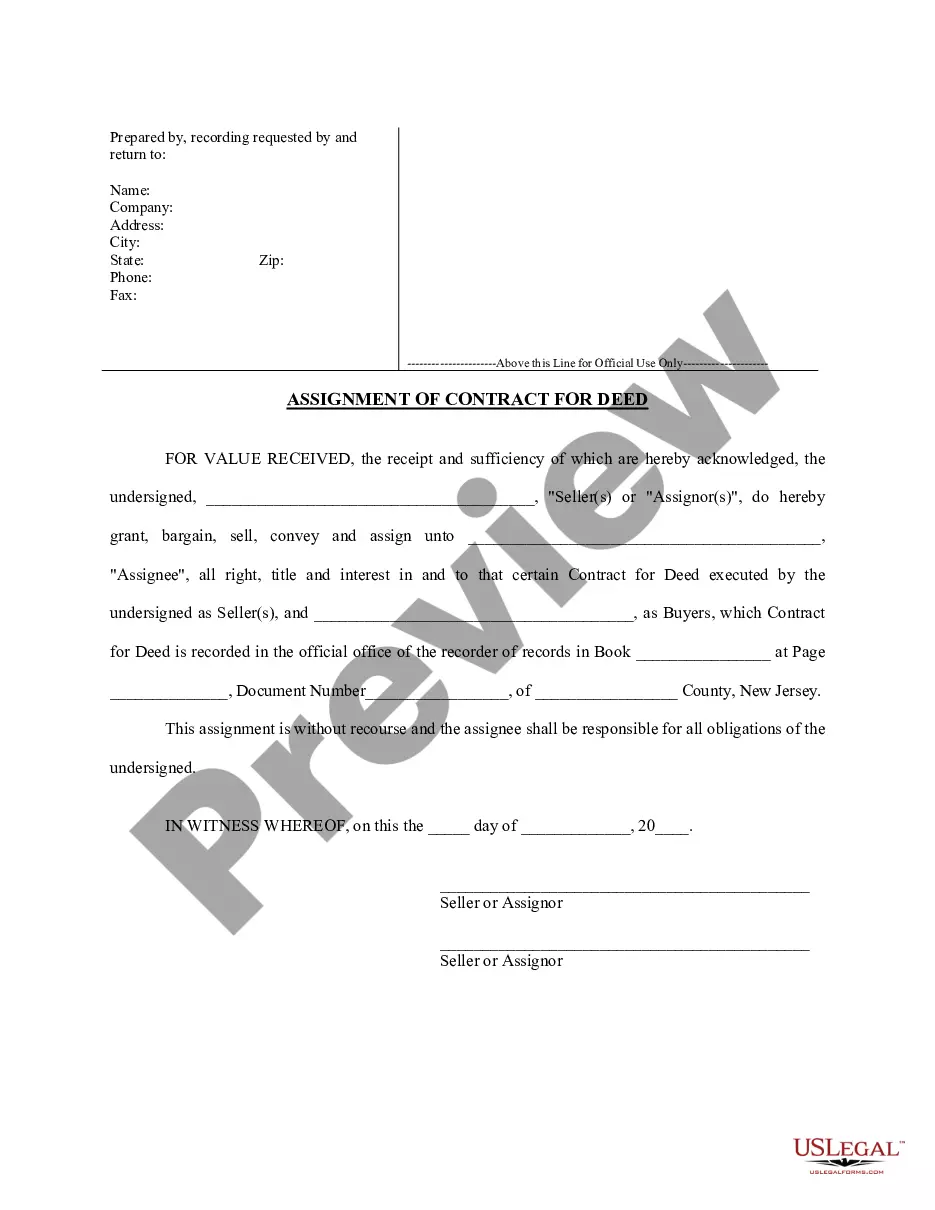

New Jersey Assignment of Contract for Deed by Seller

Description Assignment Contract Deed

How to fill out New Jersey Assignment Of Contract For Deed By Seller?

