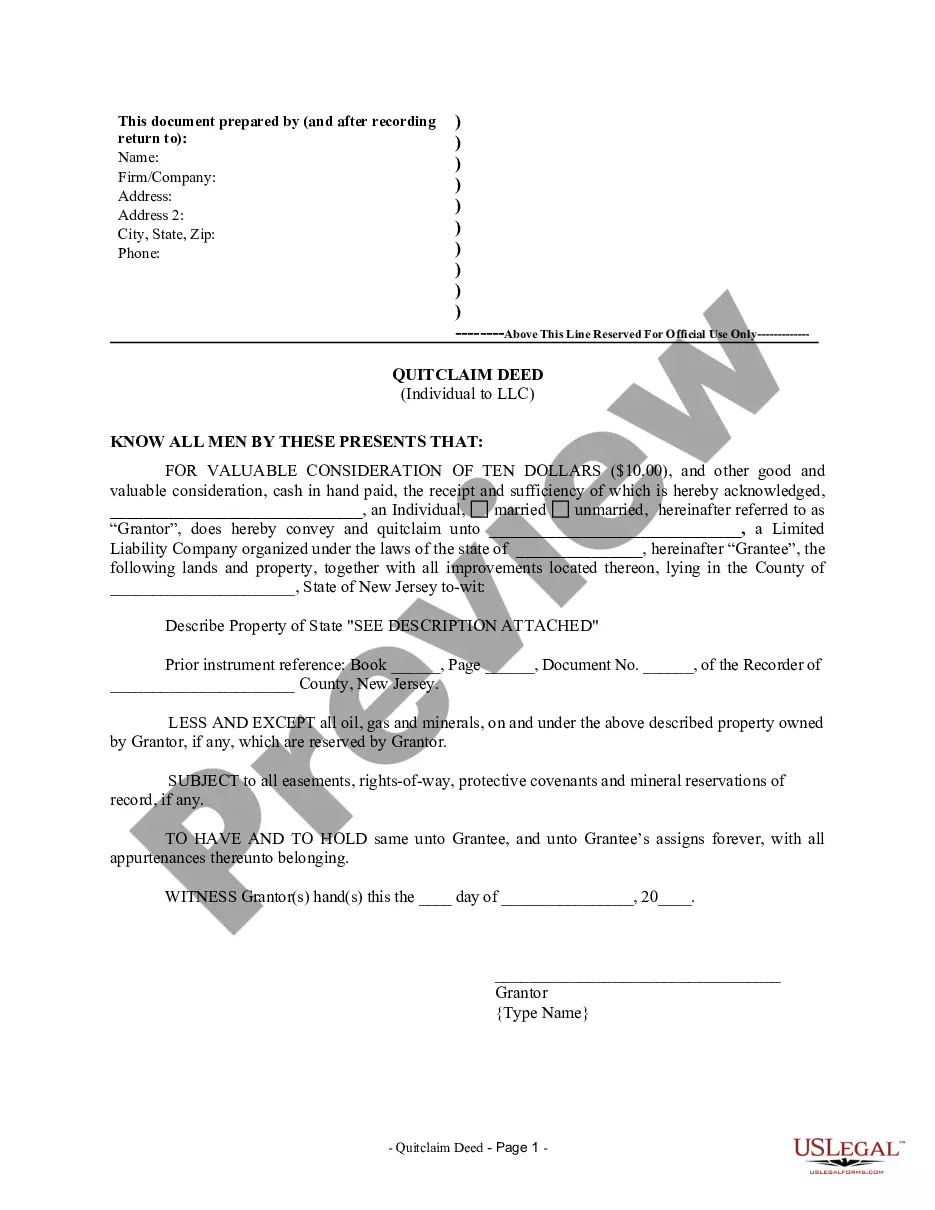

New Jersey Quitclaim Deed from Individual to LLC

Description New Jersey Quitclaim Deed

How to fill out Quit Claim Deed To Llc?

US Legal Forms is really a special platform to find any legal or tax document for submitting, including New Jersey Quitclaim Deed from Individual to LLC. If you’re tired with wasting time looking for appropriate samples and paying money on document preparation/attorney service fees, then US Legal Forms is exactly what you’re seeking.

To experience all the service’s advantages, you don't have to download any software but simply pick a subscription plan and register your account. If you have one, just log in and look for the right sample, download it, and fill it out. Saved documents are all kept in the My Forms folder.

If you don't have a subscription but need New Jersey Quitclaim Deed from Individual to LLC, take a look at the recommendations listed below:

- Double-check that the form you’re checking out is valid in the state you want it in.

- Preview the form and read its description.

- Click on Buy Now button to access the register webpage.

- Choose a pricing plan and carry on signing up by entering some info.

- Decide on a payment method to complete the registration.

- Download the file by choosing the preferred file format (.docx or .pdf)

Now, complete the file online or print it. If you are unsure regarding your New Jersey Quitclaim Deed from Individual to LLC sample, contact a lawyer to check it before you decide to send or file it. Start hassle-free!

New Jersey Quick Claim Deed Form popularity

New Jersey Quit Claim Deed Other Form Names

Quitclaim FAQ

However, there are substantial downsides associated with transferring your primary home into an LLC.If you are using your personal residence for estate planning purposes, a qualified personal residence trust (QPRT) may be more effective than transferring your property to a limited liability company.

A Quitclaim Deed must be notarized by a notary public or attorney in order to be valid.Consideration in a Quitclaim Deed is what the Grantee will pay to the Grantor for the interest in the property.

How to Quitclaim Deed to LLC. A quitclaim deed to LLC is actually a very simple process. You will need a deed form and a copy of the existing deed to make sure you identify titles properly and get the legal description of the property.

Signing - According to New Jersey law, the quit claim deed must be signed by the seller of the property in the presence of a Notary Public. Recording - All quit claim deeds that have been notarized should be filed with the County Clerk's Office within the jurisdiction that the property falls under.

A quitclaim deed is a legal instrument that is used to transfer interest in real property.The owner/grantor terminates (quits) any right and claim to the property, thereby allowing the right or claim to transfer to the recipient/grantee.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners get divorced and one spouse's name is removed from the title or deed.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.