US Legal Forms - one of many largest libraries of authorized types in the USA - offers an array of authorized file layouts you can acquire or printing. While using site, you will get 1000s of types for enterprise and specific purposes, sorted by types, claims, or keywords and phrases.You will find the most up-to-date variations of types like the New Hampshire HAMP Loan Modification Package in seconds.

If you currently have a monthly subscription, log in and acquire New Hampshire HAMP Loan Modification Package from the US Legal Forms library. The Down load switch will appear on every develop you view. You gain access to all formerly acquired types from the My Forms tab of the accounts.

If you would like use US Legal Forms initially, listed here are basic directions to obtain started off:

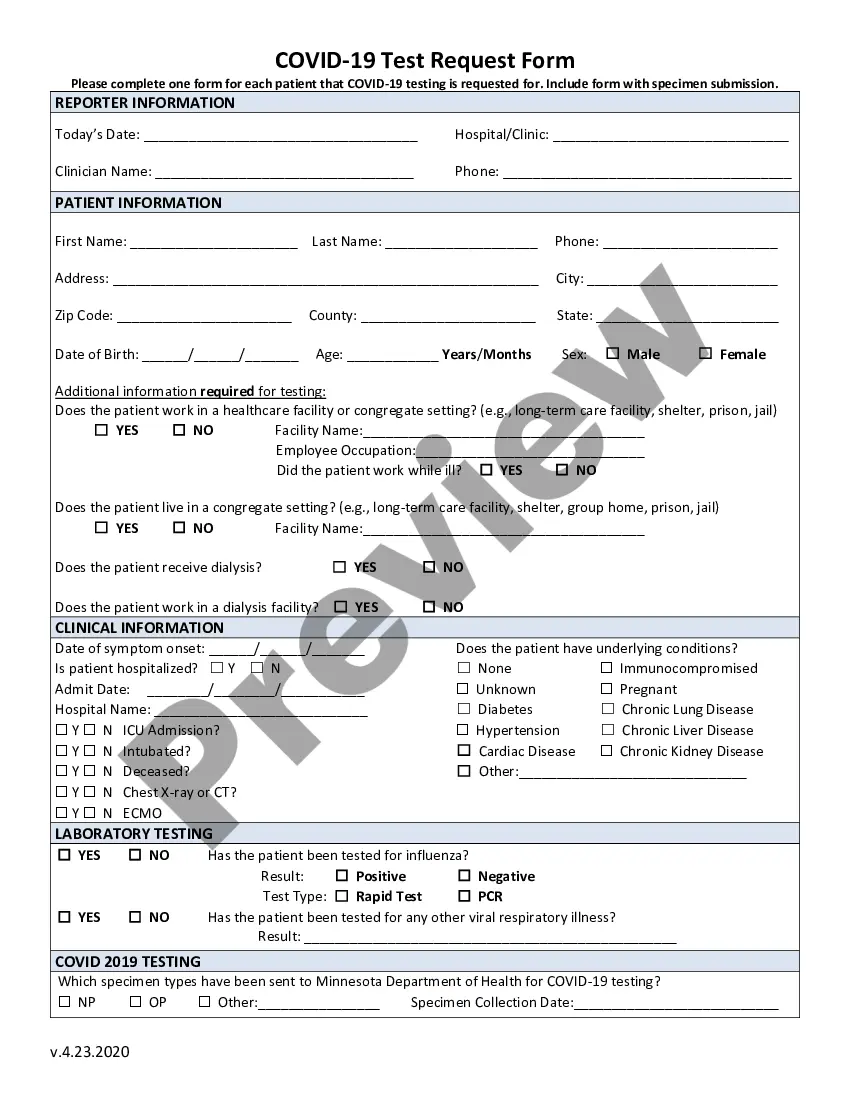

- Be sure you have picked the correct develop for your city/region. Click on the Review switch to check the form`s content material. See the develop outline to ensure that you have chosen the right develop.

- In the event the develop does not match your requirements, take advantage of the Look for field near the top of the monitor to find the one which does.

- Should you be satisfied with the form, confirm your decision by visiting the Get now switch. Then, pick the costs program you want and supply your references to register for the accounts.

- Approach the financial transaction. Use your Visa or Mastercard or PayPal accounts to finish the financial transaction.

- Select the structure and acquire the form in your gadget.

- Make modifications. Complete, modify and printing and indicator the acquired New Hampshire HAMP Loan Modification Package.

Every single design you added to your bank account does not have an expiration day and is also your own permanently. So, if you wish to acquire or printing one more backup, just proceed to the My Forms segment and click in the develop you will need.

Get access to the New Hampshire HAMP Loan Modification Package with US Legal Forms, one of the most comprehensive library of authorized file layouts. Use 1000s of expert and condition-particular layouts that satisfy your small business or specific demands and requirements.