This form is a Grant Deed where the Grantor is an individual and the Grantee is an individual. This deed complies with all state statutory laws.

New Jersey Grant Deed from an individual to an individual

Description

How to fill out New Jersey Grant Deed From An Individual To An Individual?

US Legal Forms is actually a unique platform where you can find any legal or tax form for submitting, including New Jersey Grant Deed from an individual to an individual. If you’re tired of wasting time seeking appropriate samples and spending money on file preparation/legal professional charges, then US Legal Forms is exactly what you’re trying to find.

To enjoy all of the service’s advantages, you don't need to install any software but just pick a subscription plan and register an account. If you already have one, just log in and get an appropriate template, download it, and fill it out. Downloaded documents are all kept in the My Forms folder.

If you don't have a subscription but need to have New Jersey Grant Deed from an individual to an individual, check out the instructions listed below:

- Double-check that the form you’re taking a look at is valid in the state you want it in.

- Preview the form its description.

- Click on Buy Now button to access the sign up webpage.

- Select a pricing plan and proceed registering by entering some information.

- Pick a payment method to complete the sign up.

- Download the document by selecting the preferred format (.docx or .pdf)

Now, fill out the file online or print out it. If you feel uncertain about your New Jersey Grant Deed from an individual to an individual sample, speak to a lawyer to review it before you send out or file it. Start without hassles!

