Solar panels are becoming an important addition to roofs around the world. While solar shingles may represent the cutting edge use of solar cells. Photovoltaics (PV) is the field of technology and research related to the application of solar cells for energy by converting sun energy (sunlight or sun ultra violet radiation) directly into electricity. Solar panel modules can be installed or integrated on to your roof or on the ground. When the sunlight comes in contact with the solar panels, it is converted into power. The power goes through a solar inverter, which converts it into alternating current and passes it on to your home through a service panel. If you produce more energy than you need, the excess can be run back through your meter into your electric company's grid.

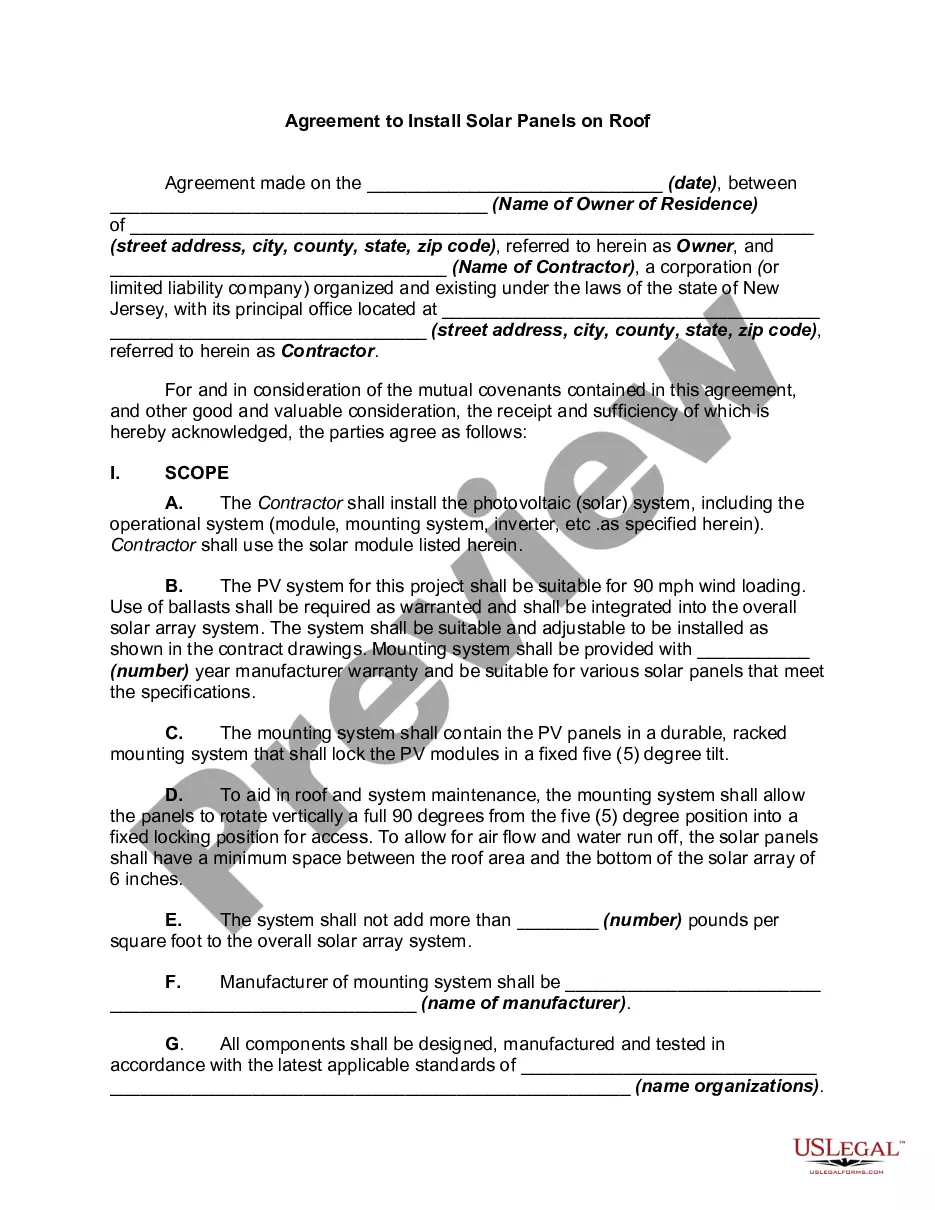

New Jersey Agreement to Install Solar Panels on Roof - Self-Employed

Description

How to fill out New Jersey Agreement To Install Solar Panels On Roof - Self-Employed?

- Log in to your existing US Legal Forms account and ensure your subscription is active. Click on the Download button to retrieve your document if you have used the service before.

- For new users, begin by reviewing the Preview mode and form description. Verify that you have selected the correct agreement that aligns with your requirements and local jurisdiction.

- If you don’t find the right template, utilize the Search tab to locate other options that may be more suitable.

- Once you find the correct document, click on the Buy Now button. Choose a subscription plan that best meets your needs before proceeding.

- Complete your purchase using credit card details or a PayPal account to finalize your subscription and gain access.

- Download the form to your device, allowing easy access anytime from the My documents section of your profile.

US Legal Forms not only offers a robust collection of legal templates but also provides unmatched user support, including access to legal experts for precise document assistance.

Streamline your solar panel installation process today! Visit US Legal Forms to get started.

Form popularity

FAQ

A solar PV system must be installed before December 31, 2019, to claim a 30% credit. It will decrease to 26% for systems installed in 2020 and to 22% for systems installed in 2021. And the tax credit expires starting in 2022 unless Congress renews it. There is no maximum amount that can be claimed.

As of April 2021, the average solar panel cost in New Jersey is $2.80/W. Given a solar panel system size of 5 kilowatts (kW), an average solar installation in New Jersey ranges in cost from $11,900 to $16,100, with the average gross price for solar in New Jersey coming in at $14,000.

In New Jersey, homes with solar panels can sell for 9.9% more than homes without solar-energy systems. That is a profit of $32,281 for the median-valued home in that state. Here's the top 10 states with the highest solar premiums, according to Zillow's findings: New Jersey: 9.9% or $32,281 for the median-valued home.

Here's the deal: There is no such thing as a free lunch (or a free solar panel installation). Free solar panels' are not actually free; you will pay for the electricity that they produce, usually under a 20 to 25 year solar lease or power purchase agreement (PPA).

Federal Solar Investment Tax Credit (ITC) Buy and install new solar panels in New Jersey in 2021, with or without battery storage, and qualify for the 26% federal solar tax credit. The residential ITC drops to 22% in 2023 and ends in 2024.

Going solar is now FREE for homeowners in NJ.

Filing requirements for the solar tax credit To claim the credit, you must file IRS Form 5695 as part of your tax return. You'll calculate the credit on Part I of the form, and then enter the result on your 1040.

The investment tax credit (ITC), also known as the federal solar tax credit, allows you to deduct 26 percent of the cost of installing a solar energy system from your federal taxes. The ITC applies to both residential and commercial systems, and there is no cap on its value.