New Jersey Paving Contract for Contractor

What is this form?

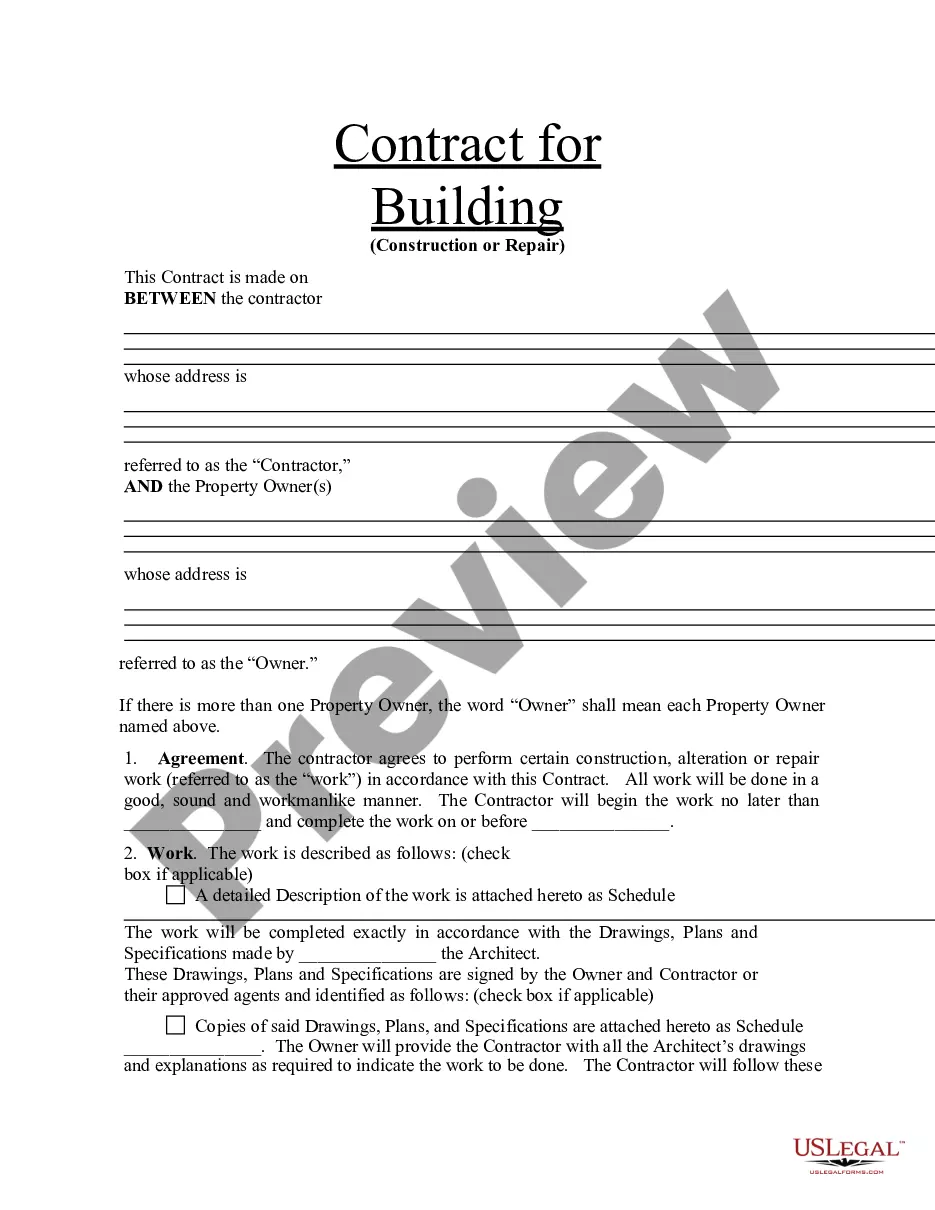

The Paving Contract for Contractor is a legal document used to outline the terms between paving contractors and property owners for pavement installation projects. This contract is essential for defining payment arrangements, work site responsibilities, and other key project elements, distinguishing it from other construction contracts by its specific focus on paving work. It ensures both parties understand their rights and obligations, especially within the jurisdiction of New Jersey.

Key components of this form

- Permits - Contractor is responsible for obtaining necessary permits, included in the project price.

- Soil Conditions - The contract limits the contractor's liability regarding soil conditions at the work site.

- Insurance - Requires the contractor to maintain liability and workers' compensation insurance.

- Change Orders - Any modifications, including increases in project scope or costs, must be documented and agreed upon in writing.

- Contract Price - The pricing structure can be fixed or cost plus, depending on the agreement.

- Warranty - Covers defects in workmanship for one year, while material warranties are assigned to the owner.