US Legal Forms is actually a special platform to find any legal or tax document for completing, including New Jersey Assignment of Contract for Deed by Seller. If you’re tired of wasting time seeking suitable samples and spending money on papers preparation/legal professional service fees, then US Legal Forms is precisely what you’re looking for.

To reap all the service’s advantages, you don't have to download any application but simply choose a subscription plan and create an account. If you already have one, just log in and look for the right template, save it, and fill it out. Downloaded files are all saved in the My Forms folder.

If you don't have a subscription but need New Jersey Assignment of Contract for Deed by Seller, have a look at the guidelines listed below:

- Double-check that the form you’re looking at applies in the state you need it in.

- Preview the sample and read its description.

- Click on Buy Now button to access the register webpage.

- Pick a pricing plan and proceed registering by providing some information.

- Select a payment method to complete the registration.

- Download the document by selecting your preferred file format (.docx or .pdf)

Now, complete the file online or print it. If you feel uncertain regarding your New Jersey Assignment of Contract for Deed by Seller sample, contact a attorney to check it before you decide to send or file it. Start hassle-free!

Form popularity

FAQ

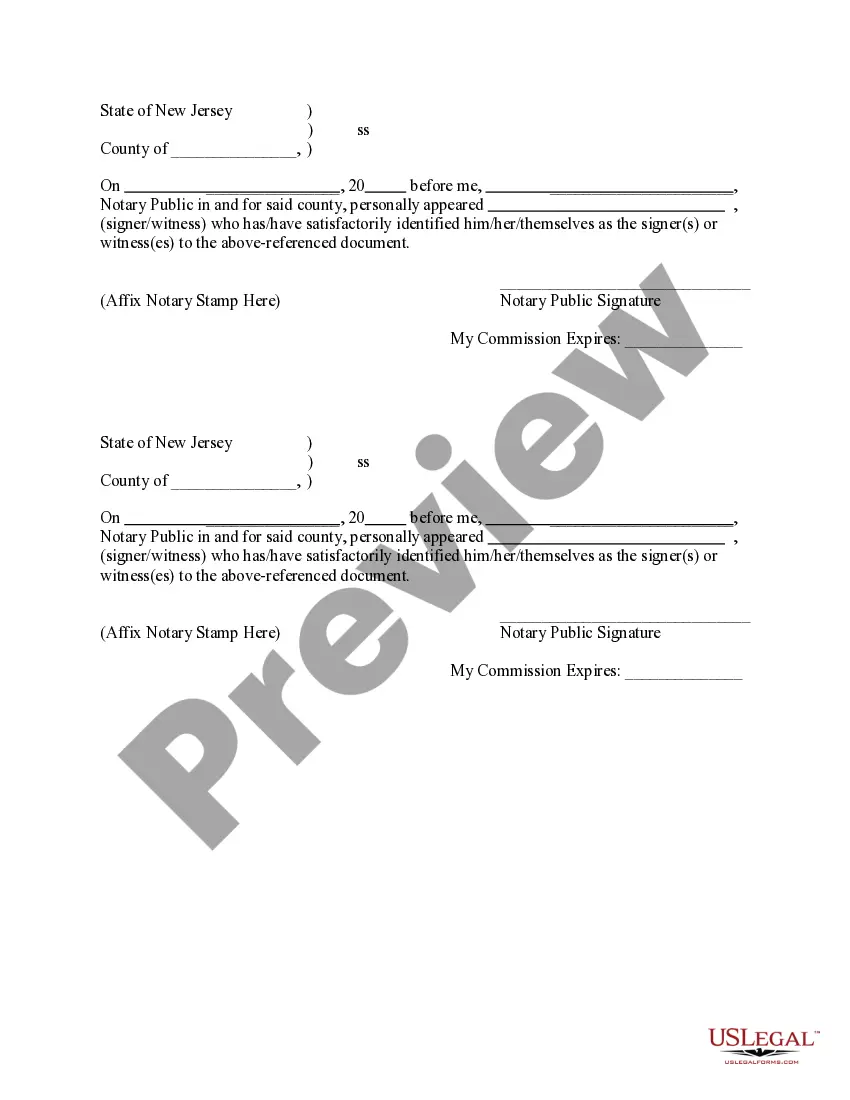

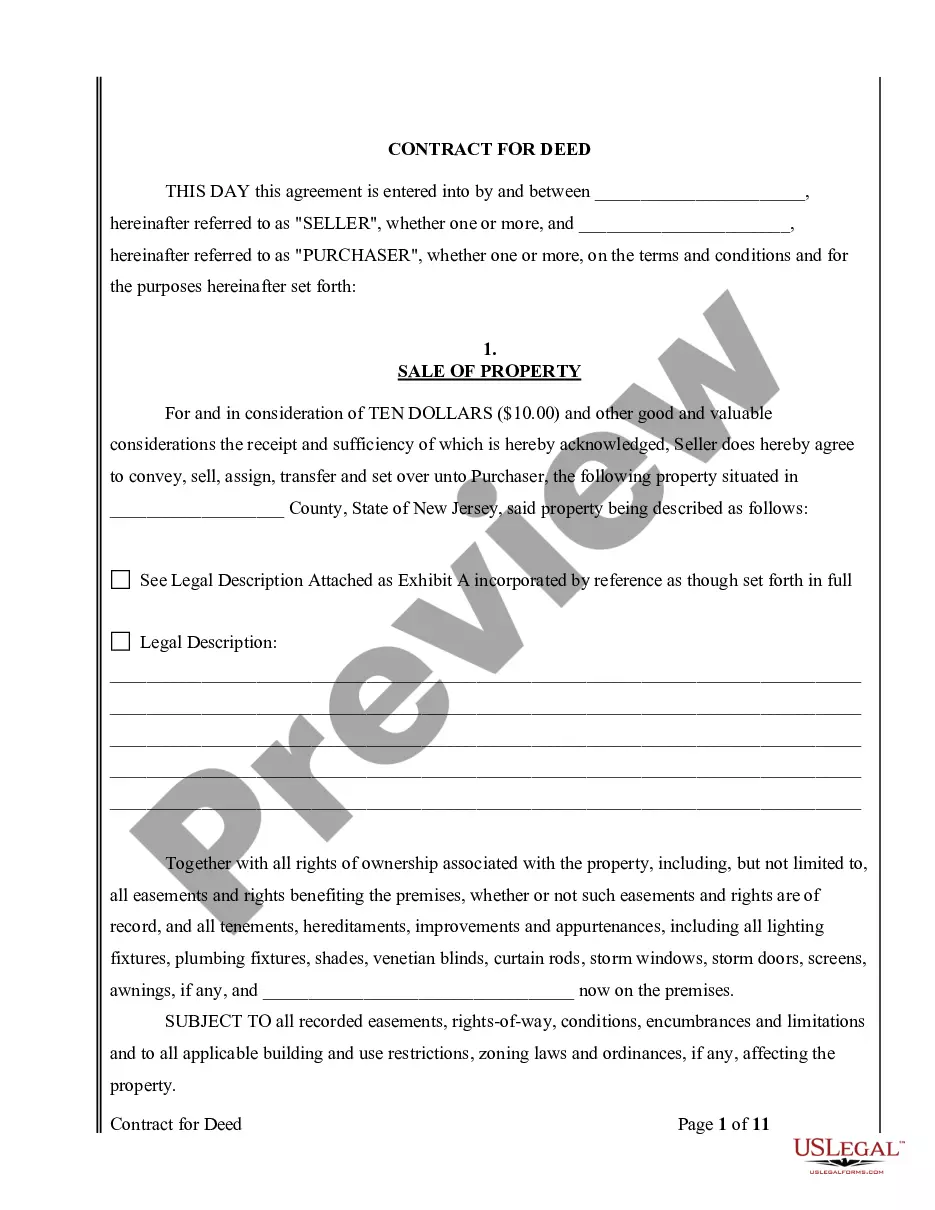

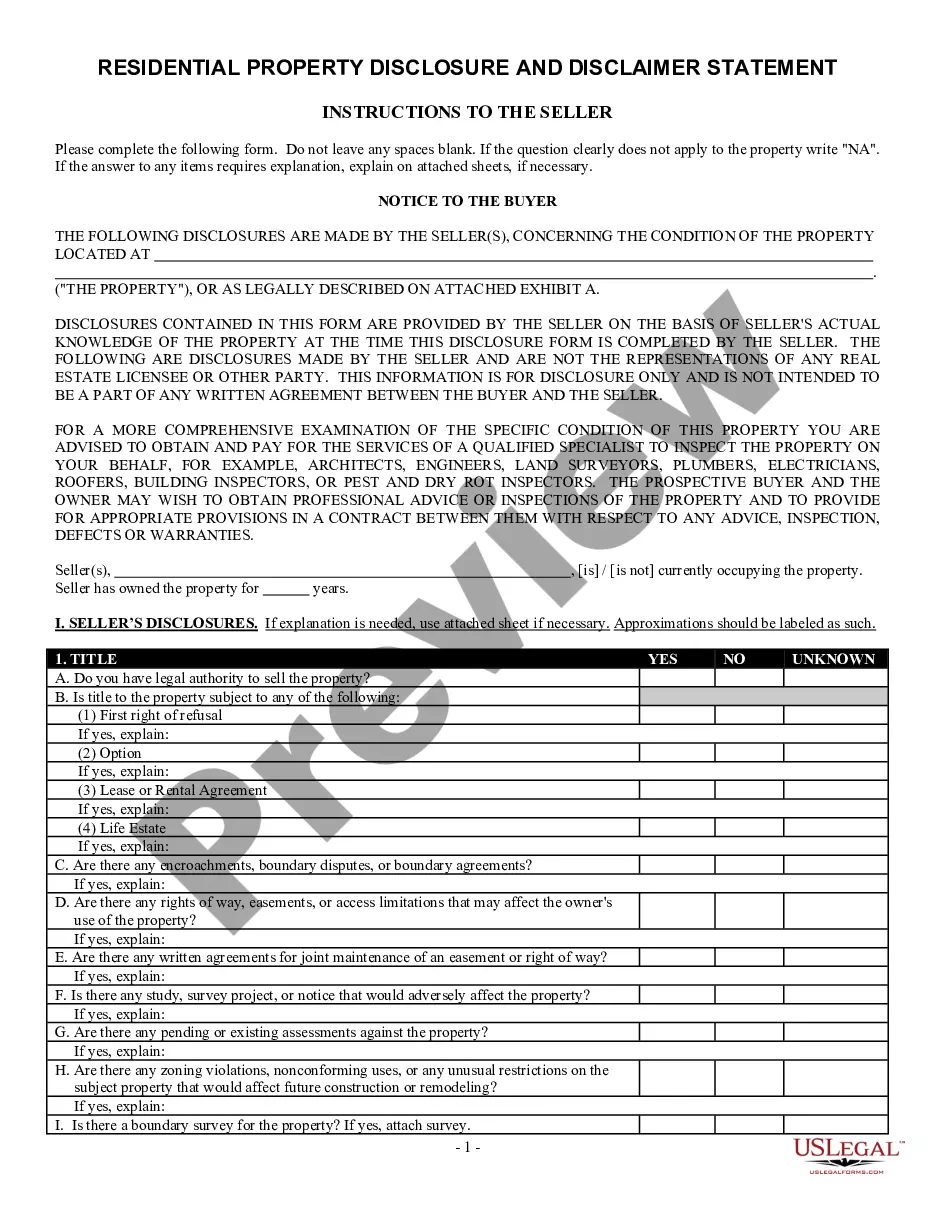

In New Jersey, the deed must be in English, identify the seller/buyer (grantor/grantee), name the person that prepared the deed, state the consideration (amount paid) for the transfer, contain a legal description of the property (a survey), include the signature of the grantor and be signed before a notary.

Find a motivated seller. First, let's understand what a motivated seller is. Get the contract. Submit contract to title. Assign the contract to the buyer. Get paid!

