New Hampshire Clauses Relating to Initial Capital contributions

Description

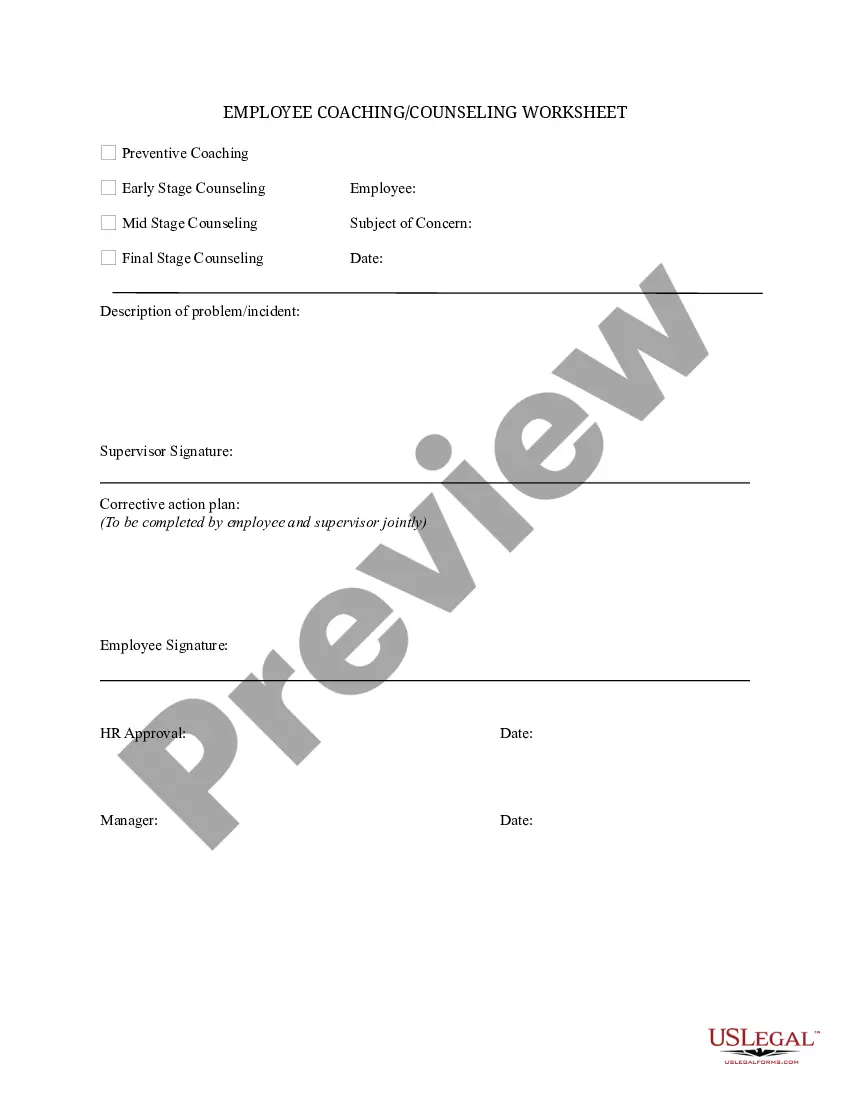

How to fill out Clauses Relating To Initial Capital Contributions?

US Legal Forms - among the biggest libraries of lawful forms in the USA - provides an array of lawful document web templates you are able to acquire or produce. Utilizing the website, you will get a huge number of forms for organization and personal uses, sorted by groups, states, or keywords.You will find the most up-to-date versions of forms just like the New Hampshire Clauses Relating to Initial Capital contributions within minutes.

If you already possess a registration, log in and acquire New Hampshire Clauses Relating to Initial Capital contributions through the US Legal Forms collection. The Obtain key will show up on every develop you view. You get access to all earlier delivered electronically forms in the My Forms tab of your own account.

In order to use US Legal Forms the very first time, listed here are easy recommendations to help you started off:

- Be sure you have chosen the best develop for your personal metropolis/area. Go through the Preview key to review the form`s content. See the develop outline to actually have chosen the correct develop.

- In the event the develop doesn`t suit your specifications, make use of the Lookup industry towards the top of the monitor to discover the one who does.

- If you are pleased with the shape, affirm your decision by visiting the Acquire now key. Then, opt for the rates plan you like and provide your accreditations to register on an account.

- Method the financial transaction. Make use of your bank card or PayPal account to finish the financial transaction.

- Find the format and acquire the shape on your product.

- Make changes. Complete, revise and produce and signal the delivered electronically New Hampshire Clauses Relating to Initial Capital contributions.

Each and every design you included with your bank account lacks an expiration day which is your own forever. So, if you want to acquire or produce one more version, just visit the My Forms segment and click on the develop you need.

Get access to the New Hampshire Clauses Relating to Initial Capital contributions with US Legal Forms, one of the most substantial collection of lawful document web templates. Use a huge number of specialist and status-specific web templates that satisfy your small business or personal needs and specifications.

Form popularity

FAQ

Strategies such as contributions to retirement accounts and health savings accounts (HSAs) may reduce your income below the zero-capital gains tax threshold. As a result, you wouldn't owe any taxes on qualified dividends.

On January 1, 2025, New Hampshire will ring in the new year as the only Northeastern state without an income tax. On that day, New Hampshire will join seven other states?Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, and Wyoming?as the only U.S. states that don't tax personal income.

All business organizations, including corporations, fiduciaries, partnerships, proprietorships, single member limited liability companies (SMLLC), and homeowners' associations which are part of a group of related business organizations operating a unitary business as defined in RSA 77-A:1, XIV engaged in business ...

All domestic business partnerships headquartered in the United States must file Form 1065 each year, including general partnerships, limited partnerships, and limited liability companies (LLCs) classified as partnerships with at least two members.

Interest from money markets, bank CDs, and bonds is taxed at ordinary tax rates. That means a person in the top tax bracket pays taxes on interest payments up to 37%. If you compare that to the maximum 23.8 % tax on qualified dividends, the "after-tax" returns are significantly better with dividends.

How to avoid taxes on CD interest. One way to postpone being taxed on CDs is to put them in a tax-deferred individual retirement account (IRA) or 401(k).

What Is The New Hampshire Capital Gains Tax? Unlike federal capital gains taxes, there is no capital gains tax in New Hampshire. In other words, there is not a state-level tax imposed on capital gains earned by individuals, businesses, or other legal entities.

It is a tax on interest and dividend income. Please note that the I&D Tax is being phased out. The I&D Tax rate is 5% for taxable periods ending before December 31, 2023. That rate is 4% for taxable periods ending on or after December 31, 2023, and 3% for taxable periods ending on or after December 31, 2024.