Form popularity

FAQ

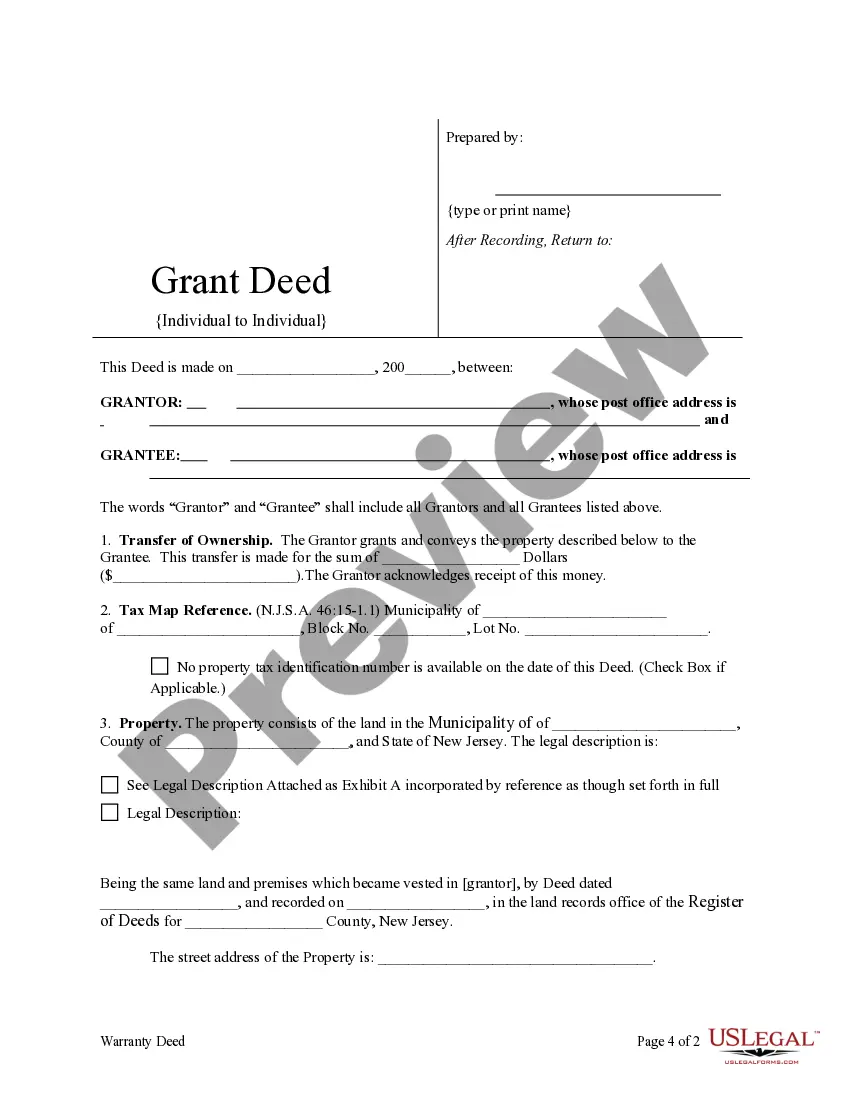

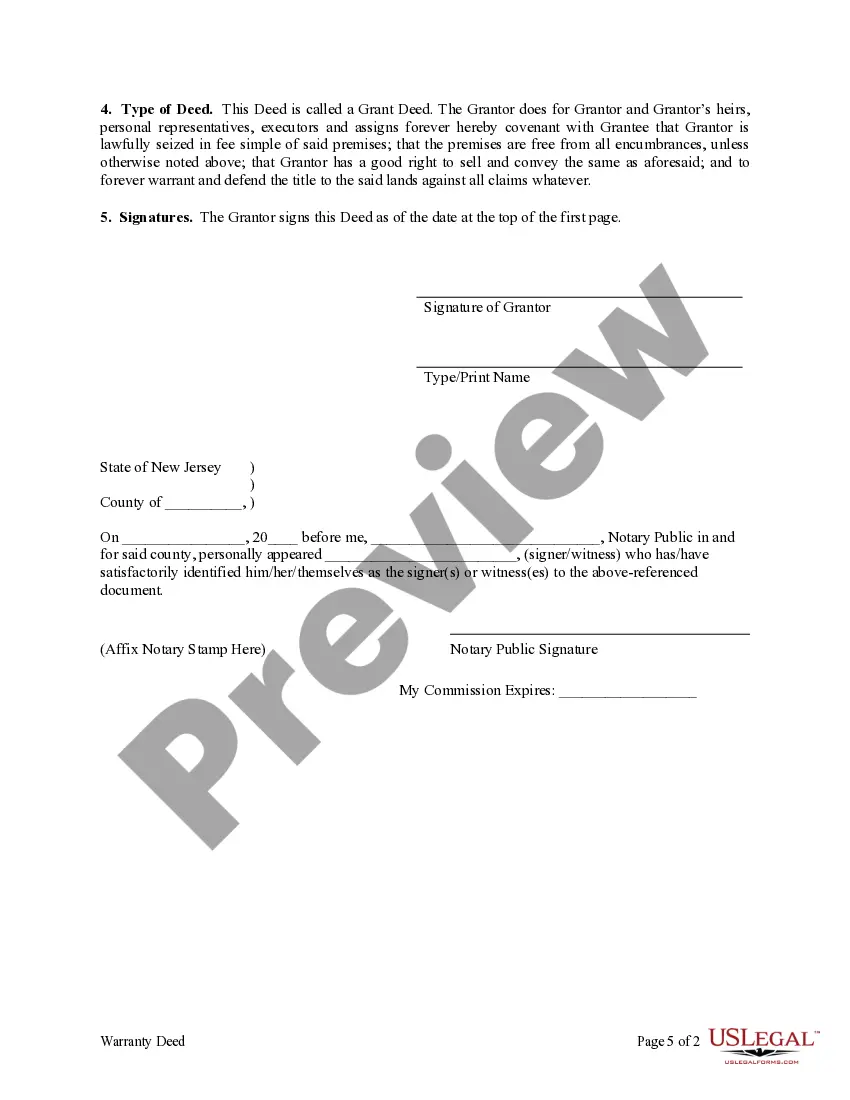

In New Jersey, the deed must be in English, identify the seller/buyer (grantor/grantee), name the person that prepared the deed, state the consideration (amount paid) for the transfer, contain a legal description of the property (a survey), include the signature of the grantor and be signed before a notary.

The seller or the seller's broker will hire an attorney to prepare the real estate deed to ensure that all of the requirements in the creation of a valid deed are met before the seller conveys title to the property. All real estate deeds must be in writing.

Realty Transfer Fee: Sellers pay a 1% Realty Transfer Fee on all home sales. The buyer is not responsible for this fee. However, buyers may pay an additional 1% fee on all home sales of $1 million or more.

Print a grant deed from an online source. Sign the document in the presence of a notary public. Take the deed to the recorder's office in the county where the property is located.

To sign over property ownership to another person, you'll use one of two deeds: a quitclaim deed or a warranty deed.

Contrary to normal expectations, the Deed DOES NOT have to be recorded to be effective or to show delivery, and because of that, the Deed DOES NOT have to be signed in front of a Notary Public. However, if you plan to record it, then it does have to be notarized as that is a County Recorder requirement.

1Retrieve your original deed.2Get the appropriate deed form.3Draft the deed.4Sign the deed before a notary.5Record the deed with the county recorder.6Obtain the new original deed.

Grantor's name. Grantee's name and address. Description of grantee (ex: unmarried man, husband and wife, joint tenants) Person who requested grant deed. Address of real estate that is being transferred. Legal description of property (lot number) Original title order number for property.

A grant deed is the instrument used to transfer title to an interest in real property from one owner to someone else.A deed of trust is the security instrument given to a lender to secure a loan or other obligation. Bare naked title is deeded to the trustee, who holds the power of sale or the power to re-convey.