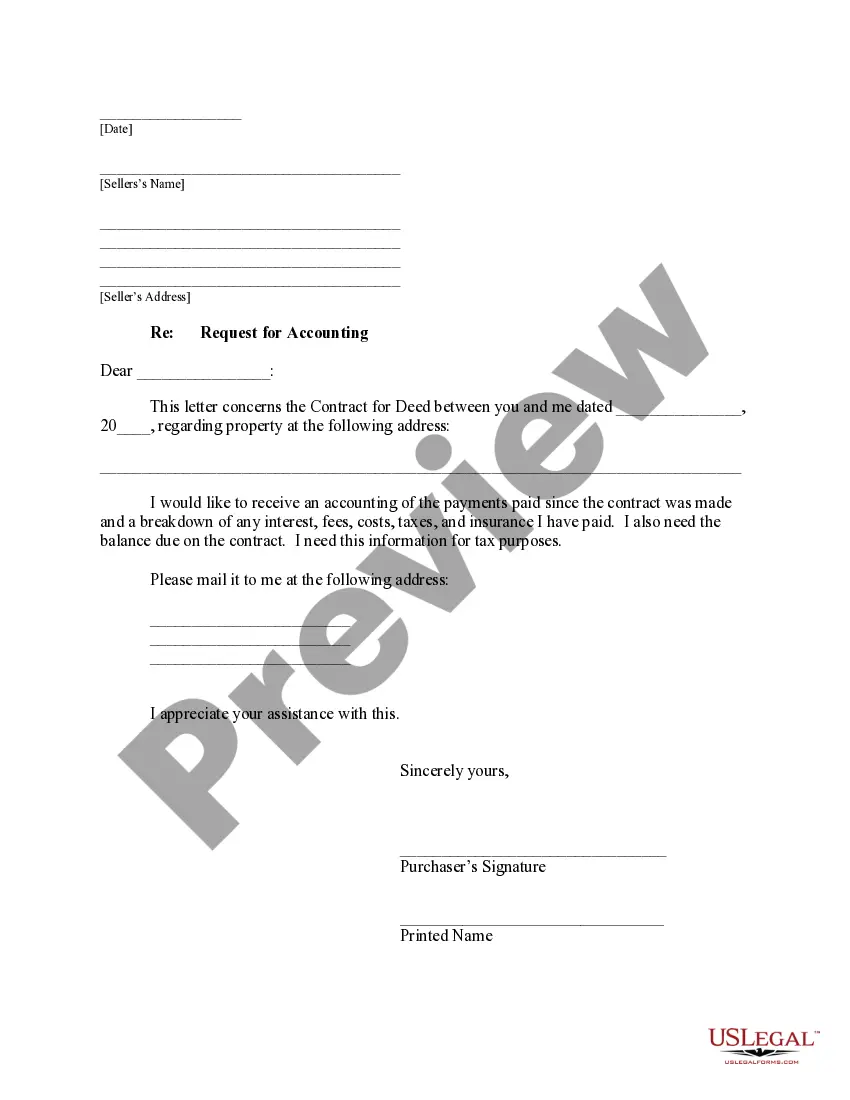

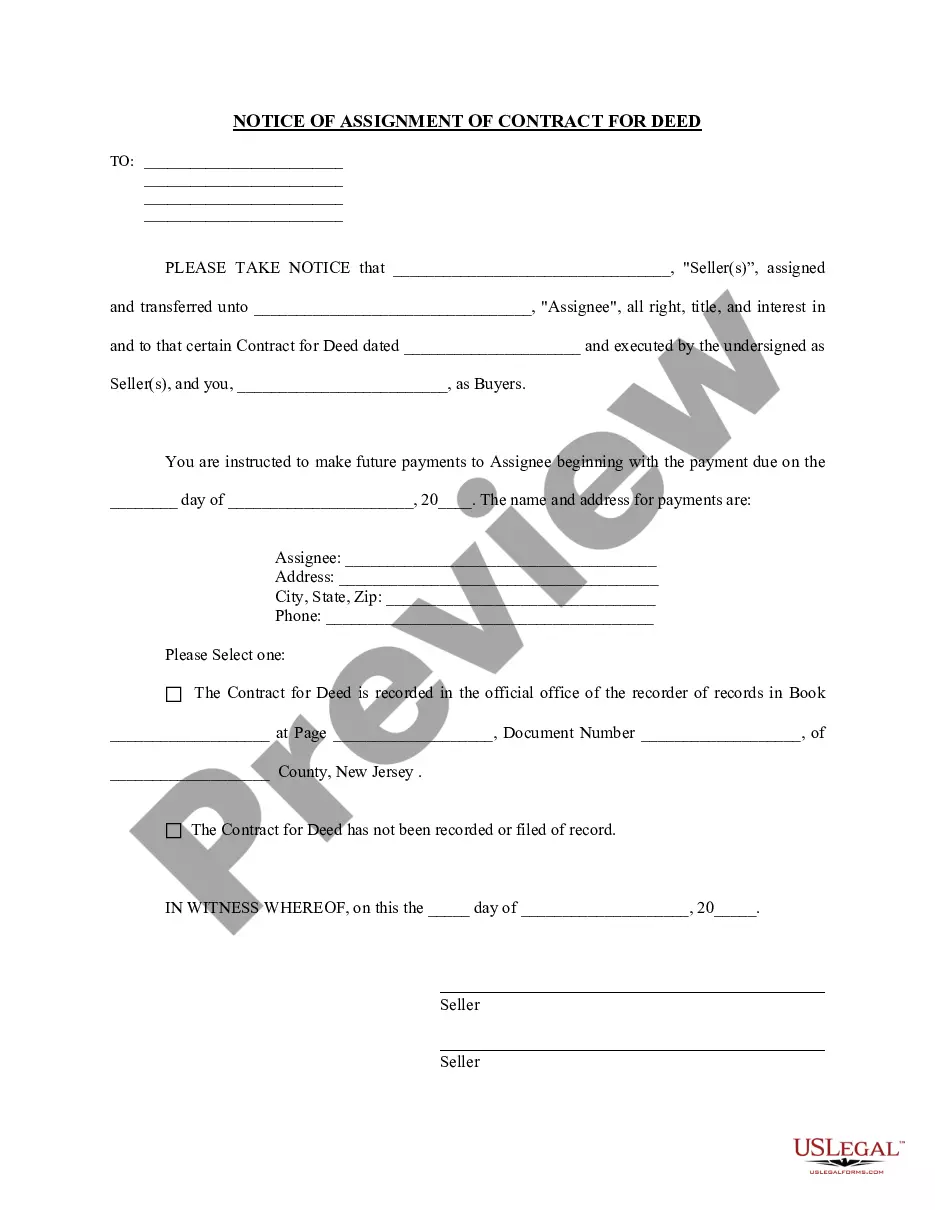

An assignment of contract occurs when one party to an existing contract (the "assignor") hands off the contract's obligations and benefits to another party (the "assignee"). Ideally, the assignor wants the assignee to step into his shoes and assume all of his contractual obligations and rights.

In order to transfer a property into one person's name, you will need to complete a 'Transfer of Whole of Registered Title' form and send it to HM Land Registry, along with the correct fee and identity verification forms. In some cases, there may also be Stamp Duty Land Tax to pay.

Realty Transfer Fee: Sellers pay a 1% Realty Transfer Fee on all home sales. The buyer is not responsible for this fee. However, buyers may pay an additional 1% fee on all home sales of $1 million or more.

Discuss property ownership interests. Access a copy of your title deed. Complete, review and sign the quitclaim or warranty form. Submit the quitclaim or warranty form. Request a certified copy of your quitclaim or warranty deed.

Retrieve your original deed. Get the appropriate deed form. Draft the deed. Sign the deed before a notary. Record the deed with the county recorder. Obtain the new original deed.

Find the right property. Acquire a real estate contract template. Submit the contract. Assign the contract. Collect the fee.

The State of New Jersey imposes a Realty Transfer Fee (RTF) on the seller whenever there is a transfer of title by deed. The fee is based on the sales price of the property, and the seller is required to pay the fee at the time of closing.