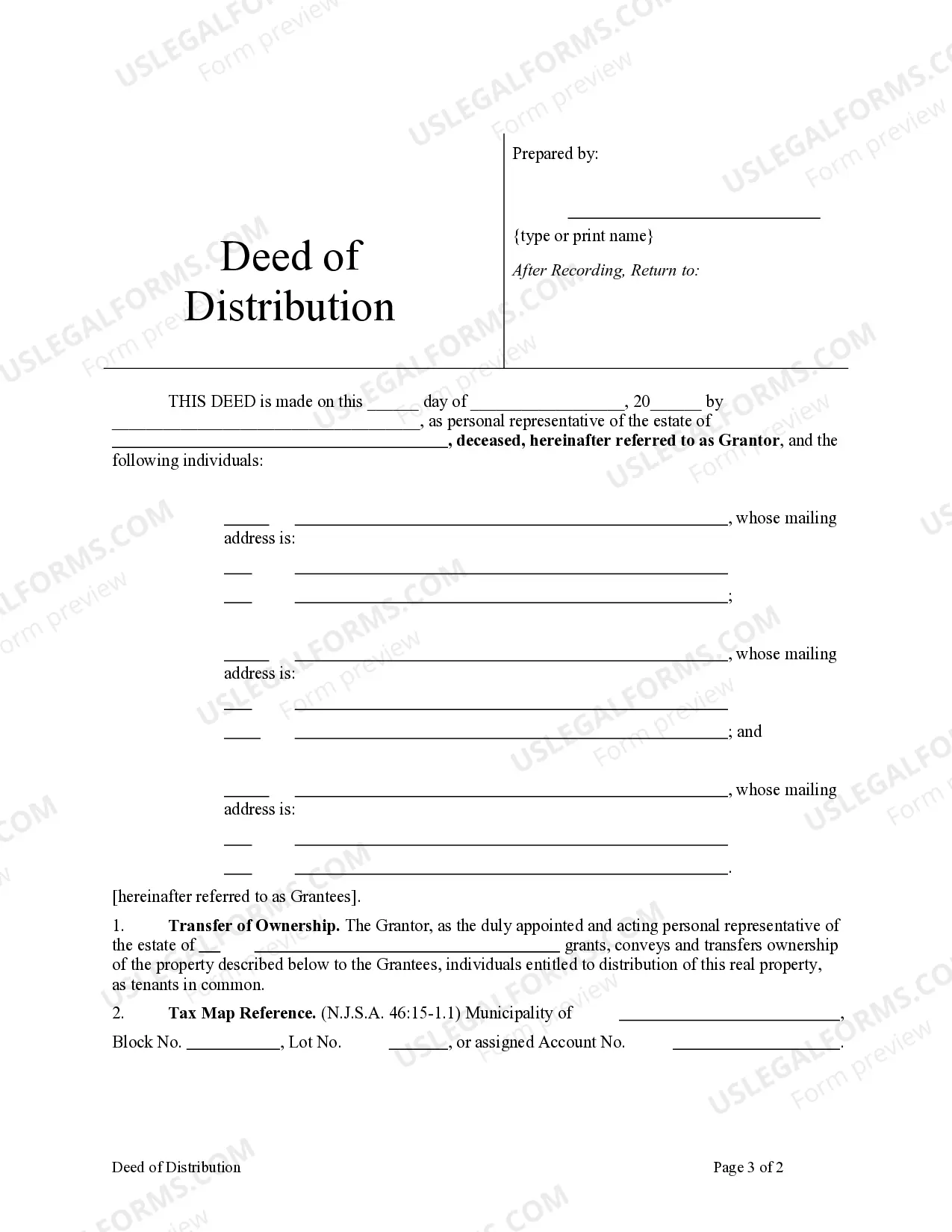

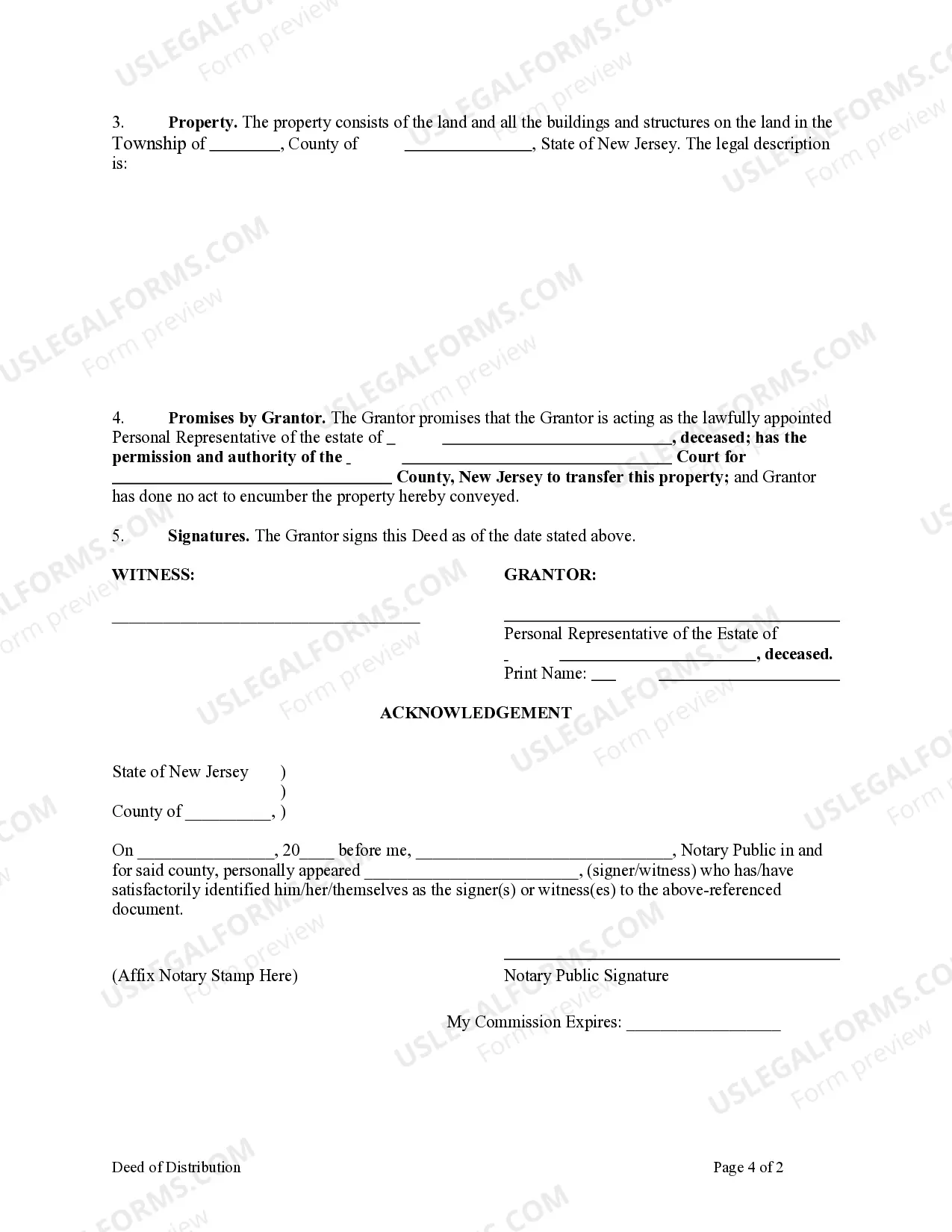

This form is a Deed of Distribution where the Grantor is the personal respresentative of an estate and the Grantees are beneficiaries of the estate. Grantor conveys and transfers the described property to the Grantees. The Grantor warrants only that Grantor was properly and lawfully appointed personal representative of the estate of the deceased; that Grantor is acting with the authority and permission of the court; and that the Grantor has done nothing to burden the title to the property. This deed complies with all state statutory laws.

New Jersey Deed of Distribution to Three Individuals

Description

How to fill out New Jersey Deed Of Distribution To Three Individuals?

US Legal Forms is actually a special platform to find any legal or tax form for submitting, such as New Jersey Deed of Distribution to Three Individuals. If you’re fed up with wasting time searching for suitable samples and spending money on papers preparation/legal professional service fees, then US Legal Forms is precisely what you’re searching for.

To experience all the service’s advantages, you don't need to install any software but just choose a subscription plan and sign up an account. If you already have one, just log in and look for an appropriate sample, download it, and fill it out. Downloaded files are all stored in the My Forms folder.

If you don't have a subscription but need to have New Jersey Deed of Distribution to Three Individuals, take a look at the guidelines below:

- Double-check that the form you’re considering is valid in the state you want it in.

- Preview the sample its description.

- Click on Buy Now button to access the sign up page.

- Choose a pricing plan and keep on signing up by providing some info.

- Pick a payment method to complete the registration.

- Download the file by selecting the preferred format (.docx or .pdf)

Now, complete the file online or print out it. If you are unsure about your New Jersey Deed of Distribution to Three Individuals form, contact a lawyer to examine it before you send or file it. Get started hassle-free!