When this form is needed

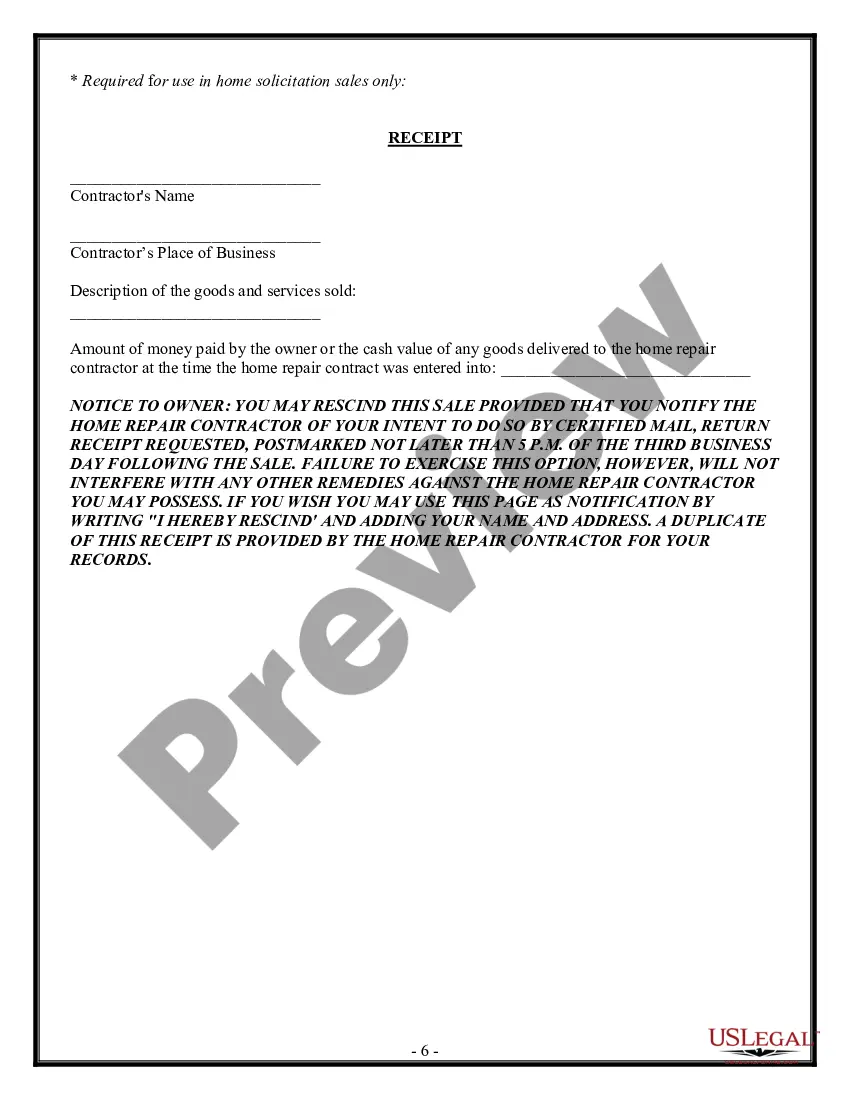

This form should be utilized when a property owner hires a paving contractor for projects such as driveways, parking lots, or road paving. It is essential any time there is a significant investment in pavement work that requires clear terms regarding the scope of work, payment, potential changes, and warranties.

Intended users of this form

- Property Owners looking to hire a paving contractor.

- Paving Contractors seeking a comprehensive agreement that aligns with New Jersey laws.

- Contractors engaging subcontractors for specific tasks related to paving projects.

