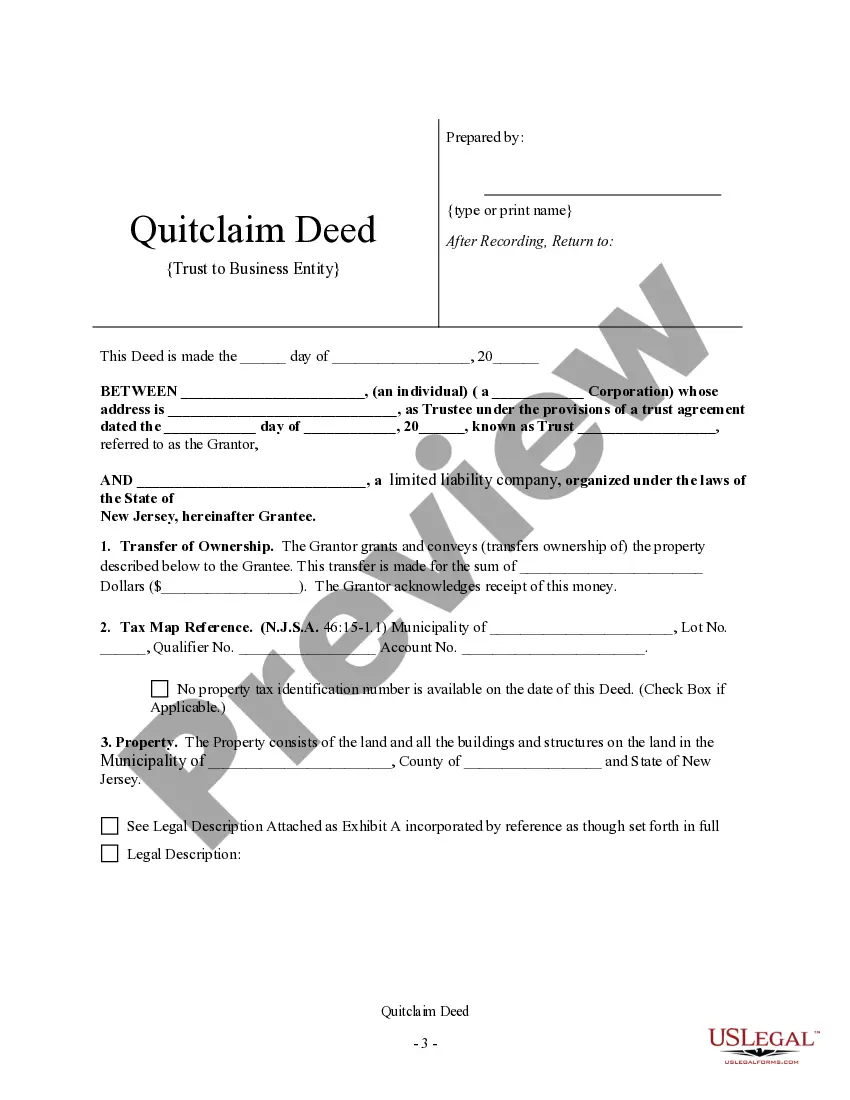

This form is a Quitclaim Deed where the Grantor is a Trust and the Grantee is a Business Entity - a limited liability company or a corporation. Grantor conveys and quitclaims any interest Grantor might have in the described property to Grantee. This deed complies with all state statutory laws.

New Jersey Quitclaim Deed - Trust to Business Entity

Description

Key Concepts & Definitions

Quitclaim Deed: A legal instrument used to transfer interest in real property. The grantor (transferrer) terminates any right and claim to the property, granting it to the grantee (receiver), without warranties.

Trust: An arrangement where a trustee holds property as its nominal owner for the good of one or more beneficiaries.

Business Entity: An entity that is formed and administered as per commercial law in order to engage in business activities, usually for profit.

Step-by-Step Guide to Transferring Property via Quitclaim Deed from Trust to Business Entity

- Review the Trust Agreement: Ensure the trustee has the authority to transfer property without violating the terms of the trust.

- Select a Notary Public: Identify a notary public to witness the deed signing.

- Prepare the Quitclaim Deed Form: Include the legal description of the property, trust details, and business entity's information.