Form popularity

FAQ

Be in English or include an English translation (N.J.S.A. Identify the grantor / grantee (N.J.S.A. Be signed by the grantor with the name printed underneath (N.J.S.A. Include the name and mailing address of the grantee (N.J.S.A. Be notarized (N.J.S.A.

An executor is entitled to receive 6% of all income received. (N.J.S.A. 3B:18-13) For example, if an estate receives $50,000 income from stocks and bonds held in a brokerage account. The executor would be entitled to $3,000.

Yes you can. This is called a transfer of equity but you will need the permission of your lender. If you are not married or in a civil partnership you may wish to consider creating a deed of trust and a living together agreement which we can explain to you.

When done properly, a deed is recorded anywhere from two weeks to three months after closing.

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

The simplest way to add a spouse to a deed is through a quitclaim deed. This type of deed transfers whatever ownership rights you have so that you and your spouse now become joint owners. No title search or complex transaction is necessary. The deed will list you as the grantor and you and your spouse as grantees.

It is possible to be named on the title deed of a home without being on the mortgage. However, doing so assumes risks of ownership because the title is not free and clear of liens and possible other encumbrances.If a mortgage exists, it's best to work with the lender to make sure everyone on the title is protected.

Any creditor who wishes to make a claim against the estate's assets must do so within 9 months under New Jersey law. The 9 months begins on the date of debtor's death. The executor/personal representative cannot distribute assets to beneficiaries until all claims are satisfied.

To add a co-owner, the bank would have to create a new home loan agreement, which must be registered after paying the due stamp duty and registration charges. The bank would also insist on making the co-owner a co-borrower in the home loan applicable.