Instructions for completing this form

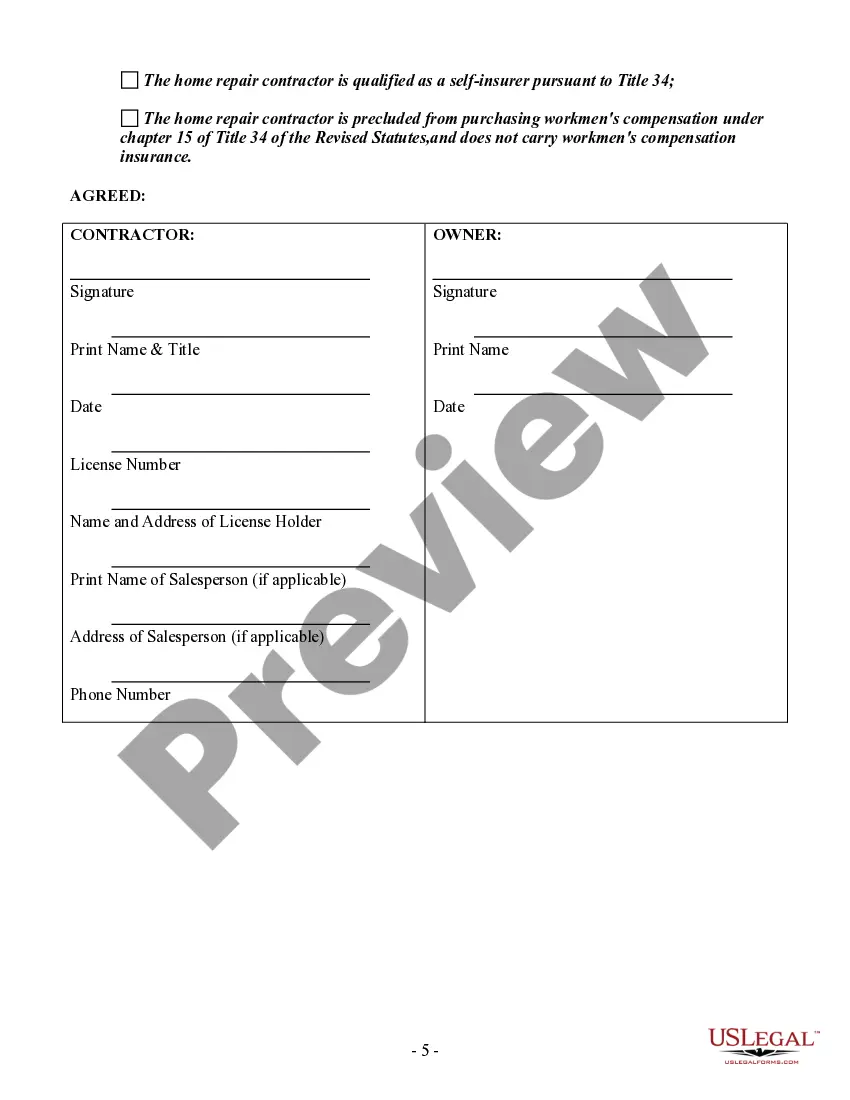

- Identify the parties involved: enter the names and contact information for both the contractor and property owner.

- Specify the project details: describe the scope of work, including materials and expected completion timeline.

- Enter payment terms: indicate whether the contract is a fixed price or a cost-plus arrangement.

- Document change order procedures: outline how modifications will be handled and who must approve them.

- Ensure signatures: both parties must sign and date the contract to make it legally binding.

Notarization guidance

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Common mistakes to avoid

- Failing to specify the scope of work clearly, leading to misunderstandings.

- Not including detailed payment terms and timelines.

- Neglecting to document any changes in writing as required by the contract.

- Overlooking the importance of signatures from both parties.

Why complete this form online

- Convenient access to legal forms that can be completed quickly.

- Editability allows customization to fit specific project needs.

- Reliability of professionally drafted documents that comply with state laws.

Summary of main points

- The Paving Contract for Contractor is essential for formalizing paving agreements.

- Clear terms regarding payment, project scope, and warranty help prevent disputes.

- This form is specifically designed to meet New Jersey legal standards.

Form popularity

FAQ

Contractors are required to pay Sales or Use Tax on the materials, supplies, equipment, and services they purchase, rent, or use when performing work on the real property of others, except as described below. It is the general rule that the sale to the actual consumer is a retail sale.

Sales Tax LawExempt items include most food sold as grocery items, most clothing and footwear, disposable paper products for household use, prescription drugs, and over-the-counter drugs.

Professional services: These are considered the least-taxed services due to powerful lobbying presences. Accountants fall into this area, as well as the work performed by attorneys and healthcare professionals, among other licensed professionals.

Form 1099 information returns with a letter of transmittal should be sent to: State of New Jersey-Division of Taxation, Revenue Processing Center, Gross Income Tax, PO Box 248, Trenton, NJ 08646-0248.

In New Jersey are authorized to alter, paint, remodel, repair, restore, renovate, move, modernize, or demolish any part of residential properties. This work includes patios, kitchens, cabinets, porches, doors, fences, bathrooms, garages, basements, and floor coverings.

You're not required to file Forms 1099-NEC and 1099-MISC with your state.

To do home construction and many types of substantial home repairs in New Jersey, an individual must be a licensed contractor. Obtaining an NJ contractor license requires the contractor to register with the New Jersey Division of Consumer Affairs, a process that involves multiple smaller steps.

In most states, construction contractors must pay sales tax when they purchase materials used in construction.In some cases, this can be an advantage because any markup you charge to your customer on the materials, supplies and labor, won't be subject to sales tax.

When you buy items or services in New Jersey, you generally pay Sales Tax on each purchase. The seller (a store, service provider, restaurant, etc.) collects tax at the time of the sale and sends it to the State. The law exempts some sales and services from Sales Tax.