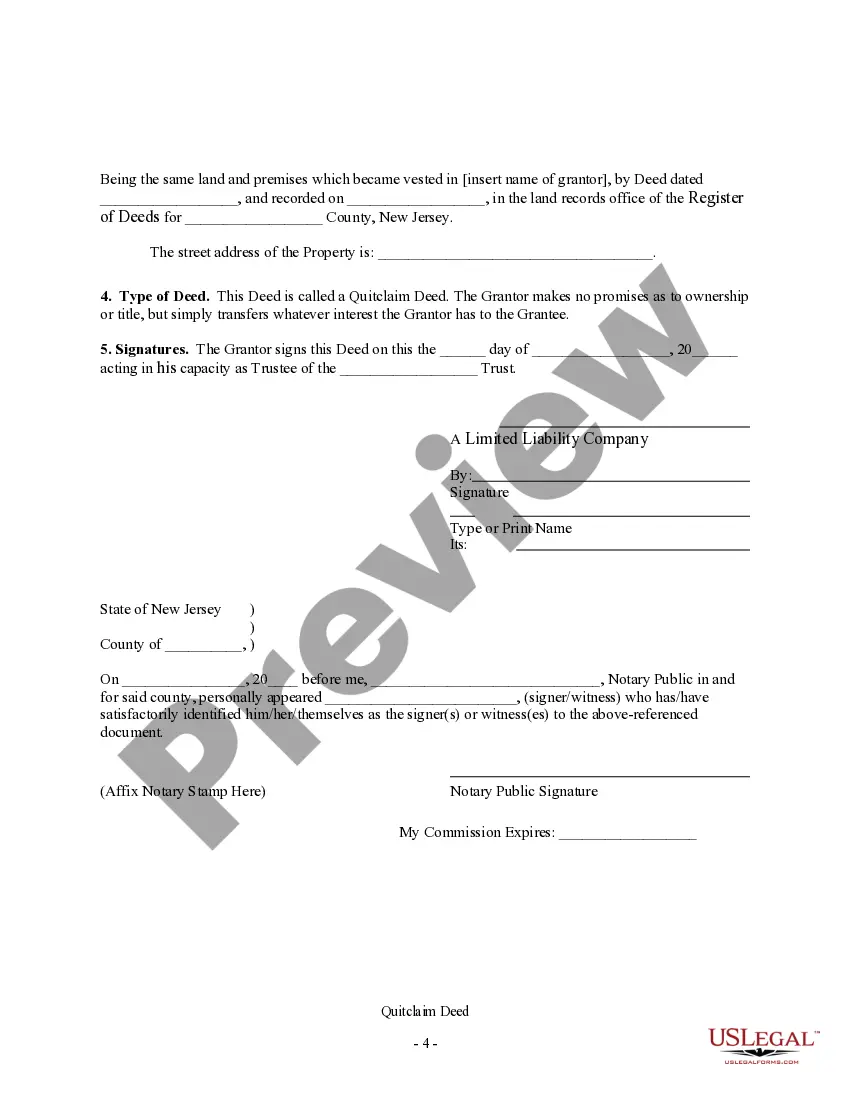

- Sign the Deed: Both the trustee and a representative of the business entity must sign the deed in the presence of the notary public.

- Record the Deed: File the signed deed with the appropriate county office to make the transfer official.

Risk Analysis

- Lack of Warranty: Quitclaim deeds do not guarantee clear title, potentially leading to legal disputes over property ownership.

- Violation of Trust Terms: Transferring property without proper authorization from the trust can result in legal actions against the trustee.

- Impacts on Mortgages and Leases: Existing mortgages or commercial leases may have clauses that are triggered by ownership changes, potentially leading to financial liabilities.

- Due Diligence: Inadequate investigation into the property or the business entity might result in unforeseen encumbrances or liabilities.

Best Practices

- Legal Consultation: Always consult with a real estate attorney to review documents and ensure compliance with real estate law.

- Accurate Property Description: Confirm the legal description of the property on the deed matches public records to avoid disputes.

- Transparency with Beneficiaries: Keep trust beneficiaries informed to preempt any objections or conflicts.

- Regular Review of Trust Documents: Regular audits and reviews of trust documents to avoid inconsistencies or oversight.

How to fill out New Jersey Quitclaim Deed - Trust To Business Entity?

US Legal Forms is really a special system where you can find any legal or tax document for submitting, including New Jersey Quitclaim Deed - Trust to Business Entity. If you’re tired of wasting time looking for perfect examples and paying money on document preparation/lawyer service fees, then US Legal Forms is precisely what you’re searching for.

To enjoy all the service’s benefits, you don't need to download any software but just select a subscription plan and register your account. If you already have one, just log in and get a suitable template, download it, and fill it out. Downloaded documents are stored in the My Forms folder.

If you don't have a subscription but need to have New Jersey Quitclaim Deed - Trust to Business Entity, take a look at the recommendations below:

- Double-check that the form you’re looking at applies in the state you want it in.

- Preview the form its description.

- Click Buy Now to reach the register webpage.

- Pick a pricing plan and continue registering by providing some information.

- Choose a payment method to finish the registration.

- Save the document by selecting your preferred file format (.docx or .pdf)

Now, fill out the document online or print it. If you are unsure about your New Jersey Quitclaim Deed - Trust to Business Entity template, contact a legal professional to review it before you decide to send out or file it. Begin without hassles!

Form popularity

FAQ

Signing - According to New Jersey law, the quit claim deed must be signed by the seller of the property in the presence of a Notary Public. Recording - All quit claim deeds that have been notarized should be filed with the County Clerk's Office within the jurisdiction that the property falls under.

However, there are substantial downsides associated with transferring your primary home into an LLC.If you are using your personal residence for estate planning purposes, a qualified personal residence trust (QPRT) may be more effective than transferring your property to a limited liability company.

A quitclaim deed is a legal instrument that is used to transfer interest in real property.The owner/grantor terminates (quits) any right and claim to the property, thereby allowing the right or claim to transfer to the recipient/grantee.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners get divorced and one spouse's name is removed from the title or deed.

How to Quitclaim Deed to LLC. A quitclaim deed to LLC is actually a very simple process. You will need a deed form and a copy of the existing deed to make sure you identify titles properly and get the legal description of the property.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

Yes, a quit claim deed supercedes the trust. The only thing that can be done is to file a suit in court challenging the deed as the product of fraud and undue influence. A court action like that will cost thousands of dollars, but might be worth it if the house was owned free and clear.

A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.