This non-employee director option agreement grants the optionee (the non-employee director) a non-qualified stock option under the company's non-employee director stock option plan. The option allows optionee to purchase shares of the company's common stock up to the number of shares listed in the agreement.

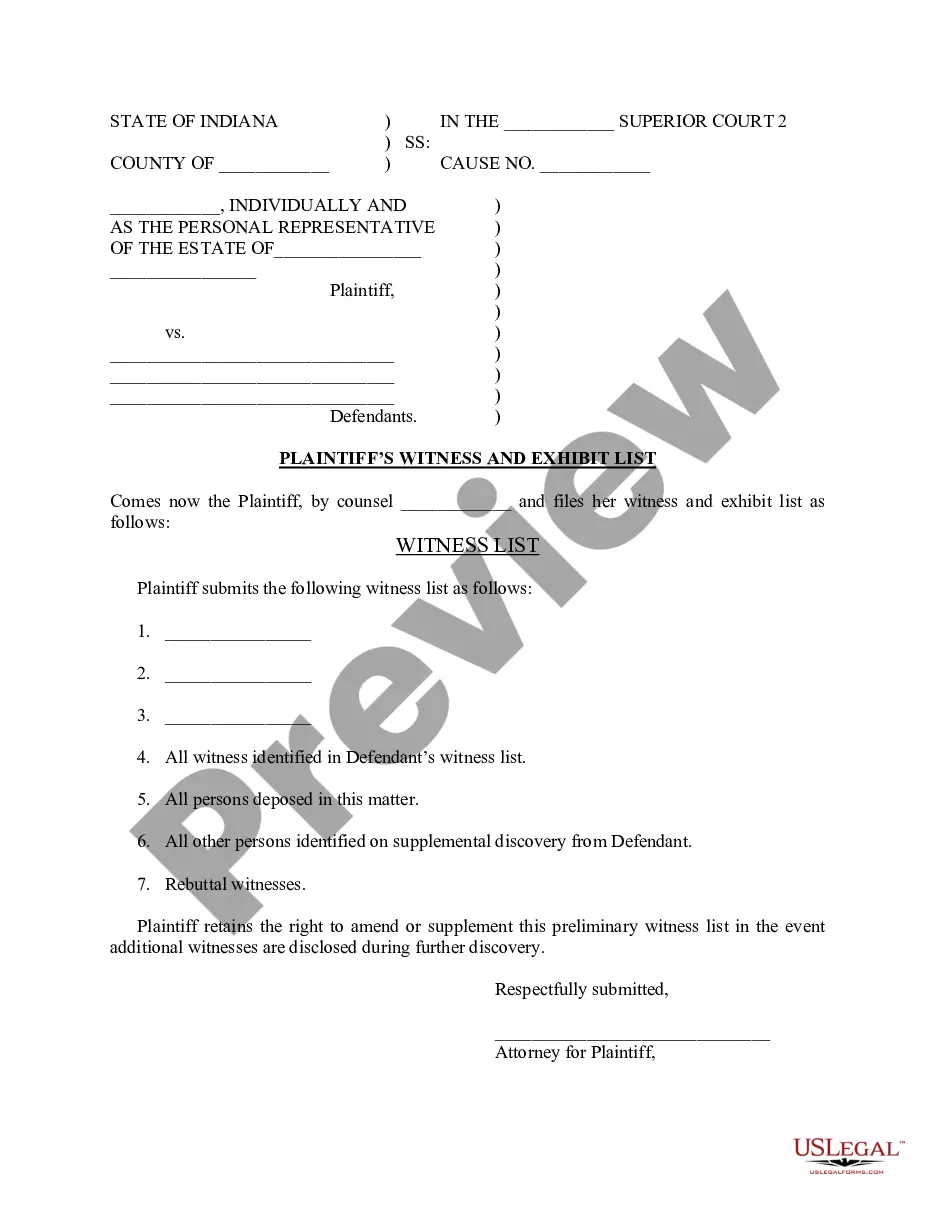

New Hampshire Non Employee Director Stock Option Agreement

Description

How to fill out Non Employee Director Stock Option Agreement?

Finding the right legal file format might be a have difficulties. Needless to say, there are plenty of templates accessible on the Internet, but how will you obtain the legal type you will need? Utilize the US Legal Forms site. The assistance offers a huge number of templates, such as the New Hampshire Non Employee Director Stock Option Agreement, which can be used for company and private demands. All the varieties are checked by specialists and meet federal and state specifications.

Should you be presently registered, log in in your bank account and then click the Download key to obtain the New Hampshire Non Employee Director Stock Option Agreement. Utilize your bank account to search with the legal varieties you may have acquired previously. Proceed to the My Forms tab of your respective bank account and get another backup in the file you will need.

Should you be a brand new customer of US Legal Forms, allow me to share easy guidelines that you can follow:

- Initially, make sure you have chosen the right type to your area/state. You can look through the shape utilizing the Preview key and look at the shape information to make sure it is the right one for you.

- In case the type is not going to meet your needs, utilize the Seach field to get the correct type.

- Once you are certain that the shape is acceptable, select the Acquire now key to obtain the type.

- Select the rates strategy you need and enter the required information. Make your bank account and pay money for the order utilizing your PayPal bank account or bank card.

- Opt for the data file formatting and download the legal file format in your product.

- Total, change and printing and indication the received New Hampshire Non Employee Director Stock Option Agreement.

US Legal Forms is the greatest library of legal varieties for which you can find different file templates. Utilize the service to download expertly-manufactured files that follow status specifications.

Form popularity

FAQ

Non-qualified stock options (NSOs) can be granted to employees at all levels of a company, as well as to board members and consultants. Also known as non-statutory stock options, profits on these are considered ordinary income and are taxed as such.

Employee Stock option plan or Employee Stock Ownership Plan (ESOP) is an employee benefit scheme that enables employees to own shares in the company. These shares are purchased by employees at price below market price, or in other words, a discounted price.

Here are nine reasons why. Better employee performance. ... Attract and recruit top talent. ... Create an ownership culture in your company. ... ESPPs are a broad-based, cross-border benefit. ... Raise capital. ... Lower expense than other equity compensation. ... Corporate tax deductions. ... Increase employee savings.

Share option plans have become a popular form of employee compensation in the corporate world. These plans provide employees and directors with the opportunity to purchase company shares at a predetermined price within a specified timeframe.

A good starting point when thinking about option allocations, is to consider the total sizeof the option pool. A typical employee stock option pool at pre-seed round is about 12-15%, diluted to 10% at series A.

An employee stock option (ESO) is a form of financial equity compensation that is offered to employees and executives by their organization. The stock options offered come in the form of regular call options and allow the employee or executive to purchase their organization's stocks at a specified price and time.