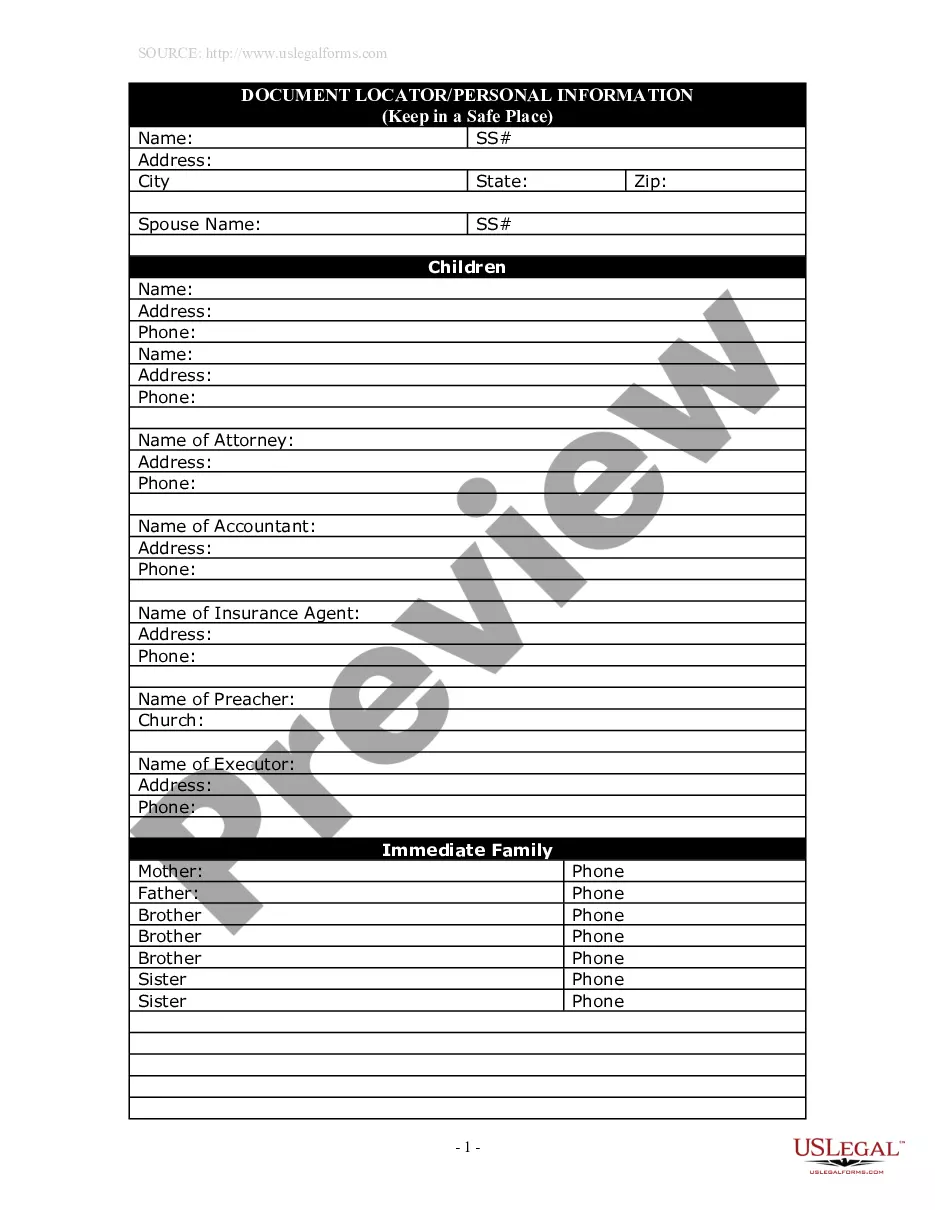

- Take advantage of the Review key to examine the shape.

- Read the information to ensure that you have selected the correct kind.

- If the kind is not what you are seeking, make use of the Lookup industry to discover the kind that fits your needs and requirements.

- Whenever you obtain the right kind, click Get now.

- Opt for the pricing prepare you would like, fill out the specified information and facts to create your bank account, and pay money for your order with your PayPal or credit card.

- Select a practical data file file format and download your copy.

Find all of the file layouts you may have bought in the My Forms food list. You can aquire a further copy of New Hampshire Memorandum of Operating Agreement and Financing Statement anytime, if necessary. Just click on the needed kind to download or print out the file web template.

Use US Legal Forms, one of the most substantial assortment of legal varieties, to conserve time as well as stay away from blunders. The assistance provides appropriately produced legal file layouts which you can use for a range of functions. Create a free account on US Legal Forms and begin making your lifestyle easier.

Form popularity

FAQ

An operating agreement is a document that outlines the way your LLC will conduct business. New Hampshire doesn't require an operating agreement, but it is an essential component of your business.

How to start an LLC in New Hampshire Name your New Hampshire LLC. Create a business plan. Get a federal employer identification number (EIN) Choose a registered agent in New Hampshire. File for your New Hampshire Certificate of Formation. Obtain business licenses and permits. Understand New Hampshire tax requirements.